Use our Marriage Tax Calculator to estimate taxes for married couples. Compare filing options and plan finances for maximum tax savings.

Getting married changes many aspects of your life, including your tax situation. Whether you're planning to tie the knot or have recently married, understanding the tax implications can potentially save you thousands of dollars. Our Marriage Tax Calculator helps you compare different filing statuses, identify potential tax benefits, and determine the most advantageous way to file your taxes as a married couple.

Marriage Tax Calculator

Enter your income details below to see how marriage affects your tax situation. Compare filing jointly vs. separately to find your optimal tax strategy.

Our Marriage Tax Calculator provides a side-by-side comparison of different filing options

How Marriage Affects Your Federal Income Tax

When you get married, your tax filing options change significantly. Understanding these changes is crucial for optimizing your tax situation and potentially reducing your tax burden. The U.S. uses a progressive income tax system where tax rates increase as income rises, but marriage can shift which tax brackets apply to your household income.

Marriage Tax Benefits and Potential Penalties

Marriage can create both tax advantages and disadvantages depending on your specific financial situation. The term "marriage penalty" refers to situations where married couples pay more tax filing jointly than they would as two single individuals. Conversely, a "marriage bonus" occurs when couples pay less tax when filing jointly.

Potential Marriage Tax Benefits:

- Access to the married filing jointly status with potentially lower tax rates

- Higher standard deduction ($29,200 for joint filers in 2024 vs. $14,600 for single filers)

- Increased income thresholds for certain tax credits and deductions

- Ability to combine charitable contributions for larger deductions

- Tax-free transfers of property between spouses

Potential Marriage Tax Drawbacks:

- Combined income may push you into a higher tax bracket

- Limitations on certain deductions when income exceeds thresholds

- Potential phase-out of credits and deductions at higher combined income levels

- Both spouses become liable for tax debt when filing jointly

- Possible reduction in certain income-based benefits

Understanding your filing options can lead to significant tax savings for married couples

Marriage Tax Calculator: Comparing Filing Statuses

As a married couple, you have options when it comes to filing your taxes. The two primary choices are "married filing jointly" and "married filing separately." Each has distinct advantages and potential drawbacks depending on your specific financial situation.

| Filing Status | Advantages | Disadvantages | Best For |

| Married Filing Jointly |

- Lower tax rates for most couples - Higher standard deduction ($29,200 in 2024) - Full eligibility for credits and deductions - Simplified tax filing process |

- Joint liability for tax debt - Potential "marriage penalty" for dual high earners - Combined income may reduce certain benefits |

- Couples with disparate incomes - One spouse with little or no income - Most married couples (70-80%) |

| Married Filing Separately |

- Individual liability for taxes - May lower tax burden in specific situations - Protection from spouse's tax issues |

- Lower standard deduction per person - Ineligibility for many tax credits - Higher tax rates for most income levels - More complex filing process |

- Couples with significant medical expenses - When one spouse has tax issues - Certain income-based student loan repayment plans |

Not sure which filing status is best for your situation? Our Marriage Tax Calculator can help you compare your options and make an informed decision.

2024 Tax Brackets and Marginal Tax Rates for Married Couples

Understanding the federal income tax brackets is essential for calculating your potential marriage tax benefits or penalties. The U.S. tax system uses marginal tax rates, meaning different portions of your income are taxed at different rates. For 2024, the tax brackets for married couples filing jointly differ significantly from those for single filers.

| Tax Rate | Married Filing Jointly | Married Filing Separately | Single Filers (for comparison) |

| 10% | $0 - $23,200 | $0 - $11,600 | $0 - $11,600 |

| 12% | $23,201 - $94,300 | $11,601 - $47,150 | $11,601 - $47,150 |

| 22% | $94,301 - $201,050 | $47,151 - $100,525 | $47,151 - $100,525 |

| 24% | $201,051 - $383,900 | $100,526 - $191,950 | $100,526 - $191,950 |

| 32% | $383,901 - $487,450 | $191,951 - $243,725 | $191,951 - $243,725 |

| 35% | $487,451 - $731,200 | $243,726 - $365,600 | $243,726 - $609,350 |

| 37% | $731,201+ | $365,601+ | $609,351+ |

Notice how the income thresholds for married filing jointly are not exactly double those for single filers in all brackets. This discrepancy can create either a marriage bonus or penalty depending on your specific income levels.

This graph illustrates where marriage tax penalties and bonuses typically occur based on income combinations

How to Use Our Marriage Tax Calculator

Our Marriage Tax Calculator is designed to help you understand the tax implications of marriage and determine the optimal filing status for your situation. Follow these simple steps to get started:

- Enter Income Information: Input both spouses' annual income, including wages, self-employment income, and other taxable income sources.

