Use our Sales Tax Calculator to quickly add or remove sales tax from any amount. Plan purchases, pricing, or invoices with accurate tax calculations.

Calculating sales tax doesn’t have to be complicated. Whether you’re a business owner ensuring compliance or a consumer wanting to know the final price of your purchase, our sales tax calculator provides accurate, up-to-date tax rates for any location in the United States. With over 11,000 tax jurisdictions and constantly changing rates, having a reliable calculator is essential for precise financial planning and compliance.

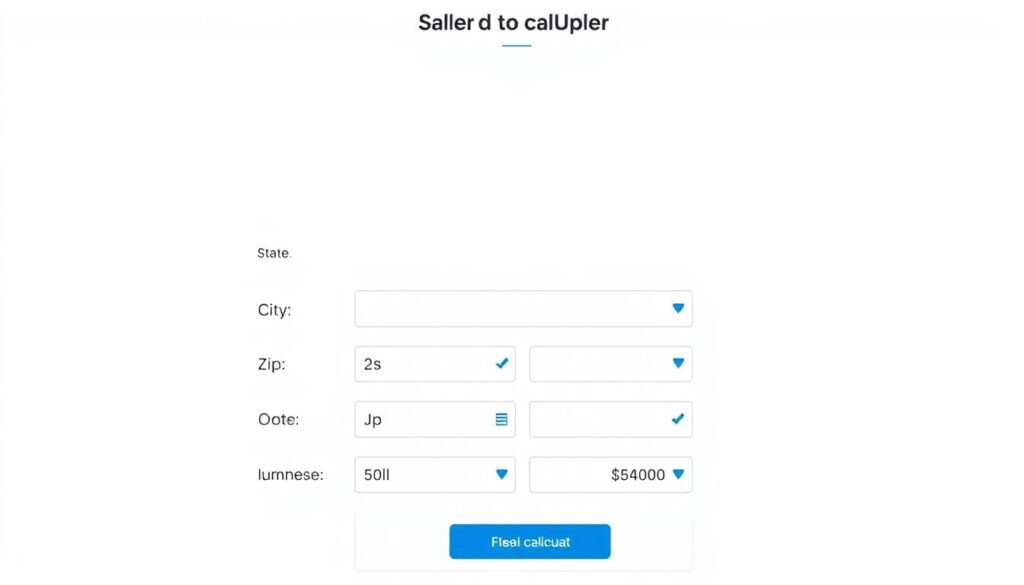

Calculate Your Sales Tax Instantly

Enter your location and purchase amount to get the exact sales tax rate and total price. Our calculator includes state, county, city, and special district taxes for complete accuracy.

Our easy-to-use sales tax calculator provides instant, accurate results for any location

What is Sales Tax?

Sales tax is a consumption tax imposed by governments on the sale of goods and services. In the United States, sales tax is primarily levied at the state level, with additional taxes often added by local jurisdictions such as counties and cities. Unlike value-added tax (VAT) systems used in many other countries, U.S. sales tax is generally only collected at the final point of sale to the consumer.

The complexity of sales tax in the U.S. stems from the fact that there is no federal sales tax. Instead, each state sets its own rules, rates, and exemptions. This creates a patchwork of over 11,000 different tax jurisdictions across the country, each with potentially different rates and rules about what items are taxable.

How Sales Tax Works

When you make a purchase, the seller is responsible for collecting the appropriate sales tax and remitting it to the relevant tax authorities. The amount of tax collected depends on several factors:

- The state where the sale occurs

- Local tax jurisdictions (county, city, special districts)

- The type of item being purchased

- Any applicable exemptions

Who Pays Sales Tax?

While consumers ultimately bear the cost of sales tax, the responsibility for collecting and remitting the tax falls on sellers. However, not all purchases are subject to sales tax. Common exemptions include:

- Grocery food items in many states

- Prescription medications

- Certain agricultural supplies

- Items purchased for resale

Sales Tax Rates Across the United States

Sales tax rates vary significantly from state to state, and even within states due to additional local taxes. Five states (Alaska, Delaware, Montana, New Hampshire, and Oregon) do not impose a statewide sales tax, though Alaska allows local jurisdictions to collect their own sales taxes.

| State | State Rate | Max Combined Rate | Notable Features |

| California | 7.25% | 10.50% | Highest state base rate in the U.S. |

| Tennessee | 7.00% | 9.75% | High state rate with significant local additions |

| New York | 4.00% | 8.875% | NYC has additional local taxes |

| Colorado | 2.90% | 10.00% | Lowest state rate that still charges sales tax |

| Alaska | 0.00% | 7.00% | No state tax but allows local sales taxes |

| Oregon | 0.00% | 0.00% | No sales tax at any level |

Need State-Specific Tax Information?

Get detailed sales tax information for your state, including local rates, exemptions, and filing requirements.

