Use our Rental Property Calculator to estimate rental income, expenses, and ROI. Plan property investments and make informed real estate decisions.

Making informed decisions about rental property investments requires accurate calculations of potential returns. Our free Rental Property Calculator helps you analyze key metrics like cash flow, ROI, cap rate, and cash-on-cash returns to determine if a property is worth your investment. Stop guessing about profitability and start knowing with precision.

What is a Rental Property Calculator?

A rental property calculator is a specialized tool that helps real estate investors evaluate the financial performance of potential or existing rental properties. Unlike basic mortgage calculators, a comprehensive rental property calculator factors in all relevant income and expenses to provide accurate projections of your investment’s profitability.

Why Use Our Rental Property Calculator?

- Analyze complete financial picture including income, expenses, and financing

- Calculate multiple return metrics (cash flow, ROI, cap rate, cash-on-cash return)

- Compare different investment opportunities with standardized metrics

- Make data-driven decisions rather than relying on gut feelings

- Save hours of manual calculations and spreadsheet work

- Identify potential issues before investing your money

Key Metrics Our Rental Property Calculator Provides

Cash Flow

The monthly or annual income remaining after all expenses and mortgage payments. Positive cash flow means your property is generating profit beyond its costs.

Cap Rate

The capitalization rate measures a property’s annual net operating income relative to its purchase price, indicating its intrinsic profitability regardless of financing.

Cash-on-Cash Return

This metric calculates the return on the actual cash invested, accounting for leverage when using a mortgage to finance the purchase.

Understanding Rental Property Calculations

Income Calculations

The first step in analyzing a rental property is calculating potential income. Our calculator helps you determine:

| Income Type | Description | Calculation Method |

| Gross Rental Income | Total potential rent if fully occupied | Monthly Rent × 12 |

| Effective Gross Income | Rental income adjusted for vacancy | Gross Rental Income × (1 – Vacancy Rate) |

| Other Income | Additional revenue sources | Laundry + Parking + Pet Fees + Other Fees |

| Total Income | All income sources combined | Effective Gross Income + Other Income |

Expense Calculations

Accurate expense estimation is crucial for realistic return projections. Our calculator includes:

Operating Expenses

- Property taxes

- Insurance

- Property management (typically 8-12% of rent)

- Maintenance (1-2% of property value annually)

- Repairs (5-15% of rental income)

- Utilities paid by landlord

- HOA or condo fees

- Landscaping and snow removal

- Vacancy (typically 5-8% of rental income)

Financing Expenses

- Mortgage principal

- Mortgage interest

- Loan origination fees

- Closing costs

- Private mortgage insurance (if applicable)

Return Metrics Formulas

Understanding these key formulas will help you interpret the results from our rental property calculator and make more informed investment decisions.

| Metric | Formula | Example |

| Net Operating Income (NOI) | Total Income – Operating Expenses | $15,000 – $6,000 = $9,000 |

| Cash Flow | NOI – Debt Service (Mortgage Payments) | $9,000 – $7,200 = $1,800 annual ($150 monthly) |

| Cap Rate | (NOI ÷ Property Value) × 100 | ($9,000 ÷ $200,000) × 100 = 4.5% |

| Cash-on-Cash Return | (Annual Cash Flow ÷ Total Cash Invested) × 100 | ($1,800 ÷ $40,000) × 100 = 4.5% |

| Gross Rent Multiplier (GRM) | Property Price ÷ Annual Gross Rental Income | $200,000 ÷ $15,000 = 13.3 |