- Add Deduction Details: Enter information about your potential deductions, including mortgage interest, charitable contributions, and other itemized deductions.

- Include Tax Credits: Add any tax credits you may qualify for, such as child tax credits, education credits, or retirement savings credits.

- Review Your Results: The calculator will show your estimated tax liability under different filing statuses, helping you identify the most advantageous option.

- Compare Scenarios: Try different income and deduction combinations to plan for future tax years or major life changes.

Follow these steps to get the most accurate results from our Marriage Tax Calculator

Ready to Calculate Your Marriage Tax Situation?

Our easy-to-use calculator provides instant results and helps you make informed decisions about your tax strategy.

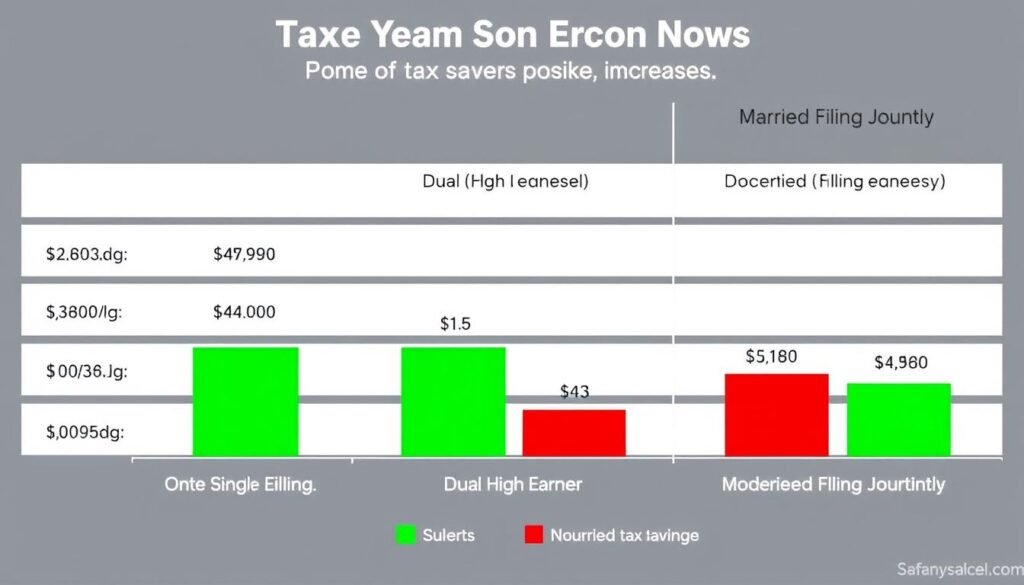

Marriage Tax Calculator: Real-World Examples

To help you understand how marriage affects taxes in practical terms, let's examine several common scenarios. These examples illustrate when couples might experience a marriage bonus or penalty.

Example 1: One High Earner + Low/No Earner (Marriage Bonus)

Scenario: Alex earns $100,000 annually while Jordan stays home or works part-time earning $15,000.

As Single Filers (Unmarried):

- Alex would pay approximately $15,009 in federal income tax

- Jordan would pay approximately $1,501 in federal income tax

- Total tax: $16,510

As Married Filing Jointly:

- Combined income: $115,000

- Federal income tax: approximately $13,479

- Tax savings: $3,031

Example 2: Dual High Earners (Potential Marriage Penalty)

Scenario: Both Morgan and Taylor earn $200,000 each annually.

As Single Filers (Unmarried):

- Morgan would pay approximately $42,097 in federal income tax

- Taylor would pay approximately $42,097 in federal income tax

- Total tax: $84,194

As Married Filing Jointly:

- Combined income: $400,000

- Federal income tax: approximately $89,075

- Marriage penalty: $4,881

Example 3: Moderate Dual Earners (Minimal Impact)

Scenario: Casey earns $60,000 and Riley earns $55,000 annually.

As Single Filers (Unmarried):

- Casey would pay approximately $6,794 in federal income tax

- Riley would pay approximately $6,069 in federal income tax

- Total tax: $12,863

As Married Filing Jointly:

- Combined income: $115,000

- Federal income tax: approximately $13,479

- Marriage penalty: $616

Visual comparison of tax differences between filing statuses for various income combinations

Marriage Tax Deductions and Credits

Beyond filing status, marriage affects your eligibility for various tax deductions and credits. Understanding these can help you maximize your tax advantages when using our Marriage Tax Calculator.

