Use our Interest Calculator to quickly estimate interest earned or owed on loans and savings. Plan finances and make informed decisions with accurate calculations.

An interest calculator is a powerful financial tool that helps you determine how your money grows over time or how much you’ll pay on loans. Whether you’re planning for retirement, saving for a major purchase, or managing debt, understanding interest calculations is essential for making informed financial decisions. This comprehensive guide will walk you through everything you need to know about interest calculators and provide you with a functional tool to perform your own calculations.

Interest Calculator Tool

Use our calculator below to quickly determine how your money will grow or how much interest you’ll pay. Simply enter your values and select the calculation type to get started.

Understanding Interest Calculations

Interest is the cost of borrowing money or the reward for saving it. It’s typically expressed as a percentage of the principal amount (the initial sum of money) over a specific period. Understanding the different types of interest is crucial for making informed financial decisions.

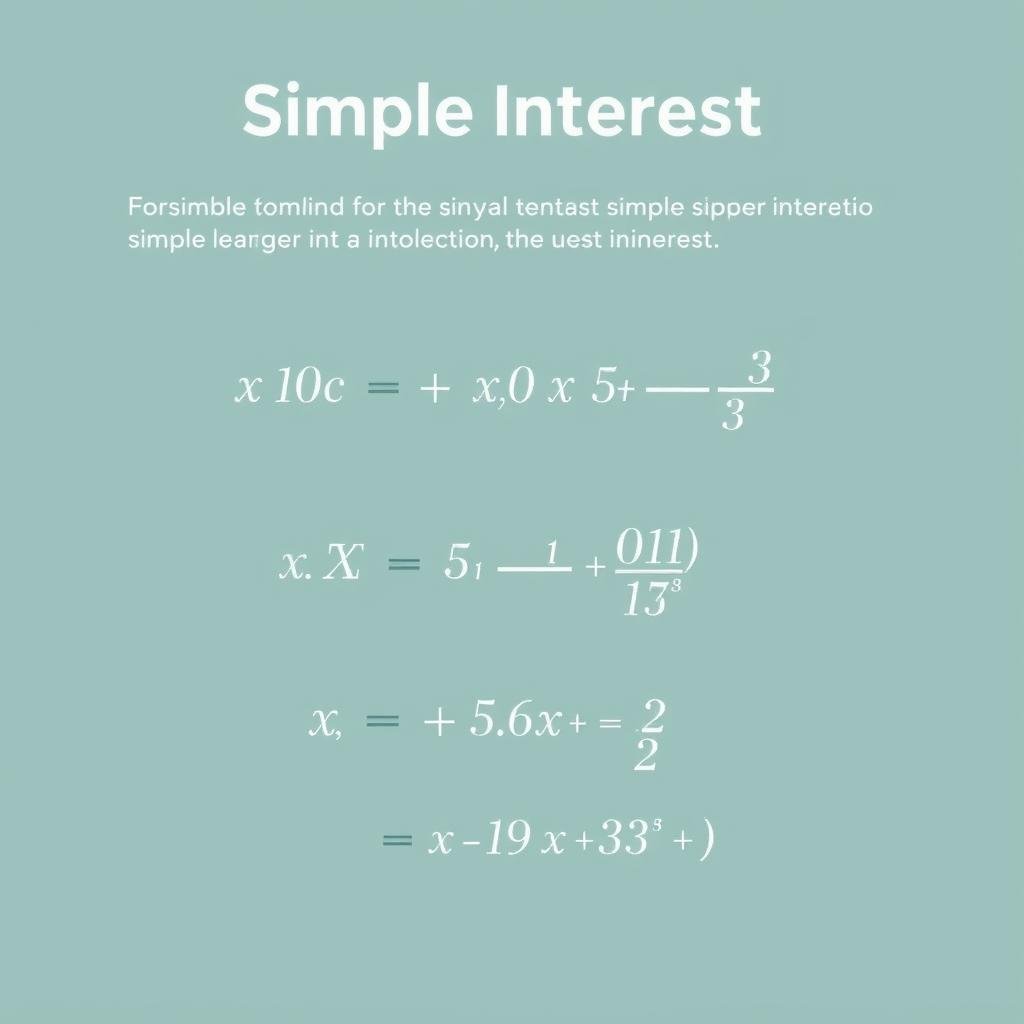

Simple Interest

Simple interest is calculated only on the initial principal amount. The formula for simple interest is:

Interest = Principal × Rate × Time

Where rate is expressed as a decimal (e.g., 5% = 0.05) and time is in years.

