Use our Estate Tax Calculator to estimate taxes on your estate. Plan inheritances, understand tax implications, and manage wealth transfer efficiently.

Planning for the future of your estate requires understanding potential tax implications. Our estate tax calculator helps you estimate federal and state estate tax liabilities, allowing you to make informed decisions about wealth transfer strategies. With significant changes coming in 2026 that could dramatically impact exemption amounts, now is the critical time to assess your estate's tax exposure.Our estate tax calculator provides a clear breakdown of potential tax liabilities.

Estate Tax Calculator

Use our comprehensive calculator to estimate your potential estate tax liability. Enter your estate's value, location, and other relevant details to receive an accurate assessment based on current federal and state tax laws.

Calculate Your Estate Tax Liability

Get a personalized estimate of federal and state estate taxes based on your specific situation and current tax laws.

Understanding Estate Taxes

An estate tax is a tax imposed on the total value of a person's estate at the time of their death. Often referred to as a "death tax," it applies to the transfer of assets from the deceased to their heirs. The tax is calculated based on the fair market value of all assets owned at death, minus allowable deductions.

Federal Estate Tax Exemptions and Rates

For 2025, the federal estate tax exemption is $13.99 million per individual and $27.98 million for married couples. This means estates valued below these thresholds won't owe federal estate taxes. For amounts exceeding the exemption, a flat 40% tax rate applies.

| Year | Individual Exemption | Married Couple Exemption | Tax Rate |

| 2023 | $12.92 million | $25.84 million | 40% |

| 2024 | $13.61 million | $27.22 million | 40% |

| 2025 | $13.99 million | $27.98 million | 40% |

| 2026 (Projected) | ~$7 million | ~$14 million | 40% |

Important: The current historically high exemption amounts are scheduled to sunset on December 31, 2025. Without new legislation, exemption amounts will approximately be cut in half starting in 2026, potentially exposing many more estates to federal estate taxes.

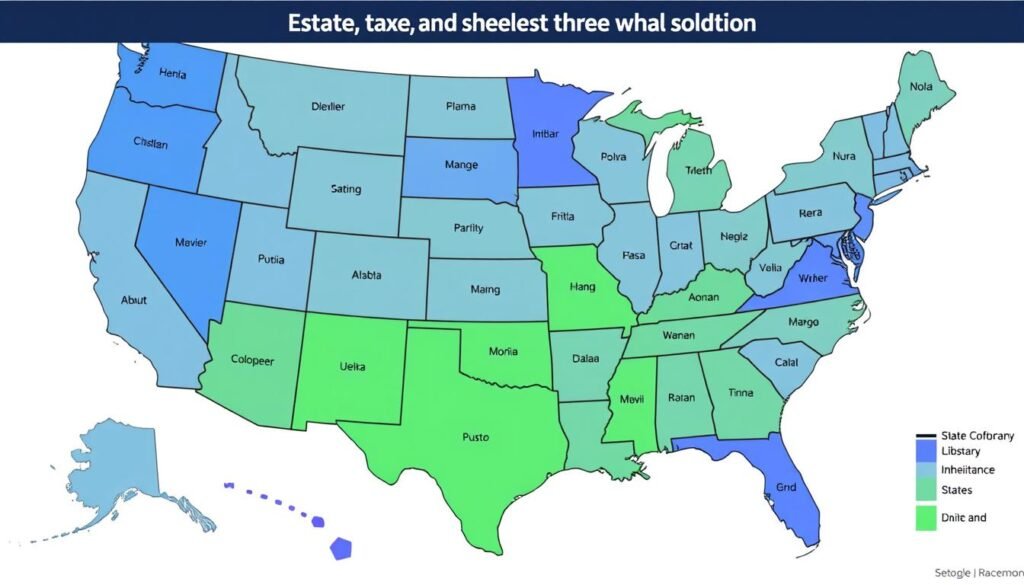

State Estate and Inheritance Taxes

While federal estate taxes affect relatively few Americans, state-level estate and inheritance taxes often have much lower exemption thresholds. Understanding your state's specific requirements is crucial for comprehensive estate planning.

