Use our Repayment Calculator to estimate monthly payments, interest, and total repayment for loans. Plan your finances and manage debt effectively.

Our Repayment Calculator helps you understand and plan your loan payments for various types of loans including mortgages, auto loans, student loans, and personal loans. By calculating your monthly payments, total interest, and payoff timeline, you can make informed decisions about your financial future and potentially save thousands in interest payments.

Calculate Your Loan Repayments

Enter your loan details below to see your monthly payment amount, total interest paid, and payoff date. Adjust the values to see how different terms affect your repayment plan.

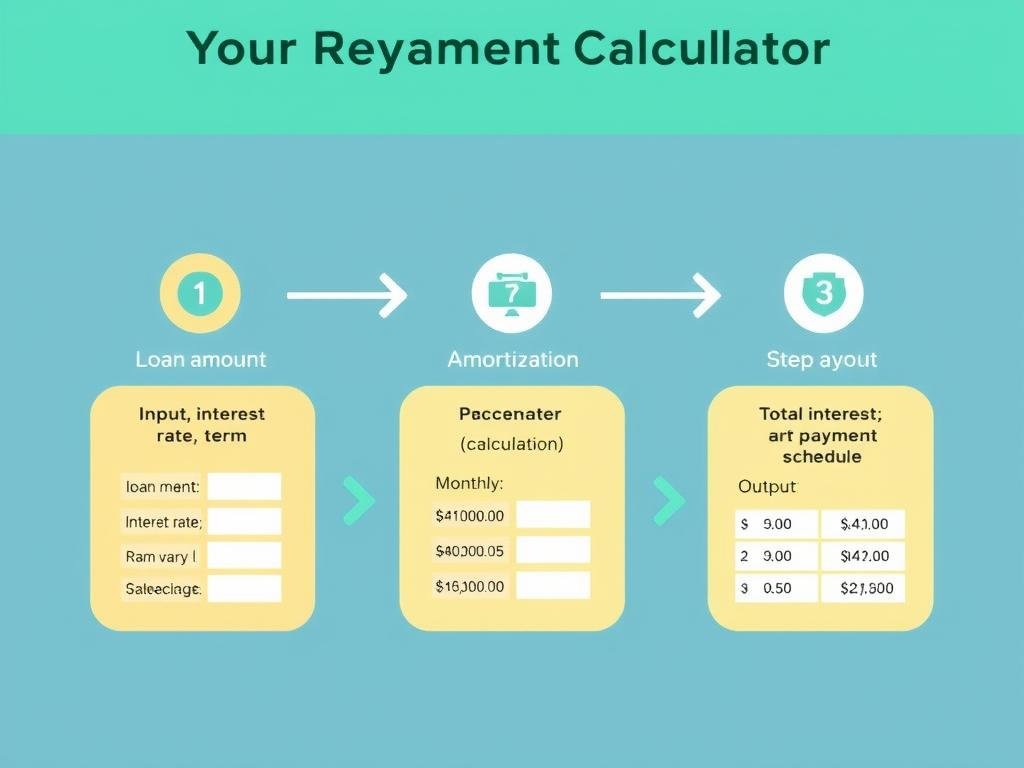

How the Repayment Calculator Works

The Repayment Calculator uses your loan information to determine your monthly payments and total interest costs. Understanding how this calculator works helps you make better financial decisions and potentially save money over the life of your loan.

Enter Loan Details

Input your loan amount, interest rate, and loan term (in years or months). For existing loans, you can enter your current balance instead of the original loan amount.

Calculate Payments

The calculator uses a standard amortization formula to determine your monthly payment amount, breaking down how much goes toward principal and interest.

Analyze Results

Review your monthly payment amount, total interest paid, and full repayment schedule to understand the true cost of your loan over time.

Types of Repayment Calculators

Different loans require different calculation approaches. Our repayment calculator can be used for various loan types, each with its own specific considerations.

