Use our Personal Loan Calculator to estimate monthly payments, interest, and total repayment. Plan your personal finances and manage loans effectively.

Planning to take out a personal loan? Understanding the true cost of borrowing is essential before signing any agreement. Our Personal Loan Calculator helps you estimate monthly payments, total interest costs, and visualize your complete repayment schedule. Whether you’re consolidating debt, financing a major purchase, or covering unexpected expenses, this calculator provides the clarity you need to make informed financial decisions.

What is a Personal Loan Calculator?

A personal loan calculator is a financial tool that helps you determine how much your monthly payments will be based on the loan amount, interest rate, and repayment term. It also calculates the total amount you’ll pay over the life of the loan, including both principal and interest.

Unlike basic calculators, a personal loan calculator factors in compound interest and provides an amortization schedule showing how each payment is divided between principal and interest. This gives you a complete picture of your loan costs and helps you determine if the loan fits your budget.

Ready to Calculate Your Loan Payments?

Use our free calculator to get instant estimates and make informed borrowing decisions.

How to Use Our Personal Loan Calculator

Getting accurate estimates with our calculator is simple. Just follow these steps to determine your potential loan payments and total costs:

- Enter your desired loan amount (between $1,000 and $100,000)

- Input the annual interest rate offered by your lender

- Select your loan term (typically 1-7 years for personal loans)

- Add any origination fees if applicable (usually 0-10% of the loan amount)

- Click “Calculate” to see your results instantly

Understanding the Input Fields

Loan Amount: This is the principal amount you plan to borrow. For personal loans, this typically ranges from $1,000 to $100,000, depending on your credit score, income, and the lender’s policies.

Interest Rate: The annual percentage rate (APR) charged by the lender. Personal loan interest rates generally range from 6% to 36%, with your credit score being the primary factor determining your rate.

Loan Term: The time period over which you’ll repay the loan, usually expressed in months or years. Most personal loans have terms between 12 and 84 months (1-7 years).

Origination Fee: An upfront fee some lenders charge for processing the loan, typically ranging from 1% to 10% of the loan amount. This fee is usually deducted from the loan proceeds.

How to Interpret Your Personal Loan Calculator Results

After entering your loan details, our calculator provides several key pieces of information to help you understand the full cost of your loan:

Monthly Payment

The fixed amount you’ll pay each month for the duration of your loan. This includes both principal and interest portions.

Total Principal

The original amount borrowed, which matches your loan amount input. This is the base amount you’re obligated to repay.

Total Interest

The total amount of interest you’ll pay over the life of the loan. This represents the cost of borrowing the principal amount.

Total Loan Payments

The combined total of principal and interest payments over the entire loan term. This shows the full cost of the loan.

Payoff Date

The date when your loan will be fully paid off, assuming you make all scheduled payments on time.

Amortization Schedule

A detailed breakdown showing how each payment is split between principal and interest throughout the loan term.

In the early stages of your loan, a larger portion of each payment goes toward interest. As you continue making payments, more of each payment is applied to the principal balance. This is known as amortization.

Compare Personal Loan Offers

Ready to find the best personal loan rates? Check offers from multiple lenders with no impact on your credit score.

Key Components of a Personal Loan

Understanding the fundamental elements of personal loans helps you make better borrowing decisions. Here’s a breakdown of the key components that affect your loan costs:

Principal Amount

The principal is the original sum of money borrowed in a loan. It’s the base amount upon which interest is calculated. When choosing a loan amount, consider borrowing only what you need to minimize interest costs. Lenders determine maximum loan amounts based on your credit score, income, existing debt, and other financial factors.

Interest Rates: Fixed vs. Variable

Fixed Interest Rates

Fixed rates remain constant throughout the loan term, providing predictable monthly payments. Most personal loans come with fixed rates, making budgeting easier since your payment never changes.

