Use our Debt Payoff Calculator to estimate how long it will take to clear your debt. Compare payment plans and find the fastest way to become debt-free.

Feeling overwhelmed by debt? You’re not alone. The average American household carries over $90,000 in debt across credit cards, auto loans, mortgages, and student loans. Our Debt Payoff Calculator helps you create a clear, personalized strategy to become debt-free faster. Whether you’re tackling high-interest credit cards or managing multiple loans, this calculator shows exactly when you’ll be debt-free and how much you’ll save in interest.

Find Your Debt-Free Date

Enter your debt details below to create a personalized payoff plan. See exactly when you’ll be debt-free and how much you’ll save in interest.

Our calculator creates a personalized debt elimination plan based on your unique financial situation

How the Debt Payoff Calculator Works

Our calculator uses proven mathematical models to determine the most efficient way to eliminate your debt. By analyzing your debt balances, interest rates, and monthly payment capabilities, it creates a customized plan that fits your financial situation.

Information You’ll Need:

- Current balance for each debt

- Interest rate (APR) for each debt

- Minimum monthly payment for each debt

- Any extra amount you can pay monthly

What You’ll Discover:

- Your projected debt-free date

- Total interest savings with your plan

- Month-by-month payment schedule

- Visual progress charts and milestones

The calculator interface is designed for ease of use while providing comprehensive results

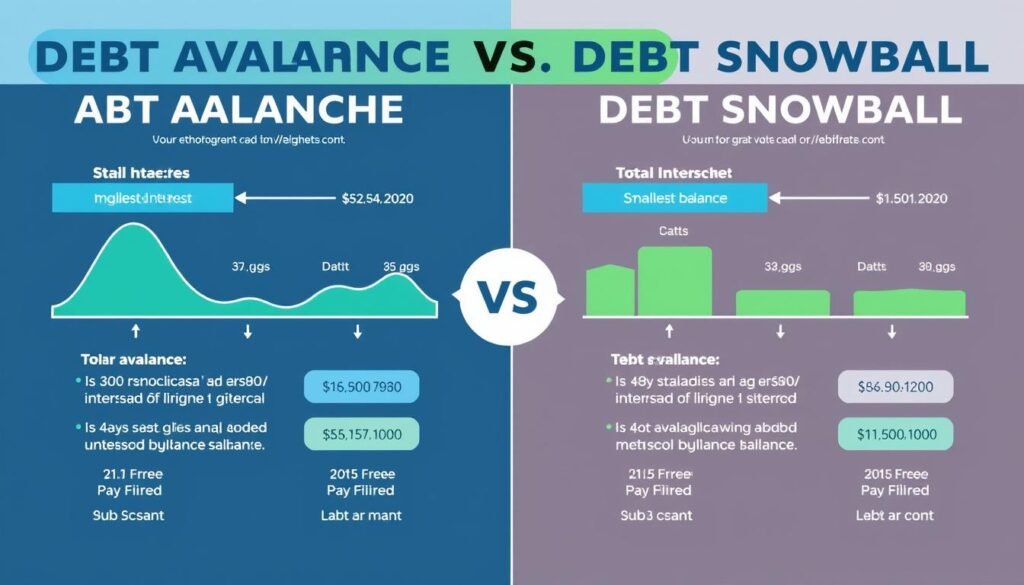

Debt Payoff Strategies: Choose Your Method

There are two primary strategies for paying off debt efficiently. Our calculator supports both methods, allowing you to compare approaches and choose the one that works best for your situation and personality.

Debt Avalanche Method

The debt avalanche method prioritizes debts with the highest interest rates first. This approach saves the most money mathematically by reducing the total interest paid over time.

Best for:

- Those motivated by maximum interest savings

- People with high-interest credit card debt

- Individuals who take a logical approach to finances

Debt Snowball Method

The debt snowball method targets your smallest debts first, regardless of interest rate. This creates quick wins that build momentum and motivation as you eliminate each debt.

Best for:

- Those motivated by seeing immediate progress

- People with multiple smaller debts

- Individuals who need psychological wins to stay motivated

Avalanche Method Advantages

- Minimizes total interest paid

- Mathematically optimal approach

- Faster total payoff time (in most cases)

Snowball Method Advantages

- Creates early wins for motivation

- Simplifies finances by reducing number of payments

- Better for those who need psychological momentum

Visual comparison of how the avalanche and snowball methods affect your debt payoff journey

Benefits of Using a Debt Payoff Calculator

Creating a structured debt payoff plan with our calculator offers numerous advantages over the minimum payment approach or unstructured extra payments.

