Use our Auto Loan Calculator to estimate monthly payments, interest, and total cost. Plan your car purchase and manage your loan efficiently.

Buying a car is exciting, but navigating auto financing can be overwhelming. An auto loan calculator is your secret weapon for understanding the true cost of your car purchase before signing any paperwork. This powerful tool helps you estimate monthly payments, compare loan offers, and avoid costly financing mistakes. In this guide, we’ll show you how to use an auto loan calculator effectively to make confident, informed decisions about your next vehicle purchase.

Auto loan calculators help you understand the true cost of financing your next vehicle purchase

What Is an Auto Loan Calculator?

An auto loan calculator is a financial tool that helps you determine how much your car loan will cost on a monthly basis and over the entire loan term. By inputting a few key variables, you can quickly see how different loan scenarios affect your budget and total cost of ownership.

Key Components of Auto Loan Calculations

- Principal amount: The total amount borrowed, typically the vehicle price minus any down payment or trade-in value, plus taxes and fees

- Interest rate: The annual percentage rate (APR) charged by the lender, which varies based on your credit score and market conditions

- Loan term: The length of time you have to repay the loan, usually expressed in months (36, 48, 60, 72, or 84)

- Monthly payment: The amount you’ll pay each month, which includes both principal and interest

The calculator uses a mathematical formula to determine your monthly payment based on these variables. Understanding how these components interact is crucial for making informed financing decisions.

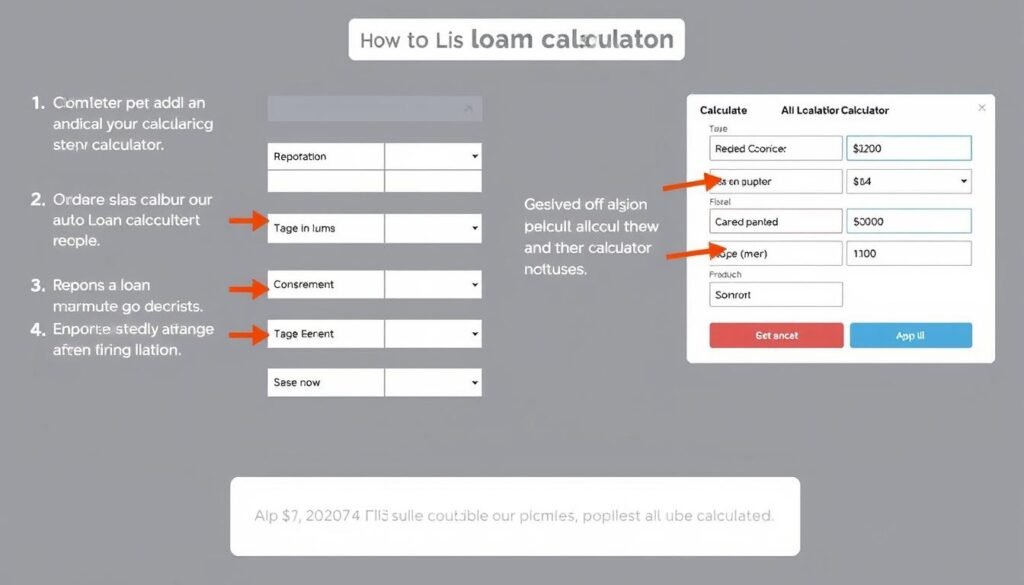

How to Use an Auto Loan Calculator Effectively

Getting the most accurate results from an auto loan calculator requires entering precise information. Follow these steps to use an auto loan calculator effectively:

- Enter the vehicle price – Use the actual negotiated price or MSRP if you haven’t started shopping yet

- Input your down payment amount – Aim for at least 20% of the purchase price for new cars and 10% for used cars

- Add trade-in value – If you’re trading in a vehicle, include its value and any remaining loan balance

- Enter the interest rate – Use rates from pre-approval offers or estimate based on your credit score

- Select a loan term – Choose the number of months you plan to finance (typically 36-72 months)

- Include sales tax and fees – Add your local sales tax rate and any registration or documentation fees

- Review the results – Examine the monthly payment, total interest paid, and total cost of the loan

Pro Tip: Don’t just settle for the first calculation. Try different scenarios by adjusting the loan term, down payment, or vehicle price to see how each variable affects your monthly payment and total cost.

