Use our Simple Interest Calculator to estimate interest earned or owed on loans and investments. Plan finances and track interest accurately and easily.

Our simple interest calculator helps you quickly determine the interest earned or paid on loans, investments, and savings accounts. Whether you’re a student learning financial concepts, an investor planning your strategy, or someone managing personal finances, this calculator provides accurate results with just a few inputs. Understand how interest accumulates over time and make informed financial decisions with our easy-to-use tool.

What is Simple Interest?

Simple interest is the most basic form of interest calculation where interest is computed only on the initial principal amount. Unlike compound interest, simple interest does not account for previously earned interest in future calculations.

When you borrow or lend money, interest represents either the cost you pay to use someone else’s money or the compensation you receive for allowing others to use your money. Simple interest is straightforward because it’s calculated solely on the original principal amount for the entire duration of the loan or investment.

For example, if you deposit $1,000 in a savings account with a 5% simple interest rate, you’ll earn $50 in interest each year, regardless of how long you keep the money in the account. The interest doesn’t compound or grow based on previous interest earnings.

Key Point: With simple interest, the interest amount remains constant for each time period because it’s always calculated on the original principal only.

Simple Interest Formula

The formula for calculating simple interest is straightforward and easy to remember:

I = P × r × t

Where:

- I = Interest amount

- P = Principal (the initial amount of money)

- r = Interest rate (in decimal form, e.g., 5% = 0.05)

- t = Time period (usually in years)

To find the total amount (principal plus interest), use this formula:

A = P(1 + rt)

Where:

- A = Total amount (principal + interest)

- P = Principal

- r = Interest rate (in decimal)

- t = Time period

Simple Interest Calculation Examples

Example 1: Calculating Interest on a Loan

Let’s say you borrow $5,000 at a simple interest rate of 6% for 3 years.

| Variable | Value |

| Principal (P) | $5,000 |

| Interest Rate (r) | 6% = 0.06 |

| Time (t) | 3 years |

Using the simple interest formula:

I = P × r × t = $5,000 × 0.06 × 3 = $900

Total amount to be repaid: A = P + I = $5,000 + $900 = $5,900

Example 2: Calculating Interest on a Savings Account

Suppose you deposit $10,000 in a savings account with a simple interest rate of 4% per annum for 2 years.

| Variable | Value |

| Principal (P) | $10,000 |

| Interest Rate (r) | 4% = 0.04 |

| Time (t) | 2 years |

Using the simple interest formula:

I = P × r × t = $10,000 × 0.04 × 2 = $800

Total amount after 2 years: A = P + I = $10,000 + $800 = $10,800

Calculating Simple Interest for Different Time Periods

Calculating for Years

When the time period is in years, you can directly use the formula I = P × r × t, where t is the number of years.

Calculating for Months

To calculate simple interest for a period in months, convert the months to years by dividing by 12:

t (in years) = Number of months ÷ 12

Example: For a $2,000 loan at 5% for 9 months:

t = 9 ÷ 12 = 0.75 years

I = $2,000 × 0.05 × 0.75 = $75

Calculating for Days

For daily calculations, convert days to years by dividing by 365:

t (in years) = Number of days ÷ 365

Example: For a $3,000 investment at 3% for 90 days:

t = 90 ÷ 365 = 0.247 years

I = $3,000 × 0.03 × 0.247 = $22.23

Simple Interest vs. Compound Interest

Understanding the difference between simple and compound interest is crucial for making informed financial decisions. While simple interest is calculated only on the principal amount, compound interest is calculated on both the principal and the accumulated interest from previous periods.

Simple Interest

- Calculated only on the original principal

- Interest amount remains the same each period

- Formula: I = P × r × t

- Linear growth over time

- Typically used for short-term loans

Compound Interest

- Calculated on principal plus accumulated interest

- Interest amount increases each period

- Formula: A = P(1 + r)^t

- Exponential growth over time

- Common for investments and long-term loans

Comparison Example

Let’s compare simple and compound interest for a $1,000 investment at 5% annual interest over 10 years:

| Year | Simple Interest | Compound Interest | Difference |

| 1 | $1,050.00 | $1,050.00 | $0.00 |

| 2 | $1,100.00 | $1,102.50 | $2.50 |

| 5 | $1,250.00 | $1,276.28 | $26.28 |

| 10 | $1,500.00 | $1,628.89 | $128.89 |

Need to Calculate Compound Interest?

For investment planning and long-term savings, compound interest calculations are essential. Try our compound interest calculator to see how your money can grow exponentially over time.

Real-World Applications of Simple Interest

Simple interest calculations are used in various financial scenarios. Understanding where simple interest applies can help you make better financial decisions.

Short-Term Loans

Many short-term personal loans, auto loans, and some mortgages use simple interest calculations. The interest is typically calculated daily based on the outstanding principal.

Bonds and Treasury Bills

Some bonds and treasury bills pay simple interest. The investor receives regular interest payments based on the face value of the bond, regardless of accumulated interest.

Discounts and Penalties

Early payment discounts and late payment penalties are often calculated using simple interest principles, especially in business transactions and invoicing.

Who Benefits from Simple Interest?

