Use our Investment Calculator to estimate returns, growth, and future value of investments. Plan contributions, track performance, and make informed financial decisions.

Making informed investment decisions requires understanding how your money can grow over time. An investment calculator helps you visualize potential returns based on different variables, allowing you to plan your financial future with confidence. Whether you’re saving for retirement, a home purchase, or building wealth, this powerful tool can help you map your journey to financial success.

Key Components of Investment Calculations

Understanding the fundamental elements that drive investment growth is essential for making informed financial decisions. Investment calculators use several key variables to project how your money might grow over time.

Principal Amount

This is your initial investment – the starting amount you put into an investment. Whether it’s $100 or $100,000, this serves as the foundation upon which your investment will grow. A larger principal generally leads to greater returns, thanks to the power of compound interest.

Interest Rate/Return Rate

This percentage represents how much your investment is expected to grow annually. Different investments offer varying rates of return, with higher rates typically associated with greater risk. The S&P 500, for example, has historically averaged around 10.5% annual returns before inflation.

Time Horizon

The length of time you plan to keep your money invested significantly impacts your returns. Thanks to compound interest, even modest investments can grow substantially over longer periods. This is why starting early is one of the most powerful investment strategies.

Compound Frequency

This refers to how often interest is calculated and added to your principal. Investments may compound annually, semi-annually, quarterly, monthly, or even daily. More frequent compounding typically results in higher returns over time, though the difference may be small.

Additional Contributions

Many investors add money to their investments regularly. Whether weekly, monthly, or annually, these additional contributions can dramatically accelerate growth. Investment calculators allow you to factor in these regular deposits to provide a more accurate projection.

Inflation Rate

While not always included in basic calculators, accounting for inflation helps you understand the real purchasing power of your future investment. The Federal Reserve typically targets a 2% annual inflation rate, meaning your investments should aim to grow faster than this rate.

Types of Investment Calculators

Different financial goals require different calculation approaches. Here are the most common types of investment calculators you might encounter, each designed for specific planning purposes.

Compound Interest Calculators

These calculators focus on how compound interest grows your money over time. They’re ideal for basic investment planning and understanding the time value of money. The formula used is typically:

A = P(1 + r/n)^(nt)

Where A is the final amount, P is principal, r is interest rate, n is compounding frequency, and t is time in years.

Retirement Planning Calculators

These specialized tools help you determine if you’re on track to meet your retirement goals. They often include factors like current age, retirement age, life expectancy, expected inflation, and potential Social Security benefits to provide a comprehensive view of your retirement readiness.

Stock Return Calculators

For equity investors, these calculators help project potential returns from stock investments. They may include options for dividend reinvestment, varying growth rates, and market volatility to simulate different scenarios for stock performance over time.

Mutual Fund Calculators

These tools help investors understand potential returns from mutual fund investments. They typically account for expense ratios, load fees, and historical performance data to provide more accurate projections for these diversified investment vehicles.

Ready to see how your investments could grow?

Try our recommended investment calculator to get a personalized projection based on your financial situation and goals.

How to Use an Investment Calculator: Step-by-Step Guide

Using an investment calculator effectively can help you make more informed financial decisions. Here’s how to get the most out of these powerful planning tools with practical examples.