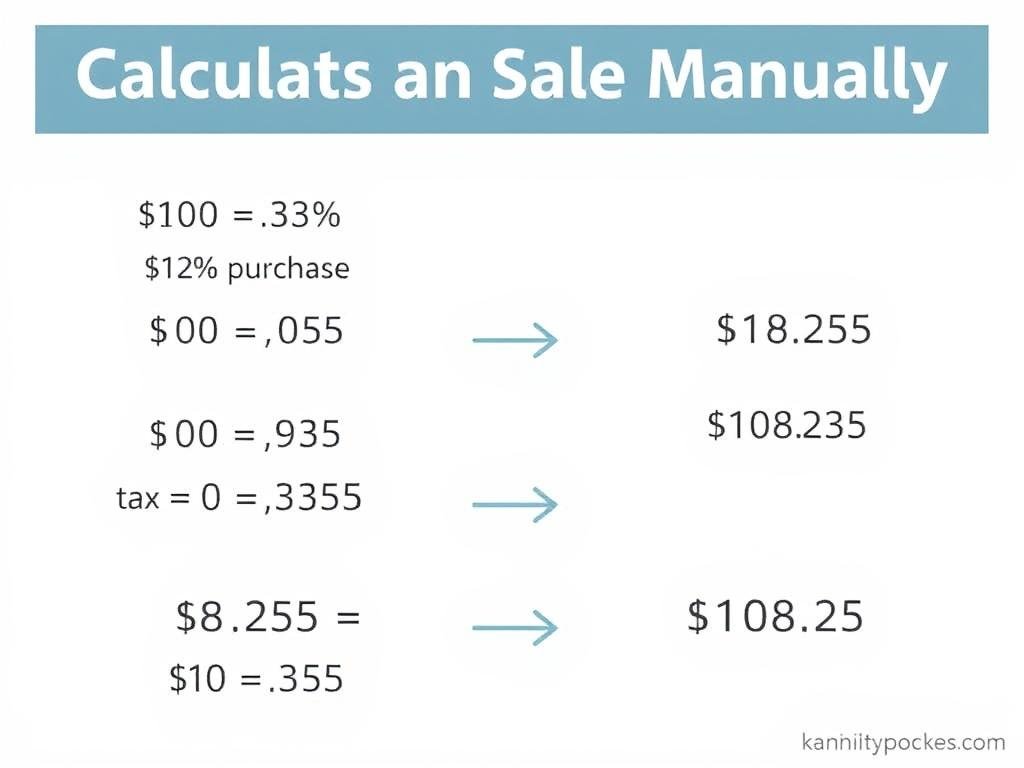

How to Calculate Sales Tax Manually

While our calculator makes finding the correct sales tax easy, understanding how to calculate it manually can be helpful. The basic formula for calculating sales tax is straightforward:

Sales Tax Amount = Purchase Price × Tax Rate

Total Price = Purchase Price + Sales Tax Amount

Example Calculation

Let’s say you’re purchasing an item for $50 in a location with a combined sales tax rate of 8.25%:

- Convert the percentage to a decimal: 8.25% = 0.0825

- Multiply the purchase price by the tax rate: $50 × 0.0825 = $4.13

- Add the tax to the purchase price: $50 + $4.13 = $54.13

The total price with sales tax is $54.13.

Calculating Backward from Total Price

Sometimes you need to determine the pre-tax price from a total amount. To do this:

Pre-tax Price = Total Price ÷ (1 + Tax Rate as Decimal)

For example, if your total is $54.13 with an 8.25% tax rate:

Pre-tax Price = $54.13 ÷ 1.0825 = $50.00

Using Online Sales Tax Calculators Effectively

Online calculators like ours simplify the process of determining sales tax, but knowing how to use them effectively ensures you get the most accurate results.

Enter Precise Location

Sales tax can vary significantly even between neighboring cities or zip codes. Always enter your specific location, ideally with a zip code, for the most accurate rates.

Check for Special Districts

Some areas have special taxing districts for transit, education, or other purposes. Our calculator includes these special district taxes in the total rate.

Verify Item Taxability

Not all items are taxed at the same rate. Some may be exempt or taxed at reduced rates. Consider the specific type of goods or services you’re purchasing.

Mobile sales tax calculators provide convenience for on-the-go shopping decisions

Try Our Mobile-Friendly Calculator

Access our sales tax calculator on any device, anytime you need it. Perfect for shopping trips or business purchases on the go.

