Auto Loan Calculator

Auto Loan Calculator to calculate monthly Auto loan payments, compare loan options, and plan your Auto purchase

Vehicle Details

Or 20.0% of vehicle price

Loan Terms

Additional Costs (Optional)

Vehicle Cost Breakdown

Loan Summary

Principal vs Interest

Loan Balance Over Time

Payment Schedule (First 12 Months)

| Month | Payment | Principal | Interest | Balance |

|---|

Introduction to Auto Loan Calculator

Auto Loan Calculator – Buying a car is an exciting milestone, but it also comes with a significant financial commitment. Whether you’re considering a brand-new model or a dependable used vehicle, understanding how much you’ll pay each month is crucial to your budgeting. This is where an auto loan calculator becomes an essential tool, helping you estimate your monthly payments, interest rates, and loan terms so you can make an informed decision before committing to an auto loan.

At its core, an auto loan calculator estimates your monthly car payments based on factors like loan amount, interest rate, loan term, down payment, and even trade-in value. Instead of guessing what you can afford or waiting on dealership financing teams, you can quickly crunch the numbers yourself.

Why is this important? Because car loans come with more than just the sticker price. Taxes, fees, and add-ons can quickly increase your final cost. A calculator helps you prepare in advance, so you don’t fall in love with a car that stretches your budget too thin.

In short, an auto loan calculator gives you clarity, control, and confidence in one of the biggest financial decisions you’ll make after buying a home.

How an Auto Loan Calculator Works

An auto loan calculator might seem simple, but it uses a precise formula to break down your payments. Let’s look at what it takes into account:

Loan Amount – The price of the car minus your down payment and trade-in value.

Interest Rate (APR) – The annual cost of borrowing money, expressed as a percentage.

Loan Term – The length of time (in months) you’ll take to pay off the loan, commonly 36, 48, 60, or 72 months.

Down Payment – The cash you put upfront, which reduces the total amount borrowed.

Trade-In Value – The credit from your old car, which also lowers the amount financed.

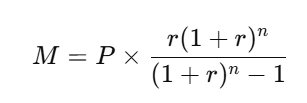

The formula behind auto loan calculations is similar to mortgages:

Where:

M = Monthly payment

P = Loan amount (after down payment & trade-in)

r = Monthly interest rate (APR ÷ 12)

n = Total number of payments (loan term in months)

For example, if you’re financing a $25,000 car with a $5,000 down payment, 5% interest, and a 60-month term, your monthly payment comes out to around $377 (excluding taxes and fees).

An auto loan calculator handles this math instantly—saving you from tedious calculations and giving you a realistic payment estimate.

Benefits of Using an Auto Loan Calculator

Why should you use an auto loan calculator before signing any paperwork? Here are the key advantages:

Budget Planning – Know exactly how much car you can afford each month.

Loan Comparison – See how different loan terms or rates affect your payments.

Avoiding Surprises – Factor in taxes, fees, and extras for a true picture of affordability.

Negotiation Power – Walk into the dealership with real numbers in hand.

Debt Management – Prevent overspending and ensure your car loan fits your financial goals.

For example, a 60-month loan may seem affordable, but comparing it to a 48-month option might reveal big interest savings. Without a calculator, spotting this difference is nearly impossible.

In short, this tool ensures you buy smart—not just buy fast.

Types of Auto Loan Calculators

Not all calculators are built the same. Depending on your needs, you may want to try different ones:

Basic Auto Loan Calculator – Estimates monthly payments based on loan amount, interest, and term.

Affordability Calculator – Tells you how much car you can afford based on income, expenses, and debts.

Lease vs. Buy Calculator – Compares the long-term costs of leasing a car versus financing one.

Refinance Calculator – Helps you see if refinancing an existing loan will save you money.

For example, if you’re torn between leasing a car with lower monthly payments and buying a car for long-term value, a lease vs. buy calculator will show you which option costs less in the long run.

By using the right calculator for your situation, you can make smarter choices that fit your lifestyle and financial health.

