Use our Debt Consolidation Calculator to see how combining debts can lower payments and interest. Plan smarter and pay off your debt faster.

Struggling with multiple debt payments each month? Our debt consolidation calculator helps you discover if combining your debts could save you money and simplify your financial life. See how much you could save in interest, reduce your monthly payments, and find the fastest path to become.

How to Use Our Debt Consolidation Calculator

- Enter your credit score range - This helps determine what interest rates you might qualify for on a debt consolidation loan.

- Add your current debts - Include the balance, interest rate, and monthly payment for each debt you're considering consolidating (credit cards, personal loans, medical debt, etc.).

- Review your current situation - The calculator will show your total debt, average interest rate, monthly payment, and time to debt freedom.

- Compare consolidation options - See how different consolidation methods could impact your finances with a lower interest rate.

- Analyze potential savings - Review how much you could save in interest and how much faster you could become debt-free.

Ready to See Your Potential Savings?

Use our calculator above to discover how much you could save by consolidating your debts.

Understanding Debt Consolidation: Is It Right for You?

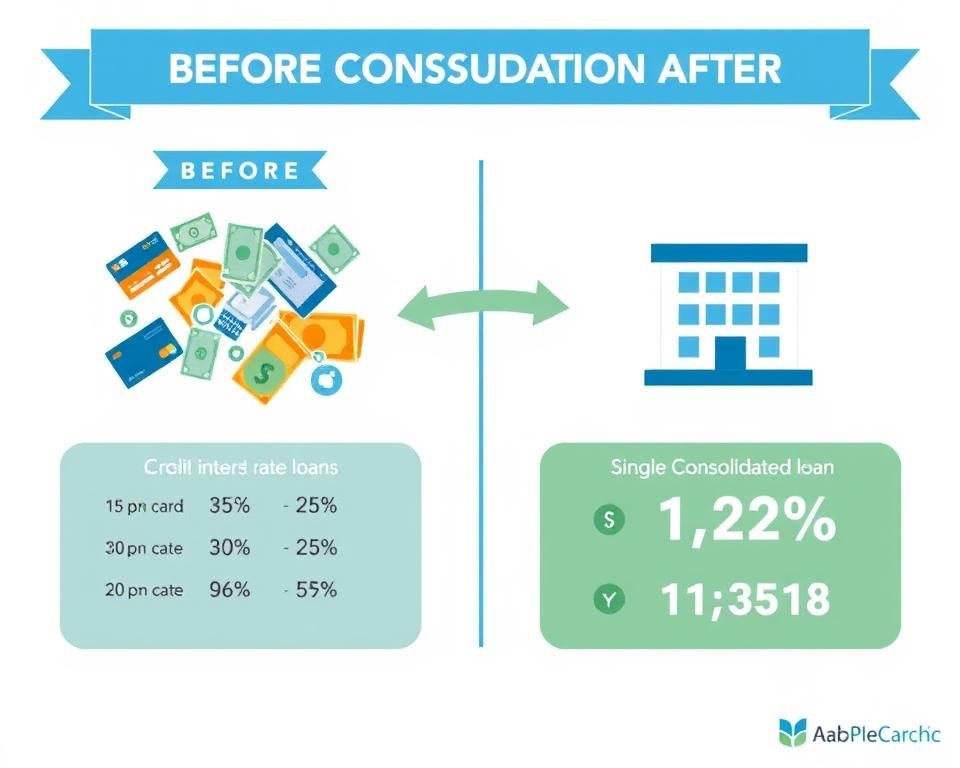

Debt consolidation combines multiple debts into a single loan, typically with a lower interest rate. This strategy can simplify your finances by giving you just one payment to manage each month while potentially saving you money on interest.

Benefits of Debt Consolidation

- Single monthly payment instead of multiple payments

- Potentially lower interest rate than high-interest credit cards

- Fixed repayment schedule with clear end date

- Simplified debt management with one loan to track

- Possible improvement to credit score over time

Potential Drawbacks

- May not qualify for low rates with poor credit

- Could pay more interest if extending loan term

- Possible fees for loan origination or balance transfers

- Risk of accumulating new debt if spending habits don't change

- Secured loans put assets at risk if you default

The debt consolidation calculator helps you determine if consolidation makes financial sense for your specific situation by comparing your current debt costs with potential consolidation options.

