Planning a concrete project requires precise calculations to avoid costly mistakes. Whether you’re pouring a patio slab, building footings, or creating columns, knowing exactly how much concrete you need is essential for budgeting and execution. This comprehensive guide explains how to calculate concrete volume for any project, helping both DIY enthusiasts and professionals plan effectively.

What Is a Concrete Calculator?

A concrete calculator is a mathematical tool that helps determine the precise amount of concrete needed for construction projects. It uses dimensions like length, width, and depth to calculate volume, typically expressed in cubic yards, cubic feet, or cubic meters. While many online tools can perform these calculations automatically, understanding the underlying formulas allows you to verify results and make adjustments as needed.

Accurate concrete estimation is crucial because ordering too little can halt your project mid-pour, creating weak “cold joints” where new concrete meets partially set material. Ordering too much wastes money on excess material you can’t return. The right calculation ensures your project proceeds smoothly while optimizing your budget.

Basic Concrete Calculation Formula

The standard formula for calculating concrete volume is straightforward:

Volume = Length × Width × Depth (or Height)

This calculation gives you the volume in cubic units (feet, yards, or meters). For construction in the United States, concrete is typically ordered in cubic yards. Since there are 27 cubic feet in one cubic yard, you’ll need to convert your measurement:

Cubic Yards = Cubic Feet ÷ 27

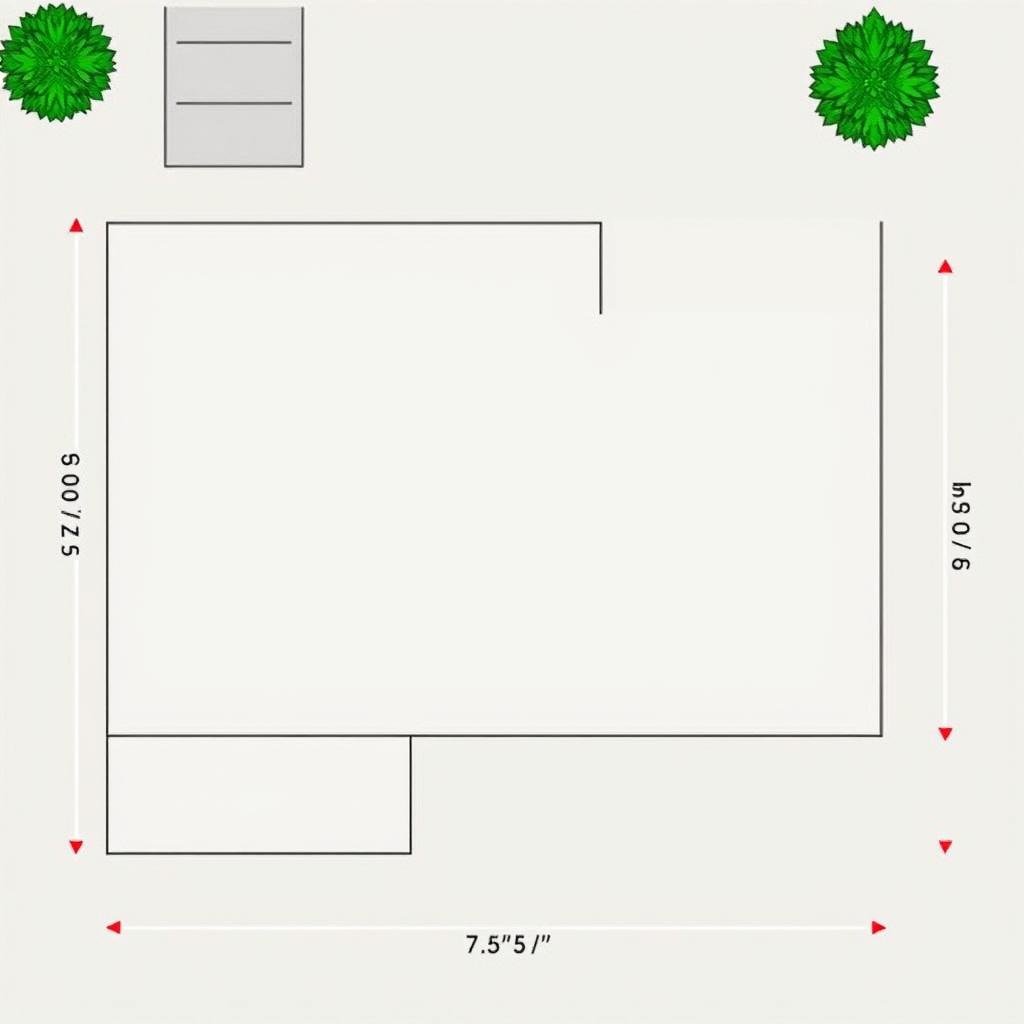

Practical Example: Calculating Concrete for a Patio

Let’s walk through a common example: calculating concrete for a 10ft × 10ft patio with a standard 4-inch thickness.

Step-by-Step Calculation

- Convert all measurements to feet: 4 inches = 0.33 feet

- Calculate cubic feet: 10ft × 10ft × 0.33ft = 33 cubic feet

- Convert to cubic yards: 33 ÷ 27 = 1.22 cubic yards

- Add waste factor (10%): 1.22 × 1.1 = 1.34 cubic yards

For this patio, you should order approximately 1.5 cubic yards of concrete, rounding up to ensure you have enough material to complete the job without interruption.

Common Project Dimensions Reference Table

Use this quick reference table to estimate concrete needs for typical residential projects. All calculations include a 10% waste factor.

