Use our House Affordability Calculator to determine how much home you can afford. Plan your budget, mortgage, and expenses for a smart home purchase.

Buying a home is one of the biggest financial decisions you'll ever make. Before you start browsing listings or visiting open houses, it's crucial to understand exactly how much house you can afford. A house affordability calculator is your first step toward making an informed decision about your home purchase, helping you set realistic expectations and avoid financial strain.

What Is a House Affordability Calculator?

A house affordability calculator is a financial tool that helps potential homebuyers estimate how much house they can reasonably afford based on their income, expenses, savings, and other financial factors. Rather than guessing or relying on outdated rules of thumb, these calculators use established financial principles and lending criteria to provide a personalized estimate.

Using a house affordability calculator early in your home buying journey can save you time, prevent disappointment, and help you focus your search on properties within your financial reach. It also gives you insights into how different factors—like your down payment amount or monthly debt—affect your buying power.

Ready to Find Out How Much House You Can Afford?

Use our calculator to get a personalized estimate based on your unique financial situation.

Key Inputs for a House Affordability Calculator

To provide an accurate estimate, house affordability calculators require several pieces of financial information. The more details you provide, the more precise your estimate will be.

Income Information

- Gross monthly income (before taxes)

- Additional income sources (bonuses, investments)

- Stability and history of your income

- Combined household income (for joint purchases)

Debt and Expenses

- Monthly debt payments (credit cards, car loans)

- Student loan payments

- Other financial obligations

- Recurring monthly expenses

Down Payment Details

- Amount saved for down payment

- Down payment percentage of home value

- Source of down payment funds

- Additional savings for closing costs

Mortgage Factors

- Current mortgage interest rates

- Loan term (typically 15 or 30 years)

- Type of mortgage (conventional, FHA, VA)

- Your credit score range

How House Affordability Calculators Work

House affordability calculators use specific financial ratios and formulas that lenders rely on to determine how much they're willing to lend. Understanding these calculations helps you make sense of your results.

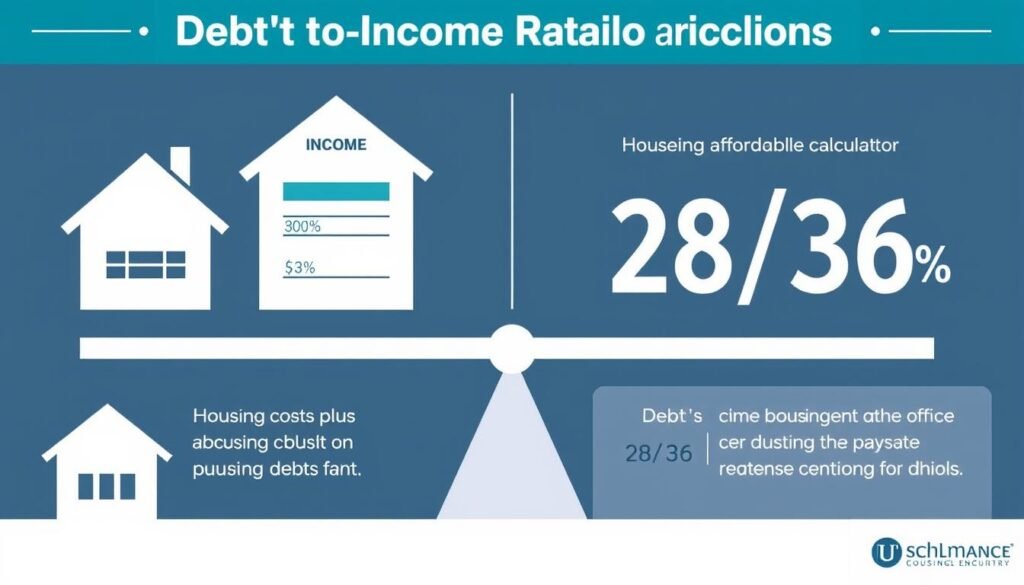

The 28/36 Rule: The Foundation of Affordability

Most house affordability calculators use the 28/36 rule as their baseline. This widely accepted guideline states that:

Front-End Ratio (28%)

Your monthly housing costs (mortgage payment, property taxes, insurance, and HOA fees) should not exceed 28% of your gross monthly income.