Example of Simple Interest

If you deposit $1,000 in a savings account with a 5% annual simple interest rate for 3 years:

Interest = $1,000 × 0.05 × 3 = $150

After 3 years, your account would have $1,150 ($1,000 principal + $150 interest).

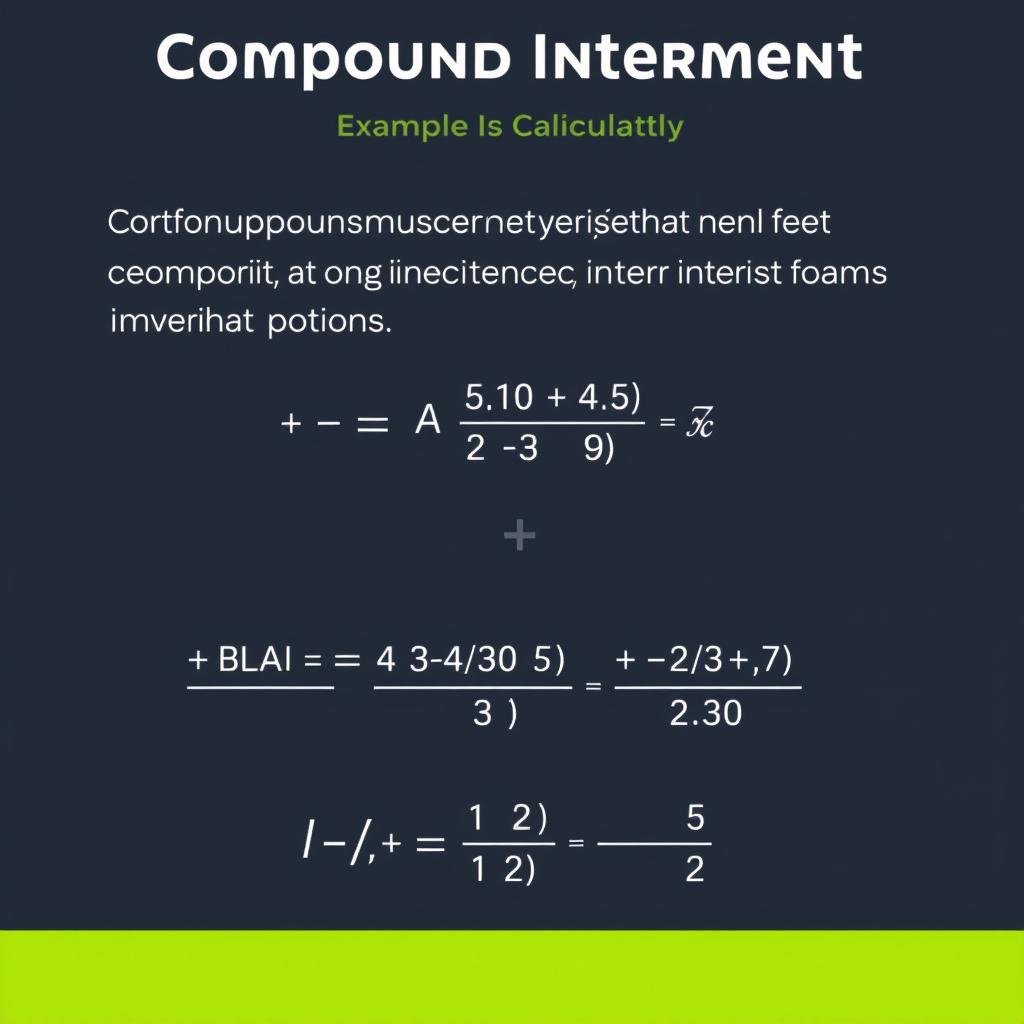

Compound Interest

Compound interest is calculated on both the initial principal and the accumulated interest from previous periods. The formula for compound interest is:

A = P(1 + r/n)^(nt)

Where A is the final amount, P is the principal, r is the annual interest rate (as a decimal), n is the number of times interest is compounded per year, and t is the time in years.

Example of Compound Interest

If you deposit $1,000 in a savings account with a 5% annual interest rate compounded monthly for 3 years:

A = $1,000(1 + 0.05/12)^(12×3) = $1,161.47

After 3 years, your account would have $1,161.47 ($1,000 principal + $161.47 interest).

Key Components of Interest Calculation

Understanding the key components that affect interest calculations will help you make better financial decisions. Here are the main factors that influence how interest is calculated:

Principal Amount

The principal is the initial sum of money that you either borrow or deposit. It’s the base amount upon which interest is calculated. A larger principal generally results in more interest earned or paid.

