Use our Down Payment Calculator to estimate how much you need for a home deposit. Plan your budget, mortgage, and savings for a smooth home purchase.

Planning to buy a home? Our down payment calculator helps you estimate how much money you’ll need upfront for your home purchase. Whether you’re exploring different loan options or determining how much to save, this calculator provides a clear picture of your down payment requirements and how they affect your overall home buying cost.

Our calculator helps you plan your home purchase with confidence

What Is a Down Payment?

A down payment is the upfront portion of money you pay when purchasing a home. It represents a percentage of the total home price and is not financed through your mortgage loan. The remaining balance becomes your mortgage loan amount that you’ll pay off over time.

Down Payment Formula

The basic formula for calculating a down payment is:

Down Payment = Home Price × Down Payment Percentage

For example, if you’re buying a $300,000 home with a 20% down payment, you would need:

$300,000 × 0.20 = $60,000 for your down payment

Why Down Payments Matter

- Reduces the amount you need to borrow

- Lowers your monthly mortgage payments

- May help you qualify for better interest rates

- Can eliminate the need for private mortgage insurance (PMI)

- Provides immediate equity in your home

Minimum Down Payment Requirements by Loan Type

Different loan types have different minimum down payment requirements. Understanding these requirements can help you choose the right loan for your situation.

| Loan Type | Minimum Down Payment | Credit Score Requirement | PMI/Mortgage Insurance |

| Conventional | 3-5% | 620+ | Required if less than 20% down |

| FHA Loan | 3.5% | 580+ | Required for life of loan |

| VA Loan | 0% | 620+ (varies by lender) | No PMI, but funding fee required |

| USDA Loan | 0% | 640+ (typical) | No PMI, but guarantee fee required |

| Jumbo Loan | 10-20% | 700+ | Varies by lender |

Not sure which loan type is right for you?

Try our Mortgage Loan Comparison Calculator to see which option fits your financial situation best.

Down Payment vs. Closing Costs: Understanding the Difference

Down Payment

- Percentage of home purchase price

- Paid directly to the seller

- Reduces the amount you need to borrow

- Provides immediate equity in your home

- Typically ranges from 3-20% of home price

Closing Costs

- Fees for finalizing your mortgage

- Paid to various service providers

- Includes lender fees, title insurance, appraisals

- Does not contribute to home equity

- Typically ranges from 2-5% of home price

Total Cash Needed = Down Payment + Closing Costs

When budgeting for a home purchase, remember to account for both your down payment and closing costs. For a $300,000 home with a 20% down payment and 3% closing costs, you would need:

Down Payment: $60,000 (20% of $300,000)

Closing Costs: $9,000 (3% of $300,000)

Total Cash Needed: $69,000

Want to estimate your closing costs?

Use our Closing Cost Calculator to get a detailed breakdown of potential fees.

Benefits of a Larger Down Payment

Advantages of Larger Down Payment

- Lower monthly mortgage payments

- Reduced interest paid over the life of the loan

- Elimination of PMI with 20% or more down

- Potential for better interest rates

- More equity in your home from day one

- Improved chances of loan approval

- Stronger position in competitive markets

Considerations for Larger Down Payment

- Depletes more of your savings

- Less liquidity for emergencies

- Opportunity cost of not investing those funds

- Delayed home purchase while saving

- Risk of market value changes during saving period

- Less cash available for home improvements

How Down Payment Affects Your Monthly Payment

| Home Price: $300,000 | 5% Down | 10% Down | 15% Down | 20% Down |

| Down Payment Amount | $15,000 | $30,000 | $45,000 | $60,000 |

| Loan Amount | $285,000 | $270,000 | $255,000 | $240,000 |

| Monthly Payment (Principal & Interest)* | $1,736 | $1,644 | $1,553 | $1,462 |

| PMI Required | Yes | Yes | Yes | No |

*Based on a 30-year fixed mortgage at 6.5% interest rate. Does not include taxes, insurance, or PMI.

Down Payment Assistance Programs

If saving for a down payment is challenging, various assistance programs can help make homeownership more accessible. These programs are typically designed for first-time homebuyers or those with moderate incomes.

Government Programs

- FHA loans with 3.5% down payment

- VA loans with zero down for veterans

- USDA loans with zero down for rural areas

- State housing finance agency programs

Local Assistance

- City and county grant programs

- Community development organizations

- Employer-assisted housing programs

- Neighborhood stabilization initiatives

Special Programs

- First-time homebuyer grants

- Forgivable loans for down payments

- Matched savings programs

- Professional-specific assistance (teachers, healthcare workers)

“Down payment assistance programs helped us buy our first home three years sooner than we expected. We only needed to come up with 1% of the purchase price ourselves.”

Find Down Payment Assistance Programs

Use our tool to discover assistance programs available in your area.

Strategies for Saving Your Down Payment

Saving for a down payment requires discipline and strategy. Here are effective approaches to help you reach your down payment goal faster.

Budgeting Strategies

- Create a dedicated down payment savings account

- Set up automatic transfers on payday

- Use the 50/30/20 budgeting rule

- Cut unnecessary expenses temporarily

- Consider a side hustle for extra income

Alternative Sources

- Gift funds from family members

- Down payment assistance programs

- Employer homebuying benefits

- IRA withdrawals (up to $10,000 for first-time buyers)

- 401(k) loans (be cautious with this approach)

Timeline Accelerators

- Temporarily move to lower-cost housing

- Sell unused assets or investments

- Bank all windfalls (tax refunds, bonuses)

- Consider house hacking opportunities

- Look for homes with seller concessions

Down Payment Savings Calculator

Use this calculator to estimate how long it will take to save for your down payment based on your current savings rate.