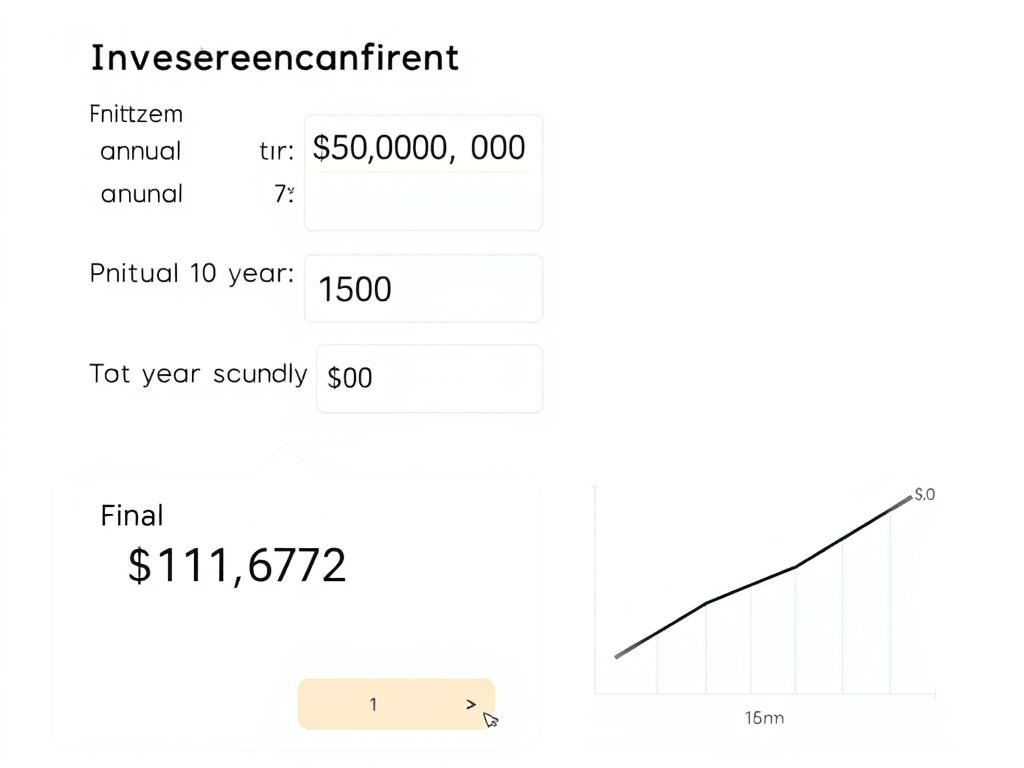

Example 1: Basic Compound Interest Calculation

Scenario: You have $10,000 to invest for 10 years at a 7% annual return rate.

- Enter your initial investment: $10,000

- Enter the expected annual rate of return: 7%

- Set your time horizon: 10 years

- Select compounding frequency: Annually

- Leave additional contributions at $0

Result: After 10 years, your $10,000 would grow to approximately $19,672 without any additional contributions.

Example 2: Retirement Planning Scenario

Scenario: You’re 35 years old with $50,000 already saved and want to retire at 65.

- Enter your current age: 35

- Enter your retirement age: 65

- Enter current savings: $50,000

- Set monthly contribution: $500

- Enter expected annual return: 8%

- Account for 2.5% inflation (optional)

Result: By age 65, your retirement savings could grow to approximately $1.2 million in future dollars, or about $611,000 in today’s purchasing power when adjusted for inflation.

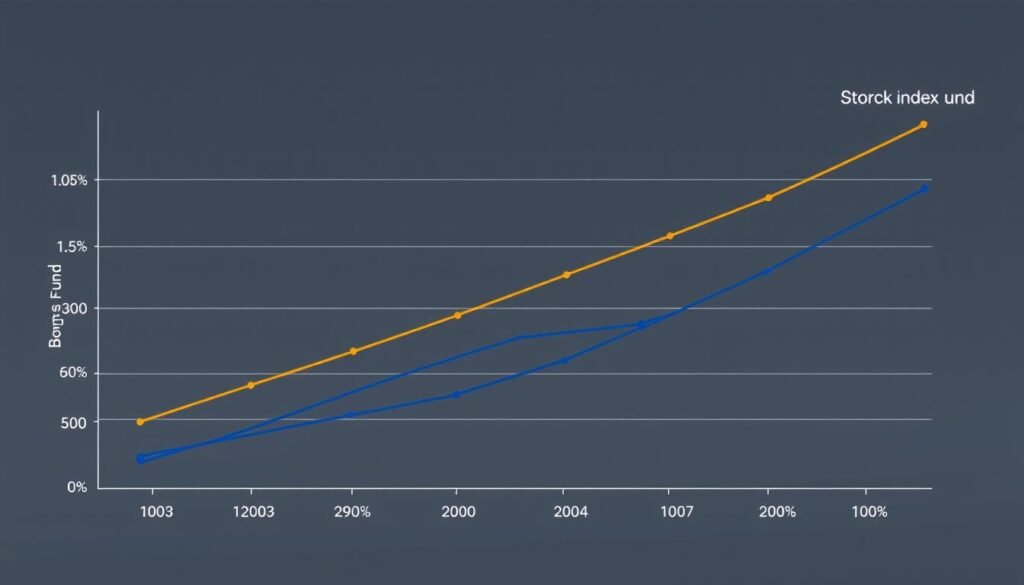

Example 3: Comparing Different Investment Options

| Investment Type | Initial Amount | Monthly Contribution | Expected Return | Time Period | Final Value |

| High-Yield Savings | $5,000 | $200 | 1.5% | 10 years | $30,272 |

| Bond Fund | $5,000 | $200 | 4% | 10 years | $34,518 |

| Balanced Fund | $5,000 | $200 | 7% | 10 years | $40,728 |

| Stock Index Fund | $5,000 | $200 | 10% | 10 years | $48,182 |

This comparison clearly shows how different expected returns can significantly impact your investment growth over time, even when starting with the same principal amount and making identical monthly contributions.