Interest Rate

The interest rate is the percentage charged or earned on the principal amount. It’s usually expressed as an annual percentage rate (APR). Higher interest rates lead to more interest earned on savings or more interest paid on loans.

Time Period

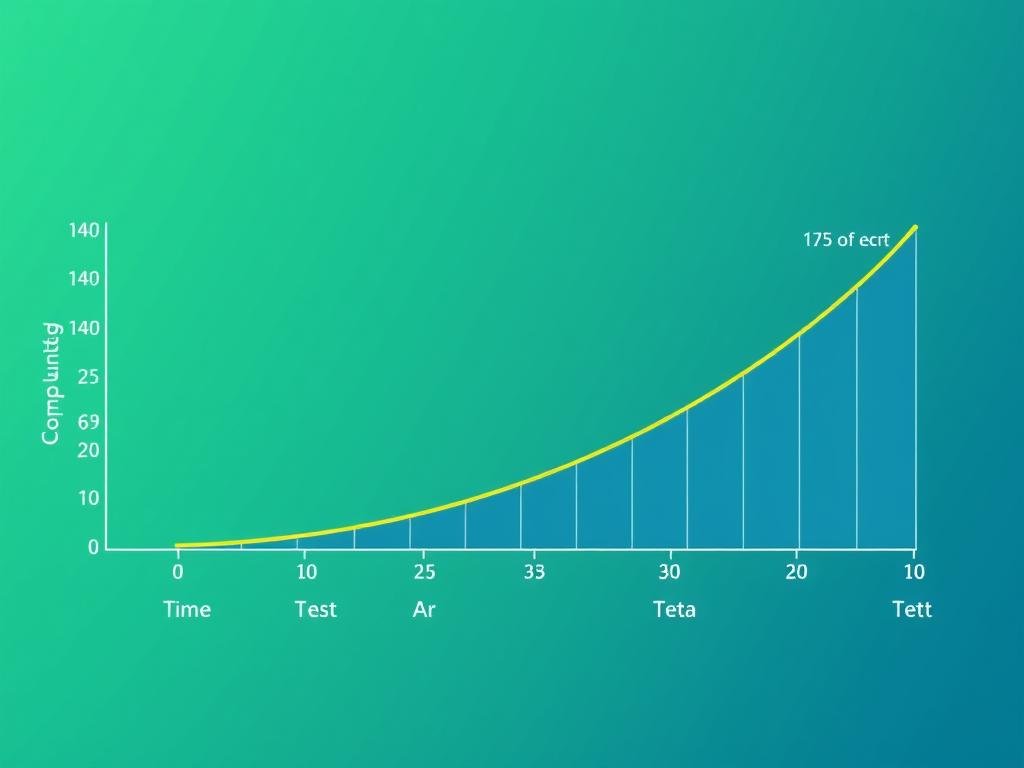

The time period is the duration for which the interest is calculated. Longer time periods generally result in more interest earned or paid, especially with compound interest where the effect compounds over time.

Compounding Frequency

The compounding frequency refers to how often interest is calculated and added to the principal. Common compounding periods include daily, monthly, quarterly, semi-annually, and annually. More frequent compounding results in more interest earned or paid over time.

| Compounding Frequency | Times Per Year (n) | Effect on Interest |

| Daily | 365 | Highest interest accumulation |

| Monthly | 12 | Common for savings accounts and loans |

| Quarterly | 4 | Common for some investments |

| Semi-annually | 2 | Common for bonds |

| Annually | 1 | Lowest interest accumulation |

Common Applications of Interest Calculators

Interest calculators are versatile tools that can be applied to various financial scenarios. Understanding how to use them in different contexts can help you make better financial decisions.

Savings Accounts

Interest calculators help you determine how much your savings will grow over time. By inputting your initial deposit, interest rate, and time period, you can see the future value of your savings and make informed decisions about where to keep your money.

For example, comparing a regular savings account at 0.5% interest with a high-yield savings account at 2% interest can show you the significant difference in growth over several years.

Loans and Mortgages

When taking out a loan or mortgage, an interest calculator can help you understand the total cost of borrowing. By calculating the interest paid over the loan term, you can compare different loan offers, determine the impact of making extra payments, and plan your budget accordingly.

For instance, you can see how much interest you would save by making bi-weekly instead of monthly mortgage payments.

Investments

Interest calculators are invaluable for investment planning. They help you project the growth of your investments over time, compare different investment options, and set realistic financial goals.