Save Thousands in Interest

By strategically targeting your debts, you can significantly reduce the total interest paid over the life of your loans. Many users save thousands of dollars by following an optimized plan.

See Your Debt-Free Date

Knowing exactly when you’ll be debt-free provides powerful motivation. Our calculator shows your projected freedom date and how extra payments can accelerate your timeline.

Create a Realistic Plan

Our calculator helps you develop a payment plan that fits your budget while maximizing your debt reduction. No more guessing about which debt to pay first.

The emotional reward of reaching your debt-free milestone is priceless

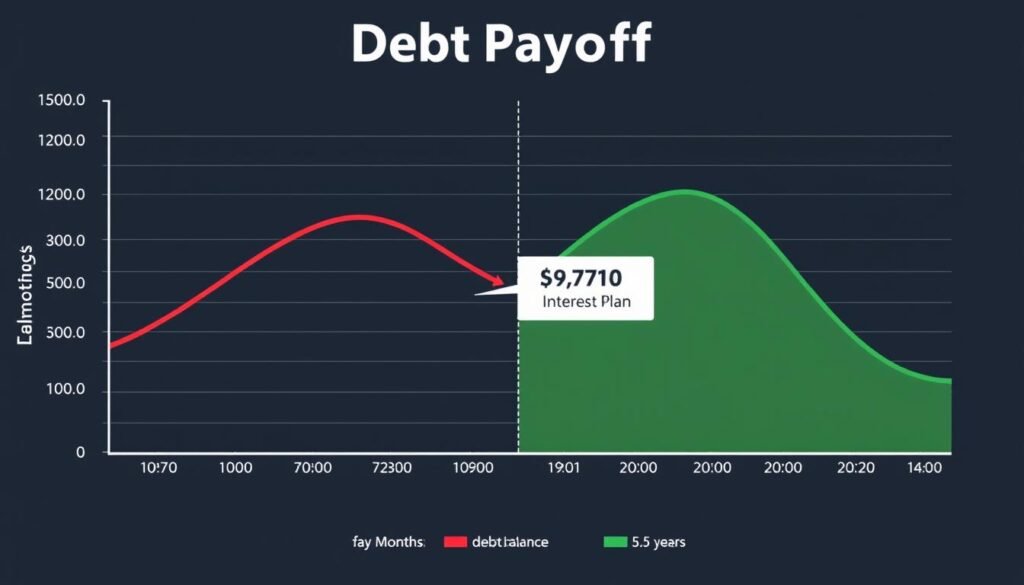

Real-World Example: The Power of Strategic Debt Payoff

Let’s look at how our Debt Payoff Calculator can transform a typical debt situation. Consider Sarah, who has the following debts:

| Debt Type | Balance | Interest Rate | Minimum Payment |

| Credit Card A | $5,000 | 18.99% | $150 |

| Credit Card B | $2,500 | 15.99% | $75 |

| Auto Loan | $12,000 | 4.5% | $250 |

| Student Loan | $18,000 | 5.8% | $210 |

Minimum Payment Approach

If Sarah only makes minimum payments:

- Time to debt freedom: 17 years, 3 months

- Total interest paid: $14,830

- Total amount paid: $52,330

With Debt Payoff Calculator Plan

If Sarah adds just $200 extra per month using the avalanche method:

- Time to debt freedom: 5 years, 7 months

- Total interest paid: $5,120

- Total amount paid: $42,620

Result: By using our Debt Payoff Calculator, Sarah saves $9,710 in interest and becomes debt-free nearly 12 years sooner!

Visual comparison of Sarah’s debt journey with and without a strategic payoff plan

Common Debt Payoff Mistakes to Avoid

Even with the best intentions, many people make mistakes that slow down their debt payoff journey. Our calculator helps you avoid these common pitfalls:

Paying Only Minimums

Making only minimum payments extends your debt for years or even decades. Our calculator shows how even small extra payments can dramatically reduce your payoff time.

No Strategic Order

Paying extra on random debts is inefficient. Our calculator determines the optimal order to maximize interest savings and minimize payoff time.