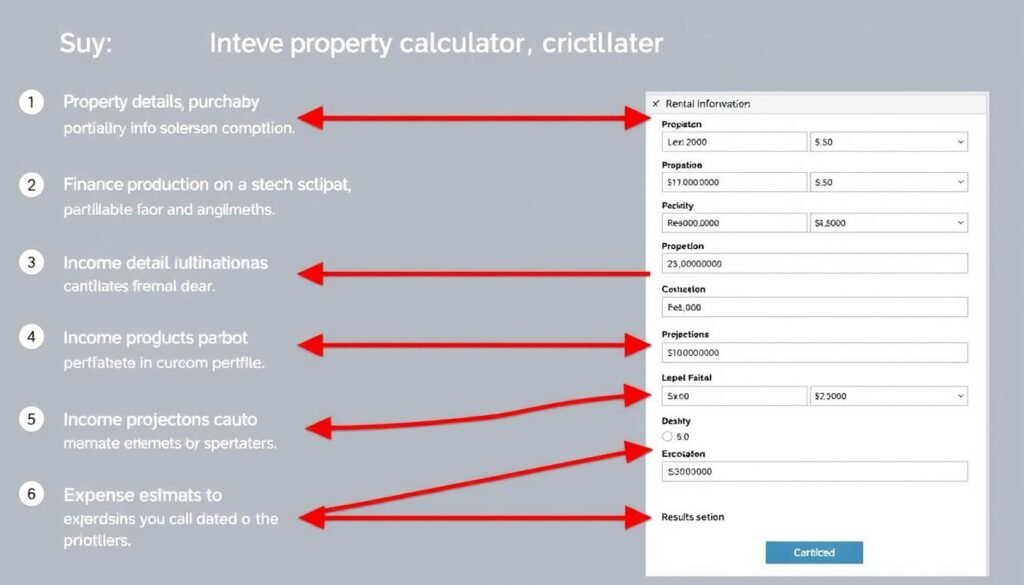

How to Use Our Rental Property Calculator

- Enter Property Details – Input the property’s purchase price, square footage, and number of units or bedrooms.

- Add Purchase Information – Include closing costs, initial repair expenses, and any other upfront investments.

- Input Financing Details – Enter your down payment amount, interest rate, loan term, and any points or fees.

- Project Rental Income – Add the expected monthly rent and any additional income sources like laundry or parking.

- Estimate Expenses – Include all operating costs such as property taxes, insurance, maintenance, and management fees.

- Review Results – Analyze the calculated metrics including cash flow, ROI, cap rate, and cash-on-cash return.

- Adjust Variables – Try different scenarios by changing inputs to see how they affect your returns.

Ready to Analyze Your Rental Property?

Our calculator makes it easy to evaluate potential investments and determine if they meet your financial goals.

Analyzing Different Rental Property Investment Scenarios

Different property types offer varying returns and challenges. Our calculator can help you analyze any rental investment scenario.

Single-Family Homes

Typical Metrics:

- Lower vacancy rates (3-5%)

- Higher appreciation potential

- Cap rates: 4-7%

- Cash-on-cash returns: 6-10%

Single-family homes often attract long-term tenants and require less management, but may offer lower cash flow in high-value markets.

Multi-Family Properties

Typical Metrics:

- Higher vacancy rates (5-8%)

- More stable cash flow

- Cap rates: 5-10%

- Cash-on-cash returns: 8-12%

Multi-family properties offer diversified income streams and economies of scale for maintenance, but require more active management.

Commercial Properties

Typical Metrics:

- Higher vacancy risk (8-12%)

- Longer lease terms

- Cap rates: 6-12%

- Cash-on-cash returns: 7-14%

Commercial properties typically offer higher returns but come with increased complexity, longer vacancies, and higher tenant improvement costs.

Pro Tip: When comparing different property types, don’t just look at the headline numbers. Consider your management capabilities, risk tolerance, and long-term investment goals. Our calculator helps you standardize comparisons across different property types.

Factors Affecting Rental Property Profitability

Location Factors

Location significantly impacts both income potential and expenses. Our calculator helps you account for these regional variations:

- Property taxes – Vary dramatically by location (1-4% of property value)