Key Deductions for Married Couples

Standard Deduction (2024)

- Married Filing Jointly: $29,200

- Married Filing Separately: $14,600 each

- Single: $14,600

- Head of Household: $21,900

For many couples, the higher standard deduction when filing jointly creates immediate tax savings.

Itemized Deductions

- Mortgage Interest: Deduct interest on up to $750,000 of qualified residence loans

- Charitable Contributions: Combined giving may increase deduction value

- Medical Expenses: Deductible when exceeding 7.5% of AGI

- State and Local Taxes (SALT): Limited to $10,000 for both joint and separate filers

Tax Credits for Married Couples

Family-Related Credits

- Child Tax Credit: Up to $2,000 per qualifying child under 17

- Child and Dependent Care Credit: Up to $3,000 for one child or $6,000 for two or more

- Adoption Credit: Up to $15,950 per eligible child (2024)

Income and Education Credits

- Earned Income Tax Credit (EITC): Income limits are higher for married couples

- American Opportunity Credit: Up to $2,500 per eligible student

- Lifetime Learning Credit: Up to $2,000 per tax return

- Saver's Credit: Up to $2,000 for joint filers contributing to retirement accounts

Important Note: Some tax credits and deductions phase out at higher income levels. When spouses combine their incomes by filing jointly, they may lose eligibility for certain benefits. Our Marriage Tax Calculator accounts for these phase-outs when comparing filing options.

Key tax deductions and credits that married couples should consider when filing taxes

Special Tax Situations for Married Couples

Certain life circumstances create unique tax considerations for married couples. Our Marriage Tax Calculator can help you navigate these special situations.

Newly Married Couples

If you got married during the tax year, the IRS considers you married for the entire year. This means you'll file as married (either jointly or separately) even if you were single for most of the year. Key considerations include:

- Updating your W-4 withholding with employers to avoid tax surprises

- Adjusting estimated tax payments if self-employed

- Changing your name with the Social Security Administration if applicable

- Updating your address with the IRS if you've moved

Couples with Significant Medical Expenses

Medical expenses are deductible only when they exceed 7.5% of your adjusted gross income (AGI). For couples with substantial medical costs, filing separately might sometimes be advantageous:

- When one spouse has high medical expenses but relatively low income

- When the lower AGI threshold for the spouse with medical expenses allows for a larger deduction

- When the tax savings from the medical deduction outweigh other disadvantages of filing separately

Student Loan Considerations

Marriage can significantly impact income-driven repayment plans for federal student loans:

- Filing jointly typically includes both spouses' incomes for payment calculations

- Filing separately may lower payments under certain repayment plans (like Income-Based Repayment)

- Student loan interest deduction ($2,500 maximum) is not available when filing separately

- Loan forgiveness implications may differ based on filing status

Decision flowchart to help determine the optimal filing status based on your specific situation

Have a Special Tax Situation?

Our Marriage Tax Calculator can help you determine the best filing strategy for your unique circumstances.

Tax Planning Strategies for Married Couples

Strategic tax planning can help married couples minimize their tax burden. Here are effective strategies to consider when using our Marriage Tax Calculator to plan your finances:

Balance Retirement Contributions

Strategically allocate retirement contributions between spouses to reduce taxable income and potentially stay in lower tax brackets:

- Maximize 401(k) contributions ($23,000 per person in 2024)

- Consider IRA contributions based on income limits

- Explore Health Savings Account (HSA) contributions if eligible

Time Income and Deductions

Strategically time when you receive income or pay for deductible expenses:

- Defer year-end bonuses to the next tax year if beneficial

- Bunch itemized deductions in alternating years

- Accelerate or delay capital gains realizations

- Consider Roth conversions in lower-income years

Coordinate Employee Benefits

Optimize employee benefits between spouses for maximum tax advantages:

- Compare health insurance options from both employers

- Coordinate FSA or HSA contributions

- Evaluate dependent care benefits from both employers

- Consider tax implications of stock options or equity compensation

Long-Term Marriage Tax Planning

Beyond annual tax strategies, consider these long-term approaches to optimize your tax situation throughout your marriage:

Asset Allocation Strategies

- Hold growth investments in tax-advantaged accounts

- Place dividend-generating investments in retirement accounts

- Consider municipal bonds for tax-free income in taxable accounts

- Balance asset ownership between spouses for estate planning

- Leverage gift tax exclusions ($18,000 per recipient in 2024)

Strategies to Avoid

- Filing separately just to keep finances separate (usually costs more)

- Ignoring the Alternative Minimum Tax (AMT) implications

- Failing to coordinate tax-loss harvesting between spouses

- Overlooking state tax implications of different filing statuses

- Making financial decisions solely for tax reasons without considering the full picture

Strategic tax planning with professional guidance can lead to significant savings for married couples

"The best tax strategy for married couples isn't always about paying the least tax this year—it's about paying the least tax over your lifetime together."