Step-by-Step Guide: How to Use an Auto Loan Calculator

Using an auto loan calculator is easy, but interpreting the results correctly is key. Here’s how to do it:

Enter the Car Price – Start with the sticker price or negotiated value.

Add Down Payment & Trade-In – Subtract these from the total loan amount.

Set Loan Term – Choose 36, 48, 60, or 72 months.

Input Interest Rate – Use today’s average or the dealer’s quote.

Include Taxes & Fees – For accuracy, add estimated registration and dealer fees.

Click Calculate – Get your monthly payment instantly.

Example:

Car Price: $30,000

Down Payment: $4,000

Trade-In: $3,000

Loan Amount: $23,000

Interest Rate: 6%

Term: 60 months

Result → Monthly Payment ≈ $445

By adjusting numbers, you can instantly see how a bigger down payment or shorter loan term impacts your monthly costs.

Breaking Down Auto Loan Payments

When you see your estimated monthly payment on an auto loan calculator, it’s easy to think that number only covers the car itself. But in reality, several components make up the full cost of your auto loan. Knowing what these pieces are—and how they add up—can save you from nasty surprises at the dealership.

Here’s a closer look at what goes into a monthly car payment:

Principal – This is the actual loan balance you borrowed after subtracting your down payment and trade-in value. Every monthly payment chips away at this amount.

Interest – This is what the lender charges you for borrowing money. The lower your credit score, the higher your interest rate—and the more expensive your loan becomes over time.

Taxes & Fees – Sales tax, title fees, registration, and documentation charges can be rolled into your loan, increasing monthly payments. An auto loan calculator that includes taxes provides a more realistic picture.

Add-Ons – Many dealerships offer extras like extended warranties, GAP insurance, or service packages. While they might provide peace of mind, they also increase your loan amount and monthly bill.

Example: Let’s say you’re financing a $25,000 car with $2,000 in taxes and fees, plus a $1,000 extended warranty. Your financed loan isn’t $25,000 anymore—it’s $28,000. That extra $3,000 could raise your monthly payment by $50 or more.

Understanding this breakdown is crucial. A calculator that only estimates principal and interest won’t give you the full story. But once you factor in taxes, fees, and add-ons, you’ll have a much clearer view of your real monthly commitment.

Factors That Affect Auto Loan Payments

Your monthly auto loan payment isn’t set in stone—it depends on a variety of financial factors. Knowing these influences can help you adjust and find ways to save.

Credit Score – Probably the most significant factor. A higher credit score usually means a lower interest rate. For instance, someone with excellent credit might secure a 4% APR, while someone with fair credit could face 10% or more. That difference could add $100+ to your monthly bill.

Loan Term – A shorter loan term (36 or 48 months) means higher monthly payments but lower overall interest costs. A longer term (60–84 months) lowers monthly payments but increases the total interest you’ll pay.

Interest Rates – Rates fluctuate based on the economy and lender policies. Even a small difference—say 6% vs. 5.5%—can save you thousands over the life of your loan.

Down Payment – The more cash you put upfront, the less you need to finance. A bigger down payment reduces your monthly payment and helps you avoid being “upside down” (owing more than the car’s worth).

Trade-In Value – Trading in your old vehicle lowers the loan balance. A higher trade-in value means you borrow less.

Dealer Fees & Add-Ons – These can sneak up on buyers. Always double-check which extras are being rolled into your loan.

For example, if you’re buying a $25,000 car:

With a $5,000 down payment, 5% interest, and 60 months → $377/month

With no down payment, 7% interest, and 72 months → $423/month

That’s a $46 monthly difference—but over six years, it adds up to nearly $3,300.

Auto Loan Calculator for First-Time Car Buyers

Buying your first car is a milestone—but it’s also where many people make financial mistakes. A first-time car buyer calculator helps you avoid these pitfalls by showing you the true cost of car ownership before you sign a loan agreement.