States with Estate Taxes (2025)

Twelve states and the District of Columbia impose their own estate taxes, often with significantly lower exemption amounts than the federal threshold:

- Connecticut: $13.99 million (matches federal)

- Hawaii: $5.49 million

- Illinois: $4 million

- Maine: $7 million

- Maryland: $5 million

- Massachusetts: $2 million

- Minnesota: $3 million

- New York: $7.16 million

- Oregon: $1 million

- Rhode Island: $1.8 million

- Vermont: $5 million

- Washington: $3 million

- District of Columbia: $4.87 million

States with estate taxes (blue), inheritance taxes (green), and both (purple) as of 2025

Inheritance Taxes vs. Estate Taxes

While estate taxes are paid by the estate before assets are distributed, inheritance taxes are paid by the beneficiaries who receive the assets. Five states currently impose inheritance taxes: Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania. Maryland uniquely imposes both estate and inheritance taxes.

Inheritance tax rates often depend on the relationship between the deceased and the beneficiary, with spouses typically exempt and closer relatives receiving preferential treatment.

Calculate Your State-Specific Estate Tax

Our calculator includes state-specific estate and inheritance tax calculations to give you a complete picture of your potential tax liability.

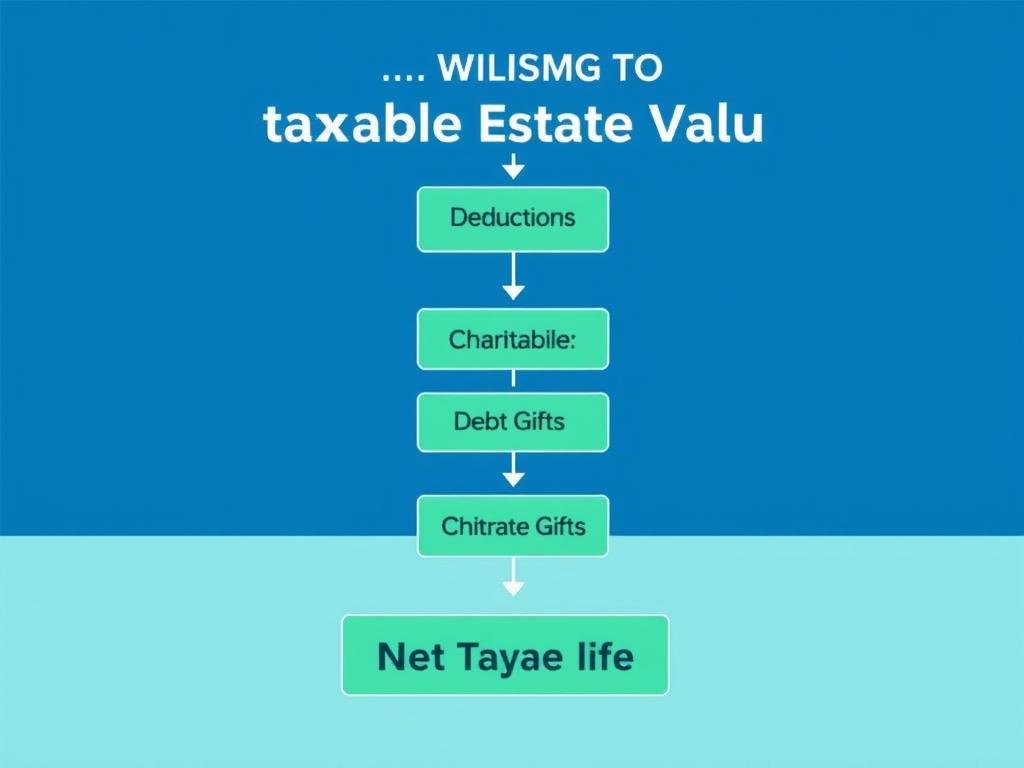

Determining Your Taxable Estate Value

Calculating your taxable estate involves more than simply adding up your assets. The process includes several steps to determine the final taxable amount.

What Assets Are Included?

