Use our Debt-to-Income Ratio Calculator to evaluate your financial health. Calculate your DTI, plan budgets, and manage debt effectively.

Your DTI ratio is looking good! (35% or less)

Lenders generally view a lower DTI as favorable. You likely have money left over for saving or spending after you've paid your bills.

You have an opportunity to improve your DTI ratio (36% - 49%)

You appear to be managing your debt, but you may want to consider lowering your DTI. This could put you in a better position for loan approval and help you handle unexpected expenses.

You should take action to improve your DTI ratio (50% or more)

With more than half your income going toward debt payments, you may not have much money left to save, spend, or handle unexpected expenses. Lenders may limit your borrowing options.

Your debt-to-income (DTI) ratio is a critical financial health indicator that lenders use to evaluate your loan eligibility. This simple percentage shows how much of your monthly income goes toward debt payments, helping lenders assess your ability to manage additional financial obligations. Whether you're planning to apply for a mortgage, auto loan, or simply want to gauge your financial standing, our DTI calculator gives you instant insight into your current situation.

What Is a Debt-to-Income Ratio?

A debt-to-income ratio is the percentage of your gross monthly income that goes toward paying debts. Lenders use this metric to measure your ability to manage monthly payments and repay borrowed money. Your DTI ratio provides a snapshot of your financial health and helps lenders determine whether you can comfortably take on additional debt.

Types of DTI Ratios

Front-End Ratio

The front-end ratio only includes your housing costs compared to your income. This includes:

- Mortgage principal and interest

- Property taxes

- Homeowners insurance

- Mortgage insurance (if applicable)

- HOA fees (if applicable)

Lenders typically prefer a front-end ratio of 28% or lower.

Back-End Ratio

The back-end ratio includes all monthly debt payments compared to your income. This includes:

- All housing costs (from front-end ratio)

- Credit card minimum payments

- Car loan payments

- Student loan payments

- Personal loan payments

- Child support or alimony

Lenders typically prefer a back-end ratio of 36% or lower, though some allow up to 43-50%.

How to Calculate Your Debt-to-Income Ratio

Calculating your DTI ratio is straightforward. Follow these steps to determine your current ratio:

- Add up all your monthly debt payments

Include minimum payments for credit cards, mortgage or rent, auto loans, student loans, personal loans, and other recurring debt obligations like child support or alimony.

- Determine your gross monthly income

This is your total income before taxes and deductions. Include salary, wages, tips, bonuses, pension, and any other sources of regular income.

- Divide your total monthly debt by your gross monthly income

This gives you a decimal number.

- Multiply by 100 to get your percentage

This final number is your debt-to-income ratio.

DTI Ratio = (Total Monthly Debt Payments ÷ Gross Monthly Income) × 100

Example Calculation

| Monthly Expense | Amount |

| Mortgage Payment | $1,500 |

| Car Loan | $350 |

| Student Loan | $250 |

| Credit Card Minimum Payments | $150 |

| Personal Loan | $100 |

| Total Monthly Debt | $2,350 |

With a gross monthly income of $6,000:

DTI Ratio = ($2,350 ÷ $6,000) × 100 = 39.2%

What to Include in Monthly Debt

Include only required minimum payments for:

- Mortgage or rent

- Auto loans

- Student loans

- Credit card minimum payments

- Personal loans

- Child support or alimony

Do NOT include:

- Utilities (electricity, water, gas)

- Cell phone bills

- Insurance premiums

- Groceries

- Entertainment expenses

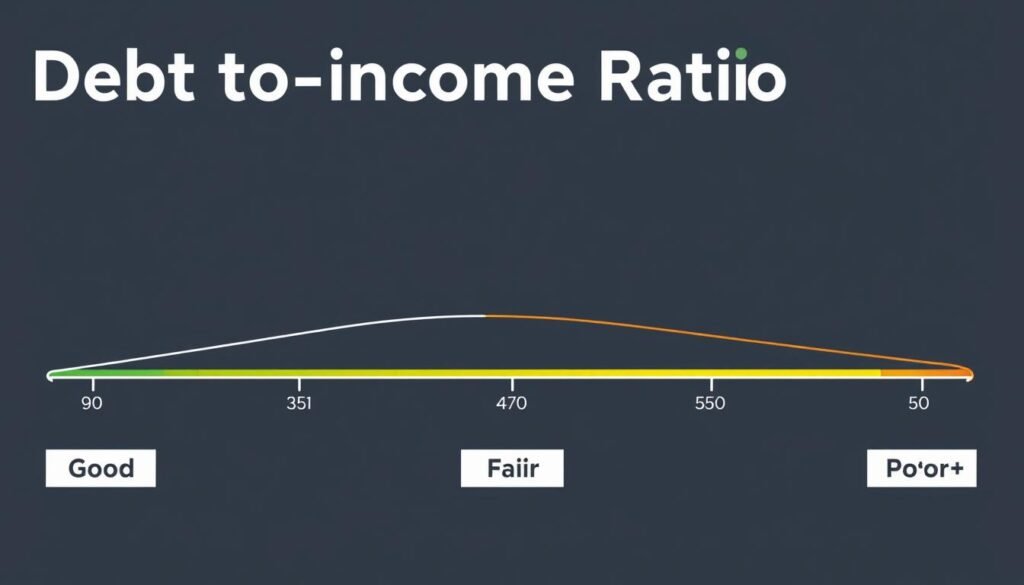

What Is a Good Debt-to-Income Ratio?