Here’s why it’s especially important for new buyers:

Realistic Budgeting – It’s tempting to go for a flashy car, but a calculator shows whether the monthly payment fits comfortably within your income. A good rule of thumb: your car payment should not exceed 15% of your monthly take-home pay.

Avoiding Sticker Shock – Many new buyers forget about taxes, registration, and insurance. A calculator that includes these costs keeps you from underestimating.

Exploring Loan Options – First-time buyers often get offered long-term loans (72–84 months) to make payments look smaller. But a calculator will reveal how much extra interest you’ll pay in the long run.

Testing “What-If” Scenarios – What if you increase your down payment by $1,000? What if your rate drops by half a percent? Playing with these scenarios helps you make better decisions.

Example for First-Time Buyer:

Income: $3,000/month (after taxes)

Recommended car payment (15% rule): $450/month max

Using a calculator: A $20,000 car, with $3,000 down, 6% interest, 60 months → $330/month

That’s well below budget, leaving room for insurance and maintenance. Without this tool, a first-time buyer might overextend themselves and risk financial stress.

Refinancing a Car Loan with a Calculator

Many people think refinancing is just for mortgages, but car loans can also be refinanced. An auto refinance calculator helps you determine whether switching to a new loan can save you money.

Refinancing makes sense if:

Interest rates have dropped since you bought your car.

Your credit score has improved, qualifying you for a better rate.

You want to lower your monthly payment by extending your loan term.

Here’s how it works:

Enter your current loan balance, interest rate, and remaining term.

Input the new loan details (proposed interest rate and term).

See the difference in monthly payments and total loan cost.

Example:

Current loan: $15,000 at 9% with 48 months left → $373/month

Refinanced loan: $15,000 at 5% with 48 months → $345/month

That’s a savings of $28/month, or about $1,344 over four years. Even if refinancing costs $200 in fees, you still come out ahead.

A calculator also reveals the break-even point—the time it takes for your savings to exceed the refinancing costs. If you plan to keep your car long enough, refinancing could be a smart move.

Advanced Features of Auto Loan Calculators

Today’s calculators do more than spit out monthly payments. They come with advanced features that give you deeper financial insight:

Extra Payment Options – See how adding an extra $50 or $100 each month shortens your loan term.

Early Payoff Scenarios – Calculate how much interest you save by making lump-sum payments.

Amortization Schedules – View a month-by-month breakdown of principal vs. interest.

Lease vs. Buy Comparisons – Decide whether leasing or financing is the smarter choice for your situation.

Debt-to-Income Ratio Tools – Some calculators also check whether your loan fits within healthy financial limits.

For example, if you’re considering making an extra $1,000 annual payment, a calculator shows how many months you can shave off your loan and how much interest you’ll save. Without this tool, you’d be guessing.

These features make calculators not just helpful but essential for anyone serious about managing their auto loan effectively.

Online vs. Offline Auto Loan Calculators

In today’s digital age, most people prefer using online auto loan calculators, but offline options still exist. Each has its strengths, and understanding the differences helps you decide which works best for your situation.

Online Auto Loan Calculators

Easily accessible from laptops, tablets, or smartphones.

Often updated with current average interest rates.

Provide advanced features like amortization charts, payoff schedules, and refinance comparisons.

Convenient for quick calculations while shopping for cars or negotiating with dealerships.

Offline Auto Loan Calculators

Can be Excel-based spreadsheets, financial calculator devices, or mobile apps you download.

Offer customization—you can build formulas to match your unique situation.

Work without internet access, which can be handy for financial advisors or those who prefer manual control.

Which One Should You Use?

If you’re a casual buyer who just wants quick estimates, an online calculator is the best choice.

If you’re detail-oriented or want to analyze multiple “what-if” scenarios, offline spreadsheets and apps can give you more control.

For example, an online calculator can instantly show your estimated monthly payment for a $20,000 car at 6% interest over 60 months. Meanwhile, an offline Excel calculator can let you adjust additional payments and track how each one impacts your payoff timeline.

