Use our Margin Calculator to quickly determine profit margins on products or services. Plan pricing strategies and boost your business profitability.

Need to find out your profit margin or determine the right selling price for your products? Our margin calculator helps you instantly calculate the relationship between cost, revenue, and profit. Whether you’re a business owner setting prices, a student learning financial concepts, or a financial professional analyzing profitability, this tool simplifies margin calculations while providing the formulas and knowledge you need to make informed decisions.

Margin Calculator Tool

Use our free margin calculator to determine profit margin, selling price, or cost price. Enter any two values to calculate the third.

Our margin calculator helps you instantly determine profit margins, selling prices, or costs

What is Margin?

Margin represents the percentage of your selling price that is profit. It’s a key financial metric that helps businesses understand their profitability and make informed pricing decisions. Unlike markup (which is based on cost), margin is calculated as a percentage of the selling price.

Margin is the ratio of profit to revenue, expressed as a percentage. It tells you what portion of your sales revenue is profit.

For example, if you sell a product for $100 and it costs you $60 to produce, your profit is $40 and your margin is 40%. This means 40% of your selling price is profit, while 60% covers the cost of goods sold (COGS).

Margin Formulas: How to Calculate Margin

Basic Margin Formula

The basic formula for calculating margin is:

Margin (%) = ((Selling Price – Cost Price) / Selling Price) × 100

How to Calculate Selling Price Using Margin

If you know your cost and desired margin, you can calculate the selling price:

Selling Price = Cost Price / (1 – (Margin / 100))

How to Calculate Cost Price Using Margin

If you know your selling price and margin, you can calculate the cost:

Cost Price = Selling Price × (1 – (Margin / 100))

Need to calculate other financial metrics?

Try our related calculators for comprehensive financial analysis

Step-by-Step: How to Calculate Profit Margin

- Find your cost of goods sold (COGS) – This is how much it costs to produce your product or service. For example, $60.

- Determine your selling price (revenue) – This is how much you sell the product or service for. For example, $100.

- Calculate your profit – Subtract the cost from the revenue: $100 – $60 = $40.

- Divide profit by revenue – $40 ÷ $100 = 0.4

- Express as a percentage – 0.4 × 100 = 40%

That’s it! Your profit margin is 40%. This means that for every dollar of revenue, you keep 40 cents as profit.

Pro Tip: To quickly check your margin calculations, use our margin calculator above. Simply input your cost and selling price to instantly see your margin percentage.

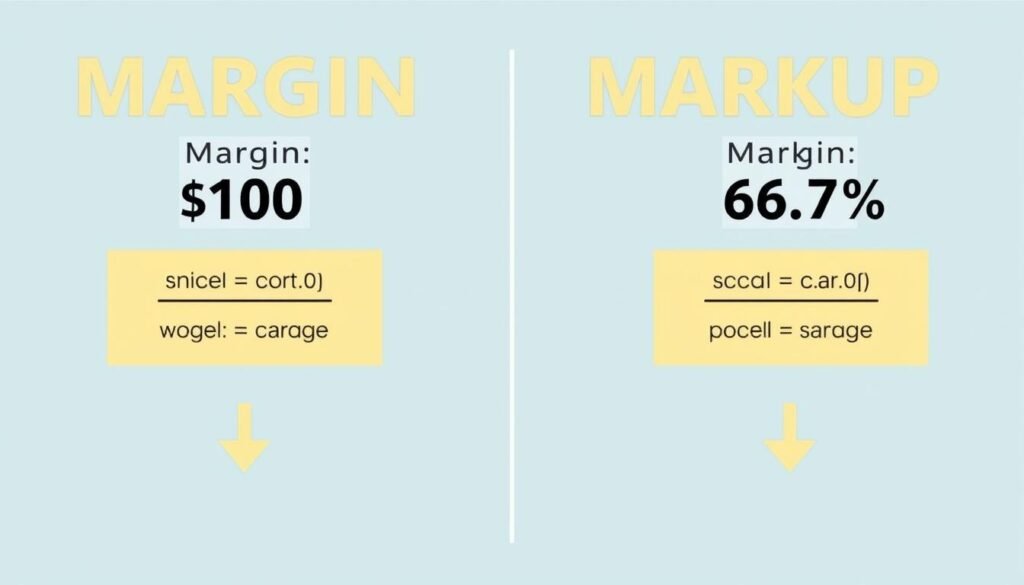

Margin vs. Markup: Understanding the Difference

Many people confuse margin and markup because both relate to pricing and profit. However, they’re calculated differently and serve different purposes in business.

