Use our Finance Calculator to estimate loans, savings, investments, and more. Plan your finances effectively and make informed money decisions.

Making informed financial decisions requires accurate calculations and a clear understanding of how your money works. Our finance calculator suite helps you navigate complex financial scenarios with ease, whether you’re planning a loan, calculating investment returns, or mapping your retirement strategy. Discover how these powerful tools can transform your financial planning process and help you achieve your monetary goals with confidence.

Understanding Finance Calculators

Finance calculators help visualize complex financial scenarios

A finance calculator is a specialized tool designed to perform time value of money (TVM) calculations and other financial computations. Unlike basic calculators, finance calculators can handle complex variables such as interest rates, payment periods, present and future values, and more.

These calculators operate on fundamental financial principles that help you understand how money grows or diminishes over time. Whether you’re calculating loan payments, investment returns, or retirement savings, finance calculators provide the mathematical framework to make sound decisions.

Ready to Make Smarter Financial Decisions?

Our comprehensive finance calculator helps you analyze loans, investments, and savings with precision.

Key Components of Finance Calculations

Understanding the five core elements of financial calculations will help you use any finance calculator effectively:

Present Value (PV)

The current worth of a future sum of money given a specified rate of return. This is the amount you start with today.

Future Value (FV)

The value of an asset or cash at a specified date in the future, based on an assumed growth rate. This is what your money will grow to over time.

Interest Rate (I/Y)

The percentage charged on a loan or earned on an investment, usually expressed as an annual rate. This determines how quickly your money grows or your debt increases.

Number of Periods (N)

The total number of compounding periods, typically expressed in months or years. This is how long your money will be invested or borrowed.

Payment (PMT)

The regular payment made on a loan or investment. For loans, this is your monthly payment. For investments, this could be your regular contribution.

Finance Calculator Tool

Use our comprehensive finance calculator to solve for any of the five key financial variables. Simply input the values you know and select which variable you want to calculate.

Finance Calculator

| N (Number of Periods) | months | |

| I/Y (Interest Rate) | % per year | |

| PV (Present Value) | $ | |

| PMT (Payment) | $ per period | |

| FV (Future Value) | $ |

How to Use the Finance Calculator

- Enter the values for the variables you know

- Select which variable you want to calculate from the dropdown

- Click “Calculate Now” to see your results

- Review the amortization schedule if applicable

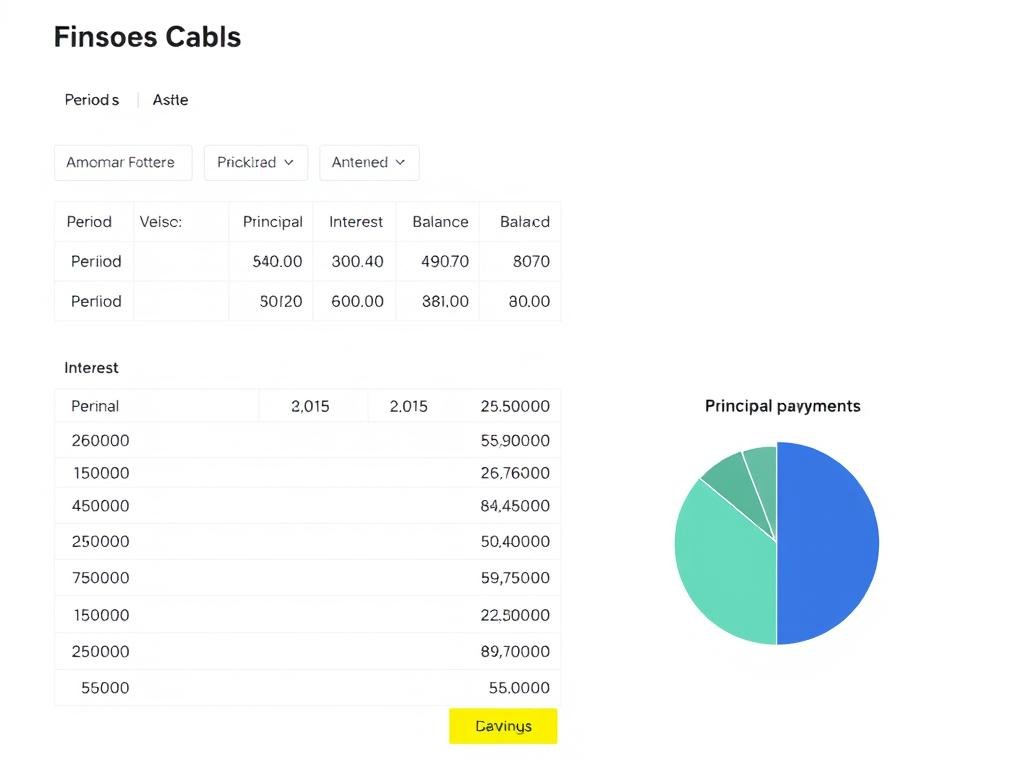

Sample calculator results with amortization schedule

Types of Finance Calculators

Different financial goals require specialized calculators. Here are the most common types of finance calculators and how they can help you make better financial decisions:

Loan Calculator

Calculate monthly payments, total interest, and amortization schedules for various loans including personal, auto, and student loans.

