Mortgage Calculator

Mortgage Calculator to calculate monthly mortgage payments, compare loan options, and plan your home purchase

Loan Details

Or 20.0% of home price

Additional Costs

Private Mortgage Insurance (if down payment < 20%)

Extra Payments (Optional)

Loan Breakdown

Monthly Payment Breakdown

Monthly Payment Breakdown

Loan Balance Over Time

Payment Schedule (First 12 Months)

| Month | Payment | Principal | Interest | Balance |

|---|

Introduction to Mortgage Calculator

Mortgage Calculator is an essential tool for anyone planning to buy a home. Buying a home is one of the biggest financial decisions you’ll ever face, and whether you’re a first-time buyer or a seasoned homeowner, knowing your potential monthly payments is vital. That’s where a mortgage calculator steps in—it’s not just a simple online tool, but a powerful financial guide that helps you understand your loan options, estimate affordability, and plan ahead with confidence.

At its core, a mortgage calculator helps you estimate monthly mortgage payments based on factors like loan amount, interest rate, term length, taxes, and insurance. Instead of diving into complex math or waiting on lenders, you can instantly see how much house you can afford, what your payments will look like, and how different loan options compare.

In today’s competitive real estate market, knowing your numbers upfront can mean the difference between landing your dream home or overstretching your budget. A good mortgage calculator doesn’t just crunch numbers—it gives you peace of mind and confidence in making one of life’s biggest purchases.

How a Mortgage Calculator Works

A mortgage calculator might look simple, but behind the scenes, it uses a powerful formula to determine your monthly obligations. Let’s break it down:

Loan Amount: The total amount borrowed after subtracting your down payment from the home price.

Interest Rate: The annual percentage rate (APR) charged by the lender.

Loan Term: How long you’ll take to repay the loan—commonly 15, 20, or 30 years.

Down Payment: The upfront cash contribution you make toward the home purchase.

Taxes & Insurance: Optional but important, as they can significantly raise your monthly payment.

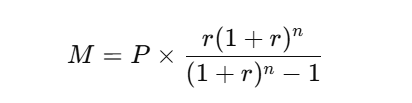

The formula behind mortgage payments is:

Where:

M = Monthly payment

P = Principal loan amount

r = Monthly interest rate (annual rate ÷ 12)

n = Number of total payments (term in years × 12)

A good mortgage calculator automatically applies this formula for you. With just a few clicks, you’ll see not only your monthly payment but also how much goes toward interest vs. principal. Some calculators even provide a full amortization table, showing payments month by month.

Benefits of Using a Mortgage Calculator

Why should you use a mortgage calculator before applying for a home loan? The benefits are endless:

Financial Clarity – Instead of guessing, you’ll know exactly what your monthly budget looks like.

Loan Comparison – Compare different mortgage terms, such as a 15-year vs. 30-year mortgage.

Avoiding Surprises – By factoring in taxes, insurance, and PMI, you get a realistic monthly estimate.

Negotiation Power – Walking into a lender’s office with numbers in hand gives you leverage.

Future Planning – Understand how extra payments can save you thousands in interest.

For instance, a $250,000 loan at 6% for 30 years results in a $1,498 monthly payment. But add an extra $200 per month, and you could cut years off your loan while saving tens of thousands in interest. Without a calculator, figuring that out would be nearly impossible.

In short, using a mortgage calculator turns an overwhelming process into a manageable one—helping you stay financially confident every step of the way.

Types of Mortgage Calculators

Not all mortgage calculators are created equal. Depending on your financial situation, you may need a specialized one. Here are the most common types:

Basic Mortgage Payment Calculator – Estimates monthly principal and interest.

Amortization Calculator – Provides a detailed payment breakdown over the loan’s lifespan.

Refinance Calculator – Helps determine if refinancing your mortgage will save you money.

Affordability Calculator – Tells you how much house you can realistically afford based on income and debt.

Extra Payment Calculator – Shows the impact of making additional payments toward the principal.

Each type serves a unique purpose. For example, an affordability calculator is perfect for first-time buyers who aren’t sure what price range to shop in. Meanwhile, a refinance calculator is ideal for current homeowners looking to lower their interest rate.

By exploring different calculators, you’ll see how small adjustments in down payment, interest rate, or loan term can dramatically change your financial future.

Step-by-Step Guide: How to Use a Mortgage Calculator Effectively

Using a mortgage calculator isn’t complicated, but knowing how to interpret the results is key. Here’s a step-by-step breakdown:

Enter the Home Price – Start with the asking price of the home.

Add Your Down Payment – The larger the down payment, the smaller your loan.

Set the Loan Term – Choose between 15, 20, or 30 years.