Both serve the same purpose—helping you make smarter financial decisions—but the right choice depends on how much detail and flexibility you need.

Common Mistakes to Avoid When Using an Auto Loan Calculator

Auto loan calculators are powerful tools, but only if you use them correctly. Many buyers make simple mistakes that lead to unrealistic expectations. Here are the most common ones to watch out for:

Ignoring Taxes and Fees – Sales tax, registration, and dealer fees can add thousands to your total loan amount. Always include them in your calculations.

Forgetting About Add-Ons – Extended warranties, service packages, and GAP insurance may seem small, but when rolled into your loan, they raise monthly payments.

Overestimating Affordability – Just because the calculator says you can afford $500/month doesn’t mean it fits your lifestyle. Consider insurance, fuel, and maintenance too.

Using Unrealistic Interest Rates – Entering a rate lower than what you’ll actually qualify for gives a false sense of affordability. Always use rates close to what lenders are offering.

Not Comparing Loan Terms – Focusing only on monthly payments without considering the total interest paid can lead you to choose a loan that costs more in the long run.

Example: A 72-month loan may give you a comfortable $350/month payment compared to $450/month on a 48-month loan. But that longer term could mean paying $3,000 more in interest.

Avoiding these mistakes ensures your calculator results reflect real-life costs, giving you the clarity you need before committing to a loan.

Tips to Reduce Monthly Car Loan Payments

Worried about high car payments? Don’t stress—there are several strategies to bring those payments down. Here are some practical tips:

Make a Larger Down Payment – The more you pay upfront, the less you finance, which lowers monthly payments. Even an extra $1,000 down can make a noticeable difference.

Negotiate Loan Rates – Shop around with banks, credit unions, and online lenders before accepting a dealership’s financing. Even half a percent lower interest rate can save you hundreds.

Extend the Loan Term – Stretching from 48 months to 60 or 72 months lowers monthly payments. However, keep in mind that you’ll pay more interest overall.

Refinance Later – If your credit improves or interest rates drop, refinancing can reduce your payment significantly.

Pay Off Add-Ons Separately – Instead of rolling warranties or insurance into your loan, pay for them upfront to avoid increasing your monthly bill.

Make Extra Principal Payments – While it doesn’t reduce your required monthly payment, it shortens your loan term and lowers total interest, giving you financial flexibility later.

Example: On a $20,000 loan at 7% interest over 60 months, your payment might be $396/month. If you put down an extra $2,000 upfront, your payment drops to about $356/month—saving you $40 each month and nearly $2,400 over five years.

These strategies prove that car loan payments aren’t fixed in stone—you can adjust and optimize them to fit your financial comfort zone.

Conclusion

An auto loan calculator is more than just a handy tool—it’s your financial roadmap for car buying. It shows you exactly what your payments will look like, breaks down interest vs. principal, and helps you prepare for taxes, fees, and extras that dealerships don’t always highlight.

Whether you’re a first-time buyer, a seasoned driver upgrading your ride, or someone considering refinancing, this calculator gives you the power to make informed, confident decisions. Instead of walking into a dealership blind, you walk in prepared—with numbers that protect your budget.

By using an auto loan calculator, you’re not just crunching numbers—you’re taking control of your financial future.

FAQs

1. How accurate are auto loan calculators?

They’re accurate for estimating payments, but actual costs may vary depending on lender fees, insurance, and local taxes.

2. Do auto loan calculators include dealer fees?

Most basic calculators don’t, unless you enter them manually. Always add taxes, registration, and dealer charges for a realistic estimate.

3. Can an auto loan calculator compare lease vs. purchase?

Yes—some advanced calculators have lease vs. buy options to help you choose the most cost-effective path.

4. Should I use multiple auto loan calculators?

Definitely. Each calculator may have different features. Using multiple tools gives you a broader perspective.

5. Does making extra payments really help?

Yes. Extra payments reduce your loan balance faster, saving you interest and potentially shaving months off your term.