Use our Inflation Calculator to see how prices change over time. Plan your finances, understand cost-of-living increases, and protect your purchasing power.

Inflation steadily erodes the purchasing power of your money over time. Our inflation calculator helps you understand exactly how much your dollars are worth today compared to any year from 1913 to the present. By using official Consumer Price Index (CPI) data from the Bureau of Labor Statistics, you can make more informed financial decisions about saving, investing, and planning for the future.

Inflation Calculator Tool

Calculate how the purchasing power of the US dollar has changed over time. Enter an amount and select the years to compare.

What is Inflation?

Inflation is defined as the general increase in prices of goods and services over time, resulting in a decrease in the purchasing power of money. When inflation occurs, each dollar buys fewer goods and services than before. The opposite of inflation is deflation, which is a general decrease in prices.

How Inflation Affects You

Inflation directly impacts your daily life by affecting how much you can buy with your money. If your income doesn’t increase at the same rate as inflation, your purchasing power decreases over time. This is particularly important for long-term financial planning, such as retirement savings, where the effects of inflation compound over decades.

If inflation averages 3% annually, the purchasing power of your money will be cut in half in about 24 years.

Why Inflation Occurs

Several factors can cause inflation in an economy:

- Demand-Pull Inflation: Occurs when demand for goods and services exceeds supply, allowing sellers to raise prices. This often happens during economic booms when consumer spending increases rapidly.

- Cost-Push Inflation: Happens when production costs increase, forcing businesses to raise prices to maintain profit margins. Rising oil prices or increased labor costs are common triggers.

- Built-In Inflation: Results from the expectation that inflation will continue, leading workers to demand higher wages and businesses to raise prices in anticipation.

- Monetary Inflation: Caused by an increase in the money supply without a corresponding increase in economic output, effectively devaluing the currency.

How Inflation is Calculated

The most common measure of inflation in the United States is the Consumer Price Index (CPI), published monthly by the Bureau of Labor Statistics. The CPI tracks the average change in prices paid by urban consumers for a basket of goods and services over time.

The Inflation Rate Formula

To calculate the inflation rate between two periods, use this formula:

Inflation Rate = ((CPI in Later Year – CPI in Earlier Year) / CPI in Earlier Year) × 100%

For example, to calculate inflation from January 2020 (CPI: 257.971) to January 2023 (CPI: 299.170):

- Calculate the difference: 299.170 – 257.971 = 41.199

- Divide by the earlier CPI: 41.199 ÷ 257.971 = 0.1598

- Multiply by 100: 0.1598 × 100 = 15.98%

Therefore, the cumulative inflation rate for this period was approximately 15.98%.

Understanding the Consumer Price Index (CPI)

The CPI is calculated by tracking the prices of a representative basket of goods and services purchased by urban consumers. This basket includes:

Housing (33%)

Rent, mortgage payments, utilities, and household furnishings

Transportation (17%)

Vehicle purchases, fuel, public transportation, and maintenance

Food & Beverages (15%)

Groceries, restaurant meals, and alcoholic beverages

Medical Care (9%)

Healthcare services, prescription drugs, and medical supplies

Education (7%)

Tuition, textbooks, and childcare services

Other (19%)