Input the Interest Rate – Use today’s average or your lender’s quoted rate.

Include Taxes and Insurance – For a realistic monthly cost.

Click Calculate – Instantly see your estimated monthly payment.

Example Scenario:

Home Price: $300,000

Down Payment: $60,000 (20%)

Loan Amount: $240,000

Interest Rate: 6%

Term: 30 years

Monthly Payment = Around $1,439 (excluding taxes and insurance).

By experimenting with numbers, you can see how different down payments or interest rates affect affordability. A few minutes on a calculator can save you from years of financial strain.

Understanding Mortgage Payments

When you first use a mortgage calculator, the results may look straightforward: a single monthly payment figure. But behind that number lies a breakdown of several important components that every homeowner should understand. Knowing what makes up your mortgage payment is essential because it helps you budget better, plan for future expenses, and avoid surprises once you move into your home.

A typical monthly mortgage payment consists of:

Principal – This is the portion of your payment that reduces the actual loan balance. In the early years of your loan, only a small fraction of your payment goes toward principal, but over time, this amount grows as interest decreases.

Interest – Lenders charge interest on the money you borrow. In the first few years, most of your monthly payment goes toward interest rather than principal. A mortgage calculator helps you visualize this balance over time.

Property Taxes – Local governments collect property taxes to fund schools, infrastructure, and public services. Depending on where you live, taxes can add hundreds or even thousands of dollars to your annual housing cost.

Homeowners Insurance – This protects your home against damage, theft, or liability. Many lenders require insurance as part of your mortgage agreement.

Private Mortgage Insurance (PMI) – If your down payment is less than 20%, lenders often require PMI to protect themselves in case you default. A mortgage calculator that includes PMI will give you a more accurate estimate.

For example, let’s say your base monthly mortgage payment (principal + interest) is $1,200. Once you add $300 for property taxes, $100 for homeowners insurance, and $150 for PMI, your actual monthly housing cost jumps to $1,750. Without a calculator, it’s easy to underestimate these extra expenses and stretch your budget too thin.

By breaking down each element of your mortgage payment, a calculator ensures you’re not just prepared for the loan itself, but for all the hidden costs of homeownership.

Amortization Schedule Explained

One of the most powerful features of an advanced mortgage calculator is its ability to generate an amortization schedule. At first glance, an amortization table may look overwhelming, but it’s essentially a roadmap of your loan repayment journey. It shows how much of each monthly payment goes toward interest and how much goes toward reducing the loan balance.

In the early stages of your mortgage, interest payments take up the bulk of your monthly bill. For example, on a $250,000 loan at 6% over 30 years, your first monthly payment of about $1,500 might allocate $1,250 to interest and only $250 to principal. Over time, as the balance decreases, more of your payment shifts toward principal.

Why is this important? Because it reveals how making extra payments can save you thousands in the long run. If you add just $100 extra per month to your payment, you could shave years off your mortgage term. Many calculators allow you to input extra payments and instantly see the interest savings.

An amortization schedule also keeps you motivated. Watching your loan balance shrink month by month is encouraging, especially when you see how much faster it falls with additional contributions. Instead of blindly paying bills, you’re in control of your financial timeline.

Think of amortization as a marathon map. Every mile marker shows where you are, how much further you have to go, and how small changes in pace (extra payments) can help you reach the finish line much faster.

Factors That Affect Your Mortgage Payments

Not all mortgages are created equal. The numbers you get from a calculator can vary dramatically based on several key factors. Understanding these elements will help you make smarter financial decisions and avoid overpaying for your home.

Credit Score – The higher your credit score, the lower your interest rate. A strong credit profile can save you tens of thousands of dollars over the life of your loan. For instance, someone with a 780 score might secure a 5.5% rate, while another with a 650 score could face 7%.

Loan Type – Mortgages come in many forms: fixed-rate, adjustable-rate (ARM), FHA, VA, USDA, and more. Each loan type has unique terms, fees, and benefits that affect your payments.

Down Payment Size – A larger down payment reduces your loan amount and may help you avoid PMI. For example, putting 20% down on a $300,000 home saves you from paying PMI, which could be $100–$300 per month.

Loan Term – A 15-year mortgage has higher monthly payments but saves significantly on interest, while a 30-year mortgage offers lower payments but costs more long-term.

Interest Rate Environment – Mortgage rates fluctuate with the economy. Timing your purchase or refinance during low-rate periods can make a huge difference in affordability.

Taxes and Insurance Costs – These vary based on location and property value. A home in Texas may have higher property taxes, while one in Florida could come with higher insurance costs due to hurricane risks.