Variable Interest Rates

Variable rates can fluctuate over time based on market indices. While they often start lower than fixed rates, they carry the risk of increasing over time, potentially raising your monthly payment.

| Interest Rate Type | Advantages | Disadvantages | Best For |

| Fixed Rate | Predictable payments, Protection from rate increases | Typically higher initial rates, No benefit if market rates drop | Long-term loans, Risk-averse borrowers, Fixed budget planning |

| Variable Rate | Lower initial rates, Potential savings if rates drop | Unpredictable payments, Risk of significant payment increases | Short-term loans, Financial flexibility, Potential early payoff |

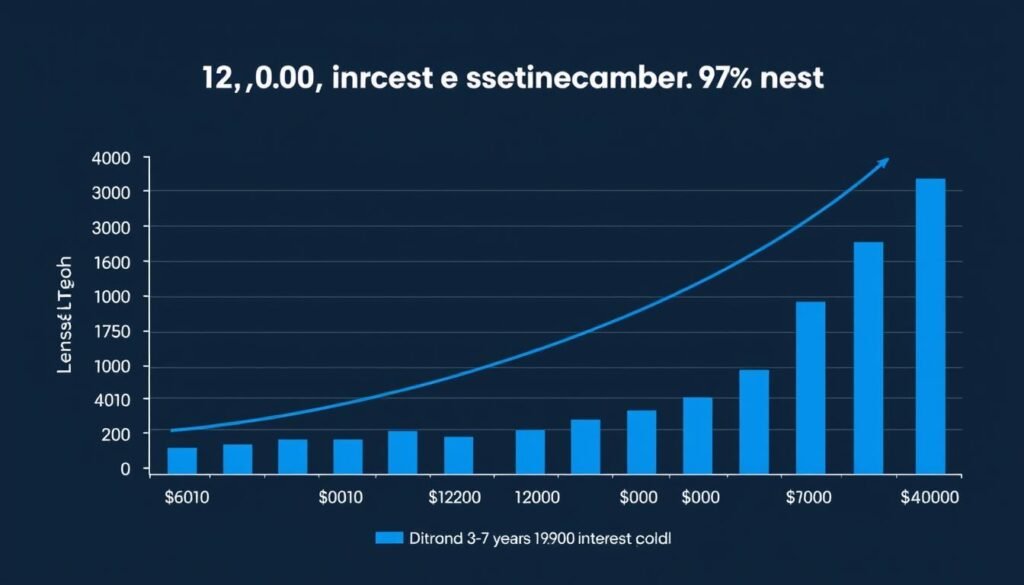

Loan Term

The loan term is the length of time you have to repay the loan in full. Personal loan terms typically range from 12 to 84 months (1-7 years). The term you choose significantly impacts both your monthly payment and the total interest paid:

Shorter Loan Terms

- Higher monthly payments

- Less total interest paid

- Faster debt freedom

- Often come with lower interest rates

Longer Loan Terms

- Lower monthly payments

- More total interest paid

- Longer debt obligation

- Usually have higher interest rates

Personal Loan Calculation Examples

Let’s look at some real-world examples to understand how different loan parameters affect your payments and total costs:

Example 1: Impact of Loan Amount

| Loan Amount | Interest Rate | Term | Monthly Payment | Total Interest |

| $5,000 | 10% | 3 years | $161.34 | $808.24 |

| $10,000 | 10% | 3 years | $322.67 | $1,616.12 |

| $20,000 | 10% | 3 years | $645.34 | $3,232.24 |

Example 2: Impact of Interest Rate

| Loan Amount | Interest Rate | Term | Monthly Payment | Total Interest |

| $15,000 | 7% | 5 years | $297.46 | $2,847.60 |

| $15,000 | 10% | 5 years | $318.71 | $4,122.60 |

| $15,000 | 15% | 5 years | $356.56 | $6,393.60 |

Example 3: Impact of Loan Term

| Loan Amount | Interest Rate | Term | Monthly Payment | Total Interest |

| $12,000 | 9% | 3 years | $381.49 | $1,733.64 |

| $12,000 | 9% | 5 years | $248.99 | $2,939.40 |

| $12,000 | 9% | 7 years | $192.98 | $4,210.32 |

As these examples demonstrate, even small changes in interest rate or loan term can significantly impact your total cost of borrowing. Using a personal loan calculator before committing to a loan helps you understand these trade-offs and choose the option that best fits your financial situation.

