Use our Social Security Calculator to estimate your retirement benefits. Plan your retirement income and make informed decisions about when to claim.

Planning for retirement requires understanding how Social Security benefits fit into your financial future. Our Social Security calculator helps you estimate your benefits based on your unique situation, allowing you to make informed decisions about when to claim. With accurate projections and expert guidance, you can maximize your retirement income and ensure financial security for your golden years.

Social Security Benefits Calculator

Get a personalized estimate of your Social Security benefits based on your age, income history, and planned retirement date. Our calculator provides accurate projections to help you plan your financial future.

Our calculator provides personalized benefit estimates based on your unique situation

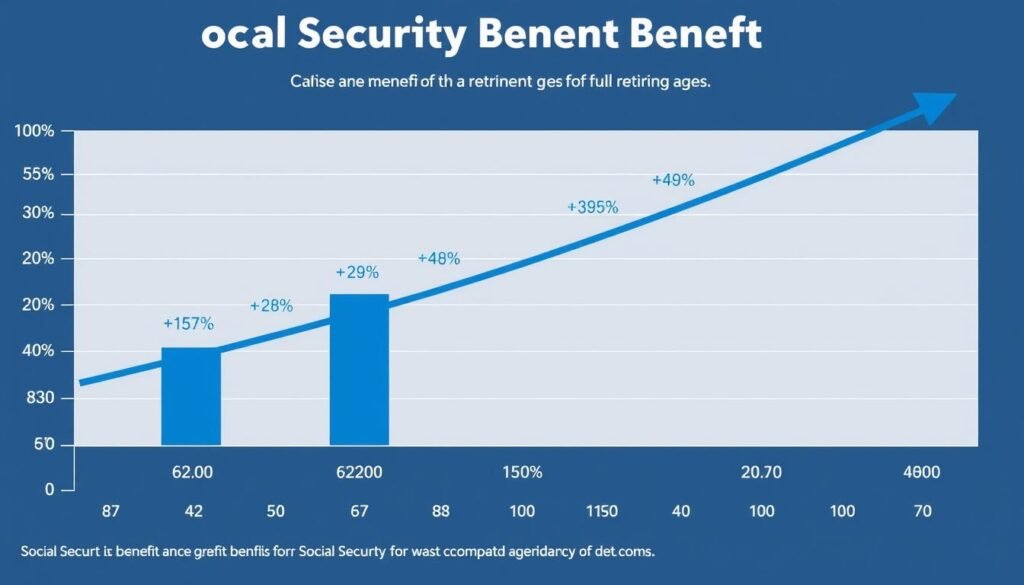

How Retirement Age Impacts Your Benefits

One of the most significant factors affecting your Social Security benefits is the age at which you choose to claim them. Understanding the impact of different claiming ages can help you maximize your lifetime benefits.

Early Retirement (Age 62)

Claiming at the earliest possible age results in a permanent reduction of up to 30% from your full retirement benefit. While you’ll receive benefits for a longer period, each monthly payment will be significantly smaller.

Full Retirement Age (66-67)

Your full retirement age depends on your birth year. For those born in 1960 or later, it’s age 67. Claiming at this age means you’ll receive 100% of your calculated benefit amount.

Delayed Retirement (Up to Age 70)

For each year you delay claiming beyond full retirement age, your benefit increases by approximately 8%. This results in a maximum increase of 24-32% if you wait until age 70 to claim.

| Birth Year | Full Retirement Age | Reduction at Age 62 | Increase at Age 70 |

| 1943-1954 | 66 | 25% | 32% |

| 1955 | 66 and 2 months | 25.83% | 30.67% |

| 1956 | 66 and 4 months | 26.67% | 29.33% |

| 1957 | 66 and 6 months | 27.5% | 28% |

| 1958 | 66 and 8 months | 28.33% | 26.67% |

| 1959 | 66 and 10 months | 29.17% | 25.33% |

| 1960 and later | 67 | 30% | 24% |

Find Your Optimal Claiming Age

Use our calculator to see how different claiming ages affect your lifetime benefits.

Factors That Affect Your Social Security Benefits

Beyond your claiming age, several other factors influence the amount of Social Security benefits you’ll receive. Understanding these factors can help you make more informed decisions about your retirement planning.

Work History

Your benefits are based on your 35 highest-earning years. Working fewer than 35 years means zeros are included in your calculation, reducing your benefit. Working longer can replace lower-earning years with higher-earning ones, potentially increasing your benefit.

Earnings Record

Higher lifetime earnings result in higher benefits, up to the annual maximum taxable earnings limit ($176,100 in 2025). Checking your earnings record through your my Social Security account can help ensure accuracy.

