Use our FHA Loan Calculator to estimate monthly mortgage payments, interest, and total cost. Plan your FHA loan and manage your home financing effectively.

Navigating the world of home loans can be challenging, especially when considering an FHA loan. Our FHA Loan Calculator helps you understand exactly what your monthly payments might look like, including mortgage insurance premiums, property taxes, and homeowners insurance. Whether you’re a first-time homebuyer or looking to refinance, this calculator provides the clarity you need to make informed decisions about your mortgage options.

FHA Loan Calculator

Use our calculator to estimate your monthly FHA loan payment, including principal, interest, mortgage insurance premiums, property taxes, and homeowners insurance.

Our FHA Loan Calculator helps homebuyers understand their potential monthly mortgage payments

What Is an FHA Loan?

FHA loans are mortgages insured by the Federal Housing Administration, a part of the U.S. Department of Housing and Urban Development (HUD). Created in 1934 after the Great Depression, the FHA’s mission is to increase homeownership across America by making mortgages more accessible.

Unlike conventional loans, FHA loans are government-backed, which means the FHA insures the loan against default. This insurance protects lenders, allowing them to offer more favorable terms to borrowers who might not qualify for conventional financing.

Key Features of FHA Loans

- Lower down payment requirements (as low as 3.5% with a credit score of 580+)

- More flexible credit score requirements (minimum 500 with 10% down)

- Competitive interest rates compared to conventional loans

- Lower closing costs in many cases

- Ability to finance the upfront mortgage insurance premium

It’s important to understand that the FHA doesn’t actually lend money. Instead, you get an FHA loan from an FHA-approved lender, and the FHA provides insurance on that loan. This insurance reduces the risk for lenders, making it possible for them to offer more favorable terms to borrowers with lower credit scores or smaller down payments.

How Our FHA Loan Calculator Works

Our FHA Loan Calculator takes several key factors into account to provide an accurate estimate of your monthly mortgage payment. Understanding these components helps you see exactly where your money goes each month.

Breakdown of a typical FHA loan monthly payment

Calculator Input Fields

Home Price & Down Payment

Enter the total purchase price of the home and your planned down payment. Remember, FHA loans require a minimum down payment of 3.5% with a credit score of 580 or higher, or 10% with a credit score between 500-579.

Loan Term & Interest Rate

Select your loan term (typically 15 or 30 years) and enter the interest rate. FHA loan rates are often competitive with or slightly lower than conventional loan rates for borrowers with similar credit profiles.

Additional Costs

Include property taxes, homeowners insurance, and HOA fees if applicable. Our calculator automatically adds both the upfront and annual mortgage insurance premiums required for FHA loans.

Calculator Output

After entering your information, the calculator will display:

- Total monthly payment (principal, interest, taxes, insurance, and MIP)

- Breakdown of payment components

- Amortization schedule showing how your loan balance decreases over time

- Total interest paid over the life of the loan

Ready to Calculate Your FHA Loan Payment?

Get a detailed breakdown of your potential monthly payments and see if an FHA loan is right for you.