Understanding what constitutes a good DTI ratio helps you gauge your financial health and loan eligibility. Here's how lenders typically view different DTI ranges:

| DTI Ratio | Rating | What It Means |

| 35% or less | Good | You're managing debt well and likely have money left for saving and spending. Lenders view this favorably, and you'll likely qualify for most loans with competitive rates. |

| 36% - 49% | Fair | You're managing your debt adequately, but there's room for improvement. Lenders may approve loans but might charge higher interest rates or require additional documentation. |

| 50% or higher | Poor | More than half your income goes toward debt payments, which is concerning to lenders. You may face limited borrowing options and should focus on reducing debt before taking on new loans. |

DTI Requirements by Loan Type

Different loan types have varying DTI requirements. Here's what you need to know:

Conventional Loans

Maximum DTI: 36-50%

For automated underwriting, the maximum back-end DTI is typically 50%. For manually underwritten loans, lenders prefer 36% front-end and 43% back-end, though exceptions may be made for strong credit scores.

FHA Loans

Maximum DTI: 31/43% to 55%

FHA loans allow a front-end ratio of 31% and back-end ratio of 43% for manual underwriting. With automated underwriting, back-end ratios up to 55% may be accepted with compensating factors.

VA Loans

Maximum DTI: 41% to no cap

VA loans have no official DTI cap with automated underwriting, though most lenders prefer 41% or lower. Manually underwritten VA loans typically require a back-end ratio of 41% or less.

How to Improve Your Debt-to-Income Ratio

If your DTI ratio is higher than you'd like, there are several effective strategies to improve it. Remember, a lower DTI not only helps with loan approval but also indicates better overall financial health.

Strategies to Lower Your DTI

- Pay down existing debt - Focus on high-interest debt first or use the debt snowball method to tackle smaller debts for quick wins.

- Increase your income - Ask for a raise, work overtime, start a side hustle, or find a higher-paying job.

- Avoid taking on new debt - Postpone major purchases that require financing until your DTI improves.

- Refinance or consolidate debt - Potentially lower your monthly payments by refinancing at a lower interest rate.

- Create and stick to a budget - Track spending and allocate more money toward debt reduction.

Practices to Avoid

- Making minimum payments only - This extends the life of your debt and increases interest costs.

- Opening new credit accounts - New debt will increase your DTI ratio.

- Missing payments - Late payments damage your credit score and may lead to higher interest rates.

- Ignoring your budget - Overspending prevents you from allocating more money to debt reduction.

- Using one debt to pay another - This creates a cycle of debt that's difficult to escape.

Need help improving your financial situation?

Get personalized guidance on debt reduction strategies and budget planning.

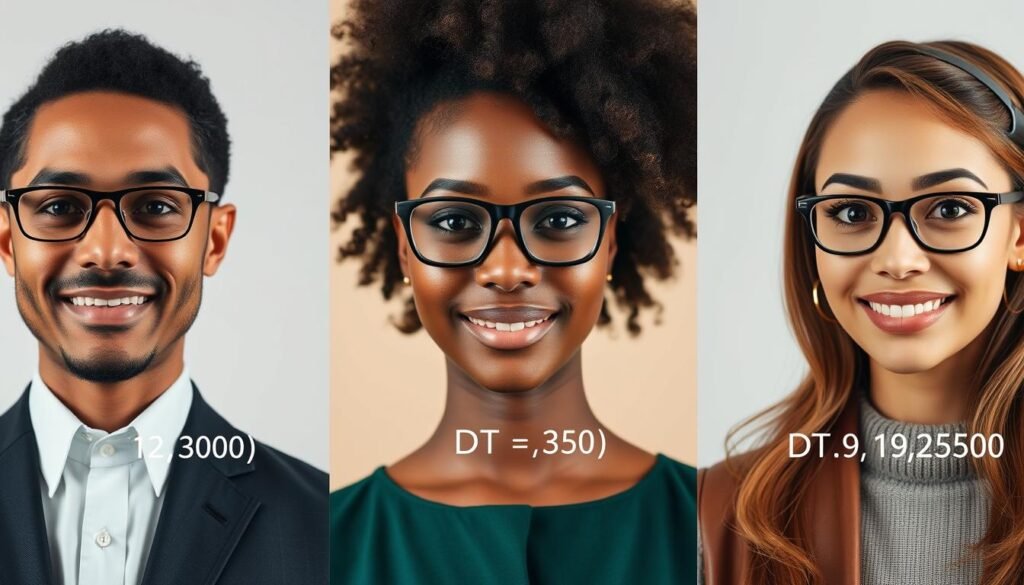

Real-Life DTI Ratio Examples

Understanding how DTI calculations work in real-life scenarios can help you better assess your own financial situation. Here are three examples with different income and debt levels:

Example 1: Low DTI

Sarah, Marketing Specialist

Gross Monthly Income: $5,000

Monthly Debts:

- Rent: $1,000

- Car payment: $300

- Student loan: $200

- Credit card minimum: $50

Total Monthly Debt: $1,550

DTI Calculation: ($1,550 ÷ $5,000) × 100 = 31%

Result: Good DTI

Sarah has a healthy DTI ratio and would likely qualify for most loans with favorable terms.

Example 2: Medium DTI

Michael, IT Professional

Gross Monthly Income: $6,500

Monthly Debts:

- Mortgage: $1,800

- Car payment: $450

- Student loan: $350

- Credit card minimum: $200

- Personal loan: $150

Total Monthly Debt: $2,950

DTI Calculation: ($2,950 ÷ $6,500) × 100 = 45.4%

Result: Fair DTI

Michael's DTI is in the fair range. He might qualify for loans but could face higher interest rates.

Example 3: High DTI

Jessica, Small Business Owner

Gross Monthly Income: $4,000

Monthly Debts:

- Mortgage: $1,400

- Business loan: $500

- Car payment: $350

- Credit card minimum: $300

- Student loan: $250

- Personal loan: $200

Total Monthly Debt: $3,000

DTI Calculation: ($3,000 ÷ $4,000) × 100 = 75%

Result: Poor DTI

Jessica's DTI is too high. She should focus on reducing debt before applying for new loans.

DTI Ratio vs. Credit Score: What's the Difference?

While both your DTI ratio and credit score are important financial indicators, they measure different aspects of your financial health and are used differently by lenders.

Debt-to-Income Ratio

- Measures: The relationship between your debt and income

- Calculation: (Monthly debt payments ÷ Gross monthly income) × 100

- What it shows: Your ability to take on and manage additional debt

- Who uses it: Primarily lenders, especially mortgage lenders

- Not reported: DTI is not reported to credit bureaus

- Changes: Can change quickly if income or debt changes

Credit Score

- Measures: Your history of managing and repaying debt

- Calculation: Based on payment history, amounts owed, length of credit history, new credit, and credit mix

- What it shows: Your creditworthiness and likelihood of repaying debt

- Who uses it: Lenders, landlords, insurance companies, some employers

- Reported: Tracked by credit bureaus and available in credit reports

- Changes: Takes time to build or improve

How They Work Together

Lenders typically consider both your DTI ratio and credit score when evaluating loan applications. A good credit score might not compensate for a poor DTI ratio, and vice versa. For the best loan terms, work on improving both metrics.

Frequently Asked Questions About DTI Ratio

What is considered a good debt-to-income ratio?

Generally, a DTI ratio of 35% or less is considered good. Lenders typically prefer ratios below 36%, though some loan programs may accept higher ratios up to 43-50% with compensating factors like excellent credit or substantial savings.

Does my debt-to-income ratio affect my credit score?

Your DTI ratio does not directly affect your credit score because credit scoring models don't factor in your income. However, high debt levels can increase your credit utilization ratio, which does impact your credit score. Both metrics are important to lenders when evaluating loan applications.

What debts are included in DTI calculations?

DTI calculations include recurring monthly debt obligations such as mortgage or rent payments, auto loans, student loans, minimum credit card payments, personal loans, and legal obligations like child support or alimony. They do not include utilities, groceries, insurance premiums, or other living expenses that aren't debt.

How often should I calculate my DTI ratio?

It's a good practice to recalculate your DTI ratio whenever your financial situation changes significantly—such as when you take on new debt, pay off existing debt, or experience a change in income. At minimum, check your DTI annually as part of your financial health review.

Can I get a mortgage with a high DTI ratio?

While it's possible to get approved for a mortgage with a higher DTI ratio, it may be more difficult and you might face less favorable terms. FHA loans may accept back-end ratios up to 50% with compensating factors, while conventional loans typically prefer ratios below 43%. VA loans may be more flexible with DTI requirements.

Monitor Your DTI Ratio for Better Financial Health

Your debt-to-income ratio is a powerful indicator of your financial health and an important factor in loan approval decisions. By regularly calculating and monitoring your DTI, you can track your progress toward financial goals and identify areas for improvement.

Remember that improving your DTI ratio is a journey that requires consistent effort. Focus on paying down existing debt, avoiding new debt, and increasing your income when possible. As your DTI ratio improves, you'll not only have better access to credit but also enjoy greater financial flexibility and peace of mind.

Take control of your financial future today

Use our calculator regularly to track your progress and make informed financial decisions.