Margin

- Based on selling price (revenue)

- Calculated as: (Revenue – Cost) / Revenue

- Expressed as a percentage of revenue

- Used to analyze profitability

- Example: $40 profit on $100 sale = 40% margin

Markup

- Based on cost price

- Calculated as: (Revenue – Cost) / Cost

- Expressed as a percentage of cost

- Used to set prices

- Example: $40 profit on $60 cost = 66.7% markup

Converting Between Margin and Markup

Markup to Margin:

Margin = Markup / (1 + Markup)

Example: 66.7% markup = 66.7% / (1 + 0.667) = 40% margin

Margin to Markup:

Markup = Margin / (1 – Margin)

Example: 40% margin = 40% / (1 – 0.4) = 66.7% markup

Need to calculate markup instead?

Use our dedicated markup calculator for precise calculations

Types of Profit Margins: Gross, Operating, and Net

When analyzing business profitability, there are several different types of margins to consider. Each provides unique insights into different aspects of your business performance.

Gross Profit Margin

Measures the profitability of a product or service after subtracting the cost of goods sold (COGS).

Formula: ((Revenue – COGS) / Revenue) × 100

This is the most basic form of margin and what our calculator primarily focuses on.

Operating Profit Margin

Measures profitability after accounting for COGS and operating expenses, but before interest and taxes.

Formula: ((Revenue – COGS – Operating Expenses) / Revenue) × 100

This shows how efficiently a company manages its operations.

Net Profit Margin

Measures profitability after all expenses, including COGS, operating expenses, interest, and taxes.

Formula: ((Revenue – All Expenses) / Revenue) × 100

This is the bottom line that shows how much of each sales dollar is actual profit.

Note: While our margin calculator focuses primarily on gross margin calculations, understanding all types of margins is essential for comprehensive business financial analysis.

Margin Calculation Examples by Industry

Different industries typically have different average profit margins. Here are examples of how to calculate and interpret margins in various business sectors:

| Industry | Typical Margin | Example Calculation | Notes |

| Retail | 20-45% | $50 item, $30 cost = 40% margin | Higher for luxury goods, lower for commodities |

| Restaurants | 3-15% | $25 meal, $10 food cost = 60% margin (before other expenses) | Net margins much lower after labor, rent, utilities |

| Manufacturing | 15-35% | $200 product, $140 cost = 30% margin | Varies by product complexity and scale |

| Software/SaaS | 70-90% | $100 subscription, $15 service cost = 85% margin | High margins due to low marginal costs |

| Professional Services | 25-40% | $150/hr rate, $90/hr cost = 40% margin | Based primarily on labor costs |

Retail Example: Calculating Margin for a Clothing Store

Let’s say you run a clothing store and want to determine the margin on a jacket:

- Wholesale cost (COGS): $45

- Selling price: $89.99

- Profit: $89.99 – $45 = $44.99

- Margin calculation: ($44.99 / $89.99) × 100 = 50%

This 50% margin is typical for retail clothing and allows for covering other business expenses while maintaining profitability.

Need to analyze your business finances further?

Try our other financial calculators

Using Margin in Your Pricing Strategy

A well-developed pricing strategy based on margin analysis can significantly impact your business’s profitability. Here’s how to effectively use margin calculations in your pricing decisions:

Setting Minimum Acceptable Margins

Determine the lowest margin you can accept while still covering all business expenses and generating profit. This creates a pricing floor for your products or services.

Example: If your overhead costs require at least a 30% margin to break even, never price below this threshold.