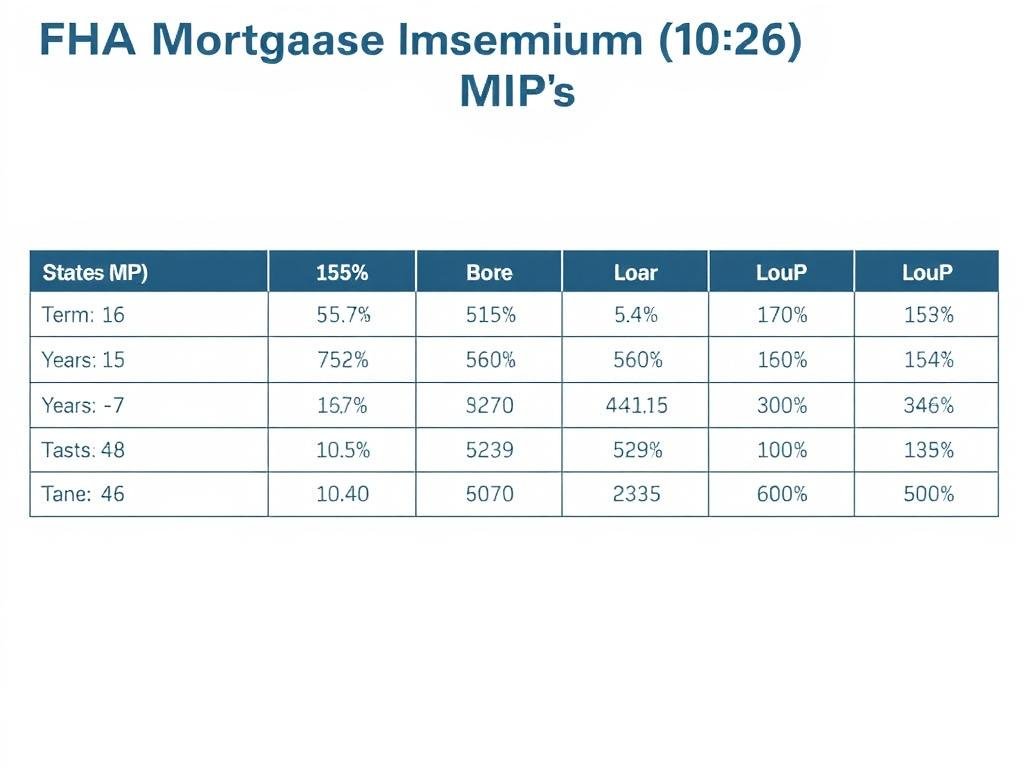

Understanding FHA Mortgage Insurance Premiums (MIP)

One of the most significant differences between FHA loans and conventional mortgages is the mortgage insurance requirement. FHA loans require two types of mortgage insurance premiums:

Upfront Mortgage Insurance Premium (UFMIP)

The upfront premium is 1.75% of your loan amount. For example, on a $200,000 loan, the UFMIP would be $3,500. While this seems substantial, you can finance this amount into your loan rather than paying it out of pocket at closing.

Annual Mortgage Insurance Premium (MIP)

The annual premium ranges from 0.15% to 0.75% of your loan amount, depending on your loan term, loan amount, and loan-to-value (LTV) ratio. This premium is divided by 12 and added to your monthly mortgage payment.

2025 FHA Annual MIP Rates

Important Note: For most FHA loans, the annual MIP is required for the entire loan term if your down payment is less than 10%. If your down payment is 10% or more, MIP can be removed after 11 years of payments.

Our FHA Loan Calculator automatically includes both UFMIP and annual MIP in its calculations, giving you a complete picture of your monthly payment.

FHA Loans vs. Conventional Loans

Understanding the differences between FHA and conventional loans can help you determine which option is best for your situation.

| Feature | FHA Loans | Conventional Loans |

| Minimum Down Payment | 3.5% with credit score ≥580 10% with credit score 500-579 |

3% for first-time buyers 5% for repeat buyers |

| Minimum Credit Score | 500 (with 10% down) 580 (with 3.5% down) |

620+ typically required |

| Debt-to-Income Ratio | Up to 43% (can go higher with compensating factors) | Up to 36% (can go to 45-50% with strong credit) |

| Mortgage Insurance | Upfront premium (1.75%) plus annual premium (0.15%-0.75%) Required for life of loan with |

No upfront premium Can be removed when equity reaches 20% |

| Property Requirements | Must meet FHA minimum property standards | Less stringent property requirements |

| Loan Limits | Lower than conventional in most areas | Higher limits, especially in high-cost areas |

FHA Loan Advantages

- Easier to qualify with lower credit scores

- Lower down payment requirements

- More flexible debt-to-income ratios

- Competitive interest rates

- May allow non-occupant co-borrowers

FHA Loan Disadvantages

- Mandatory mortgage insurance for most loans

- Insurance premiums increase overall cost

- Stricter property requirements

- Lower loan limits in some areas

- Cannot be used for investment properties

FHA loans help many families achieve homeownership with lower down payments

Compare Your Options

Not sure whether an FHA loan or conventional loan is right for you? Use our calculators to compare both options side by side.