| Project Type | Dimensions | Thickness | Cubic Yards | 80lb Bags |

| Small Patio | 8ft × 8ft | 4 inches | 0.79 | 36 |

| Standard Patio | 10ft × 10ft | 4 inches | 1.24 | 56 |

| Large Patio | 12ft × 12ft | 4 inches | 1.78 | 81 |

| Driveway | 20ft × 10ft | 5 inches | 3.09 | 140 |

| Sidewalk | 25ft × 3ft | 4 inches | 0.93 | 42 |

| Column (Round) | 10in diameter | 4ft height | 0.08 | 4 |

| Footing | 20ft × 1ft | 8 inches | 0.49 | 22 |

Key Factors Affecting Concrete Calculations

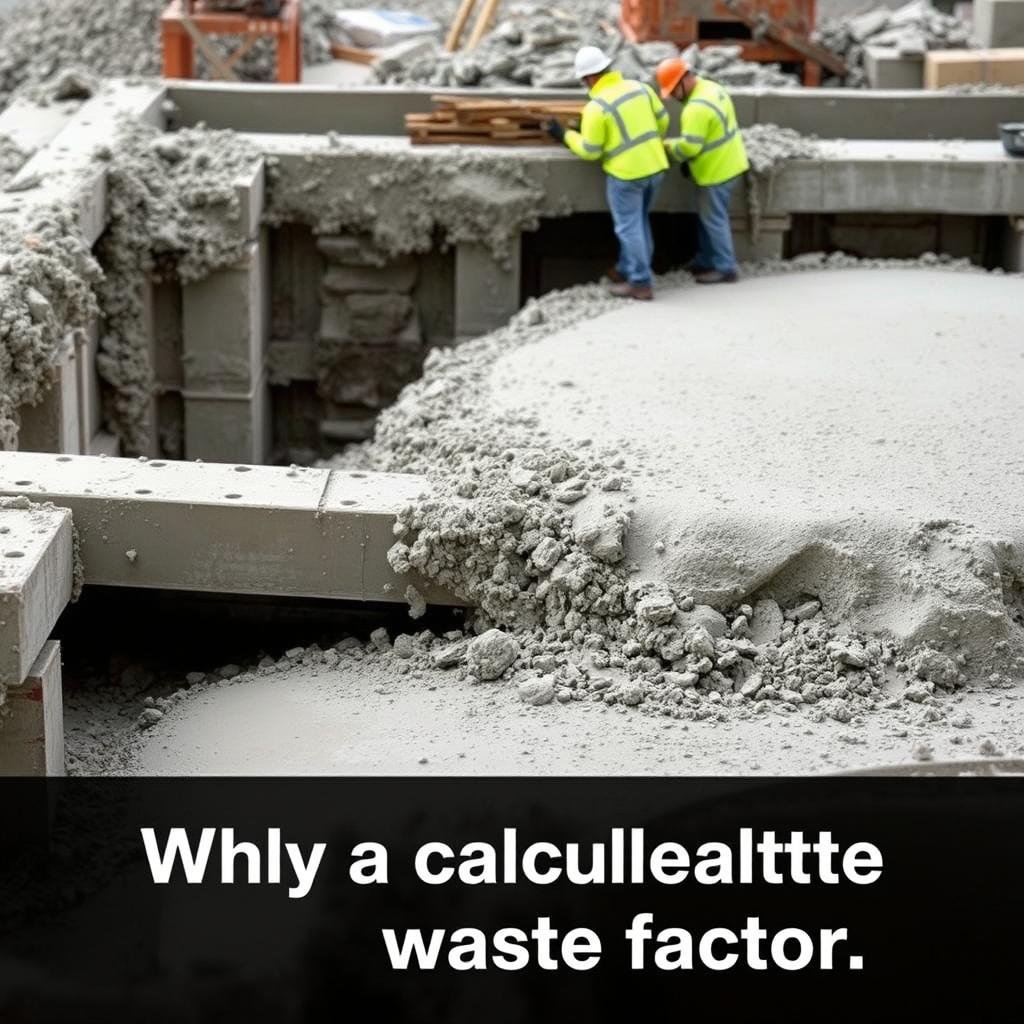

Waste Factor

Always add 5-10% extra concrete to your calculated volume. This accounts for spillage, uneven subgrade, and slight measurement errors. For complex projects or difficult site conditions, consider adding up to 15% extra.

