Use our IRA Calculator to estimate your retirement savings growth. Plan contributions, interest, and future value to secure your financial future.

Planning for retirement requires understanding how your savings will grow over time. Our IRA calculator helps you compare Traditional, Roth, SEP, and SIMPLE IRAs to find the best option for your financial future. See how different contribution amounts, investment returns, and tax scenarios affect your retirement nest egg with our easy-to-use tool.

IRA Calculator

Use our calculator to see how your IRA contributions could grow over time. Input your details below to get started.

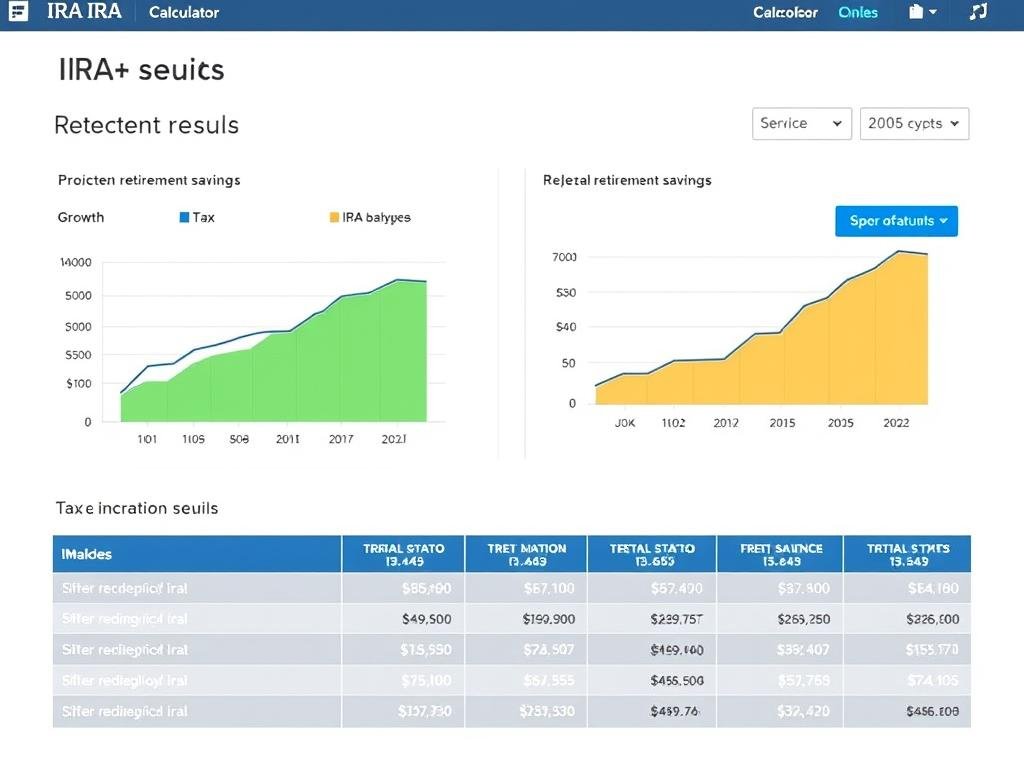

Your Retirement Calculation Results

| IRA Type | Balance at Retirement | After-Tax Value | Tax Savings |

| Traditional IRA | $0 | $0 | $0 |

| Roth IRA | $0 | $0 | $0 |

| SEP IRA | $0 | $0 | $0 |

| SIMPLE IRA | $0 | $0 | $0 |

Enter your information in the calculator to see personalized results. The calculator will show you potential growth based on your contributions, expected returns, and tax considerations.

What Is an IRA Calculator?

An IRA (Individual Retirement Account) calculator is a financial tool that helps you estimate how your retirement savings will grow over time. It takes into account factors such as your current age, retirement age, contribution amounts, expected rate of return, and tax considerations to provide projections of your future retirement savings.

Why Use an IRA Calculator?

Using an IRA calculator allows you to make informed decisions about your retirement planning by:

- Comparing different IRA types to find the best fit for your situation

- Visualizing how your savings will grow over time

- Understanding the impact of different contribution amounts

- Seeing the effects of tax-deferred or tax-free growth

- Planning for a secure financial future

Ready to See Your Retirement Potential?

Don’t leave your retirement to chance. Use our calculator to see how different IRA options can help you build your nest egg.

Types of IRAs: Which One Is Right for You?

There are several types of IRAs, each with different rules, contribution limits, and tax advantages. Understanding these differences is crucial for making the best choice for your retirement planning.

