Use our Amortization Calculator to break down your loan into monthly principal and interest payments. Plan your mortgage or loan payoff efficiently.

Managing loans effectively requires understanding how your payments are structured over time. An amortization calculator is a powerful tool that breaks down each payment into principal and interest, showing exactly how your loan balance decreases until it’s fully paid off. Whether you’re considering a mortgage, auto loan, or personal loan, this calculator helps you visualize your payment schedule and make informed financial decisions.

What is Amortization?

Amortization refers to the process of paying off a debt through regular payments over time. With each payment, a portion goes toward the principal balance while another portion covers the interest. Initially, a larger percentage of your payment goes toward interest, but as the loan matures, more of each payment reduces the principal.

This systematic approach ensures that both the principal and interest are fully paid by the end of the loan term. Understanding amortization is crucial for anyone with loans, as it affects your financial planning and helps you see the true cost of borrowing.

Ready to See Your Loan Breakdown?

Use our calculator below to visualize how your payments will be distributed between principal and interest.

How Amortization Works: A Practical Example

Let’s illustrate amortization with a simple example. Imagine you take out a $20,000 loan at 5% interest for 5 years. Your monthly payment would be $377.42, but how is that payment applied to your loan?

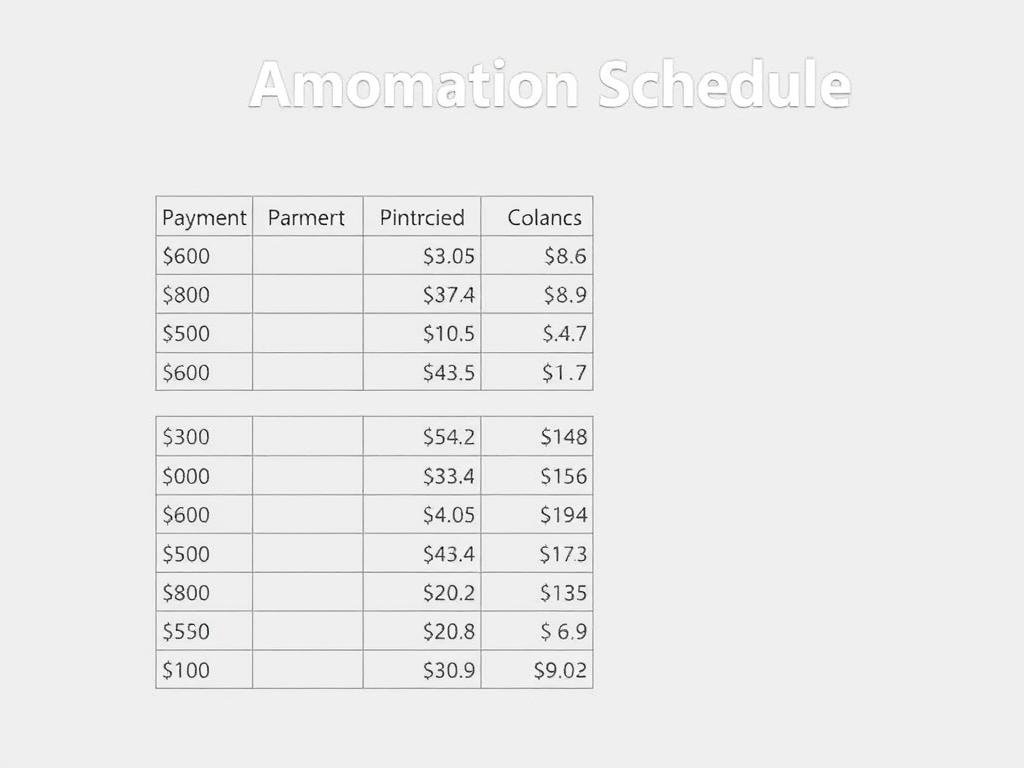

| Month | Payment | Interest | Principal | Remaining Balance |

| 1 | $377.42 | $83.33 | $294.09 | $19,705.91 |

| 2 | $377.42 | $82.11 | $295.31 | $19,410.60 |

| 3 | $377.42 | $80.88 | $296.54 | $19,114.06 |

| 4 | $377.42 | $79.64 | $297.78 | $18,816.28 |

| 58 | $377.42 | $4.68 | $372.74 | $750.16 |

| 59 | $377.42 | $3.13 | $374.29 | $375.87 |

| 60 | $377.42 | $1.57 | $375.85 | $0.00 |

Notice how in the first month, $83.33 goes toward interest while $294.09 reduces your principal. By the final payment, almost the entire amount goes toward principal. This pattern is typical of amortized loans and explains why you build equity slowly at first.