Your gross estate includes all assets you own or have certain interests in at the time of death:

- Cash and bank accounts

- Investment accounts

- Real estate

- Business interests

- Life insurance policies you own

- Retirement accounts (IRAs, 401(k)s)

- Personal property

- Certain gifts made during your lifetime

Allowable Deductions

Several deductions can reduce your taxable estate:

- Marital deduction: Assets transferred to a surviving U.S. citizen spouse are generally exempt from estate taxes

- Charitable deduction: Assets donated to qualified charities

- Debts and mortgages: Outstanding debts at time of death

- Administration expenses: Funeral costs, executor fees, legal fees

- State estate taxes: Deductible for federal estate tax purposes

The process of calculating your taxable estate value

Valuation Methods

Assets are valued at their fair market value (FMV) at the date of death. Alternatively, the executor may choose an alternate valuation date six months after death if it would decrease both the gross estate value and the resulting estate tax.

"Fair market value is not what was paid for assets or what their values were when acquired, but is assessed based on a reasonable amount at which the items would be purchased by interested buyers."

For complex assets like business interests or real estate, professional appraisals may be necessary to determine accurate values.

Estate Tax Planning Strategies

With proper planning, you can minimize estate tax liability while ensuring your assets are distributed according to your wishes.

Lifetime Gifting

The annual gift tax exclusion allows you to give up to $19,000 per recipient in 2025 without using your lifetime exemption. Married couples can combine their exclusions to gift $38,000 per recipient annually.

Additional tax-free gifts include:

- Unlimited medical expenses paid directly to providers

- Unlimited tuition paid directly to educational institutions

- Unlimited gifts to U.S. citizen spouses

- Unlimited charitable donations to qualified organizations

Trusts and Estate Planning Tools

Various trust structures can help reduce estate taxes:

Irrevocable Life Insurance Trust (ILIT)

Removes life insurance proceeds from your taxable estate while providing liquidity for heirs to pay estate taxes.

Grantor Retained Annuity Trust (GRAT)

Transfers asset appreciation to beneficiaries with minimal gift tax impact, especially effective in low-interest environments.

Charitable Remainder Trust (CRT)

Provides income to you during your lifetime while benefiting charities and reducing estate taxes.

Family Limited Partnerships (FLPs)

FLPs allow you to transfer business interests or investments to family members while maintaining control and potentially qualifying for valuation discounts that reduce gift and estate taxes.

Common estate tax planning strategies and their relationships

Spousal Portability

The Deceased Spousal Unused Exclusion (DSUE) allows a surviving spouse to use their deceased spouse's unused estate tax exemption. To secure portability, the executor must file Form 706 within nine months of death (with possible extensions).

Important: Portability is not automatic. Failure to file Form 706 within the required timeframe can result in the loss of millions in tax exemptions. Additionally, state estate tax exemptions are generally not portable between spouses.

Get Personalized Estate Planning Advice

Our estate planning experts can help you develop strategies to minimize estate taxes and protect your family's wealth.