Frequently Asked Questions About Marriage and Taxes

Here are answers to common questions about how marriage affects your tax situation:

When does the IRS consider you married for tax purposes?

The IRS considers your marital status as of December 31 for the entire tax year. If you're married on the last day of the year, you're considered married for the whole year. Similarly, if you're divorced by December 31, you're considered single for tax purposes for that entire year.

Is it always better for married couples to file jointly?

While filing jointly is advantageous for most couples, it's not always the best option. Filing separately might be beneficial if:

- One spouse has significant medical expenses, student loans, or business losses

- You want to separate your tax liability from your spouse's

- One spouse has income-based student loan payments

- There are concerns about potential tax fraud by one spouse

Our Marriage Tax Calculator can help you compare both options for your specific situation.

What is the marriage tax penalty and when does it occur?

The marriage tax penalty occurs when a married couple pays more tax filing jointly than they would if they were single and filed separately. This typically happens when:

- Both spouses have similar, relatively high incomes

- The combined income pushes the couple into a higher tax bracket

- Deduction and credit phase-outs occur at the higher combined income level

Tax reforms have reduced the marriage penalty for many couples, but it still exists in certain situations, particularly for high-income earners.

Can we still file as single if we got married during the tax year?

No. If you're legally married as of December 31, you must file as either "married filing jointly" or "married filing separately" for that entire tax year. You cannot file as single, even if you were single for most of the year.

How does marriage affect my tax withholding?

Marriage often changes your tax withholding requirements. After getting married, both spouses should:

- Submit new W-4 forms to employers

- Consider the "Two Earners/Multiple Jobs" section on the W-4

- Potentially adjust withholding to account for combined income

- Use the IRS Tax Withholding Estimator to determine optimal withholding

Failing to adjust withholding after marriage can result in unexpected tax bills or unnecessarily large refunds.

Can same-sex married couples use the Marriage Tax Calculator?

Yes. Since the Supreme Court's decision in Obergefell v. Hodges in 2015, same-sex marriages are recognized for federal tax purposes in all 50 states. Same-sex married couples have the same filing options as opposite-sex married couples and can use our Marriage Tax Calculator in exactly the same way.

Our Marriage Tax Calculator helps couples make informed decisions about their tax filing strategy

Expert Tax Advice for Married Couples

While our Marriage Tax Calculator provides valuable insights, complex tax situations may benefit from professional guidance. Here are expert recommendations for married couples navigating their tax obligations:

When to Consider Professional Tax Help

- First year of marriage to establish optimal filing patterns

- Major life changes such as buying a home or having children

- Self-employment or business ownership by either spouse

- Significant investment income or capital gains

- Multiple state tax obligations due to relocation or remote work

- International tax considerations for multinational couples

Types of Tax Professionals

- Certified Public Accountants (CPAs) - Licensed professionals with comprehensive tax knowledge

- Enrolled Agents (EAs) - Federally licensed tax practitioners who specialize in taxation

- Tax Attorneys - Lawyers specializing in tax law, particularly valuable for complex situations

- Financial Advisors - Can help with tax-efficient investment and retirement strategies

"The most expensive tax advice is often the free advice you get from someone who isn't a tax professional. Tax laws are complex and constantly changing—getting expert guidance can save you significantly more than it costs."

IRS Resources: The IRS provides free publications specifically for married taxpayers. Publication 501 (Dependents, Standard Deduction, and Filing Information) and Publication 555 (Community Property) are particularly valuable resources.

Professional tax advice can be invaluable for married couples with complex financial situations

Marriage Tax Calculator: Making Informed Decisions

Understanding how marriage affects your tax situation is crucial for making sound financial decisions. Our Marriage Tax Calculator provides a valuable tool to help you navigate the complexities of the tax code and identify the most advantageous filing strategies for your specific circumstances.

Whether you're newly married, planning for marriage, or have been filing jointly for years, regularly reviewing your tax situation can lead to significant savings. Tax laws change, and your financial situation evolves—what worked best last year might not be optimal this year.

Take advantage of our Marriage Tax Calculator to compare different filing options, understand potential tax benefits or penalties, and make informed decisions that align with your overall financial goals. For complex situations, consider consulting with a tax professional who can provide personalized guidance based on your unique circumstances.

Ready to Optimize Your Tax Situation?

Use our Marriage Tax Calculator today to see how marriage affects your taxes and discover potential savings opportunities.