Benefits of Using an Auto Loan Calculator Before Car Shopping

Taking the time to use an auto loan calculator before visiting dealerships can save you thousands of dollars and prevent financial stress. Here are the key benefits:

- Set a realistic budget – Determine how much car you can actually afford based on your comfortable monthly payment

- Compare different loan offers – Easily see which lender is offering the best overall deal

- Understand the impact of loan terms – Visualize how a longer term lowers monthly payments but increases total interest

- Prepare for negotiations – Enter the dealership knowing exactly what terms you need to meet your budget

- Avoid emotional decisions – Make choices based on numbers rather than sales pressure

- Plan for additional costs – Account for taxes, fees, and insurance in your total budget

Ready to Compare Auto Loan Rates?

Find the best rates from top lenders based on your credit profile and save on your next car purchase.

Types of Auto Loans and How They Affect Calculations

Not all auto loans are created equal. Understanding the different types available helps you choose the right option for your situation and use the calculator more effectively.

| Loan Type | Description | Impact on Calculations | Best For |

| Secured Auto Loan | Uses the vehicle as collateral | Lower interest rates, resulting in lower monthly payments | Most car buyers; standard financing option |

| Unsecured Auto Loan | No collateral required | Higher interest rates, increasing monthly payments and total cost | Buyers with excellent credit who want to avoid liens |

| Fixed-Rate Loan | Interest rate remains constant | Predictable payments throughout the loan term | Budget-conscious buyers who prefer consistency |

| Variable-Rate Loan | Interest rate can change over time | Payments may increase or decrease based on market conditions | Short-term loans or when rates are expected to decrease |

| Simple Interest Loan | Interest calculated only on remaining principal | Early payments reduce total interest paid | Buyers who may pay off the loan early |

| Precomputed Interest Loan | Total interest calculated upfront | Early payments may not reduce total interest | Buyers who plan to keep the loan for its full term |

When using an auto loan calculator, make sure you’re entering the correct loan type parameters. Most online calculators assume a fixed-rate, simple interest loan, which is the most common type for auto financing.

Common Mistakes When Using Auto Loan Calculators

Even with the best calculators, inaccurate inputs lead to misleading results. Avoid these common mistakes to get the most accurate picture of your auto loan:

What To Do

- Include all taxes and fees in your calculations

- Use your actual credit score to estimate interest rates

- Account for insurance costs in your overall budget

- Consider multiple loan terms to find the best balance

- Calculate the total cost of ownership, not just monthly payments

What To Avoid

- Focusing only on monthly payment amount

- Ignoring additional costs like taxes and fees

- Using unrealistic interest rates

- Choosing excessively long loan terms to lower payments

- Failing to include down payment in calculations

Warning: Focusing solely on lowering your monthly payment by extending your loan term can significantly increase the total amount you pay for your vehicle. Always look at the total interest paid over the life of the loan.