Amortization Calculator

Use our interactive calculator below to create your own amortization schedule. Simply enter your loan details and click “Calculate” to see your monthly payment and complete payment breakdown.

Amortization Calculator

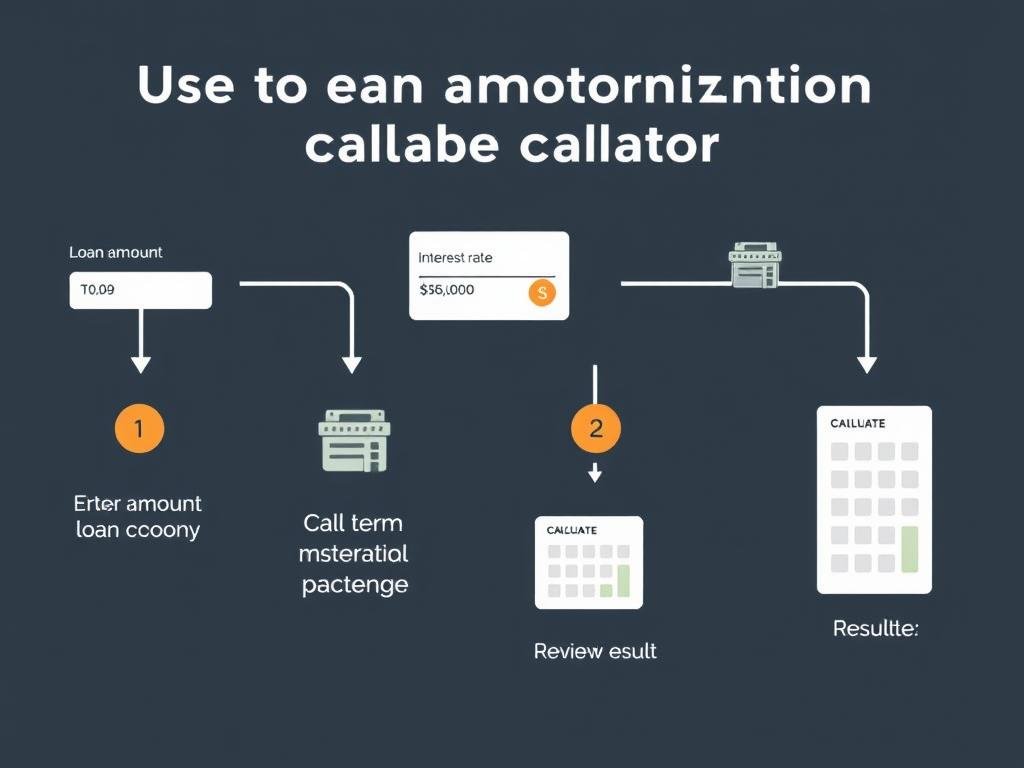

How to Use an Amortization Calculator

Using an amortization calculator is straightforward. Follow these simple steps to get a complete breakdown of your loan payments:

- Enter the loan amount – Input the total amount you’re borrowing.

- Input the interest rate – Enter the annual interest rate (as a percentage).

- Specify the loan term – Enter the number of years you’ll be paying off the loan.

- Click “Calculate” – The calculator will process your information.

- Review your results – Examine your monthly payment amount and amortization schedule.

The calculator will show you your monthly payment amount, total interest paid over the life of the loan, and a complete amortization schedule. This schedule breaks down each payment, showing how much goes toward principal and interest, plus your remaining balance after each payment.

See Your Loan Breakdown Now

Try our calculator with your specific loan details to get a personalized amortization schedule.

