Use our Cash Back or Low Interest Calculator to compare credit card offers. Maximize rewards or save on interest and make smarter financial decisions.

When shopping for a new credit card, you’ll often face a critical choice: should you opt for a card with attractive cash back rewards or one with a low interest rate? This decision isn’t always straightforward, as the best option depends on your unique spending habits and payment behavior. Our Cash Back or Low Interest Calculator helps you cut through the confusion and identify which option will truly save you more money in the long run.

The Cash Back vs. Low Interest Dilemma

Credit card companies excel at making both options sound irresistible. Cash back cards tempt you with the promise of “free money” on every purchase, while low interest cards highlight significant savings on interest payments. The reality is that each option benefits different types of consumers.

Your optimal choice hinges on whether you typically carry a balance from month to month or pay your statement in full. For those who occasionally carry balances, especially larger ones, the interest savings from a low-rate card might substantially outweigh any cash back benefits. Conversely, if you’re diligent about paying in full each month, you’ll likely benefit more from cash back rewards.

Let’s explore how each option works before diving into our calculator tool that will help you make this important financial decision.

How Cash Back Credit Cards Work

Cash back credit cards reward you with a percentage of your purchases back as a statement credit, direct deposit, or other redemption options. These rewards typically range from 1% to 5% of your spending, depending on the card and purchase category.

Cash Back Reward Structures

Most cash back cards fall into one of these structures:

- Flat-rate cash back: Offers the same percentage (typically 1.5% to 2%) on all purchases

- Tiered cash back: Provides higher percentages in specific spending categories (like 3% on dining, 2% on groceries, 1% on everything else)

- Rotating category cash back: Features higher percentages (often 5%) in categories that change quarterly

Cash Back Example

Let’s say you spend $1,500 monthly on your credit card with a 2% cash back rate. Over a year, you’d earn:

$1,500 × 12 months × 2% = $360 in cash back rewards

If you always pay your balance in full, that’s $360 in pure savings.

However, if you carry a balance and pay interest, the calculation changes dramatically. For instance, if you carry an average balance of $1,000 at 18% APR, you’d pay approximately $180 in annual interest, reducing your net benefit to $180 ($360 – $180).

How Low Interest Credit Cards Work

Low interest credit cards offer reduced APR (Annual Percentage Rate) compared to standard credit cards. While the average credit card APR hovers around 18-22%, low interest cards might offer rates between 9-14%, depending on your credit score and market conditions.

Types of Low Interest Offers

- Ongoing low APR: Cards that maintain a lower-than-average interest rate indefinitely

- Introductory 0% APR: Cards offering zero interest for a promotional period (typically 12-18 months)

- Balance transfer offers: Cards allowing you to transfer high-interest debt to a lower rate (often with a transfer fee)

Low Interest Example

Imagine you carry a $3,000 balance for a year. Compare the interest costs:

Standard card at 20% APR: $3,000 × 20% = $600 in annual interest

Low interest card at 10% APR: $3,000 × 10% = $300 in annual interest

Annual savings: $300

The key advantage of low interest cards becomes apparent when you carry balances over time. The larger your typical balance and the longer you carry it, the more valuable a low interest rate becomes.

Cash Back or Low Interest Calculator

Our calculator helps you determine which option will save you more money based on your specific financial situation. Input your details below to see a personalized comparison.

Your Results

Cash Back Card

Annual Cash Back: $0

Annual Interest Cost: $0

Net Benefit: $0

Low Interest Card

Annual Cash Back: $0

Annual Interest Cost: $0

Interest Savings vs. Standard Card: $0

Recommendation

Interactive Calculation Examples

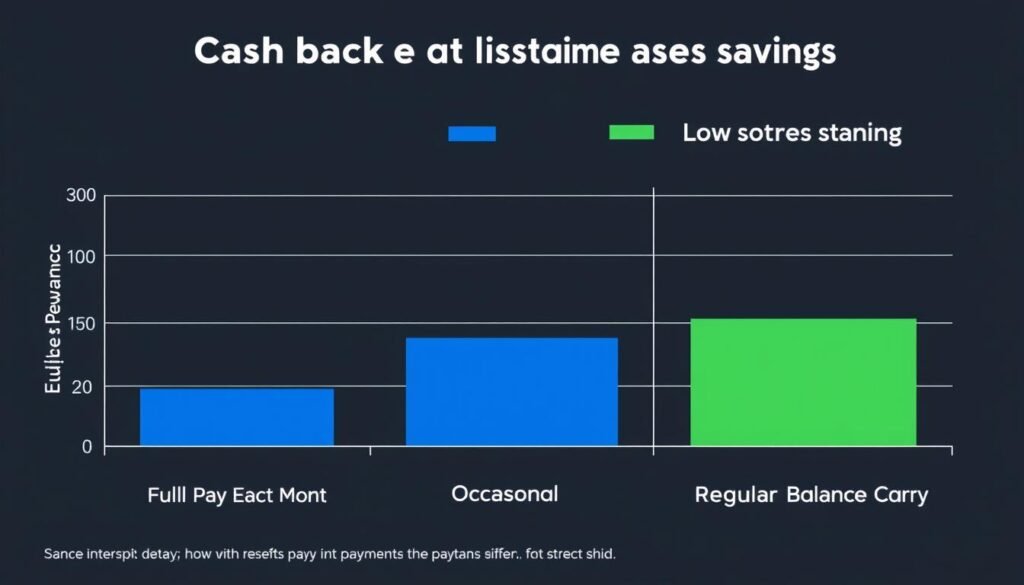

Let’s examine a few common scenarios to illustrate how different financial behaviors affect which card type is more beneficial.