Clothing, entertainment, personal care, and miscellaneous goods

Explore Our Other Financial Calculators

Make smarter financial decisions with our suite of easy-to-use calculators

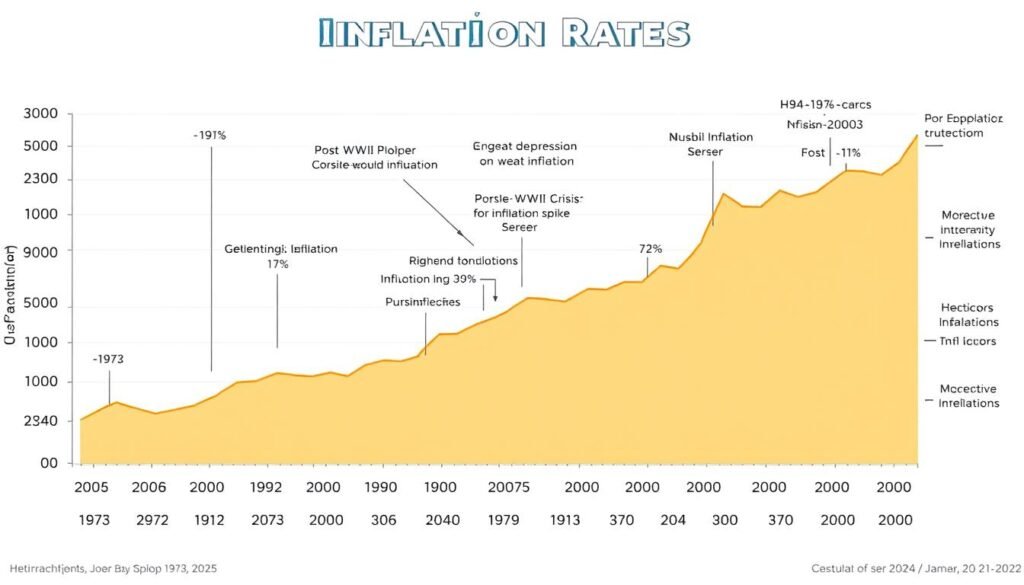

Historical Inflation Rates

Understanding historical inflation patterns can provide valuable context for financial planning. The United States has experienced varying levels of inflation throughout its history, with notable periods of high inflation and even deflation.

Notable Inflation Periods in U.S. History

| Period | Average Inflation | Key Causes | Economic Impact |

| Great Depression (1929-1933) | -5.1% (Deflation) | Stock market crash, banking crisis, reduced money supply | Severe unemployment, reduced consumer spending, economic contraction |

| Post-WWII (1946-1948) | 14.4% | Pent-up consumer demand, transition from wartime economy | Rapid economic growth, housing boom, increased consumer spending |

| Oil Crisis (1973-1981) | 9.2% | OPEC oil embargo, increased government spending, monetary policy | Stagflation, high unemployment, reduced purchasing power |

| Great Moderation (1983-2007) | 3.1% | Effective monetary policy, globalization, productivity gains | Stable economic growth, increased global trade, tech boom |

| Post-Pandemic (2021-2022) | 7.5% | Supply chain disruptions, stimulus spending, pent-up demand | Rising consumer prices, wage growth, housing market pressure |

Recent Monthly Inflation Rates (2024-2025)

The most recent inflation data from the Bureau of Labor Statistics shows the following year-over-year inflation rates:

- May 2025: 2.4% increase

- April 2025: 2.3% increase

- March 2025: 2.4% increase

- February 2025: 2.8% increase

- January 2025: 3.0% increase

- December 2024: 2.9% increase

- November 2024: 2.7% increase

- October 2024: 2.6% increase

- September 2024: 2.4% increase

- August 2024: 2.5% increase

- July 2024: 2.9% increase

- June 2024: 3.0% increase

Practical Examples of Inflation Calculations

Understanding how to apply inflation calculations to real-life scenarios can help you make better financial decisions. Here are some practical examples using our inflation calculator:

Example 1: Retirement Planning

If you need $50,000 per year for retirement expenses today, how much will you need in 30 years assuming an average inflation rate of 2.5%?

$50,000 today = $103,117 in 30 years

You’ll need more than double your current expenses to maintain the same lifestyle.

Example 2: Home Purchase Value

If your parents bought a house for $150,000 in 1990, what would be the equivalent purchase price today?

$150,000 in 1990 = $339,045 in 2025

This represents the inflation-adjusted price, not the actual market value which may be higher due to real estate appreciation.

Example 3: Salary Comparison

Is a $75,000 salary today better than a $50,000 salary in 2005?

$50,000 in 2005 = $75,750 in 2025

The $75,000 salary today is slightly less valuable in real terms than $50,000 was in 2005.

How Inflation Impacts Your Financial Life

Inflation affects various aspects of your financial life, from daily expenses to long-term investments. Understanding these impacts can help you make better financial decisions.

Who Benefits from Inflation

- Borrowers with fixed-rate loans – Your debt becomes cheaper in real terms as inflation rises

- Real estate owners – Property values typically rise with inflation

- Businesses that can easily raise prices – They can maintain profit margins

- Governments with large debts – Inflation reduces the real value of national debt

Who Is Hurt by Inflation

- People on fixed incomes – Purchasing power steadily declines

- Savers with low-interest accounts – Money loses value if interest rates are below inflation

- Lenders with fixed-rate loans – Repayments are worth less in real terms

- Workers whose wages don’t keep pace – Real income decreases over time

Inflation’s Effect on Different Asset Classes

| Asset Class | Typical Performance During Inflation | Historical Performance vs. Inflation (1913-2023) |

| Cash & Savings Accounts | Poor – Usually loses purchasing power | -1.5% real return (after inflation) |

| Bonds | Poor to Moderate – Fixed income becomes less valuable | 0.5% to 2% real return |

| Stocks | Moderate to Good – Companies can raise prices | 7% real return |

| Real Estate | Good – Hard asset that typically appreciates | 3.5% real return |

| Gold & Commodities | Good – Traditional inflation hedge | 1% real return (highly volatile) |

| TIPS (Treasury Inflation-Protected Securities) | Good – Specifically designed to counter inflation | 1-2% real return (since 1997 introduction) |