Ignoring Interest Rates

Not considering interest rates can cost you thousands. Our calculator factors in all rates to create the most cost-effective plan for your situation.

“I was making extra payments on my lowest-interest loan for years, not realizing I was losing thousands by ignoring my high-interest credit cards. The Debt Payoff Calculator showed me a better way, and I’ll be debt-free 8 years sooner.”

Identifying and correcting debt payoff mistakes can save you thousands

Frequently Asked Questions About Debt Payoff

Which debt payoff method is better: snowball or avalanche?

Both methods have their strengths. The avalanche method (paying highest interest first) saves the most money mathematically. The snowball method (paying smallest balances first) provides psychological wins that keep many people motivated. Our calculator supports both approaches, allowing you to compare and choose the one that works best for your situation and personality.

Should I save for emergencies while paying off debt?

Financial experts typically recommend having at least a small emergency fund (

Frequently Asked Questions About Debt Payoff

Which debt payoff method is better: snowball or avalanche?

Both methods have their strengths. The avalanche method (paying highest interest first) saves the most money mathematically. The snowball method (paying smallest balances first) provides psychological wins that keep many people motivated. Our calculator supports both approaches, allowing you to compare and choose the one that works best for your situation and personality.

Should I save for emergencies while paying off debt?

Financial experts typically recommend having at least a small emergency fund ($1,000-$2,000) before aggressively paying down debt. This prevents you from adding new debt when unexpected expenses arise. Once high-interest debt is eliminated, you can build a more substantial emergency fund of 3-6 months of expenses.

How do I handle variable income when creating a debt payoff plan?

With variable income, create your debt payoff plan based on your minimum reliable monthly income. Then, use our calculator’s “extra payment” feature to see how additional income (bonuses, commissions, tax refunds) can accelerate your debt freedom date. This approach ensures your plan remains sustainable during lower-income months.

Should I include my mortgage in my debt payoff plan?

Most financial experts recommend focusing on non-mortgage debt first (credit cards, auto loans, student loans) since mortgages typically have lower interest rates and potential tax benefits. Our calculator allows you to include or exclude your mortgage from your debt payoff strategy based on your personal goals.

How accurate is the debt-free date prediction?

Our calculator provides a highly accurate projection based on the information you provide. However, the actual date may vary if your payment amounts change, if you add new debt, or if you have variable interest rates. For best results, update your plan whenever your financial situation changes.

Understanding the fundamentals of debt payoff strategies helps you make informed decisions

,000-,000) before aggressively paying down debt. This prevents you from adding new debt when unexpected expenses arise. Once high-interest debt is eliminated, you can build a more substantial emergency fund of 3-6 months of expenses.

How do I handle variable income when creating a debt payoff plan?

With variable income, create your debt payoff plan based on your minimum reliable monthly income. Then, use our calculator’s “extra payment” feature to see how additional income (bonuses, commissions, tax refunds) can accelerate your debt freedom date. This approach ensures your plan remains sustainable during lower-income months.

Should I include my mortgage in my debt payoff plan?

Most financial experts recommend focusing on non-mortgage debt first (credit cards, auto loans, student loans) since mortgages typically have lower interest rates and potential tax benefits. Our calculator allows you to include or exclude your mortgage from your debt payoff strategy based on your personal goals.

How accurate is the debt-free date prediction?

Our calculator provides a highly accurate projection based on the information you provide. However, the actual date may vary if your payment amounts change, if you add new debt, or if you have variable interest rates. For best results, update your plan whenever your financial situation changes.

Understanding the fundamentals of debt payoff strategies helps you make informed decisions

Start Your Debt Freedom Journey Today

Take the first step toward financial freedom by creating your personalized debt payoff plan. Our calculator makes it easy to see exactly how and when you’ll become debt-free.

Join thousands who have achieved debt freedom with our calculator

Your Path to Debt Freedom Starts Here

Becoming debt-free isn’t just about numbers—it’s about creating freedom and peace of mind in your life. Our Debt Payoff Calculator gives you the tools and strategy to transform your financial future. By following a structured plan and making consistent progress, you can join the thousands of people who have used our calculator to eliminate debt and build a stronger financial foundation.

Remember that every journey begins with a single step. Create your personalized debt payoff plan today, and take that crucial first step toward financial freedom.