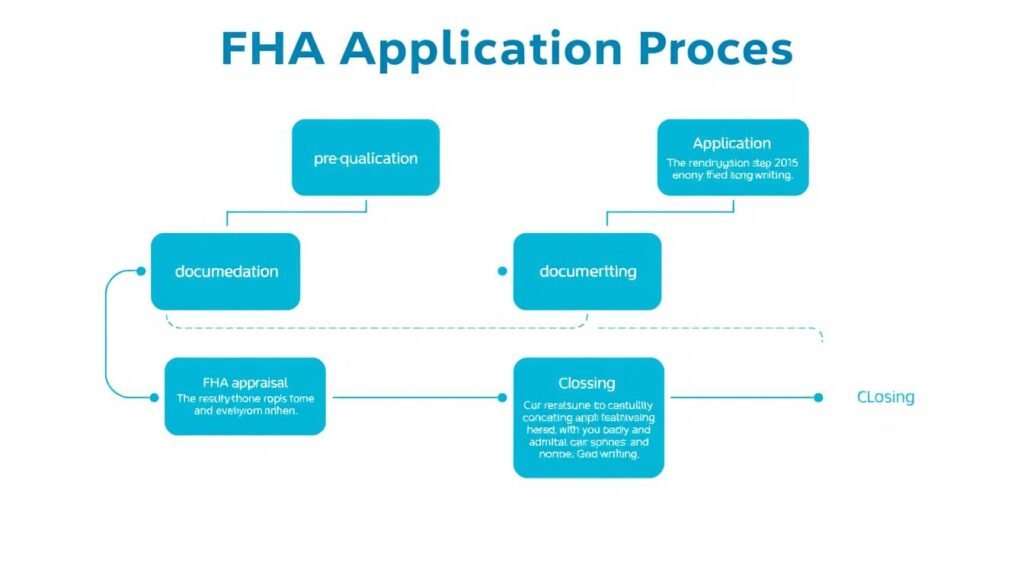

FHA Loan Requirements

To qualify for an FHA loan, you’ll need to meet several requirements established by the Federal Housing Administration:

Borrower Requirements

- Credit Score: Minimum 500 with 10% down payment, or 580+ with 3.5% down payment

- Debt-to-Income Ratio: Typically 43% or less, though exceptions can be made with compensating factors

- Employment: Steady employment history and income verification

- Residency: Must be a legal US resident with a valid Social Security Number

- Primary Residence: The property must be your primary residence (not an investment property)

Property Requirements

- Property Standards: Must meet FHA minimum property standards for safety, security, and soundness

- Appraisal: Required FHA appraisal to verify property value and condition

- Loan Limits: Must not exceed FHA loan limits for your area

- Property Types: Single-family homes, 2-4 unit properties, condos in FHA-approved projects, and manufactured homes on permanent foundations

The FHA loan application process

Compensating Factors

If your debt-to-income ratio exceeds 43%, lenders may still approve your FHA loan if you have compensating factors such as:

- Significant cash reserves (3+ months of mortgage payments)

- Minimal increase in housing payment from previous residence

- Excellent credit history or high credit score

- Low loan-to-value ratio (larger down payment)

- Additional income not counted in ratio calculation

Check If You Qualify

Want to know if you meet the requirements for an FHA loan? Use our calculator to get a preliminary assessment.

Tips for Using the FHA Loan Calculator

Get the most accurate results from our FHA Loan Calculator with these helpful tips:

Be Accurate with Your Inputs

The more accurate your input values, the more reliable your results will be. Research current interest rates, get property tax estimates for your area, and check homeowners insurance quotes before using the calculator.

Try Different Scenarios

Test various down payment amounts, home prices, and loan terms to see how they affect your monthly payment. This can help you find the sweet spot between affordability and getting the home you want.

Include All Costs

Don’t forget to include property taxes, homeowners insurance, and HOA fees if applicable. These can significantly impact your monthly payment and overall affordability.

Comparing different loan scenarios can help you find the most affordable option

Understanding the Results

After using the calculator, take time to understand what the results mean for your financial situation:

- Monthly Payment: Can you comfortably afford this amount each month?