- Rent-to-price ratio – Higher in some markets than others

- Appreciation potential – Based on local economic trends

- Vacancy rates – Affected by local rental demand

- Insurance costs – Higher in disaster-prone areas

Market Trends Impact

Economic and market trends can significantly affect your rental property’s performance over time:

| Market Factor | Impact on Returns | How to Account for It |

| Interest Rate Changes | Affects financing costs and buyer demand | Run multiple scenarios with different rates in our calculator |

| Population Growth | Increases rental demand and property values | Research local demographic trends and adjust appreciation estimates |

| Job Market Strength | Affects tenant quality and rent growth | Consider higher rent growth in strong job markets |

| New Construction | Can increase competition and vacancy rates | Use higher vacancy rates in areas with significant new supply |

| Regulatory Changes | May limit rent increases or add compliance costs | Research local landlord regulations and factor in compliance costs |

Property-Specific Considerations

Factors That Improve Returns

- Newer properties (lower maintenance costs)

- Energy-efficient features (lower utility expenses)

- Desirable amenities (higher rent potential)

- Proximity to employment centers

- Good school districts (attracts stable tenants)

- Low crime neighborhoods (lower vacancy and turnover)

Factors That Reduce Returns

- Older properties (higher maintenance costs)

- Poor energy efficiency (higher expenses)

- Outdated features (lower rent potential)

- High crime areas (higher vacancy and turnover)

- Declining neighborhoods (poor appreciation)

- Strict local rental regulations

Rental Property Calculator vs. Manual Calculations

While some investors prefer to calculate returns manually, using our specialized calculator offers significant advantages:

Manual Calculation Limitations

- Time-consuming process requiring multiple spreadsheets

- Higher risk of formula errors affecting results

- Difficult to quickly test multiple scenarios

- Easy to overlook important expense categories

- Challenging to maintain consistent methodology across properties

Calculator Advantages

- Instant results with verified calculation formulas

- Comprehensive inclusion of all relevant factors

- Easy scenario testing with adjustable variables

- Standardized methodology for comparing properties

- Time savings to focus on property selection instead of math

Save Time and Reduce Errors

Our rental property calculator handles the complex math so you can focus on finding great investment opportunities.

Frequently Asked Questions About Rental Property Calculations

What is a good cap rate for rental properties?

A “good” cap rate depends on your investment goals, property location, and risk tolerance. Generally, residential properties in stable markets might have cap rates of 4-7%, while properties in emerging or higher-risk areas might show 8-12%. Higher cap rates typically indicate higher potential returns but also higher risk. Our rental property calculator helps you determine if a property’s cap rate aligns with your investment criteria.

How much should I budget for maintenance and repairs?

A common rule of thumb is to budget 1-2% of the property value annually for maintenance and an additional 5-15% of rental income for repairs. Older properties typically require higher maintenance budgets. Our calculator allows you to adjust these percentages based on the property’s age, condition, and your knowledge of specific maintenance needs.

Should I include property management costs even if I self-manage?

Yes, we recommend including property management costs (typically 8-12% of rental income) even if you self-manage. This accounts for the value of your time and provides a more accurate comparison with other investment options. It also gives you flexibility if you decide to hire property management in the future. Our calculator makes it easy to include or exclude this expense to see its impact on your returns.

How do I account for vacancy in my calculations?

Most investors use a vacancy rate of 5-8% for residential properties, meaning the property will be vacant 5-8% of the time. This translates to approximately 2-4 weeks per year. In high-demand areas, you might use a lower rate, while in seasonal or transitional neighborhoods, a higher rate would be appropriate. Our calculator automatically adjusts your income projections based on your selected vacancy rate.

What’s more important: cash flow or appreciation?

The answer depends on your investment strategy and financial goals. Cash flow provides immediate returns and helps cover expenses, while appreciation builds long-term wealth. Most successful investors seek a balance of both. Our rental property calculator helps you analyze both aspects so you can make decisions aligned with your personal investment strategy.

Make Smarter Rental Property Investment Decisions

Successful real estate investing requires accurate analysis of potential returns. Our Rental Property Calculator provides the comprehensive tools you need to evaluate properties with confidence and precision. By accounting for all income sources, expenses, financing costs, and market factors, you can identify truly profitable opportunities and avoid costly investment mistakes.

Ready to Analyze Your Next Investment?

Stop guessing about rental property returns. Use our free calculator to get accurate, comprehensive analysis of any potential investment.