Strategies to Protect Against Inflation

While you can’t stop inflation, you can take steps to protect your financial future from its effects. Here are some effective strategies to consider:

Investment Strategies

- Diversify your portfolio – Spread investments across different asset classes that respond differently to inflation

- Invest in stocks – Companies can often raise prices during inflation, potentially maintaining real returns

- Consider real estate – Property values and rental income typically rise with inflation

- Explore TIPS (Treasury Inflation-Protected Securities) – Government bonds specifically designed to protect against inflation

- Look into I Bonds – Savings bonds that combine a fixed rate with an inflation-adjusted rate

Practical Financial Planning Tips

For Retirement Planning

- Calculate future expenses using inflation-adjusted figures

- Increase retirement contributions regularly

- Consider a retirement portfolio that can outpace inflation

- Don’t rely solely on fixed-income investments

For Homeowners & Borrowers

- Consider fixed-rate mortgages during low-rate periods

- Pay down variable-rate debt before inflation drives rates higher

- Invest in energy-efficient home improvements to reduce future costs

- Consider refinancing options when advantageous

For Income & Career

- Negotiate annual raises that at least match inflation

- Develop in-demand skills to increase earning potential

- Consider additional income streams

- Track your personal inflation rate based on your spending habits

Explore Our Retirement Planning Calculator

See how inflation will impact your retirement needs and create a personalized savings plan

Frequently Asked Questions About Inflation

What is a good inflation rate?

Most central banks, including the Federal Reserve in the United States, target an inflation rate of around 2% per year. This level is considered optimal because it’s high enough to prevent the economy from falling into deflation (which can lead to economic stagnation) but low enough to maintain price stability. A moderate, predictable inflation rate allows businesses and consumers to make long-term financial plans with confidence.

How does inflation affect my savings?

Inflation gradually erodes the purchasing power of your savings. If your money is earning interest at a rate lower than inflation, you’re effectively losing buying power over time. For example, if inflation is 3% but your savings account only pays 1% interest, your money is losing 2% of its real value each year. This is why financial advisors often recommend investing in assets that have historically outpaced inflation for long-term savings goals.

Is inflation always bad?

No, moderate inflation is actually considered beneficial for the economy. It encourages spending and investment rather than hoarding cash, which stimulates economic growth. Inflation also helps debtors by reducing the real value of their debt over time. However, high or unpredictable inflation can be harmful as it creates uncertainty, makes long-term planning difficult, and can lead to rapid price increases that outpace wage growth.

How accurate are inflation calculators?

Inflation calculators that use official Consumer Price Index (CPI) data from the Bureau of Labor Statistics are generally quite accurate for calculating average inflation effects. However, they may not perfectly reflect your personal experience with inflation because:

- The CPI basket of goods may not match your spending patterns

- Regional price differences aren’t captured in national averages

- Your lifestyle and consumption habits may change over time

For the most accurate personal assessment, consider tracking your major expenses over time to calculate your personal inflation rate.

What’s the difference between CPI and PCE inflation measures?

The Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) are the two main measures of inflation in the United States:

- CPI is calculated by the Bureau of Labor Statistics and measures the average change in prices paid by urban consumers for a basket of goods and services. It’s widely used for cost-of-living adjustments.

- PCE is calculated by the Bureau of Economic Analysis and measures price changes for all household spending. It accounts for substitution when prices change and has broader coverage than CPI.

The Federal Reserve prefers the PCE for policy decisions because it better reflects consumer behavior changes, while CPI is more commonly used for inflation adjustments in contracts and benefits.

Understanding Inflation for Better Financial Planning

Inflation is an economic reality that affects everyone’s financial life. By understanding how inflation works and using tools like our inflation calculator, you can make more informed decisions about saving, investing, and planning for the future. Remember that while inflation gradually erodes the purchasing power of cash, there are effective strategies to protect and even grow your wealth over time.

Use our inflation calculator regularly to check how your money’s value changes over time, and consider exploring our other financial calculators to build a comprehensive financial plan that accounts for inflation’s long-term effects.

Start Planning Your Financial Future Today

Use our suite of financial calculators to make informed decisions