Use our Depreciation Calculator to estimate how much value an asset loses over time. Plan budgets and track depreciation for accurate financial planning.

Understanding how assets lose value over time is crucial for businesses, investors, and individuals alike. Our comprehensive depreciation calculator helps you accurately determine how an asset’s value decreases over its useful life, whether you’re preparing financial statements, planning for tax purposes, or making investment decisions. This powerful tool supports multiple depreciation methods including straight-line, declining balance, sum-of-years digits, and units of production to give you precise calculations tailored to your specific needs.

Free Online Depreciation Calculator

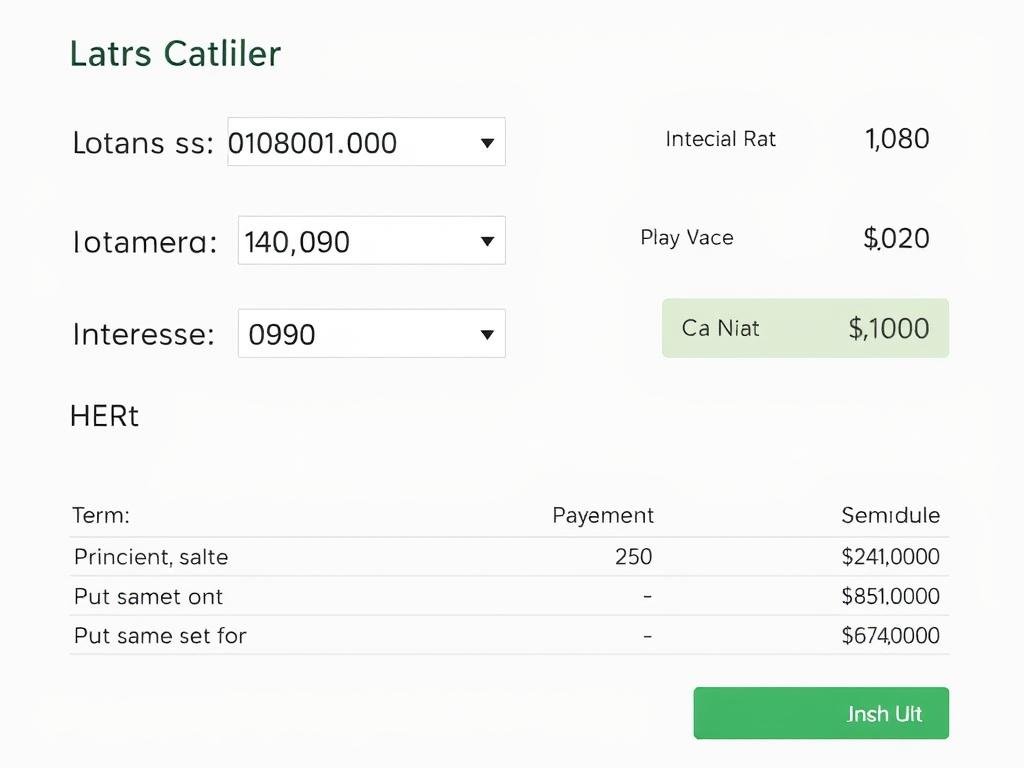

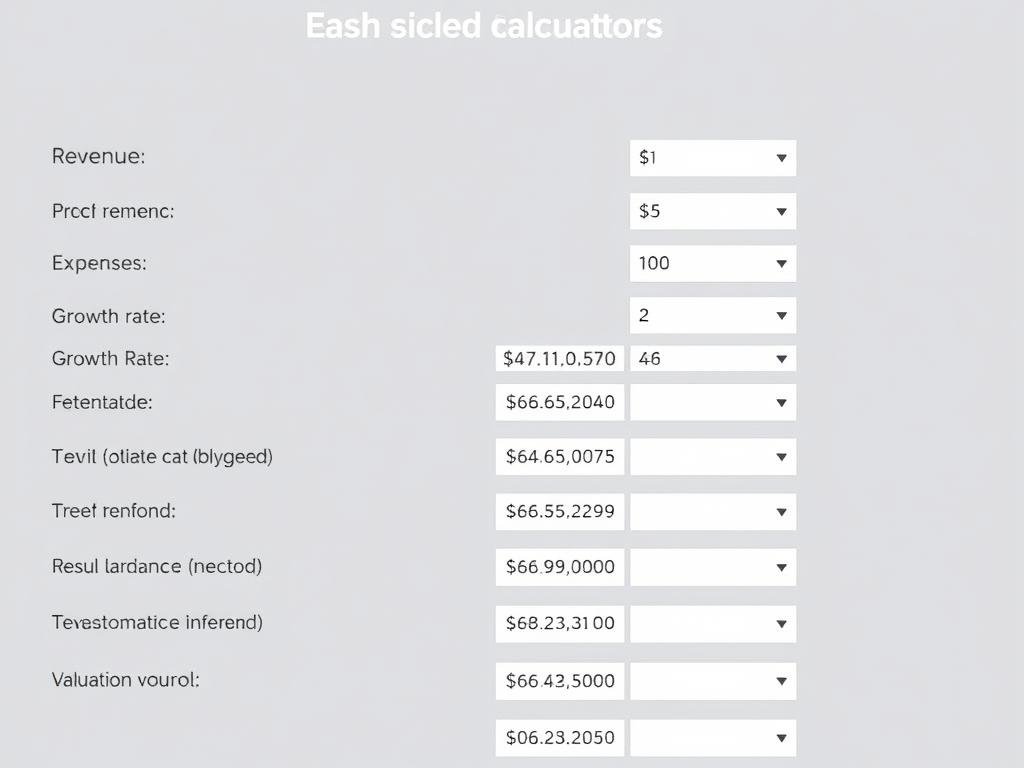

Use our intuitive depreciation calculator below to quickly determine how your asset’s value will change over time. Simply enter the required information and select your preferred depreciation method to get instant results.

Asset Depreciation Calculator

Our depreciation calculator helps visualize how different methods affect your asset’s value over time

What is Depreciation?

