Use our IRR Calculator to estimate the internal rate of return on your investments. Analyze cash flows, plan projects, and make informed financial decisions.

The Internal Rate of Return (IRR) is a crucial financial metric that helps investors and businesses evaluate the profitability of potential investments. Our IRR calculator simplifies this complex calculation, allowing you to make data-driven decisions about your investments with confidence. Whether you're comparing multiple projects, analyzing real estate opportunities, or evaluating business expansions, understanding and calculating IRR correctly is essential for maximizing your returns.

IRR Calculator

Enter your initial investment and expected cash flows to calculate the Internal Rate of Return (IRR) of your project or investment.

Our IRR Calculator provides instant results based on your investment data

What is Internal Rate of Return (IRR)?

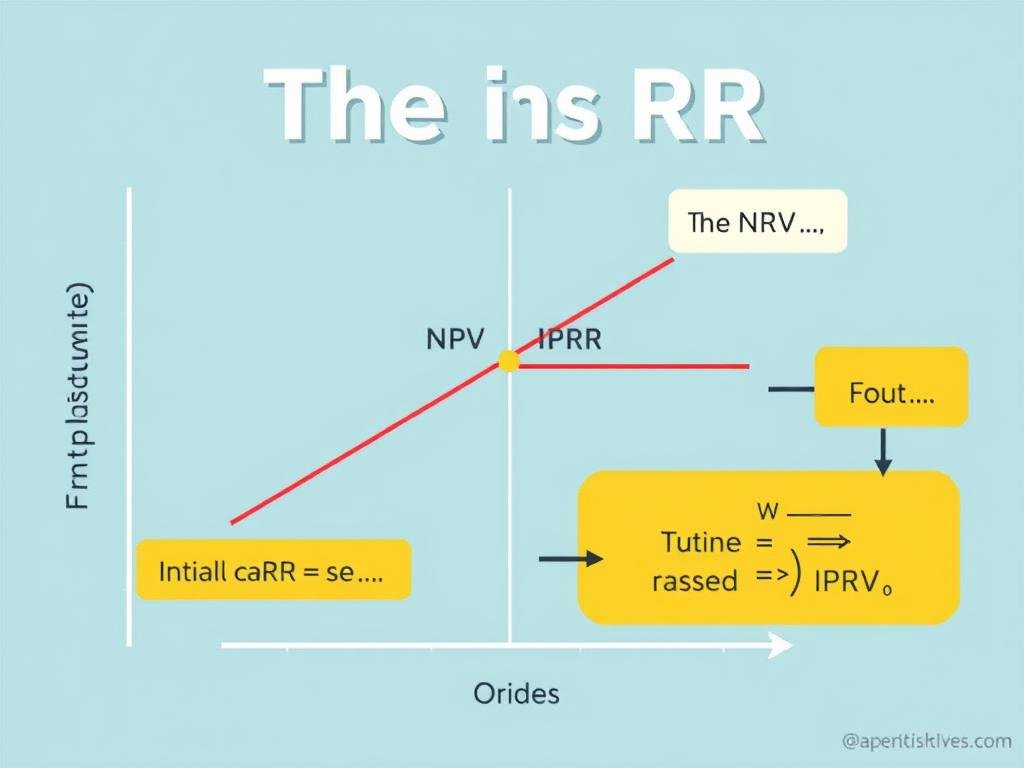

The Internal Rate of Return (IRR) is the discount rate that makes the net present value (NPV) of all cash flows from a particular project or investment equal to zero. In simpler terms, it's the rate of return that an investment is expected to generate annually over its lifetime.

IRR serves as a standardized way to measure the profitability of investments, allowing you to compare projects of different sizes, durations, and cash flow patterns. When the IRR exceeds your required rate of return (also known as the hurdle rate or cost of capital), the investment is generally considered worthwhile.

IRR is the discount rate at which the NPV of future cash flows equals the initial investment

The Importance of IRR in Financial Decision Making

IRR provides several key benefits for financial analysis:

IRR Formula and Calculation Method

The IRR formula is derived from the net present value (NPV) equation, where we set the NPV to zero and solve for the discount rate. The mathematical representation is:

0 = CF₀ + CF₁/(1+IRR)¹ + CF₂/(1+IRR)² + ... + CFₙ/(1+IRR)ⁿ

Where:

- CF₀ = Initial investment (usually negative)

- CF₁, CF₂, ..., CFₙ = Cash flows in periods 1, 2, ..., n

- IRR = Internal rate of return

- n = Total number of periods

Unlike simpler calculations, IRR cannot be solved directly through algebraic manipulation. It requires an iterative process or specialized tools like our calculator to find the rate that makes the equation equal to zero.

The iterative process of finding IRR by testing different discount rates

Using Our IRR Calculator

Our calculator simplifies this complex process into three easy steps:

Ready to Calculate Your IRR?

No more complex formulas or iterative calculations. Get your IRR instantly with our easy-to-use calculator.

Practical IRR Calculation Examples

Example 1: Business Equipment Investment

A manufacturing company is considering purchasing new equipment for $100,000. The equipment is expected to generate the following cash flows:

| Year | Cash Flow |

| 0 (Initial Investment) | -$100,000 |

| 1 | $30,000 |

| 2 | $40,000 |

| 3 | $35,000 |

| 4 | $20,000 |

Using our IRR calculator with these values gives an IRR of 12.6%. If the company's hurdle rate is 10%, this investment would be considered financially viable.