Advantages of Using a Personal Loan Calculator

A personal loan calculator is more than just a convenient tool—it’s an essential resource for making informed financial decisions. Here’s how it can benefit you:

Budget Planning

Determine if monthly payments fit within your budget before applying for a loan. This helps prevent overextending yourself financially.

Compare Loan Options

Easily compare different loan amounts, interest rates, and terms to find the most cost-effective borrowing option for your needs.

Visualize Repayment

See exactly how your payments are applied to principal and interest over time through the amortization schedule.

Avoid Surprises

Understand the total cost of borrowing upfront, including all interest payments and potential fees, preventing unexpected expenses.

Negotiate Better Terms

Armed with calculations, you can negotiate more effectively with lenders by understanding exactly how different terms affect your costs.

Plan Early Payoff

Calculate potential savings from making extra payments or paying off your loan early to reduce interest costs.

Common Mistakes to Avoid When Using a Personal Loan Calculator

While personal loan calculators are powerful tools, they’re only as accurate as the information you input. Here are some common mistakes to avoid:

Calculation Errors

- Entering the wrong interest rate (using monthly rate instead of annual)

- Forgetting to include origination fees in your total cost analysis

- Overlooking prepayment penalties when planning early payoff

- Using the wrong loan term (months vs. years)

- Not accounting for all fees in APR calculations

Planning Mistakes

- Focusing only on monthly payment, not total interest cost

- Not comparing multiple loan scenarios before deciding

- Choosing the longest term to minimize payments without considering total cost

- Borrowing the maximum amount offered rather than what you need

- Not checking if your budget can handle the calculated payment

Best Practices

- Double-check all input values for accuracy

- Include all fees when comparing loan options

- Consider both monthly payment and total interest cost

- Calculate the impact of making extra payments

- Use the amortization schedule to understand payment breakdown

Remember that calculator results are estimates based on the information provided. Actual loan terms may vary based on your credit score, income, and the lender’s specific policies. Always review the final loan agreement carefully before signing.

Comparing Personal Loans with Other Loan Types

Personal loans are just one of many borrowing options available. Understanding how they compare to other loan types can help you choose the right financial product for your needs:

| Loan Type | Typical Use | Interest Rate Range | Secured/Unsecured | Term Length |

| Personal Loan | Debt consolidation, major purchases, emergencies | 6% – 36% | Usually unsecured | 1-7 years |

| Mortgage | Home purchase or refinance | 3% – 7% | Secured by property | 15-30 years |

| Auto Loan | Vehicle purchase | 3% – 10% | Secured by vehicle | 3-7 years |

| Credit Card | Everyday purchases, small emergencies | 14% – 24% | Unsecured | Revolving |

| Student Loan | Education expenses | 3% – 13% | Unsecured | 10-25 years |

While personal loans typically have higher interest rates than secured loans like mortgages or auto loans, they offer flexibility in how you use the funds and don’t require collateral. Compared to credit cards, personal loans usually have lower interest rates and fixed repayment terms, making them a better option for larger expenses.

When deciding between loan types, consider factors beyond just the interest rate, such as:

- Loan purpose and restrictions on fund usage

- Whether you have valuable assets to use as collateral

- Your desired repayment timeline

- Application requirements and approval time

- Fees and penalties associated with each loan type

Our Mortgage Calculator, Auto Loan Calculator, and Credit Card Calculator can help you compare different borrowing options based on your specific needs.

Making Informed Borrowing Decisions

Using a personal loan calculator is just one step in the process of making smart borrowing decisions. Here are additional factors to consider when evaluating personal loan options:

Assessing Your Financial Situation

Debt-to-Income Ratio

Calculate your debt-to-income (DTI) ratio by dividing your monthly debt payments by your gross monthly income. Most lenders prefer a DTI ratio below 36%. Adding a new loan payment should not push this ratio too high.