Traditional IRA

A Traditional IRA allows you to contribute pre-tax income, reducing your current taxable income. Your investments grow tax-deferred until retirement, when withdrawals are taxed as ordinary income.

Key Features:

- Tax-deductible contributions (income limits may apply)

- Tax-deferred growth

- Withdrawals taxed as ordinary income in retirement

- Required Minimum Distributions (RMDs) starting at age 73

- Early withdrawal penalties before age 59½ (with some exceptions)

2024 Contribution Limits:

- $7,000 for individuals under 50

- $8,000 for individuals 50 and older (includes $1,000 catch-up contribution)

Roth IRA

A Roth IRA is funded with after-tax dollars, meaning you don’t get an immediate tax deduction. However, qualified withdrawals in retirement are completely tax-free, including all earnings.

Key Features:

- After-tax contributions (no immediate tax deduction)

- Tax-free growth

- Tax-free qualified withdrawals in retirement

- No Required Minimum Distributions during your lifetime

- Ability to withdraw contributions (not earnings) at any time without penalties

2024 Contribution Limits:

- $7,000 for individuals under 50

- $8,000 for individuals 50 and older (includes $1,000 catch-up contribution)

- Income limits apply for eligibility

SEP IRA

A Simplified Employee Pension (SEP) IRA is designed for self-employed individuals and small business owners. It allows for higher contribution limits than Traditional or Roth IRAs.

Key Features:

- Higher contribution limits than Traditional or Roth IRAs

- Employer-funded (self-employed individuals act as both employer and employee)

- Tax-deductible contributions

- Tax-deferred growth

- Withdrawals taxed as ordinary income in retirement

- Required Minimum Distributions starting at age 73

2024 Contribution Limits:

- Up to 25% of compensation or $69,000, whichever is less

- No catch-up contributions for those over 50

SIMPLE IRA

A Savings Incentive Match Plan for Employees (SIMPLE) IRA is designed for small businesses with 100 or fewer employees. It requires employer contributions, either as a match or as a percentage of employee compensation.

Key Features:

- Easier to set up and administer than a 401(k) plan

- Mandatory employer contributions

- Tax-deductible contributions

- Tax-deferred growth

- Withdrawals taxed as ordinary income in retirement

- Required Minimum Distributions starting at age 73

- Higher early withdrawal penalty (25%) within first two years

2024 Contribution Limits:

- $16,000 for individuals under 50

- $19,500 for individuals 50 and older (includes $3,500 catch-up contribution)

Compare All IRA Types

Not sure which IRA is right for you? Use our calculator to compare all options side by side.

How to Use Our IRA Calculator

Our IRA calculator is designed to be user-friendly while providing comprehensive results. Follow these steps to get the most accurate projections for your retirement savings.

-

Enter Your Basic Information

Start by entering your current age, expected retirement age, and current retirement savings (if any).

-

Select Your IRA Type

Choose which type of IRA you want to calculate: Traditional, Roth, SEP, or SIMPLE. You can run multiple calculations to compare different options.

-

Enter Contribution Details

Input your planned annual contribution amount. Remember to stay within the contribution limits for your selected IRA type and age.

-

Specify Investment Details

Enter your expected annual rate of return on investments. A conservative estimate is typically between 5-7%, while more aggressive portfolios might aim for 8-10%.

-

Add Tax Information

Enter your current tax rate and expected tax rate in retirement. This helps calculate the tax benefits of different IRA types.

-

Review Your Results

The calculator will display your projected retirement savings, showing both pre-tax and after-tax values where applicable.

Ready to Calculate Your Retirement Savings?

Take the first step toward a secure retirement by using our IRA calculator today.

Benefits of Using an IRA Calculator

An IRA calculator is more than just a tool—it’s a roadmap to your financial future. Here’s how it can help you make better retirement planning decisions.

Long-Term Planning

See how your retirement savings will grow over decades, helping you set realistic long-term goals and adjust your strategy as needed.

Tax Optimization

Compare the tax advantages of different IRA types to minimize your tax burden both now and in retirement.

Contribution Strategy

Determine the optimal contribution amount to meet your retirement goals without overextending your current finances.

Return Scenarios

Test different investment return scenarios to understand potential outcomes and prepare for market fluctuations.

Retirement Age Flexibility

Explore how different retirement ages affect your financial readiness, helping you decide when you can comfortably retire.

Catch-Up Planning

For those over 50, see how catch-up contributions can significantly boost your retirement savings in the final years before retirement.