Mortgage Calculator

Determine affordable home prices, monthly mortgage payments, and see how extra payments can reduce your loan term.

Investment Calculator

Project investment growth, analyze returns, and compare different investment strategies based on risk and time horizon.

Retirement Calculator

Plan for retirement by calculating required savings, estimating future income needs, and optimizing withdrawal strategies.

Tax Calculator

Estimate tax liability, plan for tax season, and identify potential deductions and credits to minimize your tax burden.

Compound Interest Calculator

Visualize how your money grows over time through the power of compounding and see the impact of different interest rates.

Practical Applications of Finance Calculators

Making Informed Loan Decisions

Comparing loan options with a finance calculator helps identify the most cost-effective choice

Finance calculators are invaluable when comparing loan options. By inputting different interest rates, loan terms, and principal amounts, you can quickly see which loan offers the best value. This is particularly useful when deciding between loans with different structures, such as fixed vs. variable rates or different term lengths.

“Using a finance calculator before taking out my auto loan saved me over $2,000 in interest by helping me identify a better loan option with a shorter term.”

Planning for Major Purchases

Before making major purchases like homes or vehicles, finance calculators help you determine what you can realistically afford. By calculating monthly payments based on your budget constraints, you can set appropriate price ranges and avoid financial strain.

Benefits of Pre-Purchase Calculations

- Determine realistic budget constraints

- Avoid overextending financially

- Compare financing options objectively

- Plan for associated costs (taxes, insurance, etc.)

- Negotiate from a position of knowledge

Risks of Skipping Financial Analysis

- Committing to unaffordable payments

- Underestimating total cost of ownership

- Accepting unfavorable loan terms

- Missing opportunities for savings

- Experiencing financial stress

Optimizing Investment Strategies

Investment calculators help you project future values of different investment strategies. By comparing various scenarios with different contribution amounts, interest rates, and time horizons, you can develop an investment approach aligned with your financial goals.

| Investment Strategy | Initial Investment | Monthly Contribution | Annual Return | Value After 20 Years |

| Conservative | $10,000 | $200 | 4% | $118,382 |

| Moderate | $10,000 | $200 | 7% | $174,931 |

| Aggressive | $10,000 | $200 | 10% | $263,949 |

Ready to Optimize Your Investment Strategy?

Use our investment calculator to see how different approaches could affect your long-term financial growth.

Key Financial Concepts Explained

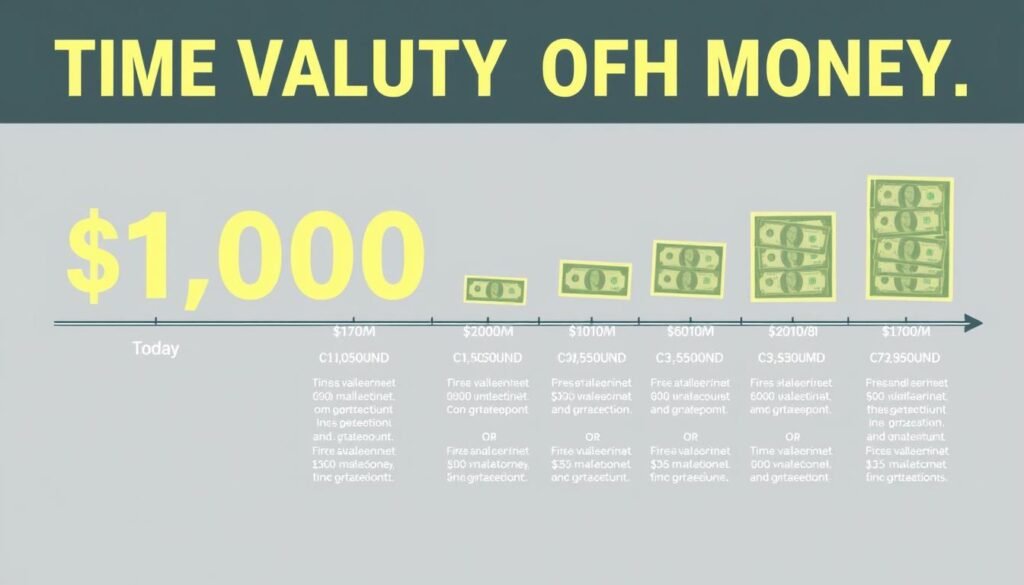

The Time Value of Money

The time value of money is a fundamental concept in finance that recognizes a dollar today is worth more than a dollar in the future. This concept forms the basis for most financial calculations, including interest payments, investment returns, and loan amortization.