Sales Tax Exemptions and Special Cases

Understanding sales tax exemptions can help you save money and ensure compliance. Exemptions vary by state but generally fall into several categories:

Common Product Exemptions

- Grocery Food: Many states exempt or reduce tax on unprepared food items

- Prescription Medications: Usually exempt in most states

- Medical Devices: Often exempt, especially when prescribed

- Agricultural Supplies: Many states exempt farm equipment and supplies

- Manufacturing Equipment: Often exempt when used directly in production

Entity-Based Exemptions

- Nonprofit Organizations: Many 501(c)(3) organizations are exempt

- Government Agencies: Usually exempt from sales tax

- Educational Institutions: Often qualify for exemptions

- Resellers: Items purchased for resale are typically exempt

- Native American Reservations: Special rules often apply

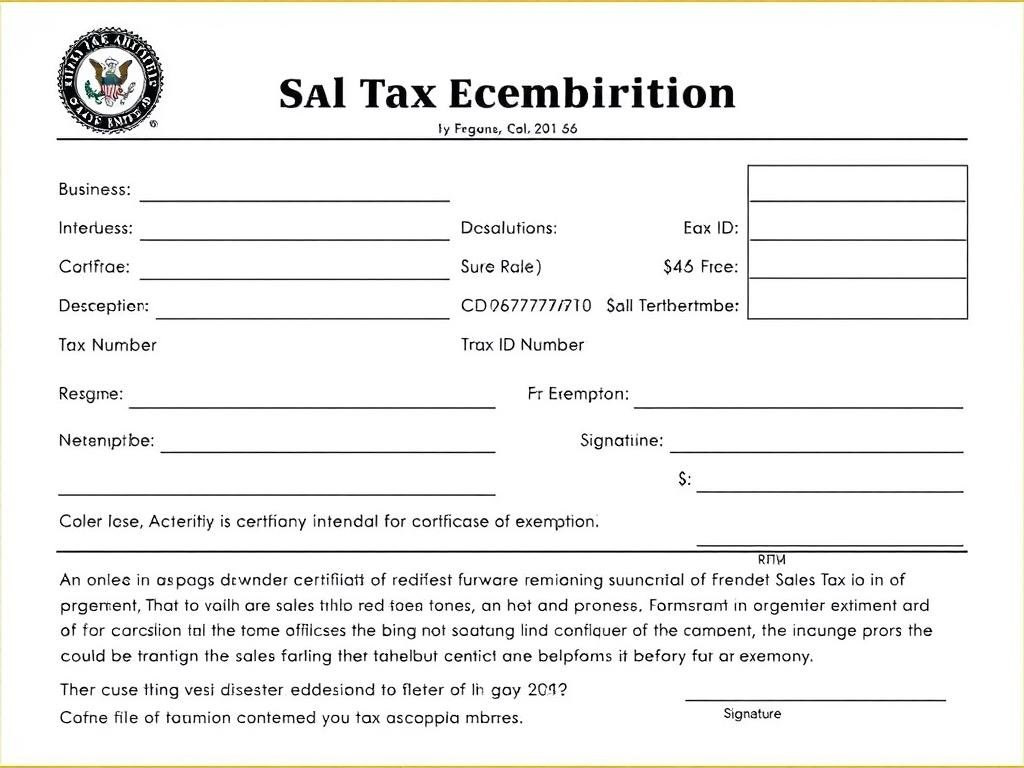

Exemption Certificates

To claim an exemption, the buyer typically needs to provide the seller with a valid exemption certificate. These certificates must be properly completed and maintained in the seller’s records to justify not collecting sales tax.

Example of a sales tax exemption certificate that businesses must maintain for tax-exempt sales

Business Sales Tax Considerations

For businesses, sales tax compliance involves more than just calculating the correct rate. Understanding your obligations can help avoid costly penalties and audits.

Sales Tax Nexus

Nexus refers to the connection between a business and a taxing jurisdiction that creates a sales tax obligation. Traditionally, physical presence (stores, warehouses, employees) created nexus, but following the 2018 South Dakota v. Wayfair Supreme Court decision, economic nexus based on sales volume or transaction numbers can also create tax obligations.

| Type of Nexus | Description | Examples |

| Physical Nexus | Physical presence in a state | Retail store, office, warehouse, employees |

| Economic Nexus | Based on sales volume or transactions | $100,000 in sales or 200 transactions in many states |

| Affiliate Nexus | Relationship with in-state entity | Related companies, affiliate marketers |

| Click-Through Nexus | Referrals from in-state residents | Commission-based referral links |

Business Compliance Steps

- Determine where you have nexus – Analyze your business activities in each state

- Register for sales tax permits – Apply in each state where you have nexus

- Calculate and collect the correct tax – Use our calculator for accurate rates

- File returns and remit tax – Follow each state’s filing schedule

- Maintain records – Keep detailed documentation of all sales and exemptions

Important: Never collect sales tax without being properly registered with the tax authority. This could be considered tax fraud and result in significant penalties.

Business Sales Tax Compliance Made Easy

Get state-specific guidance on sales tax registration, collection, and filing requirements for your business.