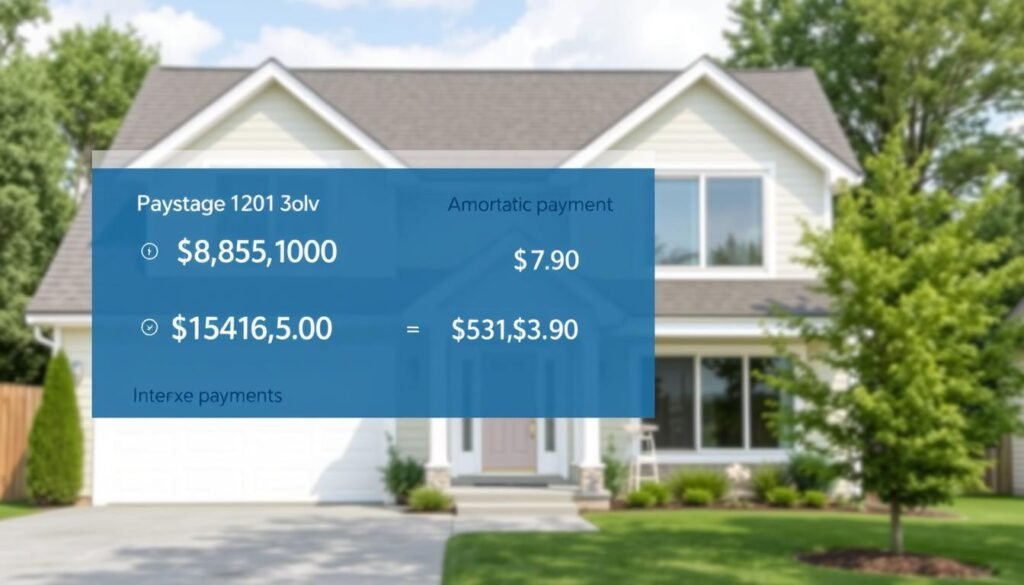

Mortgage Repayment Calculator

Mortgage repayment calculators help homeowners understand their monthly payments, which typically include principal, interest, taxes, and insurance (PITI). These calculators can show you how making extra payments can significantly reduce your loan term and save thousands in interest.

Most mortgages in the U.S. are fixed-rate loans with 15 or 30-year terms, though adjustable-rate options are also available. Our calculator can help you compare different scenarios to find the best option for your financial situation.

Auto Loan Repayment Calculator

Auto loan calculators help you determine affordable monthly payments when purchasing a vehicle. These calculators typically account for the loan amount, interest rate, term length (usually 3-7 years), and sometimes include trade-in value and down payment options.

Understanding your auto loan repayment schedule can help you negotiate better terms with dealers and avoid being “upside down” on your loan (owing more than the car is worth).

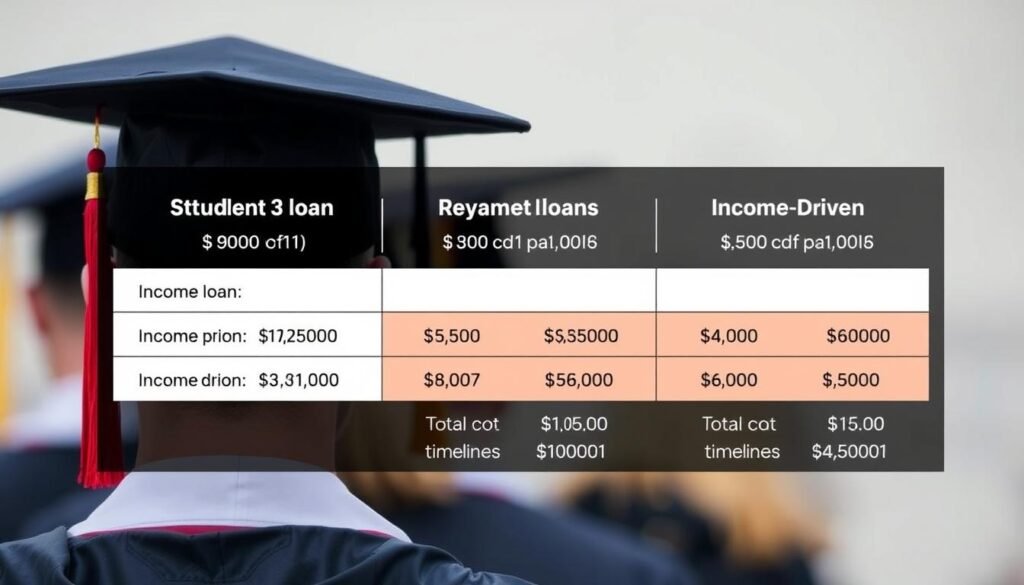

Student Loan Repayment Calculator

Student loan calculators help borrowers understand their repayment options, including standard, graduated, and income-driven repayment plans. These calculators can show how different payment strategies affect your total loan cost and payoff timeline.

For federal student loans, repayment terms typically range from 10-25 years depending on the plan. Private student loans usually have terms of 5-20 years. Our calculator can help you compare different scenarios and find the most efficient repayment strategy.