Scenario 1: The Disciplined Payer

Profile: Always pays balance in full

Monthly spending: $2,000

Cash back rate: 2%

Balance carried: $0

Cash back annual benefit: $480

Low interest annual benefit: $0

Verdict: Cash Back Card Wins

Scenario 2: The Occasional Balance Carrier

Profile: Carries balance a few months per year

Monthly spending: $1,500

Cash back rate: 1.5%

Average balance carried: $1,000

Standard APR: 18%

Low APR: 10%

Cash back annual benefit: $270 – $180 = $90

Low interest annual benefit: $180 – $100 = $80

Verdict: Cash Back Card Slightly Better

Scenario 3: The Balance Carrier

Profile: Regularly carries a balance

Monthly spending: $1,200

Cash back rate: 2%

Average balance carried: $3,000

Standard APR: 20%

Low APR: 11%

Cash back annual benefit: $288 – $600 = -$312

Low interest annual benefit: $600 – $330 = $270

Verdict: Low Interest Card Wins

Key Factors to Consider in Your Decision

Spending Habits

- High monthly spending favors cash back cards

- Spending in bonus categories can maximize cash back

- Consider whether your spending aligns with card rewards

Payment Behavior

- Always paying in full? Cash back likely better

- Carrying balances regularly? Low interest probably wins

- Consider your historical payment patterns

Debt Amount

- Larger balances make low interest more valuable

- Calculate the break-even point for your situation

- Consider seasonal spending patterns that might create temporary debt

Additional Considerations

Credit Score Impact

Your credit score affects the interest rates you’ll qualify for. Those with excellent credit (740+) typically receive the lowest advertised rates, while those with fair credit may receive higher rates that diminish the benefit of “low interest” cards.

Annual Fees

Some rewards cards charge annual fees that must be factored into your calculations. A card with a $95 annual fee needs to generate at least $95 more in benefits than a no-fee alternative to be worthwhile.

Cash Back vs. Low Interest: Pros and Cons

| Feature | Cash Back Cards | Low Interest Cards |

| Best For | Those who pay balances in full | Those who carry balances |

| Primary Benefit | Earn rewards on everyday spending | Reduce interest costs on carried balances |

| Typical Rates | 1-5% cash back, 18-24% APR | 0% intro or 9-14% ongoing APR |

| Annual Fees | Common on premium rewards cards | Less common |

| Sign-up Bonuses | Often substantial ($150-$300) | Less common, focus on 0% intro periods |

| Flexibility | Rewards can be redeemed in various ways | Benefit is fixed to interest savings |

Tips for Maximizing Credit Card Benefits

For Cash Back Cards

- Pay in full every month to avoid interest charges that negate rewards

- Use the right card for each purchase to maximize category bonuses

- Track rotating categories and activate them when required

- Redeem rewards strategically – some cards offer bonus value for certain redemption options

- Look for special promotions offering increased cash back rates

For Low Interest Cards

- Make at least minimum payments on time to preserve your low rate

- Create a debt payoff plan to eliminate balances during 0% intro periods

- Avoid cash advances, which typically have higher rates

- Consider balance transfers to consolidate high-interest debt

- Set up automatic payments to avoid late fees and penalty APRs

Hybrid Strategy: Getting the Best of Both Worlds

For maximum financial benefit, consider using multiple cards strategically:

- Use a cash back card for everyday purchases you’ll pay off immediately

- Keep a low interest card for larger purchases you’ll pay off over time

- Track your spending and balances carefully to avoid confusion

- Reassess your strategy periodically as your financial situation changes

Frequently Asked Questions

Can I have both a cash back card and a low interest card?

Yes, many financial experts recommend this strategy. Use your cash back card for everyday purchases you’ll pay off each month, and keep the low interest card for larger purchases you may need to pay off over time. Just be careful to manage multiple accounts responsibly.

Do cash back cards always have higher interest rates?

While not universal, cash back and rewards cards typically have higher APRs than low interest cards. This is how card issuers offset the cost of providing rewards. The difference can range from 2-8 percentage points depending on the card and your credit profile.

What credit score do I need for the best rates and rewards?

The most competitive cash back rewards and lowest interest rates typically require a credit score of 740 or higher (excellent credit). However, there are options for those with good credit (670-739) and even fair credit (580-669), though with less favorable terms.

How often should I recalculate which card is better for me?

It’s wise to reassess your credit card strategy whenever your financial situation changes significantly. This includes changes in income, spending patterns, debt levels, or when you’re considering a major purchase. At minimum, conduct an annual review of your credit card benefits.

Making Your Decision: Cash Back or Low Interest

The choice between a cash back card and a low interest card isn’t one-size-fits-all. Your optimal decision depends on your unique financial situation, spending habits, and payment patterns.

Our Cash Back or Low Interest Calculator provides a data-driven approach to this decision, helping you see beyond marketing promises to understand the true financial impact of each option. Remember that your circumstances may change over time, so it’s worth revisiting this calculation periodically.

Ready to Find Your Ideal Credit Card?

Use our calculator above to determine which option is best for your financial situation, then explore cards that match your needs.

Whichever option you choose, the most important financial strategy is to use credit responsibly. This means understanding the terms of your cards, tracking your spending, making payments on time, and working toward financial goals that extend beyond credit card rewards or interest savings.