Depreciation is the systematic allocation of an asset’s cost over its useful life. It represents how the value of an asset decreases over time due to factors such as wear and tear, obsolescence, or the passage of time. For accounting and tax purposes, depreciation is a way to match an asset’s expense with the revenue it helps generate throughout its useful life.

Why Depreciation Matters

Understanding depreciation is essential for several reasons:

- Accurately represents an asset’s decreasing value on financial statements

- Provides tax benefits through deductions for depreciation expenses

- Helps in planning for asset replacement and capital expenditures

- Enables more accurate calculation of business profits and asset values

- Assists in determining appropriate insurance coverage for assets

Ready to Calculate Your Asset’s Depreciation?

Our free calculator makes it easy to determine how your asset’s value will change over time.

Methods of Depreciation Calculation

There are several methods to calculate depreciation, each with its own applications and benefits. The choice of method can significantly impact your financial statements and tax obligations. Our calculator supports all of the following widely-used depreciation methods:

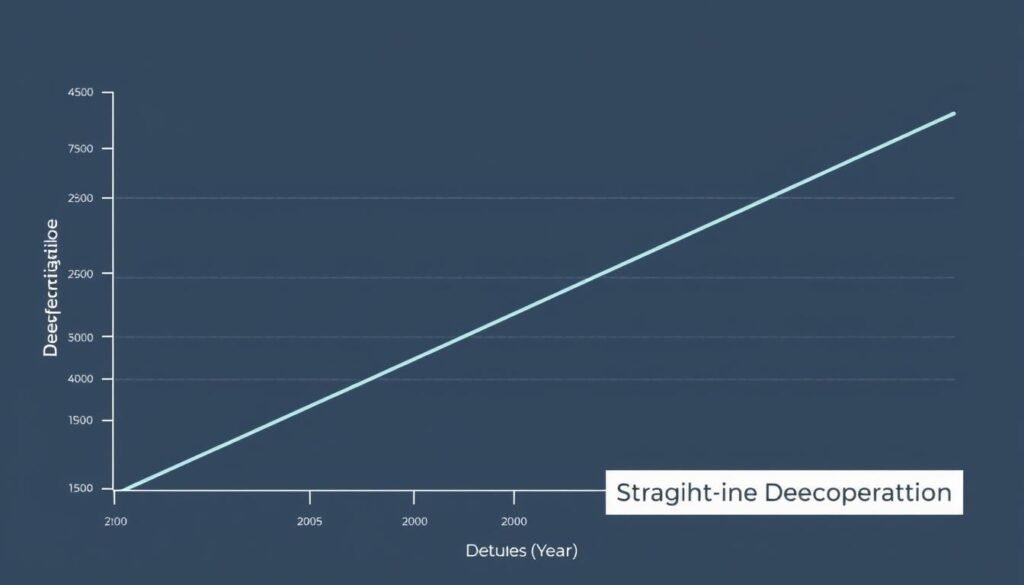

Straight-Line Depreciation Method

The straight-line method is the simplest and most commonly used approach. It allocates an equal amount of depreciation expense for each year of the asset’s useful life.