Maximize Your Retirement Potential

Use our IRA calculator to unlock these benefits and take control of your retirement planning.

IRA Investment Strategies Comparison

Different investment strategies can significantly impact your retirement savings. Use our calculator to compare these common approaches and find the one that best suits your goals and risk tolerance.

| Strategy | Risk Level | Potential Return | Best For | Typical Asset Allocation |

| Conservative | Low | 3-5% | Near-retirement or risk-averse investors | 70% bonds, 30% stocks |

| Moderate | Medium | 5-7% | Mid-career investors with balanced risk tolerance | 50% stocks, 40% bonds, 10% alternatives |

| Aggressive | High | 7-10% | Young investors with long time horizons | 80% stocks, 15% bonds, 5% alternatives |

| Target Date | Adjusts over time | Varies with age | Investors who prefer automatic adjustments | Shifts from aggressive to conservative as retirement approaches |

Comparison of different investment strategies over a 30-year period. Higher-risk strategies typically yield better long-term results but with more volatility.

Find Your Optimal Investment Strategy

Use our calculator to see how different investment strategies affect your retirement savings.

Tax Implications of Different IRA Types

Understanding the tax implications of each IRA type is crucial for maximizing your retirement savings. Our calculator helps you compare the tax effects of different IRA options.

Traditional IRA Tax Advantages

- Immediate tax deduction on contributions (if eligible)

- Tax-deferred growth until retirement

- Potentially lower tax bracket in retirement

- Good for high-income earners who expect lower retirement income

- State tax benefits in many states

Traditional IRA Tax Considerations

- All withdrawals taxed as ordinary income

- Required Minimum Distributions starting at age 73

- 10% penalty on early withdrawals (with some exceptions)

- Income limits for deduction if covered by workplace plan

- Potential for higher taxes if tax rates increase

Roth IRA Tax Advantages

- Tax-free qualified withdrawals in retirement

- Tax-free growth on all earnings

- No Required Minimum Distributions during your lifetime

- Ability to withdraw contributions at any time without taxes or penalties

- Ideal if you expect higher tax rates in retirement

Roth IRA Tax Considerations

- No immediate tax deduction for contributions

- Income limits for eligibility

- Five-year holding period required for tax-free earnings withdrawals

- 10% penalty on early withdrawal of earnings (with some exceptions)

- Less beneficial if tax rates decrease significantly in retirement

Tax treatment comparison between Traditional and Roth IRAs across different life stages.

Calculate Your Tax Advantages

Use our IRA calculator to see which IRA type offers the best tax advantages for your specific situation.

Real-World IRA Calculator Case Studies

See how different individuals can use an IRA calculator to optimize their retirement planning based on their unique circumstances.

Case Study 1: Early Career Professional

Profile:

- Age: 28

- Current Savings: $10,000

- Annual Contribution: $6,000

- Expected Retirement Age: 65

- Current Tax Bracket: 22%

- Expected Retirement Tax Bracket: 15%

Calculator Results:

| IRA Type | Pre-Tax Balance at 65 | After-Tax Balance at 65 | Total Tax Savings |

| Traditional IRA | $1,027,430 | $873,315 | $46,200 |

| Roth IRA | $801,395 | $801,395 | $0 |

Recommendation:

For this early career professional, the Traditional IRA shows a higher after-tax balance at retirement due to the long time horizon and the expectation of a lower tax bracket in retirement. However, the Roth IRA offers more flexibility and protection against future tax rate increases.

Case Study 2: Mid-Career Small Business Owner

Profile:

- Age: 45

- Current Savings: $150,000

- Annual Contribution: $30,000

- Expected Retirement Age: 67

- Current Tax Bracket: 32%

- Expected Retirement Tax Bracket: 24%

Calculator Results:

| IRA Type | Pre-Tax Balance at 67 | After-Tax Balance at 67 | Total Tax Savings |

| SEP IRA | $1,458,720 | $1,108,627 | $211,200 |

| Traditional IRA | $563,240 | $428,062 | $49,280 |

Recommendation:

For this small business owner, the SEP IRA is clearly advantageous due to the higher contribution limits, allowing for significantly more tax-deferred growth. The substantial current tax savings also make this an attractive option given the higher current tax bracket compared to expected retirement tax rates.

See What’s Possible for Your Retirement

These case studies show how different IRA strategies can lead to dramatically different outcomes. Use our calculator to see what’s possible for your unique situation.

Common Mistakes to Avoid When Using IRA Calculators

While IRA calculators are powerful tools, they’re only as good as the information you input. Avoid these common mistakes to get the most accurate projections.

