Use our College Cost Calculator to estimate tuition, housing, and other college expenses. Plan ahead and budget effectively for your education costs.

Planning for college expenses can feel overwhelming. With rising tuition rates, room and board costs, and additional expenses like textbooks and supplies, understanding the true cost of higher education is crucial for making informed decisions. Our College Cost Calculator helps you estimate these expenses accurately, allowing you to develop a realistic financial plan for your educational journey.

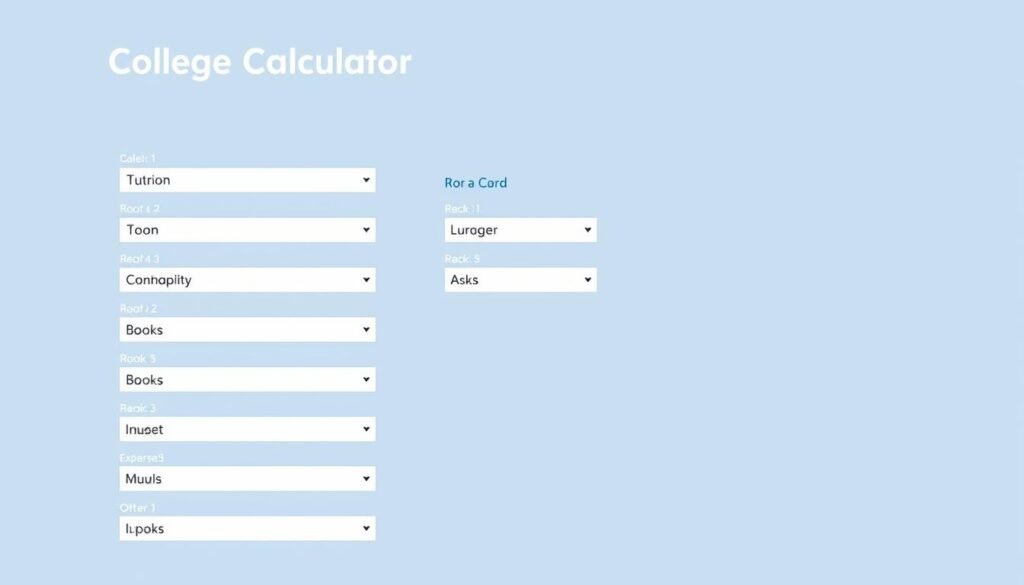

College Cost Calculator

Use our calculator to estimate your total college expenses, including tuition, room and board, books, and other costs. Simply enter your information below to get started.

Our College Cost Calculator helps you plan for all education expenses

Understanding College Costs: What You’ll Pay For

Before using the calculator, it’s important to understand the various components that make up the total cost of college. These expenses can vary significantly depending on the type of institution, location, and your personal choices.

Tuition and Fees

Tuition is typically the largest expense and varies widely between institutions. According to recent data, average annual tuition and fees for the 2024-2025 academic year are:

| Institution Type | Average Annual Cost |

| 4-year private | $62,990 |

| 4-year public (in-state) | $29,910 |

| 4-year public (out-of-state) | $49,080 |

| 2-year public | $20,570 |

Fees often include access to campus facilities, student activities, technology resources, and health services. These can add thousands to your annual costs.

Room and Board

Living expenses are the second largest component of college costs. Options typically include:

- On-campus dormitories (often required for first-year students)

- On-campus apartments

- Off-campus housing

- Living at home (commuting)

Meal plans vary from unlimited dining hall access to limited meal credits. Housing and food can cost between $10,000-$20,000 annually depending on location and options chosen.

On-campus housing is a significant part of college expenses

Books and Supplies

Textbooks and course materials can be surprisingly expensive. The average student spends $1,200-$1,500 per year on books and supplies. Ways to reduce these costs include:

- Purchasing used textbooks

- Renting textbooks

- Using digital versions when available

- Utilizing library resources

- Sharing with classmates

Personal Expenses

Don’t overlook these additional costs that can add up quickly:

- Transportation (car maintenance, fuel, public transit, flights home)

- Technology (laptop, software, internet)

- Health insurance (if not covered by parents’ plan)

- Personal items and toiletries

- Entertainment and social activities

- Clothing and laundry

Calculate Your Specific College Costs

Ready to get a personalized estimate of your college expenses? Our calculator takes into account all these factors to give you an accurate projection.

Comparing Different Types of Colleges

The type of institution you choose significantly impacts your total education costs. Understanding these differences can help you make a more informed financial decision.

Public Universities

State-funded institutions that offer lower tuition rates for in-state residents. They typically have larger student populations and a wide range of programs.