Marital Status

Marriage, divorce, and widowhood can all affect your benefits. Spouses, ex-spouses (after marriages of at least 10 years), and surviving spouses may be eligible for benefits based on their partner’s earnings record.

Other Income

Working while receiving benefits before full retirement age can temporarily reduce your benefit amount. Additionally, up to 85% of your Social Security benefits may be taxable depending on your combined income.

Medicare Premiums

Medicare Part B premiums are typically deducted from Social Security benefits. Higher-income beneficiaries pay higher premiums, which can affect net benefit amounts.

Government Pensions

If you receive a pension from work not covered by Social Security (like certain government jobs), your benefits may be reduced through the Windfall Elimination Provision (WEP) or Government Pension Offset (GPO).

Calculate Your Personalized Benefit Estimate

Our calculator takes these factors into account to provide you with an accurate benefit estimate.

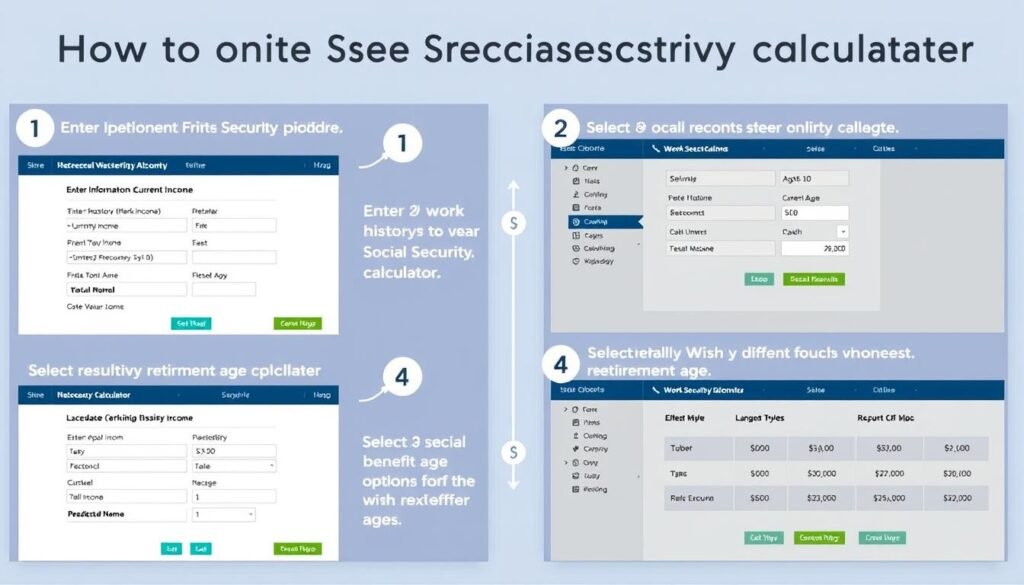

How to Use Our Social Security Calculator

Our Social Security calculator is designed to be user-friendly while providing accurate benefit estimates. Follow these simple steps to calculate your potential Social Security benefits:

Pro Tip: For the most accurate results, create a my Social Security account to access your actual earnings history. You can then enter this information into our calculator for a more precise benefit estimate.

Ready to Calculate Your Benefits?

Try our easy-to-use calculator to get a personalized estimate of your Social Security benefits.

Strategies to Maximize Your Social Security Benefits

Making informed decisions about Social Security can significantly impact your retirement income. Here are proven strategies to help you maximize your benefits:

Delay Claiming Benefits

For each year you delay claiming beyond your full retirement age (up to age 70), your benefit increases by approximately 8%. This can result in a significantly higher monthly benefit for the rest of your life.

Work for at Least 35 Years

Since benefits are calculated based on your 35 highest-earning years, working for at least that long ensures you don’t have zeros averaged into your calculation. Working longer can also replace lower-earning years with higher-earning ones.

Maximize Your Earnings

Higher lifetime earnings result in higher benefits. Consider ways to increase your income through career advancement, additional training, or side jobs to boost your future Social Security benefits.

Coordinate Spousal Benefits

Married couples can coordinate their claiming strategies. Often, it makes sense for the higher earner to delay claiming as long as possible, especially if they’re the older spouse, while the lower earner claims earlier.

Consider Ex-Spouse Benefits

If you were married for at least 10 years, you might be eligible for benefits based on your ex-spouse’s record without affecting their benefits. This can be claimed even if your ex has remarried.

Minimize Taxation

Up to 85% of your Social Security benefits may be taxable depending on your combined income. Strategic withdrawal planning from other retirement accounts can help minimize the taxation of your benefits.