Benefits of Using Investment Calculators

Investment calculators offer numerous advantages for both novice and experienced investors. Here’s how these tools can enhance your financial planning process.

Financial Goal Setting

Investment calculators help you establish realistic financial targets by showing what’s possible given your current resources and investment strategy. They transform abstract goals like “save for retirement” into concrete numbers, helping you determine exactly how much you need to invest to reach specific milestones.

Risk Assessment

By comparing different return rates, you can visualize the trade-offs between risk and reward. This helps you determine your risk tolerance and choose investments that align with your comfort level while still meeting your financial objectives.

Investment Strategy Optimization

Calculators allow you to experiment with different variables to find the optimal investment strategy. You can adjust contribution amounts, investment timeframes, and expected returns to see which combination best suits your financial situation and goals.

Time Value of Money Visualization

Perhaps the most powerful benefit is seeing how compound interest works over time. Investment calculators vividly demonstrate why starting early matters so much, even with smaller amounts, by showing the exponential growth that occurs in later years.

Reality Check

Investment calculators provide a reality check on your financial plans. They can help you identify if your current savings rate is insufficient or if your expected returns are unrealistic, allowing you to adjust your strategy before it’s too late.

Educational Tool

For those new to investing, calculators serve as excellent educational tools. By experimenting with different inputs and seeing how they affect outcomes, you can gain a deeper understanding of investment principles without risking real money.

Start planning your financial future today

Use our comprehensive investment calculator to see how your savings could grow and develop a strategy to meet your financial goals.

Limitations and Considerations

While investment calculators are powerful tools, they do have limitations you should be aware of when interpreting their results.

Simplified Assumptions

Most calculators assume constant returns year after year, which rarely happens in real markets. Actual investment performance typically fluctuates, sometimes dramatically, from year to year. This volatility can significantly impact your final results, especially if major market downturns occur near your planned withdrawal date.

Inflation Considerations

Not all calculators account for inflation, which can substantially reduce the purchasing power of your future savings. A million dollars in 30 years will buy considerably less than a million dollars today. When possible, use calculators that include inflation adjustments or mentally discount future values.

Tax Implications

Investment calculators typically show growth before taxes. Depending on the type of account you’re investing in (taxable, tax-deferred like a 401(k), or tax-free like a Roth IRA), the after-tax value of your investments could be significantly different from the calculator projections.

Fee Exclusions

Many basic calculators don’t account for investment fees, which can substantially impact long-term returns. Even a seemingly small difference of 0.5% in annual fees can reduce your final balance by tens of thousands of dollars over several decades.

Life Uncertainties

Calculators can’t predict life events that might force you to withdraw funds early or temporarily stop contributions. Job losses, medical emergencies, or other unexpected expenses can disrupt even the best-laid investment plans.

Market Realities

Historical average returns, like the often-cited 10.5% for the S&P 500, don’t guarantee future performance. Economic conditions change, and past performance doesn’t predict future results. It’s generally wise to use conservative estimates in your calculations.

Best Practices for Using Investment Calculators

To get the most accurate and useful results from investment calculators, follow these expert-recommended practices.

Recommended Investment Calculator Tools

These reliable online investment calculators offer different features to help you plan your financial future with confidence.

Calculator.net

A comprehensive investment calculator with multiple tabs for different calculations. It allows you to find specific parameters like required return rate, starting amount, or investment length based on your goals. The accumulation schedule feature shows year-by-year growth.

SmartAsset

This user-friendly calculator offers clear visualizations of your investment growth over time. It includes inflation adjustments and allows you to compare different investment strategies. The tool also provides educational content to help you understand the results.

Investor.gov

Offered by the U.S. Securities and Exchange Commission, this official calculator provides reliable, unbiased calculations. It includes compound interest projections and educational resources about investment principles from a trusted government source.

Making the Most of Investment Calculators

Investment calculators are powerful tools that can transform your approach to financial planning. By helping you visualize the growth potential of your investments, they make abstract financial concepts tangible and actionable. Whether you’re just starting your investment journey or fine-tuning an established portfolio, these calculators provide valuable insights that can guide your decision-making.

Remember that while calculators provide useful projections, they’re most effective when combined with a solid understanding of investment principles and realistic expectations. Use them as one tool in your broader financial planning toolkit, alongside education, professional advice when needed, and regular reviews of your progress.

The most important step is to start using these tools today. Even small investments, when given enough time to grow, can lead to remarkable results thanks to the power of compound interest. By leveraging investment calculators to inform your strategy, you’re taking a significant step toward securing your financial future.

Ready to take control of your financial future?

Start using our recommended investment calculator today to create a personalized plan for reaching your financial goals.