Advantages

- Lower tuition for state residents

- Wide variety of majors and programs

- Extensive research opportunities

- Diverse student body

Considerations

- Higher out-of-state tuition

- Larger class sizes

- Less personalized attention

- Competitive admission for popular programs

Private Colleges

Independent institutions with higher sticker prices but often substantial financial aid packages. They typically offer smaller class sizes and more personalized education.

Advantages

- Smaller class sizes

- More personalized attention

- Often generous financial aid

- Strong alumni networks

Considerations

- Higher sticker price

- May have fewer program options

- Financial aid varies significantly

- Need to research net price carefully

Community Colleges

Two-year institutions offering associate degrees and certificates at significantly lower costs. Many students transfer to four-year schools after completing core requirements.

Advantages

- Lowest tuition costs

- Live at home to save on housing

- Flexible scheduling for working students

- Transfer agreements with four-year schools

Considerations

- Limited bachelor’s degree options

- May need to transfer for advanced degrees

- Fewer campus activities and amenities

- Less “traditional” college experience

Different types of institutions offer varying educational experiences and cost structures

Understanding Financial Aid Options

Financial aid can significantly reduce your out-of-pocket college expenses. Understanding the different types available helps you maximize your opportunities for assistance.

Grants and Scholarships

These are the most desirable forms of financial aid because they don’t require repayment. They can be based on financial need, academic merit, athletic ability, or other criteria.

Federal Grants

- Pell Grants – Need-based aid for undergraduate students

- FSEOG – For students with exceptional financial need

- TEACH Grants – For students planning to become teachers in high-need fields

Scholarships

- Merit-based scholarships – Awarded for academic achievement

- Athletic scholarships – For student athletes

- Private scholarships – From corporations, foundations, and organizations

- School-specific scholarships – Offered directly by colleges

Financial aid award letters outline grants and scholarships you may receive

Loans

Unlike grants and scholarships, loans must be repaid with interest. Federal student loans generally offer more favorable terms than private loans.

Federal Student Loans

- Direct Subsidized Loans – For undergraduate students with financial need; government pays interest while in school

- Direct Unsubsidized Loans – Available regardless of financial need; interest accrues during school

- PLUS Loans – For parents of dependent undergraduate students or for graduate students

Private Student Loans

- Offered by banks, credit unions, and online lenders

- Usually require credit check and/or cosigner

- Often have higher interest rates than federal loans

- Fewer repayment options and borrower protections

Important: Always exhaust federal loan options before considering private loans. Federal loans offer income-driven repayment plans, loan forgiveness options, and other benefits not typically available with private loans.

Work-Study Programs

Federal Work-Study provides part-time jobs for undergraduate and graduate students with financial need. These positions are often on campus and designed to accommodate class schedules.

Calculate Your Financial Aid Eligibility

Understanding your potential financial aid can dramatically change your college cost projections. Use our calculator to estimate your net college costs after financial aid.

Completing the FAFSA is essential for accessing federal financial aid

College Savings Plans and Strategies

Starting to save early can significantly reduce the financial burden of college. Several tax-advantaged savings options are available to help families prepare for education expenses.

529 Savings Plans

State-sponsored education savings plans that offer tax advantages when funds are used for qualified education expenses.

Key Benefits:

- Tax-free growth on investments

- Tax-free withdrawals for qualified education expenses

- Some states offer tax deductions for contributions

- High contribution limits (over $300,000 in many states)

- Can be used for K-12 tuition (up to $10,000 annually)

- Minimal impact on financial aid eligibility

“529 plans are one of the most effective ways to save for college due to their tax advantages and flexibility.”

Coverdell ESAs

Education Savings Accounts that offer tax-free growth and withdrawals for qualified education expenses from kindergarten through college.

Key Benefits:

- Can be used for K-12 expenses (not just tuition)

- More investment options than most 529 plans

- Tax-free growth and withdrawals for qualified expenses

Limitations:

- $2,000 annual contribution limit per beneficiary

- Income limits for contributors

- Funds must be used by beneficiary’s 30th birthday

Other Savings Options

Additional strategies for college savings beyond education-specific accounts.

Roth IRAs

- Withdrawals of contributions (not earnings) can be made tax-free at any time

- Earnings can be withdrawn penalty-free for qualified education expenses

- Funds not used for education can be kept for retirement

- Not counted as an asset on the FAFSA

UGMA/UTMA Custodial Accounts

- No contribution limits or income restrictions

- Can be used for any purpose benefiting the child

- Child gains control at age of majority (18-21 depending on state)

- Counted heavily in financial aid calculations

Starting college savings early can significantly reduce future financial stress

Calculate Your College Savings Needs

Wondering how much you need to save each month to reach your college funding goals? Our calculator can help you develop a realistic savings plan.

Strategies to Reduce College Costs

There are numerous ways to make college more affordable without sacrificing educational quality. Consider these strategies to minimize your expenses.