Debt Consolidation Options Compared

Personal Loans

- Interest rates typically 5.99%-35.99%

- Fixed monthly payments

- Terms usually 2-7 years

- No collateral required

- Quick application process

- Best for: Good credit borrowers with multiple high-interest debts

Balance Transfer Cards

- 0% intro APR for 12-21 months

- Transfer fee typically 3-5%

- Regular APR applies after intro period

- Requires good to excellent credit

- Limited to credit card debt

- Best for: Those who can pay off debt during 0% period

Home Equity Loans

- Lower interest rates (3-12%)

- Longer terms available (5-30 years)

- Interest may be tax-deductible

- Home used as collateral

- Closing costs and fees apply

- Best for: Homeowners with significant equity and stable income

Our debt consolidation calculator can help you compare these options based on your specific debt profile and credit score range. Different consolidation methods work better for different situations.

Find Your Best Debt Consolidation Option

Use our calculator to see which method could save you the most money based on your unique situation.

Understanding Your Calculator Results

Current Debt Situation

- Total Debt Balance: The sum of all debts you entered

- Average Interest Rate: Your weighted average interest rate across all debts

- Total Monthly Payment: Combined monthly payments across all debts

- Months to Debt Freedom: How long until you're debt-free at current pace

- Total Interest Paid: Total interest you'll pay over the life of your debts

Potential Consolidation Benefits

- New Interest Rate: Estimated rate based on your credit score

- New Monthly Payment: Your single payment after consolidation

- New Payoff Timeline: Months until debt-free with consolidation

- Interest Savings: Total interest saved through consolidation

- Monthly Payment Reduction: How much less you might pay monthly

The best debt consolidation option is one where your new interest rate is lower than your current average rate, your monthly payment is affordable, and you'll pay less in total interest over the life of the loan.

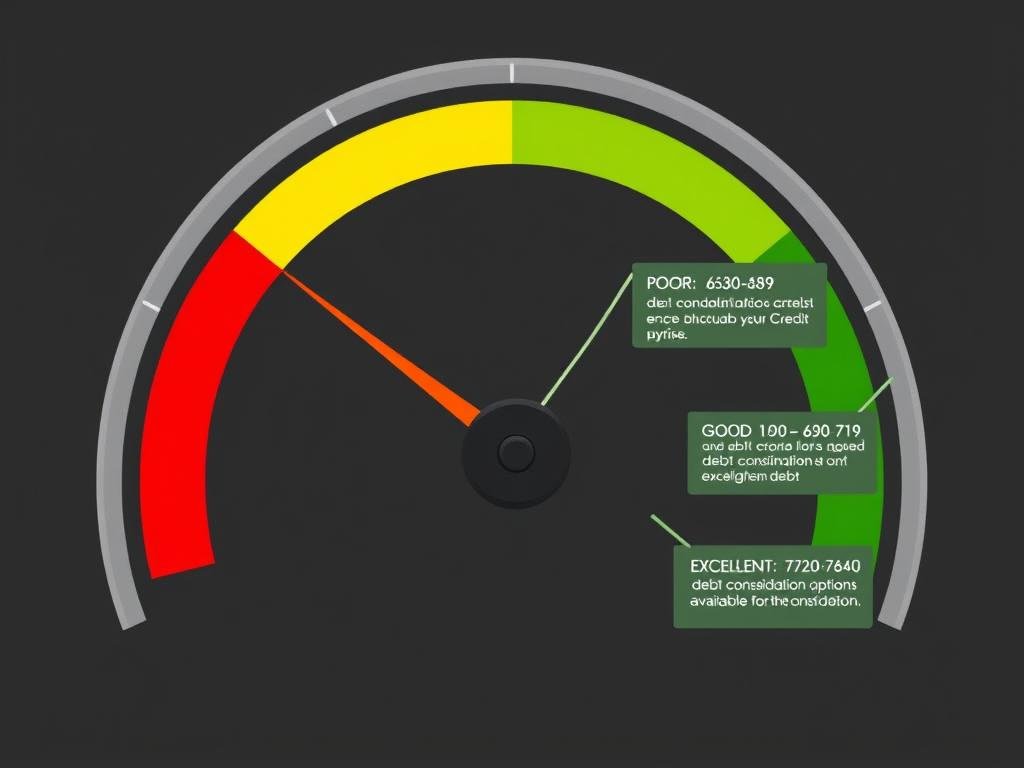

How Credit Scores Affect Debt Consolidation

Your credit score plays a crucial role in determining what debt consolidation options are available to you and what interest rates you'll qualify for. Understanding this relationship can help you set realistic expectations.