- Total Interest: How much will you pay in interest over the life of the loan?

- Mortgage Insurance: How does the MIP affect your overall costs?

- Amortization Schedule: How quickly will you build equity in your home?

Pro Tip: Most financial experts recommend that your total housing costs (mortgage payment, taxes, insurance) should not exceed 28% of your gross monthly income. Use our calculator to see if your potential FHA loan payment falls within this guideline.

Frequently Asked Questions About FHA Loans

Can I remove the mortgage insurance premium on an FHA loan?

If your down payment is less than 10%, the annual mortgage insurance premium (MIP) will remain for the entire loan term. If your down payment is 10% or more, MIP can be removed after 11 years of payments. The only other way to remove MIP is to refinance into a conventional loan once you have at least 20% equity in your home.

What credit score do I need for an FHA loan?

The minimum credit score for an FHA loan is 500 with a 10% down payment, or 580 with a 3.5% down payment. However, many lenders set their own requirements and may require higher scores, typically 620 or above.

Can I use an FHA loan to buy any type of property?

FHA loans can be used to purchase single-family homes, 2-4 unit properties (as long as you live in one unit), condos in FHA-approved projects, and manufactured homes on permanent foundations. The property must be your primary residence, not an investment property or second home.

How much can I borrow with an FHA loan?

FHA loan limits vary by county and are based on local housing costs. In 2025, the FHA loan limit for low-cost areas is 6,200 for a single-family home, while high-cost areas have limits up to

Frequently Asked Questions About FHA Loans

Can I remove the mortgage insurance premium on an FHA loan?

If your down payment is less than 10%, the annual mortgage insurance premium (MIP) will remain for the entire loan term. If your down payment is 10% or more, MIP can be removed after 11 years of payments. The only other way to remove MIP is to refinance into a conventional loan once you have at least 20% equity in your home.

What credit score do I need for an FHA loan?

The minimum credit score for an FHA loan is 500 with a 10% down payment, or 580 with a 3.5% down payment. However, many lenders set their own requirements and may require higher scores, typically 620 or above.

Can I use an FHA loan to buy any type of property?

FHA loans can be used to purchase single-family homes, 2-4 unit properties (as long as you live in one unit), condos in FHA-approved projects, and manufactured homes on permanent foundations. The property must be your primary residence, not an investment property or second home.

How much can I borrow with an FHA loan?

FHA loan limits vary by county and are based on local housing costs. In 2025, the FHA loan limit for low-cost areas is $726,200 for a single-family home, while high-cost areas have limits up to $1,089,300. You can check the specific limits for your area on the HUD website.

Can I get an FHA loan after bankruptcy or foreclosure?

Yes, but you’ll need to wait a certain period. After Chapter 7 bankruptcy, the waiting period is generally 2 years from discharge (not filing). After foreclosure, the waiting period is typically 3 years. You’ll also need to demonstrate improved credit and financial responsibility during the waiting period.

Completing the FHA loan process with document signing at closing

,089,300. You can check the specific limits for your area on the HUD website.

Can I get an FHA loan after bankruptcy or foreclosure?

Yes, but you’ll need to wait a certain period. After Chapter 7 bankruptcy, the waiting period is generally 2 years from discharge (not filing). After foreclosure, the waiting period is typically 3 years. You’ll also need to demonstrate improved credit and financial responsibility during the waiting period.

Completing the FHA loan process with document signing at closing

Make Informed Decisions with Our FHA Loan Calculator

An FHA loan can be an excellent option for many homebuyers, especially those with lower credit scores or limited funds for a down payment. Our FHA Loan Calculator helps you understand exactly what to expect in terms of monthly payments, allowing you to make an informed decision about your mortgage options.

Remember that while FHA loans offer many advantages, they also come with specific requirements and costs, particularly mortgage insurance premiums. By using our calculator and understanding all aspects of FHA loans, you can determine if this type of mortgage is the right choice for your homebuying journey.

Ready to Calculate Your FHA Loan Payment?

Take the first step toward homeownership by understanding your potential monthly payments with an FHA loan.

Join thousands of homeowners who have achieved their dream of homeownership with FHA loans