Before College

- Take AP/IB courses – Earn college credit in high school

- CLEP exams – Test out of introductory courses

- Community college courses – Earn transferable credits at lower costs

- Apply for scholarships early – Many deadlines are in fall of senior year

- Compare financial aid packages – Don’t just look at sticker prices

- Consider 2+2 programs – Start at community college, finish at university

During College

- Graduate on time – Each extra semester adds significant cost

- Maximize course load – Take full credit hours each semester

- Become a resident assistant – Often includes free or reduced housing

- Use student discounts – For software, transportation, entertainment

- Rent or buy used textbooks – Or use library copies when possible

- Cook meals – Instead of expensive meal plans or dining out

Financial Strategies

- Appeal financial aid offers – Especially if circumstances change

- Apply for scholarships throughout college – Not just before freshman year

- Work part-time – Balance with studies to reduce loan needs

- Use tax benefits – American Opportunity and Lifetime Learning credits

- Explore employer tuition assistance – Many companies offer education benefits

- Consider cooperative education – Programs that alternate study and paid work

Smart financial decisions can significantly reduce your total college costs

“The best strategy for college affordability is a combination of early planning, careful school selection, maximizing free aid, and thoughtful cost-cutting throughout your education.”

Calculate Your Potential Savings

See how implementing these cost-saving strategies could impact your total college expenses.

College Cost Calculator Tool

Now that you understand the components of college costs and strategies for reducing them, use our comprehensive calculator to estimate your specific expenses and develop a financial plan.

Our interactive calculator helps you plan for all aspects of college expenses

Note: This calculator provides estimates based on national averages and your inputs. For the most accurate information, check with specific colleges for their current costs and use their net price calculators.

Need More Detailed Financial Planning?

Explore our other financial calculators to help with your college planning:

Additional College Financial Planning Resources

Beyond our calculator, these trusted resources can help you navigate the complex world of college financing and planning.

Government Resources

- Federal Student Aid – Official source for FAFSA and federal aid information

- College Scorecard – Compare colleges based on cost, graduation rates, and more

- Benefits.gov – Education benefits you may qualify for

- IRS Education Credits – Tax benefits for education

Scholarship Resources

- Fastweb – Scholarship matching service

- Scholarships.com – Database of scholarships and grants

- BigFuture – College Board’s scholarship search

- Chegg Scholarships – Scholarship matching and applications

Financial Literacy

- CFPB Paying for College – Consumer Financial Protection Bureau tools

- Edvisors – Financial aid and planning resources

- Saving for College – 529 plans and college savings strategies

- FinAid – Comprehensive financial aid information

Utilizing trusted resources can help you navigate the complex college financing landscape

Frequently Asked Questions About College Costs

When should I start saving for college?

The earlier, the better. Starting when your child is young allows more time for investments to grow and compound. However, it’s never too late to begin saving. Even if your child is in high school, any amount saved reduces the need for loans.

How accurate are college cost calculators?

College cost calculators provide estimates based on current data and trends. They’re useful for planning purposes but may not capture institution-specific costs or future changes in tuition rates. For the most accurate projections, combine calculator estimates with research on specific schools you’re considering.

Should I prioritize saving for college or retirement?

Financial advisors typically recommend prioritizing retirement savings. While there are loans available for college, there are no loans for retirement. However, a balanced approach that contributes to both goals is ideal if your budget allows.

How do I compare financial aid offers from different schools?

Focus on the net price (cost after grants and scholarships) rather than the total financial aid package. Some schools include loans in their “aid” offers, which must be repaid. Create a spreadsheet comparing tuition, fees, room and board, grants, scholarships, and loans for each school to determine your true out-of-pocket cost.

Will applying for financial aid hurt my chances of admission?

At most colleges, admissions decisions are made separately from financial aid decisions (need-blind admissions). However, some private colleges are “need-aware,” meaning financial need may be considered for some applicants. Research each school’s policy, but don’t let this deter you from applying for financial aid if you need it.

Financial aid advisors can help answer specific questions about college costs

Plan Your College Financial Journey Today

Understanding and planning for college costs is one of the most important steps in preparing for higher education. By using our College Cost Calculator and implementing the strategies discussed in this guide, you can develop a comprehensive financial plan that makes college more affordable and reduces post-graduation debt.

Remember that college financing is not a one-size-fits-all process. Your financial situation, the schools you’re considering, and your educational goals all play important roles in determining the best approach. Revisit your plan regularly and adjust as needed as circumstances change.

Start Your College Financial Planning

Use our comprehensive College Cost Calculator to get a personalized estimate of your education expenses and develop a financial strategy that works for your situation.

With proper planning, you can achieve your educational goals while maintaining financial health