Example: If your monthly income is $6,000, your housing costs should not exceed $1,680 ($6,000 × 0.28 = $1,680).

Back-End Ratio (36%)

Your total monthly debt payments (housing costs plus other debts like car loans, student loans, and credit cards) should not exceed 36% of your gross monthly income.

Example: If your monthly income is $6,000, your total debt payments should not exceed $2,160 ($6,000 × 0.36 = $2,160).

Debt-to-Income (DTI) Ratio Calculation

The debt-to-income ratio is a key metric that lenders use to assess your ability to manage monthly payments and repay debts:

| Ratio Type | Formula | Target Percentage |

| Front-End DTI | Monthly Housing Costs ÷ Monthly Gross Income × 100% | ≤ 28% |

| Back-End DTI | (Monthly Housing Costs + Other Monthly Debt) ÷ Monthly Gross Income × 100% | ≤ 36% |

Maximum Loan Amount Calculation

Once the calculator determines your maximum monthly payment based on DTI ratios, it works backward to calculate the maximum loan amount:

- Calculate maximum monthly payment based on income and existing debt

- Subtract estimated property taxes, insurance, and HOA fees

- Determine remaining amount available for principal and interest

- Calculate maximum loan amount based on interest rate and loan term

- Add your down payment to determine maximum house price

Types of House Affordability Calculators

Not all house affordability calculators are created equal. Different calculators may be designed for specific purposes or lending criteria.

Bank-Specific Calculators

- Tailored to specific bank's lending criteria

- May pre-populate current interest rates

- Often connected to pre-approval process

- May consider existing relationship with bank

- Usually includes bank's mortgage products

General Calculators

- Based on industry-standard calculations

- More flexibility in inputs and scenarios

- Not tied to specific lending products

- Good for initial research and comparison

- Often found on real estate and financial websites

Specialized Calculators

- Designed for specific loan types (FHA, VA, etc.)

- Includes program-specific requirements

- May factor in special eligibility criteria

- Often includes specialized fees and insurance

- Helpful for those qualifying for specific programs

Compare Your Options

Try our calculator to see how different loan types affect your affordability.

Limitations and Considerations

While house affordability calculators provide valuable guidance, they have limitations you should be aware of before making decisions based solely on their results.

What Calculators Do Well

- Provide a starting point for your home search

- Apply standard lending criteria consistently

- Help you understand how different factors affect affordability

- Allow you to compare different scenarios quickly

- Give you a general price range to consider

What Calculators Miss

- Your personal comfort level with debt

- Future changes in income or expenses

- Maintenance and renovation costs

- Lifestyle preferences and priorities

- Local market conditions and property value trends

"The calculator tells you what you could borrow, not what you should borrow. Always consider your complete financial picture and future goals when determining your ideal price range."

Important: House affordability calculators provide estimates based on the information you provide. Actual loan approval will depend on a comprehensive review of your financial situation by a lender, including a credit check and verification of all information.

Step-by-Step Guide to Using a House Affordability Calculator

Follow these steps to get the most accurate and useful results from a house affordability calculator.

-

Gather Your Financial Information

Collect recent pay stubs, bank statements, and information about your debts and expenses. Having accurate information ready will ensure more precise results.

-

Enter Your Income Details

Input your gross monthly income (before taxes). If you're buying with someone else, include their income as well. Some calculators may ask for additional income sources like bonuses or investment income.

-

Add Your Monthly Debts

Enter all recurring monthly debt payments, including student loans, car payments, credit card minimums, and other financial obligations. Be thorough and honest for accurate results.

-

Specify Your Down Payment

Enter the amount you've saved for a down payment. This will affect your loan amount, potential need for mortgage insurance, and overall affordability.

-

Input Mortgage Details

Enter the current mortgage interest rate, loan term (typically 15 or 30 years), and the type of loan you're considering (conventional, FHA, VA, etc.).