“The decision about when to claim Social Security is one of the most important financial choices you’ll make. For many retirees, delaying benefits can provide valuable insurance against outliving their savings.”

See How These Strategies Affect Your Benefits

Use our calculator to explore different scenarios and find the optimal strategy for your situation.

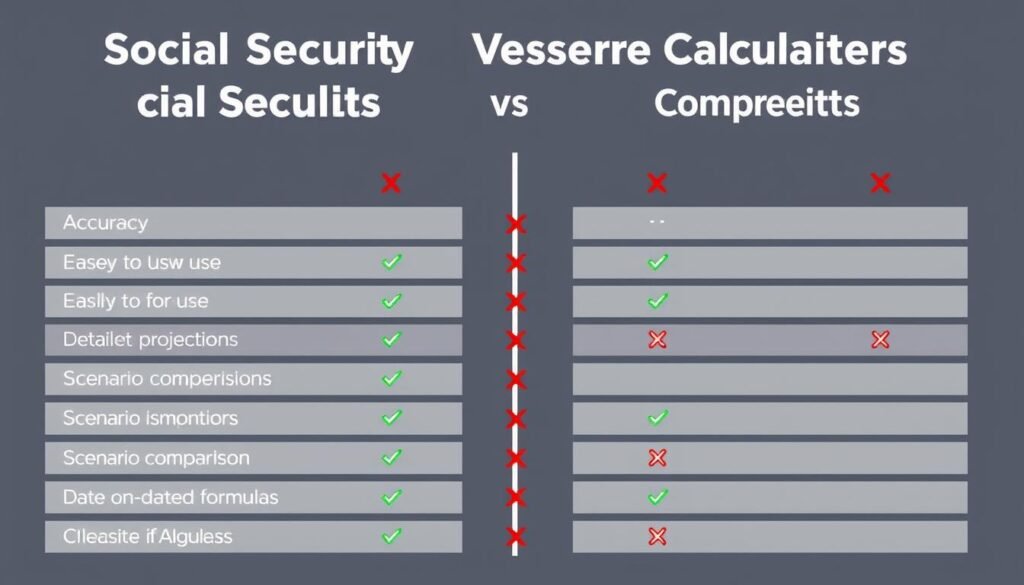

Why Choose Our Social Security Calculator

With many Social Security calculators available online, it’s important to choose one that provides accurate, comprehensive information. Here’s how our calculator compares to others:

CalculatorHunt Advantages

- Uses the latest Social Security Administration formulas for accurate calculations

- Allows detailed input of your earnings history for more precise estimates

- Shows benefit estimates at multiple claiming ages for easy comparison

- Calculates lifetime benefit totals to help you understand the long-term impact

- Includes spousal benefit calculations for married couples

- Regularly updated to reflect changes in Social Security rules and COLA adjustments

- Provides educational content to help you understand your results

Limitations of Other Calculators

- Often use outdated formulas, leading to inaccurate estimates

- Many require creating accounts or providing personal information

- Typically only show benefits at a few claiming ages

- Rarely include lifetime benefit projections

- Few account for spousal benefits or survivor benefits

- Many don’t explain the calculations or provide context for results

- Some are designed to sell financial products rather than provide objective information

Experience the Difference

Try our comprehensive Social Security calculator and see why users rate it so highly.

Frequently Asked Questions About Social Security

When should I start taking Social Security benefits?

The optimal time to claim Social Security benefits depends on your individual circumstances. If you claim at the earliest age (62), your monthly benefit will be permanently reduced by up to 30%. If you wait until your full retirement age (66-67 depending on birth year), you’ll receive your full benefit amount. Delaying beyond full retirement age increases your benefit by approximately 8% per year until age 70.

Consider factors such as your health, life expectancy, financial needs, marital status, and other retirement income sources when deciding. Our Social Security calculator can help you compare different claiming scenarios to find the optimal strategy for your situation.

How are Social Security benefits taxed?

Up to 85% of your Social Security benefits may be subject to federal income tax, depending on your “combined income.” Combined income is calculated as your adjusted gross income (AGI) plus any non-taxable interest plus half of your Social Security benefits.

For individuals with combined income between ,000 and ,000, up to 50% of benefits may be taxable. Above ,000, up to 85% may be taxable. For married couples filing jointly, the thresholds are ,000 and ,000 respectively. Some states also tax Social Security benefits, while others exempt them.

Can I work while receiving Social Security benefits?

Yes, you can work while receiving Social Security benefits, but there are some considerations. If you’ve reached your full retirement age, you can work and earn as much as you want without any reduction in benefits.