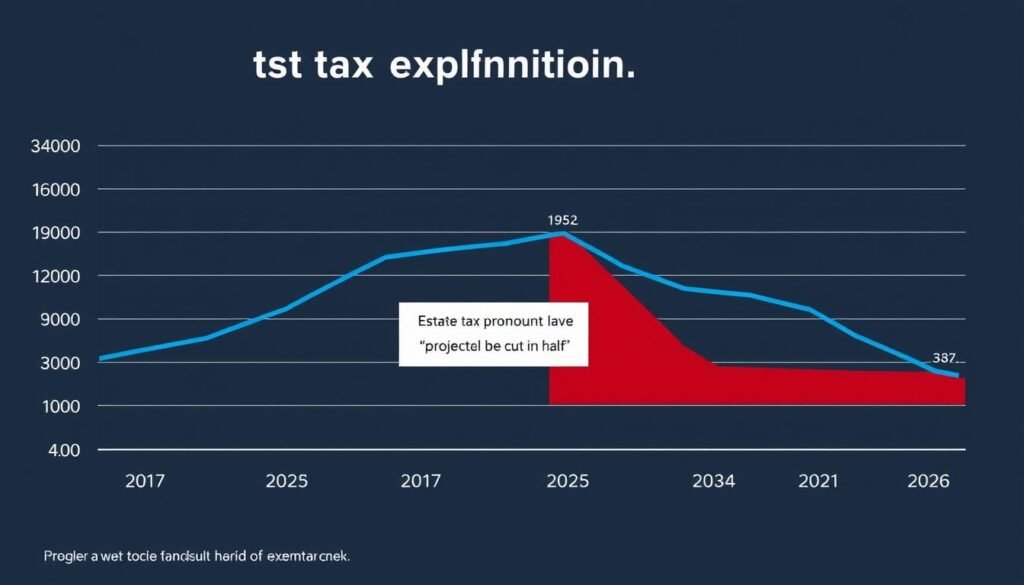

The 2026 "Tax Cliff": Why Timing Matters

The most significant estate planning consideration for 2025 is the impending "tax cliff." The Tax Cuts and Jobs Act of 2017 temporarily doubled estate tax exemptions through 2025. Without Congressional action, exemptions will revert to approximately $7 million per person on January 1, 2026.

The "tax cliff" showing the projected drop in estate tax exemptions in 2026

Impact on Different Estate Sizes

The 2026 changes will significantly impact estates valued between $7 million and $14 million (for individuals) or between $14 million and $28 million (for married couples).

| Estate Value | 2025 Tax Liability | 2026 Tax Liability | Additional Tax Cost |

| $10 million | $0 | $1,200,000 | $1,200,000 |

| $15 million | $404,000 | $3,200,000 | $2,796,000 |

| $20 million | $2,404,000 | $5,200,000 | $2,796,000 |

Planning Opportunities Before 2026

The IRS has implemented "anti-clawback" rules, meaning gifts made using the higher exemptions before 2026 will be protected even after the exemption decreases. This creates a "use it or lose it" scenario for high-net-worth individuals.

Strategies to consider before the 2026 deadline include:

- Accelerating planned lifetime gifts to use the higher exemption

- Creating irrevocable trusts to remove assets from your estate

- Implementing valuation discount strategies for business interests

- Converting traditional IRAs to Roth IRAs to reduce taxable estate value

"The window for using the historically high exemption amounts is closing. Those with estates that may be impacted should consider accelerating their wealth transfer plans before the end of 2025."

Frequently Asked Questions About Estate Taxes

Who pays estate taxes?

Estate taxes are paid by the estate before assets are distributed to heirs. The executor or personal representative of the estate is responsible for filing the estate tax return (Form 706) and paying any taxes due. The tax is calculated based on the total value of the estate, not on what each beneficiary receives.

How is the estate tax different from inheritance tax?

Estate taxes are paid by the estate before assets are distributed, while inheritance taxes are paid by the beneficiaries who receive the assets. The federal government only imposes an estate tax, not an inheritance tax. However, some states have inheritance taxes, and Maryland has both.

When are estate taxes due?

Federal estate tax returns (Form 706) must be filed within 9 months of the date of death. The tax payment is also due at that time. Extensions for filing may be granted for up to 6 months, but the tax payment deadline remains the same. In some cases, the IRS may allow installment payments for estates with closely-held businesses.

How can I avoid estate taxes?

Legal strategies to minimize estate taxes include: making lifetime gifts to use the annual gift tax exclusion, creating irrevocable trusts, establishing family limited partnerships, making charitable donations, and using the unlimited marital deduction by leaving assets to a surviving spouse. Professional estate planning is recommended for significant estates.

Do all states have estate taxes?

No. As of 2025, only 12 states plus the District of Columbia impose estate taxes: Connecticut, Hawaii, Illinois, Maine, Maryland, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont, and Washington. Five states impose inheritance taxes: Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania. Maryland is the only state with both taxes.

Plan Your Estate Tax Strategy Today

Understanding your potential estate tax liability is the first step toward effective estate planning. With significant changes coming in 2026 that could dramatically impact exemption amounts, now is the critical time to assess your estate's tax exposure and implement strategies to protect your legacy.

Our estate tax calculator provides a valuable starting point, but complex estates often benefit from professional guidance. Consider consulting with an estate planning attorney or financial advisor to develop a comprehensive strategy tailored to your specific situation.

Take Control of Your Estate Planning

Start with our free estate tax calculator and explore strategies to minimize your tax burden and maximize your legacy.