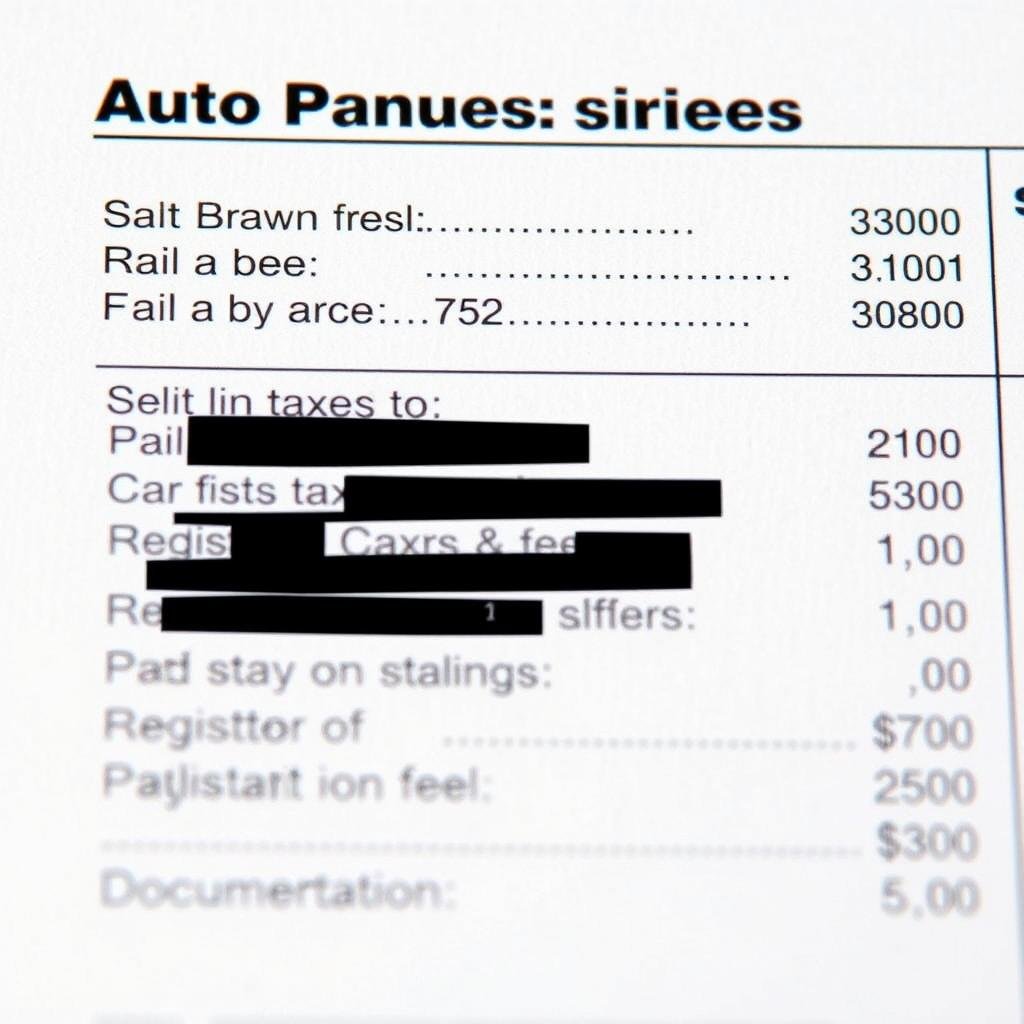

Additional Factors to Consider in Your Calculations

A basic auto loan calculator gives you a good starting point, but comprehensive financial planning requires considering these additional factors:

Taxes & Fees

- Sales tax (varies by state)

- Registration fees

- Title fees

- Documentation fees

- Destination charges

Insurance Costs

- Full coverage requirements

- Premium increases for new cars

- Deductible considerations

- Gap insurance options

- Credit score impact on rates

Down Payment Effects

- Reduced loan principal

- Lower interest costs

- Improved loan-to-value ratio

- Potential for better rates

- Protection against depreciation

Advanced auto loan calculators allow you to input these additional factors for a more complete financial picture. Remember that the “out-the-door” price of a vehicle is always higher than the sticker price due to these extra costs.

Check Your Credit Score

Your credit score significantly impacts your auto loan interest rate. Check your score for free and see how to improve it before applying.

Using Auto Loan Calculators for Refinancing Decisions

Auto loan calculators aren’t just for new purchases—they’re also valuable tools when considering refinancing an existing auto loan. Here’s how to use them effectively for refinancing decisions:

When to Consider Refinancing

- Your credit score has improved significantly

- Interest rates have dropped since your original loan

- You’re struggling with your current monthly payment

- You want to remove or add a co-signer

- You’re unhappy with your current lender’s service

How to Calculate Refinancing Benefits

- Enter your current loan details – Remaining balance, interest rate, and months left

- Input potential new loan terms – New interest rate and term length

- Compare monthly payments – See if the new payment fits your budget better

- Calculate total interest savings – Determine how much you’ll save over the life of the loan

- Factor in refinancing costs – Some lenders charge application or processing fees

| Refinancing Scenario | Current Loan | Refinanced Loan | Monthly Savings | Total Savings |

| Lower Rate, Same Term | $20,000 at 7% for 48 months | $20,000 at 4% for 48 months | $31 | $1,488 |

| Lower Rate, Shorter Term | $20,000 at 7% for 60 months | $20,000 at 4% for 48 months | -$27 (higher payment) | $2,196 |

| Lower Rate, Longer Term | $20,000 at 7% for 36 months | $20,000 at 4% for 48 months | $147 | $456 |

See If Refinancing Makes Sense For You

Compare your current auto loan with potential refinancing options to see how much you could save.