Mortgage calculators allow you to adjust these variables and see how they impact your monthly payments. For instance, reducing your rate by just 1% could lower your payment by over $150 a month on a $250,000 loan. That’s more than $54,000 in savings over 30 years!

Mortgage Calculator for First-Time Homebuyers

If you’re buying a home for the first time, the process can feel intimidating. Between negotiating prices, securing financing, and budgeting for closing costs, there’s a lot to juggle. A mortgage calculator for first-time buyers is an essential tool to simplify things and avoid costly mistakes.

First, it helps you determine your affordability range. Many experts recommend spending no more than 28% of your monthly income on housing. A calculator can quickly show whether the home you’re eyeing fits within this guideline.

Second, it prevents “sticker shock.” Without factoring in taxes, insurance, and PMI, first-time buyers often underestimate true monthly costs. A detailed calculator includes these extras so you won’t be caught off guard.

Third, it gives you flexibility in exploring “what if” scenarios. For example:

What if you put down 10% instead of 20%?

What if interest rates rise by half a percent before you lock in?

How does a 15-year mortgage compare to a 30-year option?

By playing with the numbers, you gain a deeper understanding of how different financial choices affect your future.

Finally, a calculator builds confidence. Buying your first home is emotional, but having solid numbers in hand gives you the reassurance that you’re making a smart investment—not just chasing a dream.

Refinancing with a Mortgage Calculator

Homeowners often hear about refinancing but aren’t sure if it’s worth the effort. A mortgage calculator takes the guesswork out of the decision by comparing your current payments with potential new ones.

Refinancing involves replacing your existing mortgage with a new one, usually at a lower interest rate or different loan term. But refinancing isn’t free—there are closing costs, appraisal fees, and sometimes penalties to consider.

Here’s where the calculator helps:

Input Your Current Loan Details – Balance, rate, and remaining term.

Enter New Loan Information – Proposed interest rate, new term, and costs.

See the Difference – Instantly view your new monthly payment and total savings.

For example, if you currently owe $200,000 at 7% with 25 years left, your payment is about $1,420. Refinancing to 6% drops it to around $1,288, saving $132 per month. Over 25 years, that’s nearly $40,000 in savings, even after factoring in closing costs.

Mortgage calculators also highlight the break-even point—the time it takes for your savings to outweigh the refinancing costs. If your break-even point is three years and you plan to stay in your home for ten, refinancing is a smart move.

By giving you clear numbers, a refinance calculator helps you avoid making decisions based on hype and ensures you only refinance when it’s truly beneficial.

Advanced Features of Mortgage Calculators

Mortgage calculators have evolved far beyond just calculating principal and interest. Modern versions come packed with advanced features that make them valuable not only for first-time buyers but also for seasoned homeowners managing their finances. Let’s explore some of these smart functions:

Biweekly Payment Options – Instead of paying once a month, some calculators let you test biweekly payments. This method results in 26 half-payments a year (or 13 full ones) instead of 12. That extra payment each year can cut years off your mortgage and save thousands in interest.

Extra Principal Payments – Many calculators allow you to add an extra amount to your monthly or annual payments. Even small additional payments—say, $50 or $100—can dramatically reduce the loan’s total cost over time.

Tax and Insurance Inclusion – A comprehensive calculator doesn’t just stop at principal and interest; it also factors in property taxes, homeowner’s insurance, and PMI to give you a true picture of affordability.

Amortization Charts and Graphs – Instead of just numbers, advanced calculators provide easy-to-read visuals. These graphs show how payments shift from being interest-heavy to principal-heavy over the years.

Refinancing Simulations – Some calculators let you input your current loan and simulate different refinancing scenarios, helping you identify the most cost-effective option.

Affordability Analysis – By entering your income, debts, and expenses, you can discover the maximum house price you can realistically afford without financial strain.

For example, imagine you’re deciding whether to refinance at a lower rate or keep your current mortgage but make extra payments. With an advanced calculator, you can simulate both scenarios side by side, instantly seeing which saves you more in the long run.

These features aren’t just convenient—they empower you to take control of your financial future. Instead of blindly following lender advice, you can make decisions based on clear, data-driven insights.

Online vs. Offline Mortgage Calculators

In today’s digital-first world, most people use online mortgage calculators, but offline options still exist. Each comes with its pros and cons, and knowing the difference helps you choose the right tool.

Online Calculators

Accessible on desktops, tablets, and smartphones.

Frequently updated with the latest average interest rates.

Offer advanced features like amortization schedules and extra payment simulations.

Convenient for quick comparisons while house hunting.

Offline Calculators (Excel, Financial Calculators, Apps)

Great for those who prefer working without internet access.

Excel-based calculators allow customization, which can be helpful for advanced financial planning.

