Use our Mortgage Payoff Calculator to see how extra payments affect your mortgage. Plan payoff strategies, save on interest, and manage your home loan effectively.

Discover how a mortgage payoff calculator can help you save thousands in interest and become debt-free years sooner. By understanding how extra payments impact your mortgage, you can make informed decisions about your financial future and potentially shave years off your loan term.

What Is a Mortgage Payoff Calculator?

A mortgage payoff calculator is a financial tool that helps homeowners understand how making additional payments toward their mortgage principal can impact their loan term and total interest paid. By inputting your current loan details and potential extra payment amounts, you can visualize different payoff scenarios and make strategic decisions about your mortgage.

The calculator shows you exactly how much time and money you could save by increasing your monthly payments or making occasional lump-sum contributions. For many homeowners, seeing these potential savings becomes a powerful motivator to accelerate their mortgage payoff.

Most mortgage payoff calculators allow you to experiment with different payment strategies, helping you find an approach that fits your financial situation while maximizing your interest savings.

Did you know? Paying just $100 extra per month on a $250,000, 30-year mortgage at 4% interest could save you over $30,000 in interest and help you pay off your loan 4 years earlier.

Benefits of Using a Mortgage Payoff Calculator

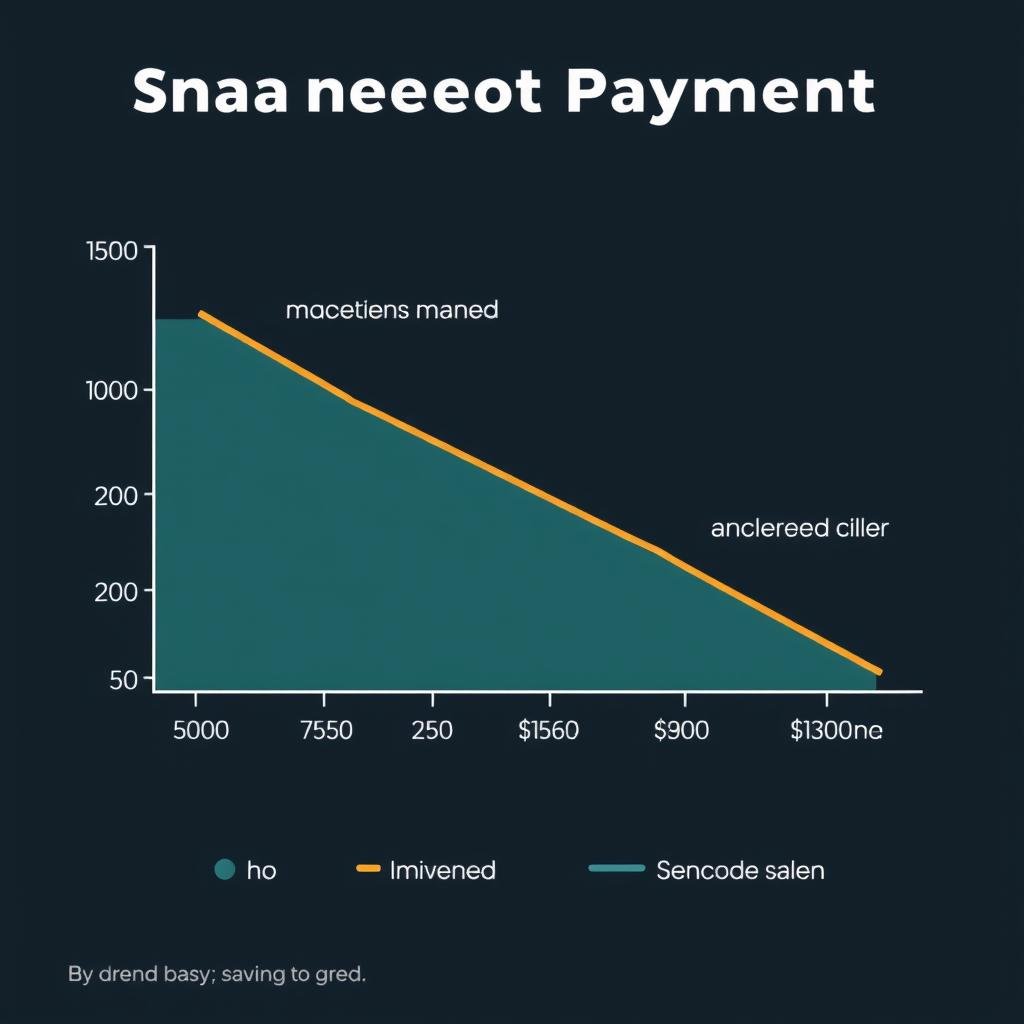

Visualize Interest Savings

See exactly how much interest you can save by making extra payments toward your principal balance.

Understand Time Savings

Calculate how many months or years you can shave off your mortgage term with different payment strategies.

Create a Payoff Strategy

Develop a personalized plan that fits your budget while maximizing your long-term financial benefits.

Ready to See Your Potential Savings?

Get personalized advice on the best mortgage payoff strategy for your unique financial situation.

How to Use a Mortgage Payoff Calculator

Using a mortgage payoff calculator is straightforward, but understanding the inputs and how to interpret the results is key to making informed decisions about your mortgage strategy.

-

Gather Your Current Mortgage Information

You’ll need your original loan amount, current outstanding balance, interest rate, and remaining term. This information can typically be found on your mortgage statement or by contacting your loan servicer.

-

Enter Your Loan Details

Input your mortgage information into the calculator. Most calculators require your current loan balance, interest rate, and either the original loan term or the remaining term.

-

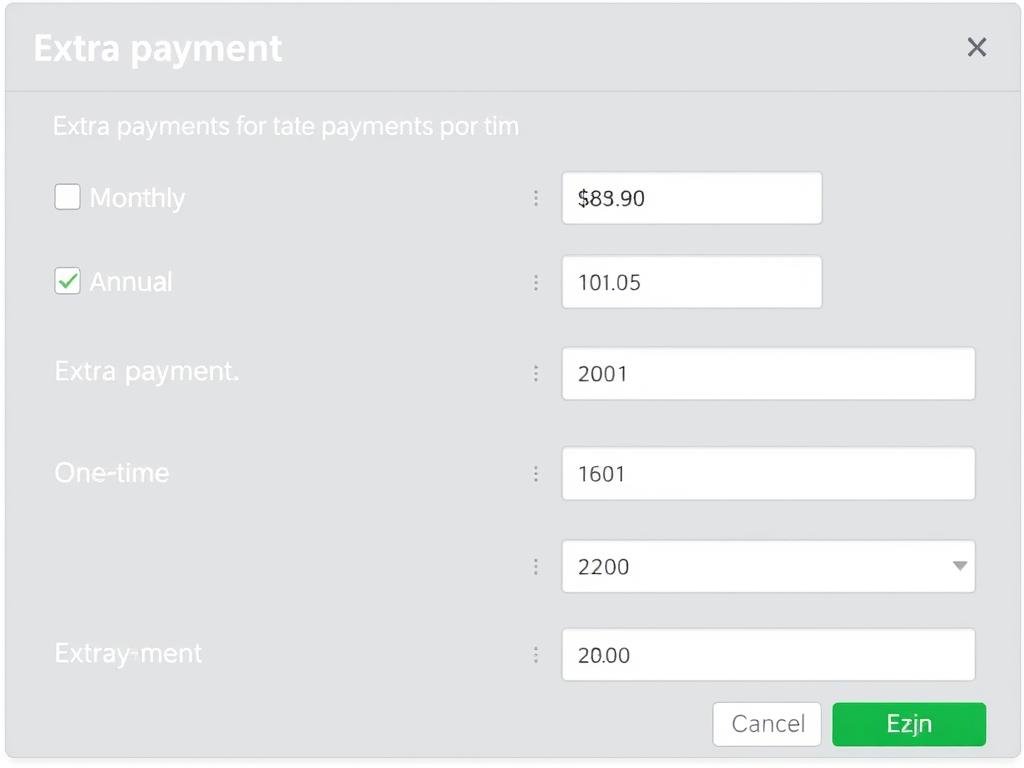

Specify Extra Payment Amount

Decide how much extra you can afford to pay toward your mortgage. You can typically choose between monthly extra payments, annual lump sums, or one-time payments.