| Credit Score Range | Typical Personal Loan Rates | Balance Transfer Eligibility | Best Consolidation Options |

| Excellent (720-850) | 5.99%-12.99% | Excellent options with 0% for 18-21 months | Balance transfer cards, personal loans, home equity |

| Good (690-719) | 10.99%-17.99% | Good options with 0% for 12-18 months | Personal loans, balance transfer cards |

| Fair (630-689) | 17.99%-25.99% | Limited options, shorter 0% periods | Personal loans, credit union options |

| Poor (300-629) | 25.99%-35.99% | Unlikely to qualify | Debt management plans, secured loans |

Our calculator takes your credit score range into account when estimating potential consolidation rates. If your credit score is lower, you might focus on improving it before applying for consolidation to secure better terms.

Steps to Successful Debt Consolidation

- Assess your debt situation - Use our calculator to understand your current debt profile and potential savings through consolidation.

- Check your credit score - Your score determines what options are available and what rates you'll qualify for.

- Research consolidation options - Compare personal loans, balance transfer cards, and other methods based on your situation.

- Apply for your chosen solution - Submit an application for the consolidation option that offers the best savings.

- Transfer or pay off existing debts - Use the new loan or credit line to pay off all the debts you're consolidating.

- Create a repayment plan - Set up automatic payments and a budget to ensure you stay on track.

- Avoid accumulating new debt - Address the root causes of debt to prevent falling back into the debt cycle.

Pro Tip: Before applying for debt consolidation, check for pre-qualification options that won't impact your credit score. Many lenders offer this feature to show you potential rates without a hard credit inquiry.

Frequently Asked Questions About Debt Consolidation

Will debt consolidation hurt my credit score?

Initially, applying for a debt consolidation loan may cause a small, temporary dip in your credit score due to the hard inquiry. However, over time, debt consolidation can actually improve your score by:

- Reducing your credit utilization ratio as you pay down debt

- Establishing a positive payment history with on-time payments

- Improving your credit mix if you replace revolving debt with an installment loan

The key is to make all payments on time and avoid accumulating new debt on the accounts you've paid off.

How much can I save with debt consolidation?

Savings vary widely based on your current debt amounts, interest rates, and the terms of your new consolidation loan. Our calculator provides personalized estimates, but here's a general example:

If you have $20,000 in credit card debt at an average 18% APR and consolidate to a 5-year personal loan at 9% APR, you could save approximately $9,000 in interest over the life of the loan.

Use our calculator above to get a customized savings estimate based on your specific situation.

What types of debt can be consolidated?

Most unsecured debts can be consolidated, including:

- Credit card balances

- Personal loans

- Medical bills

- Payday loans

- Store credit cards

- Unpaid utility bills

Secured debts like mortgages and auto loans typically aren't included in debt consolidation, as they already have relatively low interest rates and are tied to specific assets.

What credit score do I need for debt consolidation?

While requirements vary by lender and consolidation method:

- For the best personal loan rates: 720+ (excellent credit)

- For most personal loans: 660+ (good credit)

- For balance transfer cards: 690+ (good to excellent)

- For home equity loans: 620+ (fair to good)

Some lenders offer debt consolidation loans for credit scores as low as 580, but rates will be higher. Credit unions and community banks sometimes have more flexible requirements for members.

Is debt consolidation the same as debt settlement?

No, these are different approaches:

- Debt consolidation combines multiple debts into one new loan, typically with better terms. You still repay 100% of what you owe, but potentially with lower interest and simplified payments.

- Debt settlement involves negotiating with creditors to accept less than the full amount owed to consider the debt satisfied. This approach typically damages your credit score significantly and may have tax implications.

Our calculator focuses on debt consolidation, which is generally a better option for those who can afford to make payments on their debt.

Take Control of Your Debt Today

Debt consolidation can be a powerful tool for simplifying your finances, reducing interest costs, and accelerating your journey to becoming debt-free. Our debt consolidation calculator helps you determine if this strategy makes sense for your specific situation and which option might save you the most money.

Remember that successful debt consolidation requires commitment to a repayment plan and addressing the spending habits that led to debt in the first place. With the right approach, you can use consolidation as a stepping stone to greater financial freedom.

Ready to See If Debt Consolidation Can Help You?

Use our calculator to discover your potential savings and find the best path forward for your financial situation.