For example, you can calculate how much you need to invest monthly to reach a specific financial goal, such as saving for retirement or a child’s education.

Ready to Calculate Your Interest?

Use our interactive calculator above to determine how your money can grow or how much interest you’ll pay on loans. Make informed financial decisions today!

Benefits of Using Online Interest Calculators

Online interest calculators offer several advantages over manual calculations. Here’s why you should consider using them for your financial planning:

Advantages of Online Calculators

- Speed and efficiency – get results instantly without complex manual calculations

- Accuracy – eliminate human error in complex mathematical formulas

- Scenario comparison – easily compare different interest rates, time periods, or principal amounts

- Visual representation – many online calculators provide charts and graphs for better understanding

- Accessibility – use them anytime, anywhere with an internet connection

- Additional features – many calculators include extra tools like amortization schedules or inflation adjustments

Limitations of Manual Calculations

- Time-consuming – complex formulas take time to calculate by hand

- Error-prone – easy to make mistakes with decimal places or formula application

- Limited scenarios – difficult to quickly compare multiple scenarios

- No visual aids – harder to visualize growth or trends without graphical representation

- Formula knowledge required – need to understand and remember complex mathematical formulas

- Difficult compounding – calculating frequent compounding periods becomes extremely complex

Tips for Choosing the Right Interest Calculator

Not all interest calculators are created equal. Here are some factors to consider when selecting an interest calculator for your financial planning needs:

Calculation Types

Choose a calculator that offers both simple and compound interest calculations. Some advanced calculators also include options for different compounding frequencies, additional contributions, and inflation adjustments.

User Interface

Look for a calculator with a clean, intuitive interface that’s easy to use. Clear input fields, helpful tooltips, and straightforward results make the calculation process more efficient and less prone to errors.

Visual Representations

Calculators that provide visual representations of your results, such as graphs or charts, can help you better understand the impact of different variables on your financial outcomes.

Additional Features

Consider calculators that offer additional features like amortization schedules, tax considerations, or the ability to save and compare multiple scenarios. These features can provide a more comprehensive view of your financial situation.

Mobile Compatibility

If you plan to use the calculator on different devices, choose one that’s mobile-friendly and works well on various screen sizes. This ensures you can access the tool whenever and wherever you need it.

Reliability and Accuracy

Use calculators from reputable financial websites or institutions to ensure accuracy. Look for calculators that clearly explain their methodology and assumptions to understand how the results are derived.

Interpreting Results from an Interest Calculator

Understanding how to interpret the results from an interest calculator is crucial for making informed financial decisions. Here’s how to make sense of the numbers and apply them to your financial planning:

Understanding the Total Amount

The total amount shown in the calculator results includes both your principal (initial investment) and the interest earned. When evaluating savings or investments, focus on how this total amount aligns with your financial goals.

For loans, the total amount represents what you’ll pay back over the loan term, including both the principal and interest. This helps you understand the true cost of borrowing.

Analyzing Interest Earned or Paid

The interest portion of the results shows how much your money grows over time (for savings) or how much you pay for borrowing (for loans). Compare this amount across different scenarios to find the most favorable terms.

For investments, a higher interest amount indicates better returns. For loans, a lower interest amount means less cost for borrowing.

Comparing Different Scenarios

Use the calculator to run multiple scenarios with different variables. Compare how changes in interest rate, time period, or principal amount affect the final results. This helps you identify the most advantageous financial strategies.

For example, see how increasing your monthly contribution to a savings account can significantly impact your long-term growth, or how a slightly lower interest rate on a mortgage can save thousands over the loan term.

Considering Time Value of Money

Remember that the results from an interest calculator demonstrate the time value of money—the concept that money available today is worth more than the same amount in the future due to its earning potential.

This principle underscores the importance of starting to save or invest early, as time allows your money to grow through compounding interest.

Make Better Financial Decisions Today

Use our interest calculator to explore different financial scenarios and see how your money can grow over time. Take control of your financial future!

Conclusion: Leveraging Interest Calculators for Financial Success

Interest calculators are powerful tools that can help you make informed financial decisions by providing clear insights into how your money grows or how much you’ll pay in interest over time. By understanding the different types of interest calculations, the key components that affect interest, and how to interpret the results, you can use these calculators to optimize your financial strategy.

Whether you’re saving for retirement, planning a major purchase, or managing debt, an interest calculator can help you visualize the impact of different scenarios and make choices that align with your financial goals. Take advantage of the calculator provided in this guide to explore your options and take control of your financial future.