-

Review the Results

Analyze the calculator’s output, which typically shows your new payoff date, total interest savings, and the reduction in your loan term.

“Understanding how to use a mortgage payoff calculator helped me create a realistic plan to pay off my home 7 years early, saving over $45,000 in interest. It was eye-opening to see how even small extra payments made a big difference.”

Effective Mortgage Payoff Strategies

There are several approaches to paying off your mortgage early. The best strategy depends on your financial situation, goals, and preferences. Here are some popular methods:

Monthly Extra Payments

Adding a fixed amount to your regular monthly payment is one of the simplest strategies. Even an extra $100-200 per month can significantly reduce your loan term and interest costs.

This approach works well for those with stable income who can commit to a higher monthly payment. The consistency helps build momentum in reducing your principal balance.

Biweekly Payment Plan

Instead of making 12 monthly payments per year, you make half-payments every two weeks, resulting in 26 half-payments or 13 full payments annually.

This strategy works particularly well for those paid biweekly, as you can align mortgage payments with your paycheck schedule. The extra annual payment can shave years off your mortgage.

Annual Lump Sum Payments

Applying tax refunds, work bonuses, or other windfalls directly to your mortgage principal once a year can make a substantial impact without affecting your monthly budget.

This approach is ideal for those with variable income or who receive periodic bonuses. Even inconsistent extra payments can lead to significant savings over time.

Refinancing to a Shorter Term

Refinancing from a 30-year to a 15-year mortgage typically offers lower interest rates and a structured path to faster payoff, though monthly payments will be higher.

This strategy works best when interest rates have dropped significantly since you obtained your original mortgage, potentially allowing you to maintain similar monthly payments while shortening your term.

Find Your Ideal Payoff Strategy

Our mortgage experts can help you determine which payoff approach best fits your financial goals and situation.