Amortization for Different Loan Types

Amortization applies to various types of loans, but there are important differences to understand. Here’s how amortization works across common loan types:

Mortgage Loans

Mortgages typically have the longest amortization periods, usually 15-30 years. Due to this extended timeframe, early payments are heavily weighted toward interest. A mortgage amortization calculator helps homebuyers understand the true cost of homeownership and compare different loan options.

Auto Loans

Auto loans generally have shorter terms, typically 3-7 years. With these shorter amortization periods, you’ll build equity in your vehicle faster than with a mortgage. An amortization calculator can help you determine if a shorter loan term with higher payments makes more financial sense than a longer term.

Personal Loans

Personal loans usually have the shortest amortization periods, often 1-5 years. These loans typically have higher interest rates than mortgages but lower rates than credit cards. Using an amortization calculator for personal loans helps you budget effectively and understand the cost of borrowing.

While the amortization concept remains the same across these loan types, the term length and interest rates significantly impact how quickly you build equity and the total interest paid over the life of the loan.

Benefits of Using an Amortization Calculator

An amortization calculator offers numerous advantages for borrowers at any stage of the loan process. Understanding these benefits can help you make more informed financial decisions.

Benefits of Amortization Calculators

- Visualize your payment schedule – See exactly how each payment affects your loan balance over time.

- Compare loan options – Evaluate different interest rates, loan terms, and payment amounts side by side.

- Plan for extra payments – Calculate how making additional payments can reduce your loan term and save on interest.

- Budget accurately – Know precisely how much you’ll need to pay each month for the duration of your loan.

- Understand the true cost of borrowing – See the total interest paid over the life of the loan.

- Make informed refinancing decisions – Determine if refinancing would actually save you money in the long run.

By using an amortization calculator before taking out a loan, you gain transparency into the lending process and can avoid unexpected financial surprises. This knowledge empowers you to negotiate better terms and select the loan that best fits your financial situation.

Common Amortization Calculation Mistakes to Avoid

When using amortization calculators, people often make several mistakes that can lead to inaccurate results or misunderstandings about their loans. Here are the most common pitfalls and how to avoid them:

Watch Out for These Common Errors

- Confusing interest rate formats – Make sure you’re entering the annual interest rate (APR), not the monthly rate.

- Forgetting additional costs – Property taxes, insurance, and HOA fees aren’t typically included in amortization calculations but affect your total payment.

- Ignoring loan fees – Origination fees and closing costs may increase your effective interest rate.

- Misunderstanding variable rates – Standard amortization calculators assume fixed interest rates throughout the loan term.

- Not accounting for balloon payments – Some loans don’t fully amortize and require a large final payment.

- Overlooking prepayment penalties – Some loans charge fees for paying off the principal early.

To get the most accurate results from an amortization calculator, gather all your loan documentation first and make sure you understand all terms and conditions. If you’re unsure about any aspect of your loan, consult with a financial advisor before making major decisions.

Tips for Optimizing Loan Payments Using Amortization Calculations

Armed with the insights from an amortization calculator, you can implement strategies to pay off your loans more efficiently and save money on interest. Here are some effective approaches:

Make Bi-weekly Payments

Instead of making 12 monthly payments per year, make half your monthly payment every two weeks. This results in 26 half-payments, or 13 full monthly payments annually. This simple change can shave years off your loan and save thousands in interest.

Round Up Your Payments

If your monthly payment is $1,243.17, consider rounding up to $1,300. This small additional amount goes entirely toward principal reduction and can significantly shorten your loan term over time.

Make One Extra Payment Annually

Adding just one extra payment per year can dramatically reduce your loan term. You can make this as a lump sum or spread it throughout the year by adding 1/12 of your payment amount to each monthly payment.

Apply Windfalls to Principal

When you receive tax refunds, bonuses, or other unexpected money, consider applying some or all of it to your loan principal. Even occasional lump sum payments can substantially reduce your overall interest costs.

Before implementing any of these strategies, use the amortization calculator to see exactly how much time and money you could save. Also, check with your lender to ensure there are no prepayment penalties that might offset your potential savings.

Calculate Your Potential Savings

Use our amortization calculator to see how extra payments could reduce your loan term and save you money.