The time value of money illustrated: $1,000 today vs. its future value

For example, if you invest $100 today at an annual interest rate of 5%, it will grow to $105 after one year. This future value calculation demonstrates why money available now is worth more than the same amount in the future—it can be invested to generate additional returns.

Compound Interest: The Eighth Wonder of the World

Albert Einstein reportedly called compound interest “the eighth wonder of the world.” Compound interest occurs when interest is added to the principal, so that from that moment on, the interest that has been added also earns interest.

Compound Interest Formula: A = P(1 + r/n)^(nt)

Where:

- A = Final amount

- P = Principal (initial investment)

- r = Annual interest rate (decimal)

- n = Number of times interest compounds per year

- t = Time in years

The power of compound interest becomes evident over longer time periods. For instance, $10,000 invested at 7% annual return will grow to approximately $19,672 after 10 years, $38,697 after 20 years, and $76,123 after 30 years.

Amortization: Breaking Down Your Payments

Amortization refers to the process of paying off debt through regular payments over time, where each payment is allocated between principal and interest. Initially, a larger portion of each payment goes toward interest, but as the principal decreases, more of each payment is applied to the principal.

Amortization schedule showing how payments shift from interest to principal over time

Understanding amortization helps borrowers see how much of their payment actually reduces their debt versus how much goes to interest. This knowledge can inform strategies like making extra principal payments to reduce the overall interest paid and shorten the loan term.

Financial Calculation Tips and Strategies

Getting the Most Accurate Results

Common Calculation Mistakes to Avoid

Watch out for these common errors when using finance calculators:

- Confusing APR and APY (Annual Percentage Rate vs. Annual Percentage Yield)

- Forgetting to include taxes and insurance in mortgage calculations

- Overlooking loan origination fees and closing costs

- Using nominal rather than effective interest rates

- Failing to account for variable interest rates over time

Making Better Financial Decisions

Finance calculators are tools to inform decisions, not make them for you. Consider these strategies for using calculation results effectively:

For Borrowing Decisions

- Calculate total interest over the loan term, not just monthly payments

- Compare loans with different terms to find the best overall value

- Determine how much extra payments could save in interest

- Assess the impact of refinancing existing loans

For Investment Decisions

- Project returns under different market scenarios (conservative, moderate, aggressive)

- Calculate the impact of increasing contribution amounts

- Determine how long it will take to reach specific financial goals

- Assess the trade-offs between risk and potential return

Using finance calculators to support thoughtful financial decision-making

Empowering Your Financial Journey with Calculators

Finance calculators transform complex financial concepts into practical, actionable information. By leveraging these powerful tools, you can make more informed decisions about loans, investments, retirement planning, and other financial matters. The ability to visualize different scenarios and understand the long-term implications of your choices puts you in control of your financial future.

Whether you’re a financial novice or an experienced investor, our suite of finance calculators provides the precision and insight you need to optimize your financial strategy. Start exploring our calculators today to take the guesswork out of your financial planning and build a more secure financial future.

Ready to Take Control of Your Financial Future?

Explore our complete suite of financial calculators to make smarter decisions about your money.

How accurate are online finance calculators?

Online finance calculators provide highly accurate results based on the information you input. However, they typically use fixed assumptions about interest rates and other variables that may fluctuate in real-world scenarios. For the most accurate results, use up-to-date information and consult with a financial professional for major decisions.

Can finance calculators replace financial advisors?

Finance calculators are excellent tools for initial planning and understanding financial concepts, but they can’t replace the personalized guidance of qualified financial advisors. Calculators don’t account for your complete financial situation, risk tolerance, or specific goals. They’re best used as complementary tools alongside professional advice for important financial decisions.

How often should I recalculate my financial projections?

It’s wise to recalculate your financial projections whenever significant changes occur in your financial situation or in economic conditions. This includes changes in income, major expenses, interest rates, or investment performance. As a general rule, reviewing your calculations at least annually helps ensure your financial strategy remains aligned with your goals.