Business equipment investment example with 12.6% IRR

Example 2: Real Estate Investment

An investor is evaluating a rental property with a purchase price of $250,000. After accounting for all expenses and rental income, the projected cash flows are:

| Year | Cash Flow |

| 0 (Purchase) | -$250,000 |

| 1 | $15,000 |

| 2 | $16,500 |

| 3 | $18,000 |

| 4 | $19,500 |

| 5 | $21,000 |

| 5 (Property Sale) | $290,000 |

The IRR for this real estate investment is 9.8%. If the investor's minimum acceptable return is 8%, this property would be a viable investment option.

Calculate Your Own Investment Scenario

Have your own investment scenario? Try our calculator to find out if it meets your return requirements.

IRR vs. Other Financial Metrics

While IRR is a powerful tool for investment analysis, it's important to understand how it compares to other financial metrics and when each should be used.

IRR vs. NPV (Net Present Value)

NPV calculates the present value of all future cash flows minus the initial investment, giving you a dollar value. IRR gives you a percentage return rate. While related, they can sometimes lead to different conclusions when comparing mutually exclusive projects.

When to Use IRR

- When you need a simple percentage to compare against hurdle rates

- When comparing similar projects with similar risk profiles

- When explaining investment returns to stakeholders

When to Use NPV

- When absolute dollar value is more important than percentage return

- When comparing projects of vastly different sizes

- When reinvestment assumptions differ from the IRR

IRR vs. ROI (Return on Investment)

ROI is a simpler metric that divides the net profit by the cost of investment. Unlike IRR, it doesn't account for the time value of money or the timing of cash flows.

Comparison of key financial metrics for investment analysis

IRR vs. Payback Period

The payback period simply measures how long it takes to recover the initial investment. It's easy to calculate but ignores cash flows after the payback period and doesn't consider the time value of money.

"While IRR is valuable, the most comprehensive investment analysis will consider multiple metrics together, including IRR, NPV, payback period, and risk factors."

Limitations and Considerations When Using IRR

Key limitations to consider when using IRR for investment decisions

Reinvestment Assumption

IRR assumes that all positive cash flows are reinvested at the same IRR rate, which may not be realistic. In practice, interim cash flows might be reinvested at different rates based on market conditions and available opportunities.

Multiple IRR Problem

For non-conventional cash flows (where negative cash flows occur after positive ones), multiple IRR values can exist mathematically. This creates ambiguity in interpretation and can lead to incorrect decisions.

Scale of Projects

IRR doesn't account for the absolute size of investments. A small project with a high IRR might be less profitable in absolute terms than a larger project with a lower IRR.

Modified Internal Rate of Return (MIRR)

To address some of IRR's limitations, especially the reinvestment assumption, the Modified Internal Rate of Return (MIRR) was developed. MIRR assumes that positive cash flows are reinvested at the firm's cost of capital rather than at the IRR itself.

Need a More Comprehensive Analysis?

Try our MIRR Calculator for a more realistic assessment of your investment's potential return.

When to Use IRR in Financial Decision Making

Capital Budgeting

IRR is particularly useful for businesses evaluating capital expenditures like new equipment, facilities, or expansion projects. It helps prioritize projects when capital is limited.

Real Estate Investments

Property investors use IRR to compare different real estate opportunities, accounting for rental income, property appreciation, and eventual sale proceeds.

Private Equity & Venture Capital

IRR is the standard metric in private equity and venture capital for evaluating investment performance and reporting returns to limited partners.

Best Practices for Using IRR Effectively

Pro Tip: When comparing projects with different durations, consider using the equivalent annual annuity approach alongside IRR to make fair comparisons.

Frequently Asked Questions About IRR

What is a good IRR for an investment?

What constitutes a "good" IRR depends on your industry, risk tolerance, and alternative investment opportunities. Generally, an IRR should exceed your hurdle rate or cost of capital to be considered attractive. For low-risk investments, an IRR of 10-15% might be excellent, while higher-risk ventures might require 20-30% or more to compensate for the additional risk.

Can IRR be negative?

Yes, IRR can be negative, indicating that the investment is expected to lose money. A negative IRR means that the present value of the future cash flows is less than the initial investment, even when discounted at negative rates.

How is IRR different from the discount rate?

The discount rate is an input you choose based on your required return, cost of capital, or opportunity cost. IRR is a calculated output that tells you what discount rate would make the NPV equal to zero. When evaluating investments, you typically compare the calculated IRR to your required discount rate.

How do I handle irregular cash flows when calculating IRR?

Our IRR calculator can handle irregular cash flows without any special adjustments. Simply enter each period's cash flow as it occurs. For periods with no cash flow, enter zero. The calculator will properly account for the timing of each cash flow in the IRR calculation.

Should I use IRR or NPV for making investment decisions?

Ideally, you should use both. NPV tells you how much value an investment adds in absolute dollar terms, while IRR tells you the percentage return. They complement each other and provide different perspectives. In cases where they lead to different conclusions (which can happen with mutually exclusive projects), NPV is generally considered the more reliable metric.

Have More Questions?

Our comprehensive financial calculators can help you answer more complex investment questions.

Making Better Investment Decisions with IRR

The Internal Rate of Return is a powerful metric that helps investors and businesses evaluate and compare investment opportunities. By accounting for the time value of money and providing a standardized percentage return, IRR simplifies complex financial decisions.

However, as we've explored, IRR has limitations that make it most effective when used alongside other financial metrics like NPV, ROI, and payback period. By understanding when and how to apply IRR appropriately, you can make more informed investment decisions that align with your financial goals.

Our IRR calculator makes this complex calculation simple and accessible, allowing you to quickly analyze different investment scenarios without the need for complex spreadsheets or financial software.

Start Calculating Your IRR Today

Make better investment decisions with accurate IRR calculations at your fingertips.