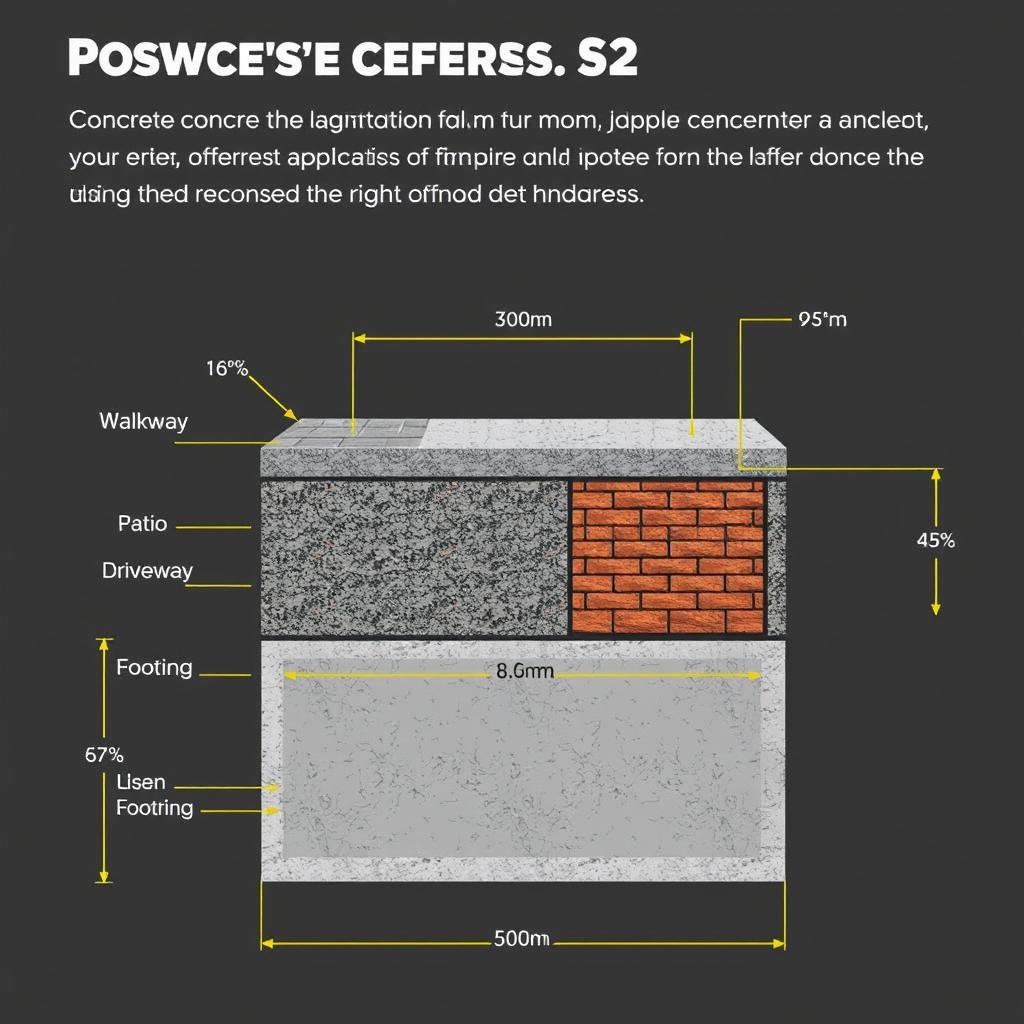

Project Type and Thickness

Different projects require different concrete thicknesses:

- Patios and walkways: 4 inches

- Driveways (residential): 4-5 inches

- Driveways (heavy vehicles): 5-6 inches

- Footings: 8-12 inches (check local code)

- Garage floors: 4-6 inches

Converting Measurements for Calculations

When working with concrete calculations, you’ll often need to convert between different units of measurement. Here are the most common conversions:

| Conversion Type | Formula | Example |

| Inches to Feet | Inches ÷ 12 | 4 inches = 0.33 feet |

| Feet to Cubic Feet | Length × Width × Depth | 10ft × 10ft × 0.33ft = 33 cubic feet |

| Cubic Feet to Cubic Yards | Cubic Feet ÷ 27 | 33 cubic feet = 1.22 cubic yards |

| Cubic Feet to Cubic Meters | Cubic Feet × 0.0283 | 33 cubic feet = 0.93 cubic meters |