Formula:

Annual Depreciation = (Asset Cost – Salvage Value) ÷ Useful Life

Example:

For an asset with an initial cost of $10,000, a salvage value of $2,000, and a useful life of 5 years:

Annual Depreciation = ($10,000 – $2,000) ÷ 5 = $1,600 per year

| Year | Beginning Book Value | Annual Depreciation | Accumulated Depreciation | Ending Book Value |

| 1 | $10,000 | $1,600 | $1,600 | $8,400 |

| 2 | $8,400 | $1,600 | $3,200 | $6,800 |

| 3 | $6,800 | $1,600 | $4,800 | $5,200 |

| 4 | $5,200 | $1,600 | $6,400 | $3,600 |

| 5 | $3,600 | $1,600 | $8,000 | $2,000 |

Declining Balance Depreciation Method

The declining balance method applies a constant rate to the asset’s decreasing book value, resulting in higher depreciation expenses in the earlier years and lower expenses in later years. This method better reflects how certain assets lose value more rapidly in their early years.

Formula:

Annual Depreciation = Book Value × Depreciation Rate

Where Depreciation Rate = (1 ÷ Useful Life) × Factor

Example:

For the same asset with a factor of 2 (double declining balance):

Depreciation Rate = (1 ÷ 5) × 2 = 0.4 or 40%

| Year | Beginning Book Value | Depreciation Rate | Annual Depreciation | Ending Book Value |

| 1 | $10,000 | 40% | $4,000 | $6,000 |

| 2 | $6,000 | 40% | $2,400 | $3,600 |

| 3 | $3,600 | 40% | $1,440 | $2,160 |

| 4 | $2,160 | 40% | $864 | $1,296 |

| 5 | $1,296 | 40% | $518 | $778 |

Note: With double declining balance, the final value may not reach the exact salvage value. In practice, you would switch to straight-line depreciation in the later years to reach the salvage value precisely.

Sum of Years’ Digits (SYD) Depreciation Method

The SYD method is another accelerated depreciation approach that allocates a higher depreciation expense in the earlier years. It uses a fraction based on the sum of the years’ digits to calculate the depreciation amount.

Formula:

Annual Depreciation = (Asset Cost – Salvage Value) × (Remaining Life ÷ Sum of Years’ Digits)

Where Sum of Years’ Digits = n(n+1)/2, and n is the useful life in years

Example:

For our example asset:

Sum of Years’ Digits = 5(5+1)/2 = 15

| Year | Remaining Life | Fraction | Annual Depreciation | Ending Book Value |

| 1 | 5 | 5/15 | $2,667 | $7,333 |

| 2 | 4 | 4/15 | $2,133 | $5,200 |

| 3 | 3 | 3/15 | $1,600 | $3,600 |

| 4 | 2 | 2/15 | $1,067 | $2,533 |

| 5 | 1 | 1/15 | $533 | $2,000 |

Units of Production Depreciation Method

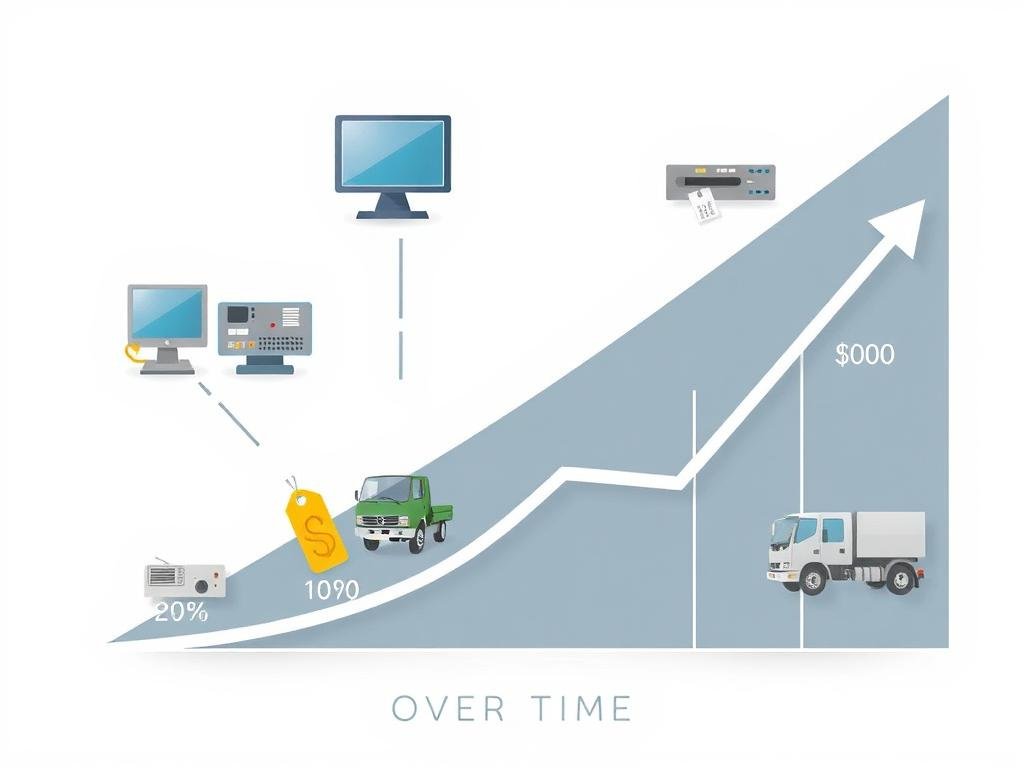

The units of production method bases depreciation on the actual usage or production of the asset rather than time. This method is particularly useful for assets whose value decreases based on how much they’re used, such as manufacturing equipment or vehicles.

Formula:

Depreciation per Unit = (Asset Cost – Salvage Value) ÷ Estimated Total Production

Annual Depreciation = Depreciation per Unit × Units Produced in the Year

Example:

For a machine with an estimated total production of 100,000 units over its lifetime:

Depreciation per Unit = ($10,000 – $2,000) ÷ 100,000 = $0.08 per unit

| Year | Units Produced | Annual Depreciation | Accumulated Depreciation | Ending Book Value |

| 1 | 25,000 | $2,000 | $2,000 | $8,000 |

| 2 | 30,000 | $2,400 | $4,400 | $5,600 |

| 3 | 20,000 | $1,600 | $6,000 | $4,000 |

| 4 | 15,000 | $1,200 | $7,200 | $2,800 |

| 5 | 10,000 | $800 | $8,000 | $2,000 |

Not Sure Which Depreciation Method to Use?

Try our calculator to compare different methods and see which works best for your specific situation.

Applications of Depreciation Calculations

Depreciation calculations serve various purposes across different sectors. Understanding when and how to apply these calculations can help you make better financial decisions and comply with relevant regulations.

Business Accounting

Businesses use depreciation to:

- Accurately report asset values on balance sheets

- Match expenses with revenue in income statements

- Plan for asset replacement and capital expenditures

- Make informed decisions about repairs versus replacements

Tax Planning

For tax purposes, depreciation helps:

- Reduce taxable income through depreciation deductions

- Comply with IRS regulations for asset depreciation

- Take advantage of accelerated depreciation methods when beneficial

- Plan major purchases to maximize tax benefits

Investment Analysis

Investors consider depreciation when:

- Evaluating the true cost of an investment over time

- Calculating return on investment (ROI) for depreciating assets

- Comparing different investment opportunities

- Determining optimal timing for asset disposal or replacement

Industry-Specific Applications

Real Estate

In real estate, depreciation is a critical concept for property investors and managers. Buildings and improvements (but not land) can be depreciated over their useful life, typically 27.5 years for residential properties and 39 years for commercial properties under U.S. tax law. This depreciation provides significant tax benefits to real estate investors.

Manufacturing

Manufacturing companies rely heavily on depreciation calculations to account for their substantial investments in machinery and equipment. The units of production method is particularly relevant in this sector, as it ties depreciation directly to output and usage rather than just the passage of time.

Fleet Management

Companies with vehicle fleets use depreciation calculations to track vehicle values, plan for replacements, and make informed decisions about maintenance versus replacement. Understanding how vehicles depreciate helps optimize fleet operations and budgeting.

Technology Companies

With rapidly evolving technology, IT assets often depreciate faster than other types of equipment. Technology companies typically use accelerated depreciation methods to account for the quick obsolescence of computers, servers, and other tech assets.

Factors Affecting Depreciation Calculations

Several key factors influence how assets depreciate and how you should calculate their depreciation. Understanding these factors helps you make more accurate depreciation estimates and choose the most appropriate method for your specific situation.