However, if you’re under full retirement age and receiving benefits, there are earnings limits. In 2025, if you’re under full retirement age for the entire year,

Frequently Asked Questions About Social Security

When should I start taking Social Security benefits?

The optimal time to claim Social Security benefits depends on your individual circumstances. If you claim at the earliest age (62), your monthly benefit will be permanently reduced by up to 30%. If you wait until your full retirement age (66-67 depending on birth year), you’ll receive your full benefit amount. Delaying beyond full retirement age increases your benefit by approximately 8% per year until age 70.

Consider factors such as your health, life expectancy, financial needs, marital status, and other retirement income sources when deciding. Our Social Security calculator can help you compare different claiming scenarios to find the optimal strategy for your situation.

How are Social Security benefits taxed?

Up to 85% of your Social Security benefits may be subject to federal income tax, depending on your “combined income.” Combined income is calculated as your adjusted gross income (AGI) plus any non-taxable interest plus half of your Social Security benefits.

For individuals with combined income between $25,000 and $34,000, up to 50% of benefits may be taxable. Above $34,000, up to 85% may be taxable. For married couples filing jointly, the thresholds are $32,000 and $44,000 respectively. Some states also tax Social Security benefits, while others exempt them.

Can I work while receiving Social Security benefits?

Yes, you can work while receiving Social Security benefits, but there are some considerations. If you’ve reached your full retirement age, you can work and earn as much as you want without any reduction in benefits.

However, if you’re under full retirement age and receiving benefits, there are earnings limits. In 2025, if you’re under full retirement age for the entire year, $1 in benefits will be deducted for every $2 you earn above $22,320. In the year you reach full retirement age, $1 in benefits will be deducted for every $3 you earn above $59,520 (this only applies to earnings before the month you reach full retirement age).

Any benefits withheld due to excess earnings aren’t lost permanently. Once you reach full retirement age, your benefit will be recalculated to give you credit for the months your benefits were reduced or withheld.

How does marriage affect Social Security benefits?

Marriage can significantly impact your Social Security benefits in several ways:

- Spousal benefits: You may be eligible to receive up to 50% of your spouse’s full retirement benefit if it’s higher than your own benefit. You must be at least 62 years old and your spouse must have filed for their own benefits.

- Survivor benefits: If your spouse passes away, you may be eligible for survivor benefits, which can be up to 100% of your deceased spouse’s benefit. You must be at least 60 years old (or 50 if disabled) or caring for a child under 16.

- Ex-spouse benefits: If you were married for at least 10 years, you might be eligible for benefits based on your ex-spouse’s record, even if they’ve remarried. You must be unmarried and at least 62 years old.

Our calculator can help married couples coordinate their claiming strategies to maximize their combined lifetime benefits.

Will Social Security run out of money?

According to the 2025 Social Security Trustees Report, the Old-Age and Survivors Insurance (OASI) Trust Fund is projected to be depleted by 2033. However, this doesn’t mean Social Security will “run out of money” entirely.

Even if the trust funds are depleted, ongoing payroll tax revenue would still cover about 77% of scheduled benefits. This means that without legislative changes, beneficiaries might receive reduced benefits after 2033, but not zero benefits.

Congress has many options to address this funding gap, including increasing the payroll tax rate, raising or eliminating the cap on taxable earnings, adjusting the benefit formula, or raising the full retirement age. Historically, Congress has acted to preserve Social Security benefits, and many experts expect similar action before 2033.

in benefits will be deducted for every you earn above ,320. In the year you reach full retirement age,

Frequently Asked Questions About Social Security

When should I start taking Social Security benefits?

The optimal time to claim Social Security benefits depends on your individual circumstances. If you claim at the earliest age (62), your monthly benefit will be permanently reduced by up to 30%. If you wait until your full retirement age (66-67 depending on birth year), you’ll receive your full benefit amount. Delaying beyond full retirement age increases your benefit by approximately 8% per year until age 70.

Consider factors such as your health, life expectancy, financial needs, marital status, and other retirement income sources when deciding. Our Social Security calculator can help you compare different claiming scenarios to find the optimal strategy for your situation.

How are Social Security benefits taxed?

Up to 85% of your Social Security benefits may be subject to federal income tax, depending on your “combined income.” Combined income is calculated as your adjusted gross income (AGI) plus any non-taxable interest plus half of your Social Security benefits.

For individuals with combined income between $25,000 and $34,000, up to 50% of benefits may be taxable. Above $34,000, up to 85% may be taxable. For married couples filing jointly, the thresholds are $32,000 and $44,000 respectively. Some states also tax Social Security benefits, while others exempt them.

Can I work while receiving Social Security benefits?