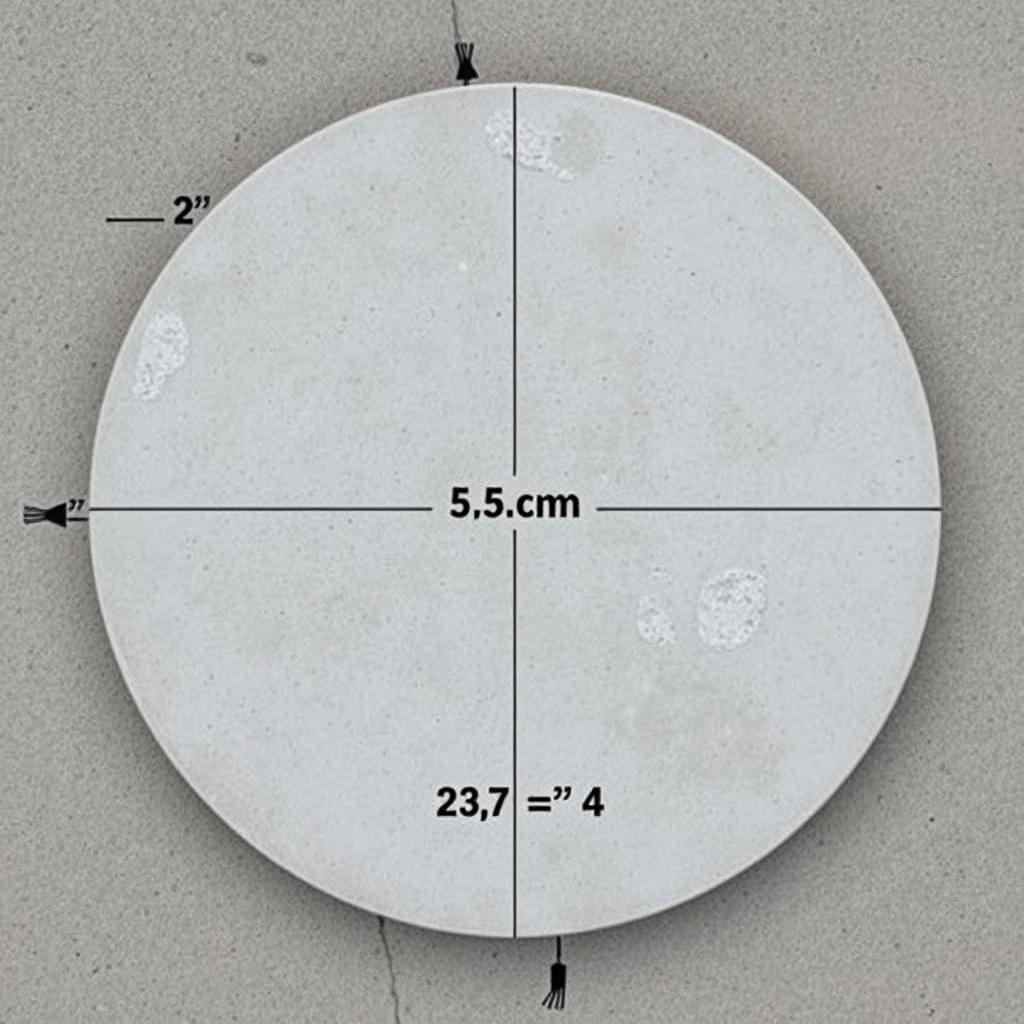

Calculating Concrete for Special Shapes

Not all concrete projects are simple rectangles. Here’s how to calculate volume for other common shapes:

Round Slabs

Volume = π × (Diameter ÷ 2)² × Thickness

Cylindrical Columns

Volume = π × (Diameter ÷ 2)² × Height

Irregular Shapes

Divide into simple shapes, calculate each separately, then add volumes together.

Essential Concrete Terminology

- Cubic Yard: Standard unit for measuring concrete volume in the US (27 cubic feet)

- Ready-Mix Concrete: Professionally mixed concrete delivered to your site in trucks

- PSI (Pounds per Square Inch): Measure of concrete strength (typical residential: 2,500-3,000 PSI)

- Slump: Measure of concrete consistency and workability

- Curing: Process where concrete hardens and gains strength over time

- Reinforcement: Steel bars or mesh added to increase concrete strength

- Subgrade: Prepared soil or base material beneath concrete

- Cold Joint: Weak point created when new concrete meets partially set concrete

Bagged Concrete vs. Ready-Mix: Making the Right Choice

Bagged Concrete

- Ideal for small projects (under 1/2 cubic yard)

- No minimum order requirements

- Can be stored for future small projects

- No delivery scheduling needed

Ready-Mix Concrete

- Perfect for larger projects (over 1 cubic yard)

- Saves time and physical labor

- Consistent quality and mix ratio

- Available in various specialized mixes

For reference: One 80-pound bag of concrete yields approximately 0.6 cubic feet (or 0.022 cubic yards). This means you would need about 45 bags to equal one cubic yard of concrete.