Comparison of Popular Auto Loan Calculator Tools

Not all auto loan calculators offer the same features or accuracy. Here’s a comparison of some popular options to help you choose the right tool for your needs:

| Calculator | Key Features | Best For | Limitations | Rating |

| Calculator.net | Detailed amortization schedule, trade-in value calculator, state tax info | Comprehensive analysis with tax considerations | No loan comparison feature | 4.8/5 |

| NerdWallet | Multiple loan comparison, credit score impact info, lender recommendations | Comparing multiple loan offers | Requires more inputs for accurate results | 4.7/5 |

| Bankrate | Simple interface, payment breakdown, principal vs. interest visualization | Quick calculations and basic understanding | Fewer advanced features | 4.5/5 |

| Edmunds | True cost to own, dealer incentives integration, real-time market rates | New car purchases with manufacturer incentives | More complex interface | 4.6/5 |

| Credit Karma | Personalized rate estimates based on credit profile, pre-qualification options | Understanding how your credit affects loan terms | Requires account creation | 4.4/5 |

For most users, a calculator that includes amortization schedules, tax considerations, and the ability to save or compare multiple scenarios will provide the most value when making auto financing decisions.

Using Calculator Results to Make Informed Decisions

The numbers from an auto loan calculator are just the beginning. Here’s how to interpret and apply those results to make smart financial decisions:

Affordability Assessment

Use the 20/4/10 rule as a starting point:

- 20% down payment minimum

- 4 years or less loan term when possible

- 10% or less of your monthly income for all auto expenses (payment, insurance, gas, maintenance)

If your calculator results don’t align with these guidelines, consider adjusting your vehicle choice, increasing your down payment, or improving your credit score before purchasing.

Loan Offer Evaluation

When comparing loan offers, look beyond the monthly payment:

- Calculate the total cost of each loan (monthly payment × number of months + down payment)

- Compare the total interest paid over the life of each loan

- Check for prepayment penalties that might limit your flexibility

- Consider the opportunity cost of a larger down payment versus investing that money

Negotiation Strategy

Armed with calculator results, you can negotiate more effectively:

- Focus on the total vehicle price rather than monthly payment

- Negotiate the interest rate separately from the vehicle price

- Use pre-approved financing as leverage with the dealer

- Be prepared to walk away if the numbers don’t match your calculated targets

- Consider timing your purchase at month-end or year-end when dealers may be more motivated

“The most expensive car is not the one with the highest price tag, but the one with the highest financing costs over time.”

Ready to Find Your Best Auto Loan?

Compare personalized rates from multiple lenders without affecting your credit score.

Conclusion: Empowering Your Car Buying Journey

An auto loan calculator is more than just a tool for estimating monthly payments—it’s a powerful ally in your car buying journey. By understanding how to use these calculators effectively and interpret their results, you can avoid costly financing mistakes, negotiate with confidence, and ensure your car purchase fits comfortably within your overall financial plan.

Remember that the best financial decisions are informed ones. Take the time to run different scenarios, compare options, and understand the long-term implications of your auto loan choices. Your future self will thank you for the money saved and the financial stress avoided.

How accurate are online auto loan calculators?

Online auto loan calculators provide reasonably accurate estimates when you input correct information. However, they may not account for all variables like dealer-specific fees or manufacturer incentives. Use them as a starting point, but verify final numbers with your lender before signing any agreements.

Should I focus on getting the lowest monthly payment possible?

While an affordable monthly payment is important, focusing solely on this number can lead to paying much more in total interest over time. The best approach is to balance a comfortable monthly payment with the shortest loan term you can afford, which minimizes your total financing costs.

How does my credit score affect auto loan calculations?

Your credit score significantly impacts the interest rate you’ll be offered, which directly affects your monthly payment and total interest paid. For example, the difference between a 4% and 8% interest rate on a $25,000 loan over 60 months is about $54 per month and over $3,200 in total interest over the life of the loan.