-

Review and Adjust Results

Examine the calculator's estimate and adjust inputs to see how changes affect your affordability. Try different scenarios to understand your options better.

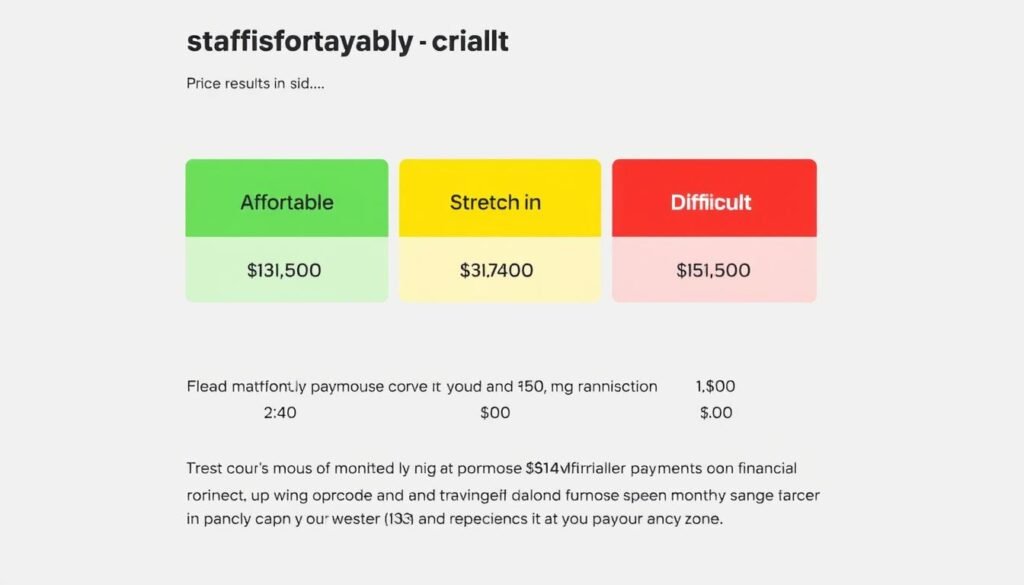

Interpreting Your House Affordability Calculator Results

Understanding what the numbers mean is just as important as getting the calculation. Here's how to interpret your results effectively.

Understanding the Price Range

Most calculators provide a maximum home price you can afford, but this should be viewed as a ceiling, not a target. Consider these categories:

Homes in this range leave room in your budget for other financial goals and unexpected expenses. This is typically 10-20% below your maximum.

Homes near your calculated maximum are technically affordable but may limit financial flexibility. You'll need disciplined budgeting.

Exceeding your calculated maximum puts you at risk of becoming "house poor" with little money left for other expenses or savings.

Monthly Payment Breakdown

Pay attention to the monthly payment breakdown, which typically includes:

| Payment Component | Description | Typical Range |

| Principal & Interest | Loan repayment amount | 60-70% of total payment |

| Property Taxes | Annual taxes divided by 12 | 15-20% of total payment |

| Homeowners Insurance | Annual premium divided by 12 | 5-10% of total payment |

| PMI/Mortgage Insurance | Required if down payment | 0.5-1% of loan annually |

| HOA Fees | If applicable | Varies widely |

Ready to Take the Next Step?

Get pre-approved for a mortgage to confirm your affordability estimate and strengthen your offer when you find the right home.

Tips for Improving Your Home Affordability

If your house affordability calculator results don't match your homeownership goals, there are several strategies you can use to improve your buying power.

Short-Term Strategies

- Increase your down payment - Saving more for your down payment can reduce your loan amount and possibly eliminate the need for mortgage insurance.

- Reduce existing debt - Paying down credit cards and other loans improves your debt-to-income ratio, potentially increasing your borrowing capacity.

- Improve your credit score - A better credit score can help you qualify for lower interest rates, which increases your affordability.

- Consider a co-borrower - Adding a financially stable co-borrower can increase your income and improve your debt-to-income ratio.