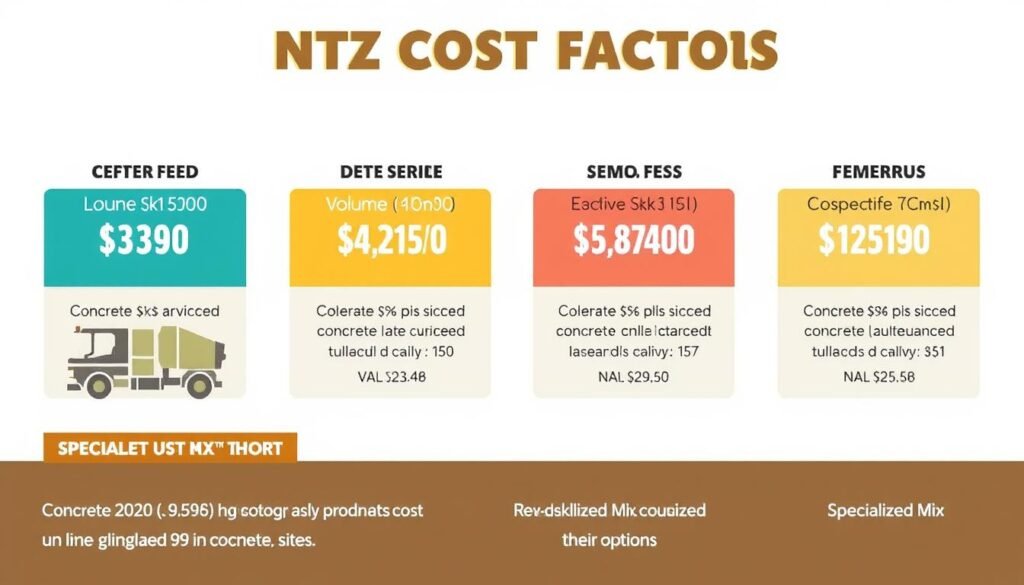

Understanding Concrete Costs

The cost of concrete varies based on several factors:

- Volume: Larger orders often have better per-yard pricing

- Mix Design: Specialized mixes cost more than standard mixes

- Delivery Distance: Further distances incur higher delivery fees

- Market Location: Regional price variations exist

- Additional Services: Pumping, weekend delivery, or special timing add costs

As of 2025, expect to pay between $125-$200 per cubic yard for standard ready-mix concrete, with additional delivery fees possible. Bagged concrete typically costs $4-$6 per 80-pound bag, making it more expensive per volume but more practical for small projects.

Tips for Accurate Concrete Estimation

Before You Calculate

- Measure dimensions multiple times for accuracy

- Consider site access for delivery vehicles

- Check local building codes for minimum thickness requirements

- Plan for proper drainage with slight slopes where needed

After Calculating

- Always add 5-10% waste factor to your final calculation

- Round up to the nearest quarter or half yard when ordering

- Consider ordering slightly more for complex projects

- Have a plan for using or disposing of excess concrete

Frequently Asked Questions

How much concrete do I need for a 10×10 slab?

For a standard 4-inch thick 10×10 foot slab, you’ll need approximately 1.24 cubic yards of concrete. This calculation is: 10ft × 10ft × 0.33ft (4 inches) = 33 cubic feet ÷ 27 = 1.22 cubic yards. Adding a 10% waste factor brings it to about 1.35 cubic yards, so you should order 1.5 cubic yards to be safe.

How many 80 lb bags of concrete make a yard?

You’ll need approximately 45 bags of 80 lb concrete to make one cubic yard. Each 80 lb bag yields about 0.6 cubic feet of concrete, and there are 27 cubic feet in a cubic yard (27 ÷ 0.6 = 45 bags).

Should I order ready-mix or use bagged concrete?

For projects requiring less than 1/2 cubic yard (about 20 bags), bagged concrete is usually more practical. For larger projects, ready-mix concrete saves time, labor, and often money. Consider the project size, your physical capabilities, time constraints, and equipment available when making this decision.

How thick should my concrete slab be?

Standard thicknesses vary by application: 4 inches for walkways and patios, 4-5 inches for residential driveways, 5-6 inches for driveways with heavy vehicles, and 4-6 inches for garage floors. Always check local building codes, as requirements may vary by location and specific application.

Plan Your Concrete Project with Confidence

Accurate concrete calculation is the foundation of any successful concrete project. By understanding the basic formulas, considering all relevant factors, and adding an appropriate waste factor, you can order the right amount of concrete for your needs. This saves money, prevents delays, and ensures your project proceeds smoothly from start to finish.

Remember that proper preparation extends beyond just calculating volume—site preparation, form construction, reinforcement placement, and weather considerations all play crucial roles in your project’s success.

Explore Our Other Construction Calculators

Need help with other construction calculations? Our website offers a variety of free calculators to help you plan your projects with precision.