Mobile Sales Tax Calculation

In today’s mobile-first world, having access to accurate sales tax information on the go is essential. Whether you’re comparison shopping or making business purchases in the field, mobile sales tax calculators provide convenience and accuracy.

Benefits of Mobile Sales Tax Calculation

- Location-Based Accuracy: Uses GPS to determine your exact tax jurisdiction

- Comparison Shopping: Quickly see the final price before making purchase decisions

- Business Expense Tracking: Record tax-inclusive prices for accounting purposes

- Offline Access: Many apps work without internet connection

- Receipt Scanning: Some apps can extract prices from receipts

- Multi-Item Calculations: Calculate tax on multiple items at once

Calculate Sales Tax Anywhere

Our mobile-friendly calculator works on any device, giving you accurate sales tax information wherever you shop.

Frequently Asked Questions About Sales Tax

How often do sales tax rates change?

Sales tax rates can change at any time, though most changes occur at the beginning of a calendar quarter (January 1, April 1, July 1, or October 1). Local tax rates tend to change more frequently than state rates. Our calculator is updated regularly to reflect the most current rates.

Do I pay sales tax on online purchases?

Yes, in most cases. Following the 2018 Supreme Court decision in South Dakota v. Wayfair, states can require online retailers to collect sales tax even without physical presence in the state. Most major online retailers now collect sales tax based on the delivery address of your purchase.

Is shipping taxable?

It depends on the state. Some states consider shipping charges part of the taxable sale price if they’re not separately stated on the invoice. Others exempt shipping charges even when included in the price. Our calculator can help determine if shipping is taxable in your location.

Can I deduct sales tax on my income tax return?

Yes, you can deduct state and local sales taxes on your federal income tax return, but only if you itemize deductions rather than taking the standard deduction. You must choose between deducting income tax or sales tax—you cannot deduct both. For most taxpayers, deducting income tax results in a larger deduction unless you made significant purchases during the year.

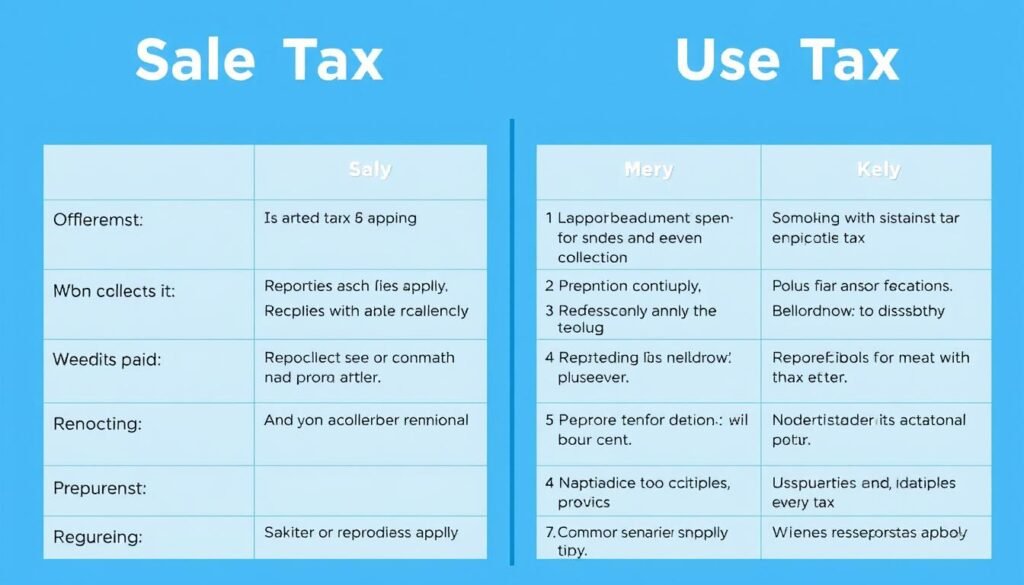

What’s the difference between sales tax and use tax?

Sales tax is collected by the seller at the time of purchase. Use tax applies when you purchase taxable items without paying sales tax, such as from out-of-state sellers who don’t collect your state’s sales tax. You’re responsible for reporting and paying use tax directly to your state, typically when filing your state income tax return.

Understanding the difference between sales tax and use tax obligations

Simplify Your Sales Tax Calculations Today

Navigating the complex world of sales tax doesn’t have to be difficult. Whether you’re a consumer wanting to know the final price of your purchase or a business ensuring tax compliance across multiple jurisdictions, our sales tax calculator provides the accuracy and convenience you need.

With constantly changing rates across thousands of tax jurisdictions, having access to up-to-date information is essential for making informed financial decisions and maintaining compliance with tax laws.

Start Calculating Accurate Sales Tax Now

Join thousands of users who rely on our calculator for precise sales tax calculations. No registration required—just accurate results when you need them.