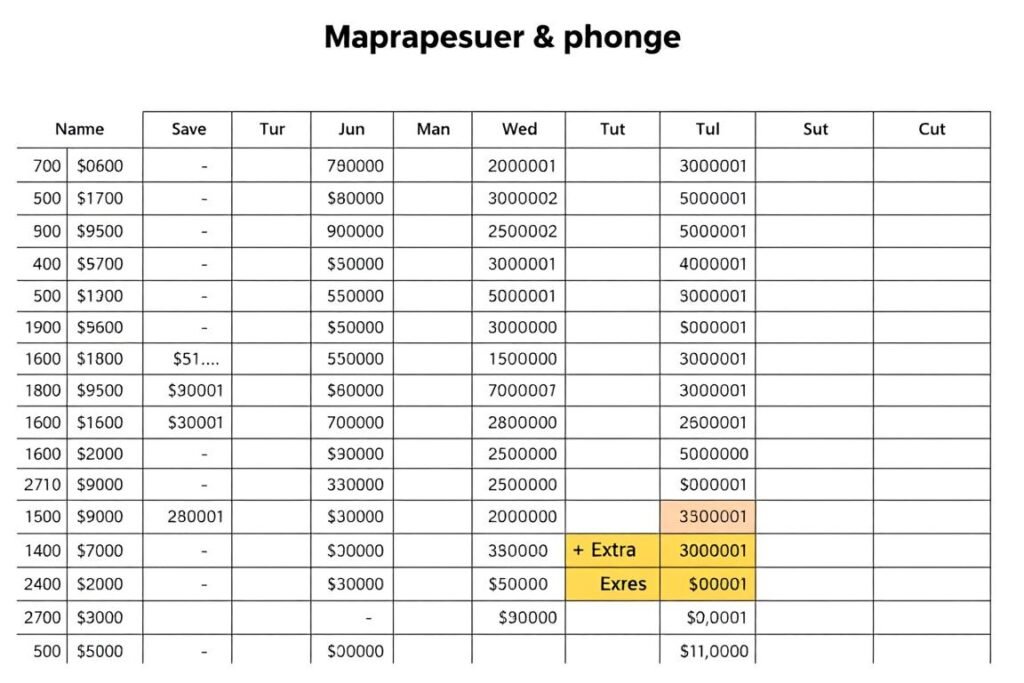

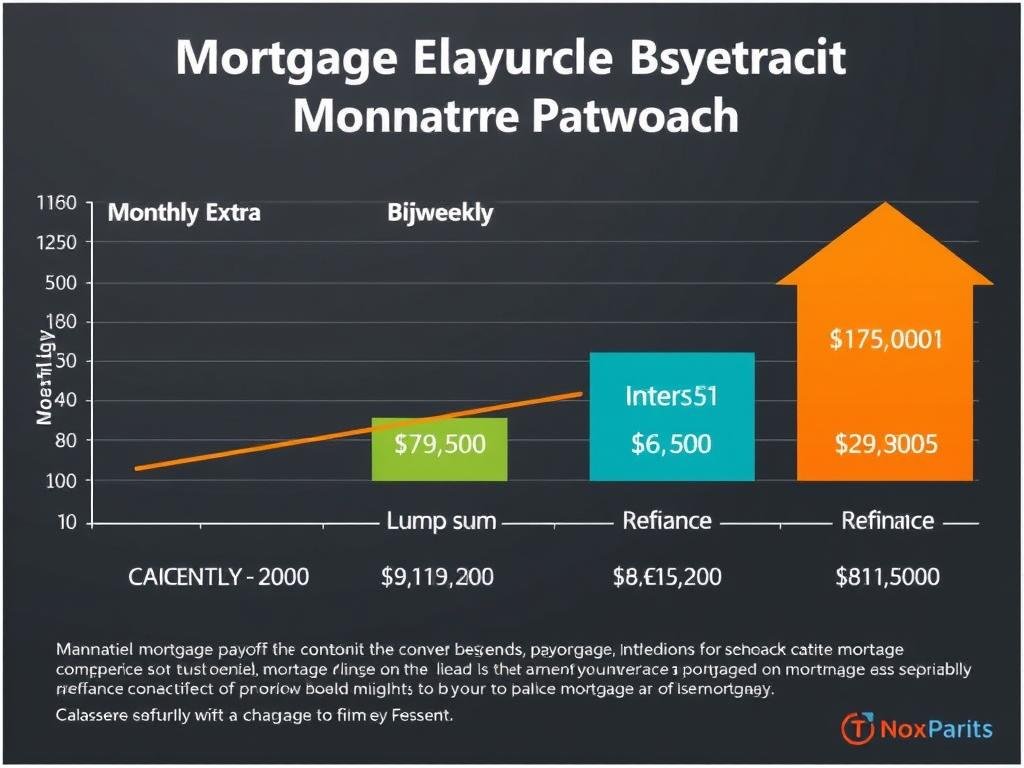

Real-World Examples of Mortgage Payoff Savings

To illustrate the potential impact of different payoff strategies, let’s look at some concrete examples using a mortgage payoff calculator:

| Scenario | Original Mortgage | Extra Payment | Time Saved | Interest Saved |

| Monthly Extra Payment | $300,000, 30-year, 4.5% | $200/month | 5 years, 6 months | $58,572 |

| Biweekly Payments | $300,000, 30-year, 4.5% | Half payment every 2 weeks | 4 years, 3 months | $45,934 |

| Annual Lump Sum | $300,000, 30-year, 4.5% | $3,000/year | 4 years, 8 months | $50,246 |

| Refinance | $300,000, 30-year, 4.5% | Refinance to 15-year, 3.5% | 15 years | $141,768 |

Important Note: These examples are for illustration purposes only. Your actual savings will depend on your specific loan terms, interest rate, and payment history. Use a mortgage payoff calculator with your own loan details to get personalized results.