Long-Term Strategies

- Increase your income - A higher income directly improves your debt-to-income ratio and borrowing capacity.

- Explore different loan programs - FHA, VA, or USDA loans may offer more favorable terms for qualifying buyers.

- Consider different locations - Property taxes and home prices vary significantly by location, affecting affordability.

- Look into first-time homebuyer programs - Many states and local governments offer assistance programs that can improve affordability.

Pro Tip: Run your house affordability calculator multiple times with different inputs to see which factors have the biggest impact on your results. This can help you focus your efforts on the changes that will give you the most significant improvements.

Manual Calculation vs. Digital House Affordability Calculators

While online calculators make the process easy, understanding how to calculate affordability manually can give you deeper insights into the factors affecting your home buying power.

Manual Calculation

Steps:

- Calculate 28% of your gross monthly income for housing costs

- Calculate 36% of your gross monthly income for total debt

- Subtract existing debt payments from the 36% figure

- Use the lower of these two figures as your maximum monthly housing payment

- Subtract estimated taxes, insurance, and HOA fees

- Use a mortgage formula to calculate loan amount based on remaining payment amount

Advantages

- Better understanding of the process

- Customizable to your situation

- No reliance on potentially biased tools

Disadvantages

- Time-consuming and complex

- Potential for calculation errors

- Difficult to compare multiple scenarios

Digital Calculators

Features:

- Instant calculations with multiple variables

- Built-in formulas for different loan types

- Automatic consideration of current interest rates

- Visual results and breakdowns

- Scenario comparison capabilities

- Mobile accessibility

Advantages

- Quick and convenient

- Reduces calculation errors

- Easy to test different scenarios

- Often includes additional insights

Disadvantages

- May use simplified assumptions

- Could be biased toward specific products

- Limited customization options

- May not account for unique situations

Future Trends in House Affordability Calculation

As technology evolves, house affordability calculators are becoming more sophisticated and personalized. Here's what to expect in the future.

AI-Powered Analysis

Future calculators will use artificial intelligence to analyze your complete financial picture, including spending patterns, career trajectory, and market trends to provide more personalized affordability estimates.

Real-Time Market Integration

Expect calculators to incorporate real-time housing market data, showing you actual available properties in your price range and predicting how market changes might affect your affordability.

Holistic Financial Planning

Tomorrow's calculators will consider your complete financial goals—retirement, education, lifestyle—to recommend a home price that balances homeownership with your other priorities.

Making Informed Decisions with House Affordability Calculators

A house affordability calculator is a powerful tool that can guide your home buying journey, but it's most effective when used as part of a comprehensive approach to homeownership.

Remember that affordability isn't just about what a lender will approve—it's about finding a home that fits your budget without compromising your financial well-being and other life goals. Use the calculator as a starting point, then consider your personal comfort level with debt, future plans, and the total cost of homeownership.

By combining the insights from a house affordability calculator with professional advice and your own financial priorities, you'll be well-equipped to make one of the most significant financial decisions of your life with confidence.

Ready to Start Your Home Buying Journey?

Connect with a mortgage specialist who can help you understand your options and guide you through the pre-approval process.

How accurate are house affordability calculators?

House affordability calculators provide estimates based on standard lending criteria and the information you provide. Their accuracy depends on the quality of your inputs and how closely the calculator's assumptions match your lender's actual criteria. They're best used as a starting point, with final affordability confirmed through pre-approval with a lender.

Should I always borrow the maximum amount I qualify for?

Not necessarily. The maximum amount you qualify for represents what lenders are willing to lend based on their risk assessment, not what might be comfortable for your lifestyle and other financial goals. Many financial advisors recommend borrowing less than your maximum to maintain financial flexibility and reduce stress.

How do different loan types affect my affordability?

Different loan types (conventional, FHA, VA, USDA) have varying requirements for down payments, credit scores, and debt-to-income ratios. For example, FHA loans might allow higher DTI ratios than conventional loans, potentially increasing your affordability. However, they also require mortgage insurance, which affects your monthly payment.