Use our RMD Calculator to estimate your required minimum distributions from retirement accounts. Plan withdrawals and manage taxes efficiently.

Understanding and calculating your Required Minimum Distributions (RMDs) is crucial for retirement planning. Our RMD calculator helps you determine exactly how much you need to withdraw from your retirement accounts to meet IRS requirements and avoid substantial penalties. Whether you have a traditional IRA, 401(k), or other qualified retirement plans, this tool provides accurate calculations based on current IRS guidelines.

Calculate Your Required Minimum Distribution

Enter your retirement account information below to determine your required minimum distribution amount. Our calculator uses the latest IRS life expectancy tables and distribution rules.

Our RMD calculator provides accurate calculations based on current IRS guidelines

What Are Required Minimum Distributions (RMDs)?

Required Minimum Distributions (RMDs) are mandatory withdrawals that the IRS requires you to take from your tax-deferred retirement accounts once you reach a certain age. These withdrawals ensure that retirement savings that have grown tax-deferred for many years eventually become taxable income.

Why RMDs Exist

Tax-deferred retirement accounts like traditional IRAs and 401(k)s allow you to postpone paying taxes on contributions and earnings. The IRS created RMD rules to ensure these tax-deferred assets don’t remain untaxed indefinitely. By requiring withdrawals, the government can collect tax revenue that was deferred during your working years.

Who Needs to Take RMDs

If you own any tax-deferred retirement accounts such as traditional IRAs, 401(k)s, 403(b)s, 457 plans, or other qualified retirement plans, you’ll need to take RMDs once you reach the required age. The rules apply to account owners as well as beneficiaries who inherit retirement accounts.

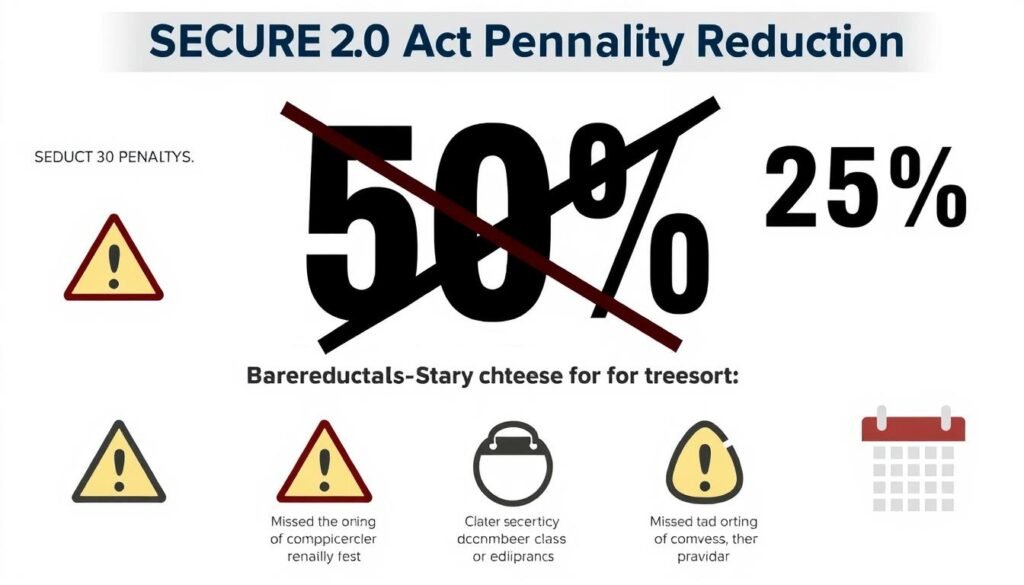

Important: Failing to take your RMD by the deadline can result in a significant excise tax penalty of 25% on the amount not withdrawn. This penalty was reduced from 50% under the SECURE 2.0 Act, but it remains substantial enough to warrant careful attention to RMD requirements.

Current RMD Rules and Age Requirements

The rules governing RMDs have changed in recent years due to legislation like the SECURE Act and SECURE 2.0 Act. Understanding the current requirements is essential for proper retirement planning.

| Birth Year | RMD Starting Age | First RMD Deadline |

| Before 1951 | 72 (or 70½ if reached before 2020) | April 1 of the year after turning 72 |

| 1951-1959 | 73 | April 1 of the year after turning 73 |

| 1960 and later | 75 | April 1 of the year after turning 75 |

Important RMD Deadlines

First RMD

For your first RMD, you have until April 1 of the year following the year you reach your required age (73 or 75, depending on your birth year). For example, if you turn 73 in 2023, you have until April 1, 2024, to take your first RMD.