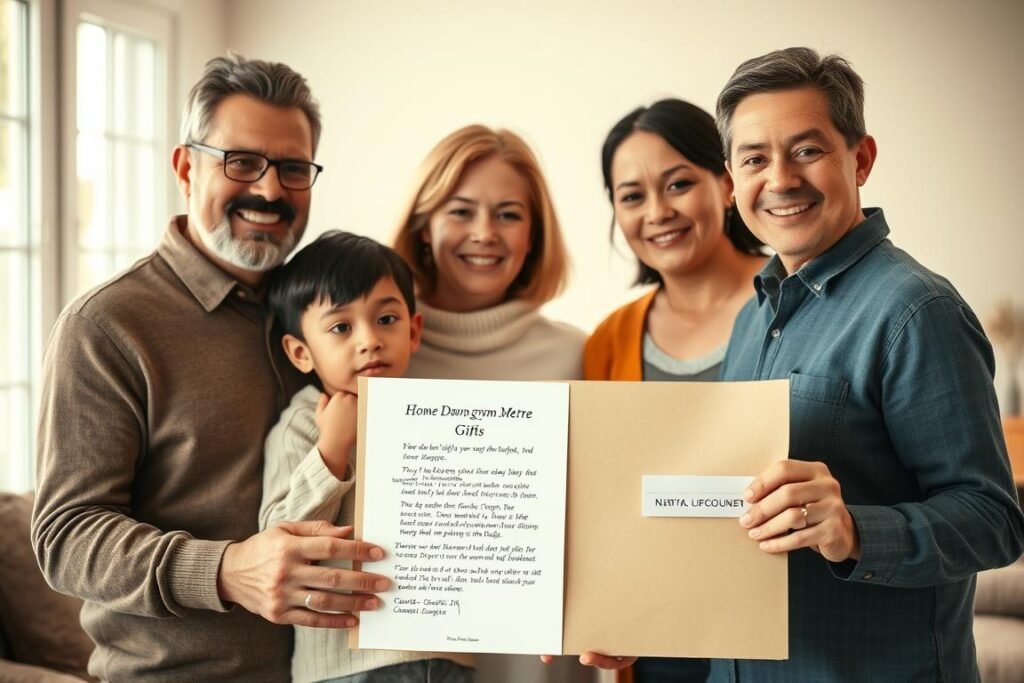

Using Gift Funds for Your Down Payment

Many homebuyers use monetary gifts from family members to help with their down payment. However, there are specific rules and documentation requirements when using gift funds.

Gift Fund Requirements

Documentation Needed

- Signed gift letter stating the amount

- Confirmation that repayment is not expected

- Donor’s relationship to the borrower

- Donor’s contact information

- Proof of the donor’s ability to provide the gift

- Documentation of the transfer of funds

Gift Fund Rules by Loan Type

- Conventional loans: Gift must come from family member

- FHA loans: Gift can come from family, close friend, employer, or charity

- VA loans: Gift can come from family, employer, charity, or government agency

- USDA loans: Similar to FHA loan gift requirements

Important: Lenders will verify the source of all large deposits in your bank accounts. Be prepared to document the source of your gift funds. The money should be in your account for at least 60 days before applying for a mortgage (seasoned funds) or be properly documented with a gift letter and transfer records.

Frequently Asked Questions About Down Payments

How does my credit score affect my down payment requirements?

Your credit score can significantly impact your down payment requirements. With a higher credit score (typically 720+), you may qualify for conventional loans with as little as 3% down. With lower scores, lenders may require larger down payments to offset the perceived risk. For FHA loans, you can put down 3.5% with a score of 580+, but you’ll need 10% down if your score is between 500-579.

Can I buy a house with no down payment?

Yes, it’s possible to buy a house with no down payment through specific loan programs. VA loans for veterans and active-duty military members and USDA loans for rural properties offer 0% down payment options. However, you must meet eligibility requirements for these programs. Some local down payment assistance programs may also cover your entire down payment if you qualify based on income and other factors.

What’s the difference between earnest money and a down payment?

Earnest money is a good-faith deposit made when you submit an offer on a house, typically 1-3% of the purchase price. It shows the seller you’re serious about buying. The down payment is a larger amount paid at closing that reduces your loan amount. If your offer is accepted, the earnest money is usually applied toward your down payment or closing costs at settlement.

How long does it take to save for a down payment?

The time needed to save for a down payment varies based on your income, expenses, savings rate, and target home price. According to research, the average first-time homebuyer takes 7-8 years to save a 20% down payment. However, with lower down payment options (3-5%) and assistance programs, many buyers can purchase homes much sooner. Use our Down Payment Savings Calculator to estimate your personal timeline.

Should I wait to save 20% or buy sooner with a smaller down payment?

This depends on your personal financial situation and local housing market. Buying sooner with a smaller down payment allows you to start building equity instead of paying rent, and you may benefit from home appreciation. However, you’ll have higher monthly payments and will likely pay PMI. Waiting to save 20% means lower monthly payments, no PMI, and potentially better loan terms. Consider factors like rent costs, housing market trends, and your overall financial stability when making this decision.

Plan Your Home Purchase with Confidence

Understanding your down payment options is a crucial step in the home buying process. By using our Down Payment Calculator and the information provided in this guide, you can make informed decisions about how much to save, which loan programs to consider, and how your down payment will affect your overall home buying costs.

Remember that while a 20% down payment is often cited as the ideal amount, many homebuyers successfully purchase homes with much less down. The right down payment amount depends on your financial situation, homeownership goals, and the local real estate market.

Ready to explore more homebuying calculators?

CalculatorHunt.com offers a comprehensive suite of financial tools to guide you through every step of your homebuying journey.