Asset Type and Classification

Different types of assets depreciate at different rates and may be subject to specific depreciation rules:

- Fixed assets (buildings, machinery, vehicles) typically depreciate over several years

- Intangible assets (patents, copyrights) are amortized rather than depreciated

- Land is not depreciable as it doesn’t have a limited useful life

- Technology assets often depreciate faster due to rapid obsolescence

Useful Life Estimation

The estimated useful life of an asset significantly impacts depreciation calculations:

- Based on expected physical wear and tear

- Influenced by technological obsolescence

- May be standardized by tax authorities or accounting standards

- Can vary by industry and specific use case

| Asset Type | Typical Useful Life (Years) |

| Office Buildings | 39 |

| Residential Rental Properties | 27.5 |

| Machinery and Equipment | 5-15 |

| Vehicles | 5 |

| Computers and Technology | 3-5 |

| Office Furniture | 7-10 |

Salvage Value Considerations

Salvage value (also called residual or scrap value) is the estimated worth of an asset at the end of its useful life:

- Affects the total depreciable amount (Asset Cost – Salvage Value)

- May be based on market data, industry standards, or historical experience

- Can be zero for assets with no expected value at end of life

- May change over time as market conditions evolve

Regulatory and Tax Considerations

Depreciation calculations are often influenced by regulatory requirements and tax laws:

- MACRS (Modified Accelerated Cost Recovery System) is required for U.S. tax depreciation

- Section 179 deduction allows for immediate expensing of certain assets

- Bonus depreciation provisions may allow for additional first-year depreciation

- Different countries have different depreciation rules and allowances

Always consult with a tax professional to ensure compliance with current tax laws and to maximize available benefits.

Need to Calculate Depreciation for Different Asset Types?

Our calculator handles all asset types and depreciation methods to give you accurate results.

Frequently Asked Questions About Depreciation

What is the difference between depreciation and amortization?

While both concepts involve allocating the cost of an asset over time, they apply to different types of assets. Depreciation applies to tangible assets like buildings, vehicles, and equipment. Amortization applies to intangible assets such as patents, copyrights, and trademarks. The calculation methods can be similar, but they’re used for different asset categories.

Can land be depreciated?

No, land cannot be depreciated because it’s considered to have an unlimited useful life. While buildings and improvements on the land can be depreciated, the land itself maintains its value and is not subject to wear and tear in the same way as other assets. This is why land and buildings are typically separated in accounting records.

Which depreciation method should I use for tax purposes?

For U.S. tax purposes, the Modified Accelerated Cost Recovery System (MACRS) is generally required. This system specifies both the depreciation method and recovery period for different types of assets. However, there are exceptions and special provisions like Section 179 deduction and bonus depreciation that may allow for faster write-offs. It’s best to consult with a tax professional to determine the most advantageous approach for your specific situation.

How does depreciation affect my business taxes?

Depreciation is a tax-deductible expense that reduces your business’s taxable income. By spreading the cost of an asset over its useful life, you can deduct a portion of the asset’s cost each year, which lowers your tax liability. This is particularly beneficial for businesses that make significant investments in equipment, buildings, or other depreciable assets. The specific tax impact depends on your business structure, tax bracket, and the depreciation methods used.

What is partial-year depreciation?

Partial-year depreciation applies when an asset is acquired or disposed of during the middle of a fiscal year. Instead of taking a full year’s depreciation, you calculate a proportional amount based on how long you owned the asset during that year. Different accounting systems and tax regulations have specific rules for handling partial-year depreciation, such as the half-year convention or mid-month convention under MACRS.

Can I change depreciation methods after I’ve started using one?

For financial reporting purposes, changing depreciation methods is considered a change in accounting estimate and is generally allowed, though it requires proper disclosure in financial statements. For tax purposes, however, changing depreciation methods typically requires IRS approval through Form 3115 (Application for Change in Accounting Method). There are some automatic changes allowed, but it’s best to consult with a tax professional before making any changes to your depreciation methods.

Start Calculating Your Asset Depreciation Today

Understanding how your assets depreciate over time is essential for making informed financial decisions, optimizing tax strategies, and maintaining accurate financial records. Our comprehensive depreciation calculator makes it easy to apply different depreciation methods to your specific situation, helping you see exactly how your asset values will change over their useful life.

Whether you’re a business owner tracking equipment values, an investor analyzing potential returns, or an individual planning for major purchases, our calculator provides the insights you need to make better financial decisions.

Ready to Calculate Your Asset’s Depreciation?

Get started now with our free, easy-to-use depreciation calculator.

For more financial tools and resources, explore our complete collection of financial calculators designed to help you make smarter money decisions.