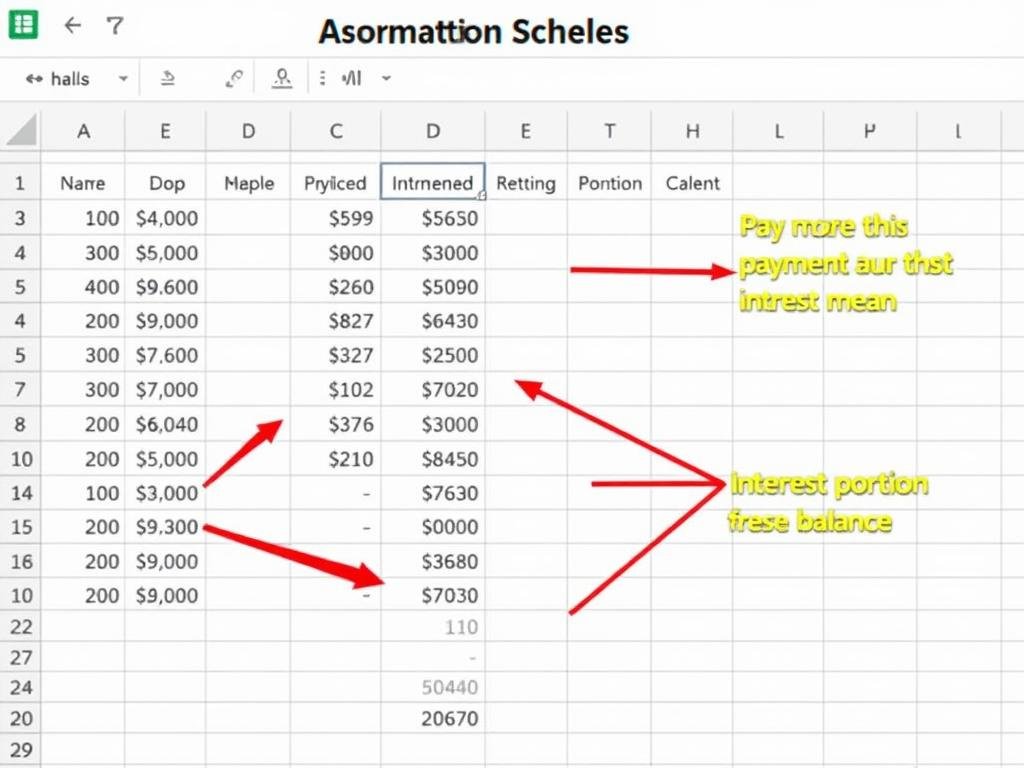

Understanding Your Amortization Schedule

An amortization schedule provides a complete breakdown of every payment over the life of your loan. Learning to read this schedule gives you valuable insights into your loan’s structure and progress.

Key Components of an Amortization Schedule

- Payment Number/Date – Identifies each payment in sequence or by date

- Payment Amount – The total monthly payment (remains constant for fixed-rate loans)

- Principal Portion – Amount that reduces your loan balance

- Interest Portion – Cost of borrowing for that period

- Remaining Balance – Outstanding loan amount after each payment

- Cumulative Interest – Total interest paid to date (sometimes included)

- Cumulative Principal – Total principal paid to date (sometimes included)

By reviewing your amortization schedule regularly, you can track your progress in paying down the loan and see the impact of any extra payments you make. This visibility helps you stay motivated and make strategic decisions about your debt management approach.

Conclusion: Taking Control of Your Loans with Amortization Calculators

An amortization calculator is more than just a financial tool—it’s a window into your financial future. By understanding how your loan payments are structured and how each payment affects your balance, you gain the power to make smarter borrowing decisions and potentially save thousands of dollars over the life of your loans.

Whether you’re shopping for a new mortgage, considering an auto loan, or planning to refinance existing debt, taking a few minutes to run the numbers through an amortization calculator can provide valuable insights that help you optimize your financial strategy. Remember that small changes in how you approach your loan repayment can yield significant long-term benefits.

Use our interactive amortization calculator to explore different scenarios, understand the true cost of borrowing, and develop a repayment strategy that aligns with your financial goals. Financial empowerment begins with knowledge—and an amortization calculator puts that knowledge at your fingertips.

Start Calculating Your Loan Payments

Take control of your financial future by understanding exactly how your loan payments work.