Emergency Fund

Ensure you have adequate emergency savings (3-6 months of expenses) before taking on new debt. This provides a financial buffer if unexpected expenses arise during your loan repayment period.

Evaluating Loan Offers

- Compare APRs, not just interest rates. The Annual Percentage Rate includes both interest and fees, providing a more accurate picture of total loan cost.

- Read the fine print. Check for prepayment penalties, late payment fees, and other potential charges that could increase your costs.

- Consider the reputation of the lender. Research customer reviews and complaints to ensure you’re working with a reputable financial institution.

- Look beyond the monthly payment. A low monthly payment with a long term may seem attractive but will cost more in total interest.

- Pre-qualify when possible. Many lenders offer pre-qualification with a soft credit check, allowing you to see potential rates without affecting your credit score.

Tips for Choosing the Best Personal Loan

Match Term to Purpose

Choose a loan term that aligns with the lifespan of what you’re financing. For example, a shorter term for debt consolidation and a moderate term for home improvements.

Improve Your Credit First

If your credit score is borderline, consider taking a few months to improve it before applying. Even a small increase can qualify you for significantly better rates.

Consider Total Cost

Focus on the total amount you’ll pay over the life of the loan, not just the monthly payment. This helps you understand the true cost of borrowing.

Ready to Find Your Best Personal Loan?

Use our calculator to determine affordable payment options, then compare personalized rates from top lenders.

Frequently Asked Questions About Personal Loan Calculators

How accurate are personal loan calculators?

Personal loan calculators provide estimates based on the information you input. They’re generally quite accurate for calculating monthly payments and total interest costs when you have the exact interest rate, loan amount, and term. However, they may not account for all fees or specific lender policies. Always verify the final terms with your lender before accepting a loan.

Can I use a personal loan calculator to determine how much I can afford to borrow?

Yes, you can use our calculator to test different loan amounts and see the resulting monthly payments. Financial experts recommend that your total debt payments (including your new loan) should not exceed 36% of your gross monthly income. Start with a loan amount and adjust it until the monthly payment fits comfortably within your budget.

How do origination fees affect my loan calculations?

Origination fees typically range from 1% to 10% of the loan amount and are deducted from your loan proceeds. For example, if you borrow ,000 with a 5% origination fee, you’ll only receive ,500, but you’ll still pay interest on the full ,000. Our calculator can account for origination fees to show you the true cost of borrowing and the actual funds you’ll receive.

How can I use the amortization schedule?

The amortization schedule shows how each payment is divided between principal and interest over the life of your loan. This is useful for understanding how your loan balance decreases over time and for planning potential early payoff strategies. It also helps you see how much interest you’ll pay in the early years of the loan compared to later years.

Will using a personal loan calculator affect my credit score?

No, using our personal loan calculator has no impact on your credit score. It’s simply a calculation tool that doesn’t require any personal identifying information. Your credit score is only affected when you formally apply for a loan and the lender performs a hard credit inquiry (though some lenders offer pre-qualification with only a soft inquiry, which doesn’t affect your score).

Take Control of Your Borrowing Decisions

A personal loan calculator is an invaluable tool for understanding the true cost of borrowing and making informed financial decisions. By providing clear insights into monthly payments, total interest costs, and amortization schedules, our calculator helps you find the loan terms that best fit your budget and financial goals.

Remember that the most affordable loan isn’t always the one with the lowest monthly payment. Consider the total cost over the life of the loan, including both interest and fees. Use our calculator to compare different scenarios before committing to a loan, and always read the fine print of any loan agreement.

Whether you’re consolidating debt, financing a major purchase, or covering unexpected expenses, CalculatorHunt’s Personal Loan Calculator gives you the information you need to borrow with confidence.

Start Calculating Your Personal Loan Options Today

Make smarter borrowing decisions with our free, easy-to-use calculator tools.