Competitive Pricing Analysis

Research competitors’ pricing and estimate their margins. Position your prices strategically based on your value proposition and target market.

Example: If competitors offer similar products at $100 with an estimated 40% margin, you might price at $95 with a 35% margin to gain market share.

Value-Based Pricing

Set prices based on the perceived value to customers rather than just adding a standard margin to costs. This can significantly increase profitability for premium products or services.

Example: A consulting service that saves clients $10,000 might command a $3,000 fee (70% margin) rather than pricing based on hours worked.

Product Mix Optimization

Analyze margins across your product line and focus marketing efforts on high-margin items while potentially phasing out low-margin products.

Example: A restaurant might promote high-margin cocktails and desserts while simplifying low-margin entrées.

Common Pricing Mistake: Many businesses make the error of applying the same markup percentage across all products. Instead, consider using different margins based on product category, competition, and customer price sensitivity.

Common Margin Calculation Mistakes to Avoid

Even experienced business owners can make errors when working with margins. Here are some common mistakes and how to avoid them:

Correct Margin Practices

- Using selling price as the denominator in margin calculations

- Including all relevant costs in your COGS

- Regularly reviewing and adjusting margins

- Using different margins for different product categories

- Considering both gross and net margins in analysis

Common Margin Mistakes

- Confusing margin with markup in calculations

- Forgetting to include all costs (shipping, packaging, etc.)

- Using the same margin across all products regardless of category

- Not adjusting margins for seasonal or market changes

- Focusing only on gross margin while ignoring net margin

“The difference between profit and loss often comes down to properly understanding and applying margin calculations in your pricing strategy.”

Frequently Asked Questions About Margin Calculations

What is a good profit margin?

A “good” profit margin varies significantly by industry. Retail businesses might consider 20-30% gross margin acceptable, restaurants 3-15%, while software companies often achieve 70-90%. Research industry benchmarks for your specific sector to determine appropriate targets. Generally, higher margins indicate better financial health, but extremely high margins might suggest vulnerability to competition.

What’s the difference between gross profit margin and net profit margin?

Gross profit margin only accounts for the cost of goods sold (COGS) and is calculated as ((Revenue – COGS) / Revenue) × 100. Net profit margin accounts for all business expenses including operating costs, taxes, interest, and is calculated as ((Revenue – All Expenses) / Revenue) × 100. Net margin gives a more complete picture of overall business profitability.

How do I calculate a 30% margin?

To calculate a selling price that gives you a 30% margin:

- Convert 30% to a decimal: 0.3

- Subtract from 1: 1 – 0.3 = 0.7

- Divide your cost by this number: Cost ÷ 0.7

For example, if your product costs , the selling price for a 30% margin would be: ÷ 0.7 = 0

Can margin be negative?

Yes, margin can be negative if your selling price is lower than your cost. This means you’re losing money on each sale. A negative margin is unsustainable in the long term unless it’s part of a strategic loss-leader approach or temporary promotional strategy. Most businesses should aim for positive margins that cover all costs and provide profit.

How often should I review my margins?

You should review your margins at least quarterly, but more frequently if your business experiences rapid cost changes, seasonal fluctuations, or operates in a highly competitive market. Regular margin analysis helps you identify trends, adjust pricing strategies, and maintain profitability despite changing market conditions.

Conclusion: Mastering Margin Calculations for Business Success

Understanding and correctly calculating profit margin is essential for making informed business decisions. Whether you’re setting prices, evaluating product profitability, or analyzing overall business performance, our margin calculator provides a simple yet powerful tool to support your financial analysis.

Remember that margin differs from markup, and different types of margins (gross, operating, and net) provide unique insights into various aspects of your business. By regularly monitoring your margins and adjusting your pricing strategy accordingly, you can maintain healthy profitability even as market conditions change.

Bookmark our margin calculator for quick access whenever you need to make pricing decisions or analyze profitability. For more comprehensive financial analysis, explore our other business calculators to gain deeper insights into your business performance.

Need More Financial Tools?

Explore our complete suite of business calculators