Underestimating Inflation

Many people forget to account for inflation when planning for retirement. What costs $50,000 today might cost $100,000 or more by the time you retire. Our calculator factors in inflation to give you more realistic projections.

Using Unrealistic Return Rates

While the stock market has historically returned around 10% annually before inflation, it’s prudent to use more conservative estimates (5-7%) for long-term planning to account for market fluctuations and economic cycles.

Ignoring Tax Implications

Different IRA types have different tax treatments. Failing to consider how taxes will affect your withdrawals can lead to significant miscalculations in your retirement planning.

Not Considering Required Minimum Distributions

Traditional, SEP, and SIMPLE IRAs require you to start taking distributions at age 73. Failing to plan for these mandatory withdrawals can disrupt your tax planning in retirement.

Overlooking Contribution Limits

Each IRA type has specific contribution limits that may change over time. Make sure your calculations reflect the current limits and account for catch-up contributions if you’re over 50.

Forgetting About Early Withdrawal Penalties

If you plan to access your funds before age 59½, remember that early withdrawals typically incur a 10% penalty (25% for SIMPLE IRAs in the first two years) in addition to regular income taxes.

Pro Tip: Regular Recalculations

Your financial situation and goals will change over time. Make it a habit to recalculate your retirement projections annually or whenever you experience significant life changes such as marriage, career advancement, or inheritance.

Get Accurate Retirement Projections

Our IRA calculator helps you avoid these common mistakes by providing comprehensive, realistic projections based on current tax laws and contribution limits.

Frequently Asked Questions About IRA Calculations

What’s the difference between a Traditional and Roth IRA in terms of calculations?

The main calculation difference is when taxes are applied. With a Traditional IRA, you deduct contributions now but pay taxes on withdrawals later. With a Roth IRA, you pay taxes on contributions now but withdrawals are tax-free later. Our calculator shows both pre-tax and after-tax values to help you compare these options effectively.

How accurate are IRA calculators for long-term projections?

IRA calculators provide estimates based on the information you input. While they can’t predict future market performance, tax law changes, or inflation rates with perfect accuracy, they’re valuable tools for comparing different scenarios and understanding the potential impact of your saving and investment decisions. For the most accurate projections, use conservative estimates and recalculate regularly.

Can I contribute to both a Traditional and Roth IRA in the same year?

Yes, you can contribute to both a Traditional and Roth IRA in the same year, but your total contributions across all IRAs cannot exceed the annual limit (,000 for 2024, or ,000 if you’re 50 or older). Our calculator can help you determine the optimal split between different IRA types based on your tax situation and retirement goals.

How do I account for employer contributions in a SIMPLE or SEP IRA?

For SIMPLE IRAs, employers must either match employee contributions up to 3% of compensation or contribute 2% of each eligible employee’s compensation. For SEP IRAs, employers can contribute up to 25% of an employee’s compensation (up to ,000 for 2024). Our calculator allows you to input these employer contributions separately to provide a complete picture of your retirement savings growth.

How do I determine which rate of return to use in the calculator?

Your expected rate of return should reflect your investment strategy and risk tolerance. Historically, a diversified portfolio of stocks has returned about 7-10% annually over long periods, while bonds have returned about 3-5%. A balanced portfolio might average 5-7%. For conservative estimates, consider using a lower rate (5-6%) to account for market fluctuations and fees. Our calculator allows you to compare different return scenarios to see the potential impact on your retirement savings.

What happens if I exceed the IRA contribution limits?

Excess contributions to IRAs are subject to a 6% penalty tax each year until the excess is corrected. You can fix an excess contribution by withdrawing it (and any earnings on it) before your tax filing deadline, including extensions. Alternatively, you can apply the excess contribution to a future year. Our calculator helps you stay within contribution limits by clearly displaying the maximum allowed contributions based on your age and IRA type.

Still Have Questions?

Our comprehensive IRA calculator can help answer many of your retirement planning questions. Try it today to get a clearer picture of your financial future.

Take Control of Your Retirement Planning Today

Planning for retirement doesn’t have to be complicated. With our IRA calculator, you can make informed decisions about your retirement savings strategy, compare different IRA types, and see how your investments will grow over time.

Whether you’re just starting your retirement savings journey or looking to optimize your existing strategy, our calculator provides the insights you need to make confident decisions about your financial future.

Start Building Your Retirement Nest Egg

Don’t leave your retirement to chance. Use our IRA calculator to create a solid plan for your financial future.