Personal Loan Repayment Calculator

Personal loan calculators help you determine monthly payments for unsecured loans used for debt consolidation, home improvements, or other major expenses. These calculators typically focus on fixed-rate loans with terms ranging from 1-7 years.

Understanding your personal loan repayment schedule can help you choose the right loan amount and term to fit your budget while minimizing interest costs.

Benefits of Using a Repayment Calculator

A repayment calculator is more than just a tool for determining your monthly payment. It provides valuable insights that can help you make better financial decisions and potentially save thousands of dollars over the life of your loan.

Advantages of Using Our Repayment Calculator

- Accurately estimate monthly payments for better budgeting

- See the total interest paid over the life of the loan

- Compare different loan terms and interest rates side by side

- Calculate the impact of making extra payments

- Determine the most efficient debt repayment strategy

- Plan for early loan payoff to save on interest

- Make informed decisions when refinancing existing loans

Strategies to Repay Loans Faster

Using our repayment calculator, you can explore various strategies to pay off your loans more quickly and save money on interest. Here are some effective approaches to consider:

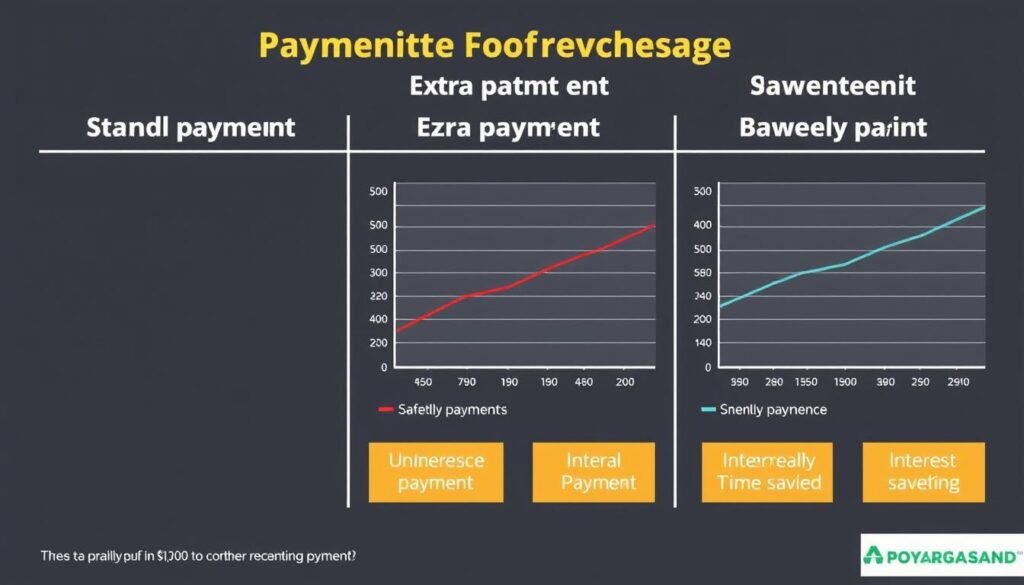

Make Extra Payments

Adding even small extra amounts to your regular payments can significantly reduce your loan term and total interest paid. Our calculator can show you exactly how much you’ll save by making additional payments toward the principal.

For example, on a $200,000 30-year mortgage at 4% interest, paying an extra $100 per month could save you over $26,000 in interest and pay off your loan 4 years earlier.

Biweekly Payments

Instead of making 12 monthly payments per year, consider making half-payments every two weeks. This results in 26 half-payments, or 13 full monthly payments per year, effectively adding one extra payment annually.

This strategy works well for borrowers who get paid biweekly and can align loan payments with their income schedule. Our calculator can show you the impact of this approach on your specific loan.

Refinance to Lower Rates

If interest rates have dropped since you took out your loan, refinancing could lower your monthly payment or shorten your loan term. Use our calculator to compare your current loan with refinancing options.

Keep in mind that refinancing typically involves closing costs, so you’ll need to calculate whether the interest savings outweigh these upfront expenses.

Before implementing any repayment strategy, consider your overall financial situation. While paying off debt faster is generally beneficial, make sure you have an emergency fund and aren’t neglecting other financial priorities like retirement savings.

Common Mistakes When Using Repayment Calculators

To get the most accurate results from our repayment calculator, avoid these common mistakes that can lead to miscalculations and unrealistic expectations.

Watch Out for These Calculation Errors

- Forgetting additional costs: Remember that your total housing payment may include taxes, insurance, and HOA fees beyond just principal and interest.

- Ignoring variable interest rates: If you have a variable-rate loan, calculations based on the current rate may not reflect future payment changes.