Subsequent RMDs

For all subsequent years, you must take your RMD by December 31. If you delay your first RMD until April 1 of the following year, you’ll need to take two distributions in that calendar year, which could potentially push you into a higher tax bracket.

Tax Planning Consideration: Taking two RMDs in one year (your first and second RMDs) could significantly increase your taxable income for that year. Consider the tax implications before delaying your first RMD to April 1 of the following year.

How to Calculate Your Required Minimum Distribution

Calculating your RMD involves a simple formula, but it requires accurate information about your account balances and the correct life expectancy factor from IRS tables.

RMD = Account Balance (as of December 31 of the previous year) ÷ Life Expectancy Factor (from IRS tables)

Step-by-Step RMD Calculation Process

- Determine your account balance as of December 31 of the previous year for each applicable retirement account.

- Find your age on the IRS Uniform Lifetime Table (or the appropriate table for your situation).

- Identify the distribution period (life expectancy factor) that corresponds to your age.

- Divide your account balance by the distribution period to calculate your RMD.

- Repeat this process for each retirement account subject to RMDs, unless you’re consolidating IRA RMDs.

IRS Uniform Lifetime Table (2022 and Later)

The IRS updated its life expectancy tables effective January 1, 2022. Below is a portion of the Uniform Lifetime Table most commonly used for calculating RMDs:

| Age | Distribution Period | Age | Distribution Period |

| 72 | 27.4 | 85 | 16.0 |

| 73 | 26.5 | 90 | 12.2 |

| 75 | 24.6 | 95 | 8.9 |

| 80 | 20.2 | 100 | 6.3 |

Simplify Your RMD Calculations

Don’t risk miscalculations or penalties. Use our accurate RMD calculator to determine exactly how much you need to withdraw.

RMD Calculation Example

Let’s walk through a practical example to illustrate how RMD calculations work in real-life scenarios.

Example: John’s RMD Calculation

Scenario: John is 75 years old in 2023. He has a traditional IRA with a balance of $500,000 as of December 31, 2022.

Step 1: Identify John’s age (75) and find the corresponding distribution period from the IRS Uniform Lifetime Table. For age 75, the distribution period is 24.6.

Step 2: Calculate the RMD using the formula:

RMD = $500,000 ÷ 24.6 = $20,325.20

Result: John must withdraw at least $20,325.20 from his traditional IRA by December 31, 2023, to satisfy his RMD requirement.

Multiple Account Considerations

IRAs (Traditional, SEP, SIMPLE)

If you have multiple IRAs, you must calculate the RMD for each account separately. However, you can withdraw the total RMD amount from one IRA or any combination of your IRAs. This gives you flexibility in managing your withdrawals.

Employer Plans (401(k), 403(b), etc.)

For employer-sponsored retirement plans like 401(k)s, you must calculate and withdraw the RMD from each account separately. You cannot combine these RMDs or satisfy them from an IRA. The exception is for 403(b) plans, which follow rules similar to IRAs.

Types of Retirement Accounts Subject to RMDs

Not all retirement accounts are subject to RMD rules. Understanding which accounts require RMDs is essential for proper retirement planning.

- Traditional IRAs

- SEP IRAs

- SIMPLE IRAs

- Traditional 401(k) plans

- 403(b) plans

- 457(b) plans

- Profit-sharing plans

- Other defined contribution plans

Accounts Subject to RMDs

- Roth IRAs (during the owner’s lifetime)

- Roth 401(k)s (as of 2024, thanks to SECURE 2.0)

- Active employer plans if you’re still working and don’t own 5% or more of the company

Accounts Exempt from RMDs

Special Considerations for Inherited Accounts

Different rules apply to retirement accounts you inherit, including Roth IRAs which are otherwise exempt from RMDs during the original owner’s lifetime.

| Beneficiary Type | Inheritance Date | RMD Rules |

| Spouse | Any | Can treat as own, take RMDs based on own age, or use special spousal rules |

| Non-spouse eligible designated beneficiary | After 2019 | Can take distributions over life expectancy |

| Other designated beneficiaries | After 2019 | Must withdraw all assets within 10 years (10-year rule) |

| Any designated beneficiary | Before 2020 | Can take distributions over life expectancy |

Eligible Designated Beneficiaries include: Surviving spouses, minor children (until reaching majority), disabled individuals, chronically ill individuals, and individuals not more than 10 years younger than the account owner.

RMD Penalties and Tax Implications

Understanding the penalties for missing RMDs and the tax implications of these withdrawals is crucial for effective retirement planning.