Handheld financial calculators are reliable but may require manual input of formulas.

While online calculators are more user-friendly and visually appealing, offline versions are great for those who want to dive deeper into custom scenarios. For instance, financial advisors often use offline spreadsheet-based calculators to analyze multiple loan options in detail.

Ultimately, the choice depends on your needs. If you want quick, on-the-go results, online is the way to go. If you prefer a more detailed, customizable approach, offline calculators can be a better fit.

Common Mistakes to Avoid When Using a Mortgage Calculator

A mortgage calculator is a fantastic tool, but only if used correctly. Many people make mistakes that lead to inaccurate expectations, and these errors can cost them thousands. Here are the most common pitfalls:

Ignoring Taxes and Insurance – Many people only look at the principal and interest, forgetting that taxes, insurance, and PMI can add hundreds of dollars to monthly payments.

Overestimating Affordability – Just because the calculator shows you can afford a $2,000 monthly payment doesn’t mean you should stretch your budget that far. You also need to factor in maintenance, utilities, and lifestyle expenses.

Using Unrealistic Interest Rates – Entering a rate that’s too low can give you a false sense of affordability. Always use either the rate your lender quotes or today’s average market rate.

Forgetting Closing Costs – Calculators often don’t include closing costs like appraisal fees, title insurance, and lender charges, which can add 2–5% of the purchase price.

Not Testing Multiple Scenarios – Relying on one calculation instead of testing different terms, rates, and down payments can limit your financial insight.

For example, if you only calculate payments based on a 30-year mortgage without exploring a 15-year option, you might miss the fact that a slightly higher payment could save you tens of thousands in interest.

Avoiding these mistakes ensures that your calculator results reflect real-life costs and set you up for financial success, not disappointment.

Tips to Reduce Your Monthly Mortgage Payments

If you’re worried that your mortgage payments might be too high, don’t panic. There are several strategies to bring those payments down without sacrificing your dream home. Here are some effective methods:

Refinance at a Lower Rate – If rates drop, refinancing could reduce your monthly payment significantly. Even a 1% rate reduction can save hundreds per month.

Extend Your Loan Term – Switching from a 15-year to a 30-year mortgage lowers payments, though it increases total interest paid. This can be a good option if you need breathing room in your budget.

Make a Larger Down Payment – A bigger down payment reduces the loan amount and may eliminate PMI, lowering your monthly costs.

Shop Around for Insurance – Property insurance rates vary widely. Comparing quotes could save you hundreds each year.

Eliminate PMI – Once you reach 20% equity in your home, you can request that your lender remove PMI, which can cut $100–$300 from your monthly bill.

Make Extra Payments When Possible – While this doesn’t immediately reduce your required monthly payment, it shortens your loan and decreases interest costs over time.

For example, say your payment is $1,800. Refinancing to a lower rate could bring it down to $1,600. Eliminating PMI might save another $200, bringing it to $1,400. That’s $400 back in your pocket each month—enough to cover utilities or boost your savings.

These strategies prove that mortgage payments aren’t set in stone. With a little financial planning, you can make your home loan work better for your budget.

Conclusion

A mortgage calculator isn’t just a convenience—it’s an essential financial planning tool for anyone buying, refinancing, or managing a home loan. From helping you understand your monthly payments to exploring amortization schedules, comparing loan terms, and uncovering refinancing opportunities, it gives you the knowledge needed to make smarter financial decisions.

By learning how to use a mortgage calculator effectively, you take control of your financial future. Instead of blindly accepting lender offers, you walk into negotiations informed and confident. Whether you’re a first-time buyer, a current homeowner, or someone considering refinancing, this tool empowers you to save money, reduce stress, and plan wisely.

At the end of the day, a mortgage calculator isn’t just about numbers—it’s about peace of mind.

FAQs

1. Can a mortgage calculator predict exact payments?

Not exactly. Calculators provide estimates. Actual payments may vary based on lender fees, insurance premiums, and changing property taxes.

2. Does a mortgage calculator include closing costs?

Most don’t, unless specifically designed to. You’ll need to factor in 2–5% of the purchase price for closing expenses.

3. How accurate are online mortgage calculators?

They’re fairly accurate for principal and interest but may miss extras like PMI, taxes, and insurance unless those inputs are included.

4. What’s the difference between fixed and adjustable mortgage calculations?

A fixed-rate mortgage keeps payments consistent, while adjustable-rate loans may change after the initial fixed period. Calculators can show how rate changes affect future payments.

5. Should I use multiple calculators?

Yes! Different calculators specialize in affordability, refinancing, amortization, and more. Using multiple tools gives a clearer financial picture.