Key Takeaways from These Examples

- Even modest extra payments can lead to significant savings over time

- The earlier in your mortgage term you start making extra payments, the greater your savings

- Refinancing to a shorter term typically offers the largest interest savings but requires higher monthly payments

- Consistent extra payments (monthly or biweekly) generally provide better results than occasional lump sums

Important Considerations Before Accelerating Your Mortgage Payoff

Benefits of Early Payoff

- Significant interest savings over the life of the loan

- Faster path to complete homeownership

- Reduced financial stress and improved cash flow after payoff

- Potential to reach other financial goals sooner

- Peace of mind from eliminating a major debt

Potential Drawbacks

- Reduced liquidity if too much cash is tied up in home equity

- Potential opportunity cost if investment returns exceed mortgage interest rate

- Loss of mortgage interest tax deduction

- Possible prepayment penalties (check your loan terms)

- May delay other financial priorities like retirement savings

Before accelerating your mortgage payoff: Ensure you have an emergency fund, have paid off high-interest debt, and are maximizing retirement contributions. Check your mortgage terms for any prepayment penalties, and consider consulting with a financial advisor to determine if early payoff aligns with your overall financial strategy.

Should I pay off my mortgage early or invest the extra money?

This depends on several factors, including your mortgage interest rate, potential investment returns, tax situation, and risk tolerance. Generally, if your mortgage rate is low (below 4%) and you have a long investment horizon, investing might yield better returns. However, paying off your mortgage offers a guaranteed return equal to your interest rate and provides emotional benefits that are harder to quantify.

How do I ensure extra payments go toward principal?

When making extra payments, clearly designate them as “principal only” payments. Check with your mortgage servicer about their specific process, as some require special instructions or separate payments. Always verify on your next statement that the extra amount was correctly applied to reduce your principal balance.

Are there any penalties for paying off my mortgage early?

Some mortgages include prepayment penalties, especially in the first few years of the loan. These penalties typically range from 1-3% of the loan balance or a certain number of months’ interest. Review your mortgage agreement or contact your lender to determine if your loan has such penalties and when they expire.

Best Practices for Using Mortgage Payoff Calculators

Tips for Accurate Results

- Use current information – Make sure you’re using your current loan balance, not the original amount

- Include all costs – Factor in property taxes and insurance if they’re part of your monthly payment

- Be realistic about extra payments – Only commit to amounts you can consistently afford

- Run multiple scenarios – Compare different strategies to find the optimal approach

Common Mistakes to Avoid

- Ignoring escrow payments – Remember that taxes and insurance are separate from principal and interest

- Overlooking prepayment penalties – Check your loan terms before making large extra payments

- Setting unrealistic goals – Extremely aggressive payoff plans often fail due to unsustainability

- Neglecting other financial priorities – Balance mortgage payoff with emergency savings and retirement planning

“The key to successful mortgage payoff isn’t just making extra payments—it’s making them consistently as part of a balanced financial plan that addresses all your money goals.”

Take Control of Your Mortgage Today

A mortgage payoff calculator is a powerful tool that can help you visualize the impact of different payment strategies on your home loan. By understanding how extra payments affect your loan term and interest costs, you can make informed decisions about accelerating your mortgage payoff in a way that aligns with your broader financial goals.

Whether you choose to make monthly extra payments, switch to a biweekly schedule, apply annual windfalls to your principal, or refinance to a shorter term, the key is to create a sustainable strategy that works with your budget and financial priorities. Even small additional payments can lead to significant savings over time.

Remember to balance your mortgage payoff goals with other important financial objectives like building emergency savings, paying off high-interest debt, and saving for retirement. With careful planning and the insights provided by a mortgage payoff calculator, you can chart a course toward mortgage freedom while strengthening your overall financial position.

Ready to Accelerate Your Mortgage Payoff?

Our mortgage experts can help you create a personalized payoff plan that fits your financial situation and goals.