Penalties for Missing RMDs

Current Penalty Structure

The SECURE 2.0 Act reduced the penalty for missed RMDs from 50% to 25% of the amount not taken. Additionally, if you correct the error by taking the missed RMD and filing the appropriate forms within a specified timeframe, the penalty may be further reduced to 10%.

Penalty Waiver

The IRS may waive the penalty if you can demonstrate that the shortfall was due to reasonable error and that you’re taking steps to remedy the situation. To request a waiver, you must file IRS Form 5329 and attach a letter of explanation.

Tax Implications of RMDs

Tax Planning Opportunities

- Qualified Charitable Distributions (QCDs) can satisfy RMDs without increasing taxable income

- Strategic timing of other income sources can minimize tax impact

- Roth conversions before RMD age can reduce future RMD amounts

Tax Challenges

- RMDs are generally taxed as ordinary income

- Large RMDs can push you into higher tax brackets

- May increase taxation of Social Security benefits

- Could trigger higher Medicare premiums (IRMAA)

Plan Your RMDs Strategically

Use our RMD calculator to determine your required withdrawals and plan your retirement income strategy accordingly.

Strategies to Manage RMDs Effectively

While RMDs are mandatory, there are several strategies you can employ to manage them more effectively and potentially reduce their tax impact.

Qualified Charitable Distributions (QCDs)

If you’re charitably inclined, consider making qualified charitable distributions directly from your IRA to eligible charities. QCDs can satisfy your RMD requirement without increasing your taxable income, up to $100,000 annually.

Roth Conversions

Consider converting traditional IRA assets to Roth IRAs before reaching RMD age. While you’ll pay taxes on the conversion amount, future growth will be tax-free, and Roth IRAs don’t require RMDs during your lifetime.

Strategic Withdrawal Planning

Plan your withdrawals strategically across different types of accounts (taxable, tax-deferred, and tax-free) to manage your tax bracket each year and potentially reduce the overall tax burden throughout retirement.

Additional RMD Management Strategies

Still Working Exception

If you’re still working beyond RMD age and don’t own more than 5% of the company, you may be able to delay RMDs from your current employer’s retirement plan until April 1 of the year following your retirement. This doesn’t apply to IRAs or plans from previous employers.

In-Kind Distributions

Instead of selling investments and taking cash, consider taking “in-kind” distributions of securities to satisfy your RMD. This allows you to maintain your investment positions while meeting RMD requirements, though the distributed assets will still be taxable.

“The key to managing RMDs effectively is to start planning well before you reach RMD age. This gives you more options and flexibility to implement tax-efficient strategies.”

Frequently Asked Questions About RMDs

Can I reinvest my RMD into another retirement account?

No, you cannot roll over or reinvest your RMD into another tax-deferred retirement account like an IRA or 401(k). However, after paying taxes on the distribution, you can invest the proceeds in a taxable brokerage account or other investment vehicles.

Do Roth IRAs require RMDs?

No, Roth IRAs do not require RMDs during the original owner’s lifetime. This is one of the significant advantages of Roth IRAs. However, beneficiaries who inherit Roth IRAs may be subject to RMD rules, depending on their relationship to the original owner and when the owner died.

Can I take more than my RMD amount?

Yes, you can withdraw more than your RMD amount. The RMD is simply the minimum amount you must withdraw; there’s no maximum limit. However, taking more than required may impact your tax situation and the longevity of your retirement savings.

What happens if I have multiple IRAs?

If you have multiple IRAs, you must calculate the RMD for each account separately. However, you can take the total RMD amount from one IRA or any combination of your IRAs. This gives you flexibility in managing which investments to liquidate.

How do RMDs affect my tax situation?

RMDs are generally taxed as ordinary income in the year you take them. Large RMDs can potentially push you into a higher tax bracket, increase the taxation of your Social Security benefits, and may lead to higher Medicare premiums through Income-Related Monthly Adjustment Amounts (IRMAA).

Have More Questions About RMDs?

Our comprehensive RMD calculator can help you determine your required withdrawals and plan accordingly.

Stay Compliant with RMD Requirements

Required Minimum Distributions are an important aspect of retirement planning that can’t be overlooked. Failing to take the correct amount can result in substantial penalties, while strategic planning around your RMDs can help optimize your tax situation and preserve your retirement savings.

Our RMD calculator provides an easy way to determine your required withdrawals based on current IRS guidelines. By staying informed about RMD rules and planning accordingly, you can ensure compliance while making the most of your retirement assets.

Calculate Your RMD Today

Use our free RMD calculator to determine your required minimum distributions and avoid penalties.