Borrowers Benefit When:

- Taking long-term loans (pay less interest compared to compound interest)

- Making regular payments on time (interest doesn’t compound on missed payments)

- Understanding exactly how much interest they’ll pay over the loan term

Lenders/Investors Benefit When:

- Offering short-term loans (minimal difference between simple and compound interest)

- Dealing with borrowers who might make late payments (can charge simple interest penalties)

- Providing transparent loan terms that are easy to understand

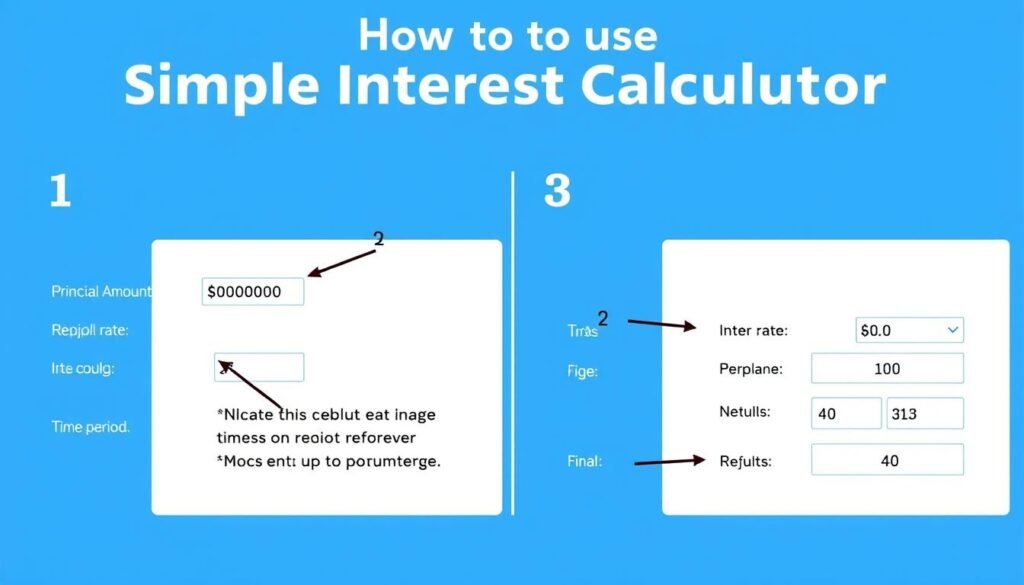

How to Use Our Simple Interest Calculator

Our simple interest calculator is designed to be intuitive and easy to use. Follow these steps to calculate simple interest for any scenario:

- Enter the Principal Amount

Type the initial amount of money (loan or investment) in the “Principal Amount” field. This is the base amount on which interest will be calculated.

- Input the Interest Rate

Enter the annual interest rate as a percentage in the “Interest Rate” field. For example, enter “5” for a 5% interest rate (not 0.05).

- Specify the Time Period

Enter the duration for which you want to calculate interest and select the appropriate unit (years, months, or days) from the dropdown menu.

- Click “Calculate”

Press the “Calculate Simple Interest” button to get your results.

- Review the Results

The calculator will display both the interest amount and the total amount (principal plus interest) in the results section.

Tip: You can recalculate as many times as needed by changing any of the input values and clicking the calculate button again. This makes it easy to compare different scenarios.

Frequently Asked Questions

What is the difference between simple interest and compound interest?

Simple interest is calculated only on the original principal amount, regardless of how long the loan or investment lasts. Compound interest, on the other hand, is calculated on both the principal and the accumulated interest from previous periods, leading to exponential growth over time.

When is simple interest typically used?

Simple interest is commonly used for short-term loans, auto loans, some mortgages, bonds, treasury bills, and early payment discounts or late payment penalties in business transactions. It’s also used in educational contexts to teach basic interest concepts.

How do I convert an annual interest rate to a monthly rate?

For simple interest, you can divide the annual rate by 12 to get the monthly rate. For example, if the annual rate is 12%, the monthly rate would be 1%. However, remember that with simple interest, you can also keep the annual rate and adjust the time period instead (e.g., use 1/12 years instead of 1 month).

Can the simple interest calculator handle different currencies?

Yes, our calculator works with any currency. The calculations remain the same regardless of the currency used. Just make sure all your inputs use the same currency.

Is simple interest better than compound interest?

Neither is inherently “better” – it depends on your perspective. For borrowers, simple interest is generally better because you pay less over time. For investors or lenders, compound interest is typically preferred because it generates more returns over longer periods. The difference becomes more significant with higher interest rates and longer time periods.

How accurate is the simple interest calculator?

Our calculator provides results accurate to two decimal places, which is sufficient for most financial calculations. The calculator uses the standard simple interest formula (I = P × r × t) which is mathematically precise.

Understanding Simple Interest: Key Takeaways

Simple interest provides a straightforward way to calculate interest on loans and investments. By understanding how simple interest works, you can make more informed financial decisions and better manage your money.

Remember these key points about simple interest:

- Simple interest is calculated only on the original principal amount

- The formula I = P × r × t makes calculations easy and transparent

- Simple interest is common in short-term loans, bonds, and certain business transactions

- For borrowers, simple interest typically results in lower total interest payments compared to compound interest

- For long-term investments, compound interest generally provides better returns

Our simple interest calculator makes it easy to perform these calculations quickly and accurately. Whether you’re planning a loan, analyzing an investment, or simply learning about financial concepts, this tool can help you understand the impact of interest on your finances.

Have Questions About Financial Calculations?

Our team is dedicated to providing accurate and helpful financial tools. If you have suggestions for improving our calculators or need help with other financial calculations, we’d love to hear from you.