- Not accounting for loan fees: Origination fees, closing costs, and other charges affect the true cost of borrowing.

- Overlooking prepayment penalties: Some loans charge penalties for early payoff, which can offset interest savings.

- Using the wrong loan term: Make sure you’re entering the remaining term for existing loans, not the original term.

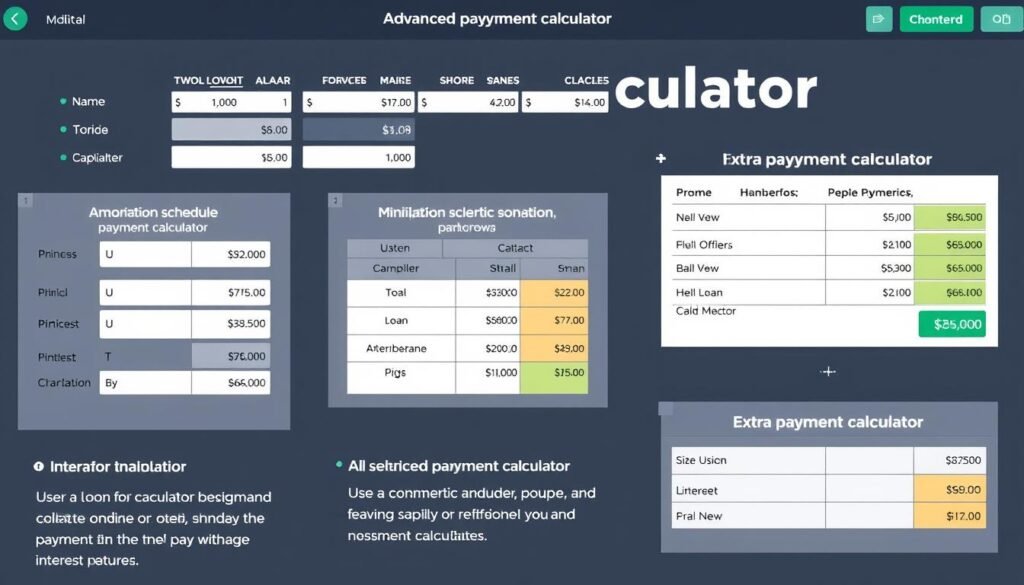

Advanced Features of Our Repayment Calculator

Our repayment calculator includes several advanced features to help you gain deeper insights into your loan repayment options and make more informed financial decisions.

Amortization Schedules

View a detailed month-by-month breakdown of your payments, showing exactly how much goes toward principal and interest over the life of your loan. This helps you understand how your loan balance decreases over time.

Extra Payment Analysis

Calculate the impact of making additional payments at different intervals (monthly, annually, or one-time). See exactly how much time and interest you’ll save with various extra payment strategies.

Loan Comparison Tool

Compare multiple loan scenarios side by side to determine which option best fits your financial goals. Evaluate different interest rates, terms, and payment strategies simultaneously.

Ready to Take Control of Your Loan Repayments?

Our comprehensive repayment calculator gives you the insights you need to make smart financial decisions and potentially save thousands in interest payments.

Integrating Repayment Calculators into Your Financial Planning

A repayment calculator is most effective when used as part of a comprehensive financial planning strategy. Here’s how to incorporate our calculator into your broader financial goals.

Debt Reduction Planning

Use the repayment calculator to develop a strategic debt payoff plan. Compare the impact of focusing extra payments on high-interest debt first (debt avalanche method) versus paying off smaller balances first (debt snowball method).

By calculating the total interest saved with different approaches, you can choose the strategy that best aligns with your financial goals and motivation style.

Budget Integration

Once you understand your monthly payment obligations, incorporate them into your overall budget. Determine how much you can realistically allocate to debt repayment while still meeting other financial needs.

Our calculator helps you find the balance between aggressive debt repayment and maintaining financial flexibility for emergencies and other priorities.

Take Control of Your Loan Repayments Today

Understanding your loan repayment options is a crucial step toward financial freedom. Our repayment calculator provides the insights you need to make informed decisions about your loans, potentially saving you thousands of dollars in interest and helping you become debt-free sooner.

Whether you’re planning to take out a new loan or looking to optimize your existing debt, our calculator gives you the power to explore different scenarios and find the repayment strategy that best fits your financial goals.

Ready to Calculate Your Loan Repayments?

Take the first step toward financial clarity and start planning your path to becoming debt-free.

Note: This calculator provides estimates based on the information you enter. Actual loan terms, interest rates, and payment amounts may vary. Always consult with a financial advisor before making important financial decisions.