Yes, you can work while receiving Social Security benefits, but there are some considerations. If you’ve reached your full retirement age, you can work and earn as much as you want without any reduction in benefits.

However, if you’re under full retirement age and receiving benefits, there are earnings limits. In 2025, if you’re under full retirement age for the entire year, $1 in benefits will be deducted for every $2 you earn above $22,320. In the year you reach full retirement age, $1 in benefits will be deducted for every $3 you earn above $59,520 (this only applies to earnings before the month you reach full retirement age).

Any benefits withheld due to excess earnings aren’t lost permanently. Once you reach full retirement age, your benefit will be recalculated to give you credit for the months your benefits were reduced or withheld.

How does marriage affect Social Security benefits?

Marriage can significantly impact your Social Security benefits in several ways:

- Spousal benefits: You may be eligible to receive up to 50% of your spouse’s full retirement benefit if it’s higher than your own benefit. You must be at least 62 years old and your spouse must have filed for their own benefits.

- Survivor benefits: If your spouse passes away, you may be eligible for survivor benefits, which can be up to 100% of your deceased spouse’s benefit. You must be at least 60 years old (or 50 if disabled) or caring for a child under 16.

- Ex-spouse benefits: If you were married for at least 10 years, you might be eligible for benefits based on your ex-spouse’s record, even if they’ve remarried. You must be unmarried and at least 62 years old.

Our calculator can help married couples coordinate their claiming strategies to maximize their combined lifetime benefits.

Will Social Security run out of money?

According to the 2025 Social Security Trustees Report, the Old-Age and Survivors Insurance (OASI) Trust Fund is projected to be depleted by 2033. However, this doesn’t mean Social Security will “run out of money” entirely.

Even if the trust funds are depleted, ongoing payroll tax revenue would still cover about 77% of scheduled benefits. This means that without legislative changes, beneficiaries might receive reduced benefits after 2033, but not zero benefits.

Congress has many options to address this funding gap, including increasing the payroll tax rate, raising or eliminating the cap on taxable earnings, adjusting the benefit formula, or raising the full retirement age. Historically, Congress has acted to preserve Social Security benefits, and many experts expect similar action before 2033.

in benefits will be deducted for every you earn above ,520 (this only applies to earnings before the month you reach full retirement age).

Any benefits withheld due to excess earnings aren’t lost permanently. Once you reach full retirement age, your benefit will be recalculated to give you credit for the months your benefits were reduced or withheld.

How does marriage affect Social Security benefits?

Marriage can significantly impact your Social Security benefits in several ways:

- Spousal benefits: You may be eligible to receive up to 50% of your spouse’s full retirement benefit if it’s higher than your own benefit. You must be at least 62 years old and your spouse must have filed for their own benefits.

- Survivor benefits: If your spouse passes away, you may be eligible for survivor benefits, which can be up to 100% of your deceased spouse’s benefit. You must be at least 60 years old (or 50 if disabled) or caring for a child under 16.

- Ex-spouse benefits: If you were married for at least 10 years, you might be eligible for benefits based on your ex-spouse’s record, even if they’ve remarried. You must be unmarried and at least 62 years old.

Our calculator can help married couples coordinate their claiming strategies to maximize their combined lifetime benefits.

Will Social Security run out of money?

According to the 2025 Social Security Trustees Report, the Old-Age and Survivors Insurance (OASI) Trust Fund is projected to be depleted by 2033. However, this doesn’t mean Social Security will “run out of money” entirely.

Even if the trust funds are depleted, ongoing payroll tax revenue would still cover about 77% of scheduled benefits. This means that without legislative changes, beneficiaries might receive reduced benefits after 2033, but not zero benefits.

Congress has many options to address this funding gap, including increasing the payroll tax rate, raising or eliminating the cap on taxable earnings, adjusting the benefit formula, or raising the full retirement age. Historically, Congress has acted to preserve Social Security benefits, and many experts expect similar action before 2033.

Plan Your Retirement with Confidence

Understanding your Social Security benefits is a crucial part of retirement planning. By using our comprehensive Social Security calculator, you can make informed decisions about when to claim benefits and how to coordinate them with your other retirement income sources.

Remember that Social Security was never intended to be your sole source of retirement income. For most retirees, it replaces only about 40% of pre-retirement income. By combining Social Security with personal savings, pensions, and other income sources, you can build a more secure financial future.

Start Planning Your Social Security Strategy Today

Use our calculator to estimate your benefits and explore different claiming scenarios.

Note: While our calculator provides accurate estimates based on current Social Security rules and formulas, it’s always a good idea to verify your benefit amount with the Social Security Administration before making final decisions. You can create a my Social Security account to view your personalized benefit estimates directly from the SSA.