Use our CD Calculator to estimate interest earnings and future value of Certificates of Deposit. Plan deposits and maximize your savings effectively.

Planning to invest in a Certificate of Deposit? Our CD Calculator helps you estimate how much interest you’ll earn over time. Whether you’re saving for a short-term goal or looking for a secure investment option, understanding your potential returns is crucial for making informed financial decisions.

What is a Certificate of Deposit?

A Certificate of Deposit (CD) is a time deposit offered by banks and credit unions that provides an interest rate premium in exchange for the customer agreeing to leave the deposit untouched for a predetermined period of time. CDs are considered one of the safest investment options as they are typically FDIC-insured up to $250,000.

Key Features of CDs

- Fixed term length (typically from 3 months to 5 years)

- Guaranteed interest rate for the entire term

- FDIC insurance up to $250,000 per depositor

- Early withdrawal penalties if funds are accessed before maturity

- Higher interest rates than standard savings accounts

Ready to calculate your potential CD earnings?

Use our calculator above to see how much your investment could grow.

How the CD Calculator Works

Our CD Calculator uses the compound interest formula to determine how much your initial deposit will grow over time. Understanding the math behind the calculations can help you make more informed investment decisions.

The Compound Interest Formula

The calculator uses this formula to determine your final balance:

A = P(1 + r/n)nt

Where:

- A = Final amount (principal + interest)

- P = Principal (initial deposit)

- r = Annual interest rate (decimal)

- n = Compounding frequency per year

- t = Time in years

Compounding Frequency Explained

The frequency at which interest is compounded can significantly impact your returns. The more frequently interest is compounded, the more you’ll earn over time.

| Compounding Frequency | Times Per Year (n) | Effect on Returns |

| Daily | 365 | Highest returns |

| Monthly | 12 | Higher than quarterly |

| Quarterly | 4 | Higher than annually |

| Annually | 1 | Lowest returns |

CD Calculation Examples

Let’s look at some practical examples to understand how different variables affect your CD returns.

Example 1: Effect of Term Length

Initial deposit: $10,000 with 4% APY, compounded daily

| Term Length | Final Balance | Interest Earned |

| 6 months | $10,201.81 | $201.81 |

| 1 year | $10,408.08 | $408.08 |

| 3 years | $11,273.76 | $1,273.76 |

| 5 years | $12,214.03 | $2,214.03 |

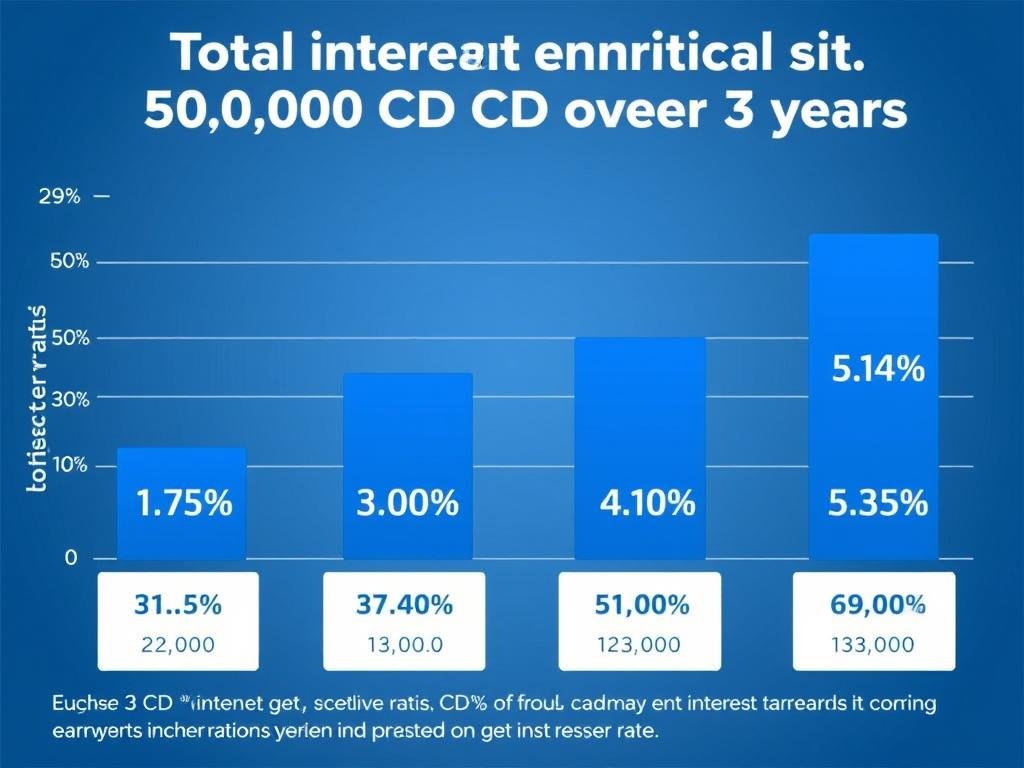

Example 2: Effect of Interest Rate

Initial deposit: $10,000 for a 3-year term, compounded monthly

| Interest Rate | Final Balance | Interest Earned |

| 1.5% | $10,458.43 | $458.43 |

| 3.0% | $10,938.43 | $938.43 |

| 4.5% | $11,441.03 | $1,441.03 |

| 5.5% | $11,774.54 | $1,774.54 |

Pro Tip: Even small differences in interest rates can significantly impact your returns over longer terms. Always compare rates from multiple financial institutions before investing in a CD.

CDs vs. Other Savings Vehicles

When planning your financial future, it’s important to understand how CDs compare to other savings and investment options.

Certificates of Deposit

- Fixed, guaranteed interest rate

- FDIC insured up to $250,000

- Terms typically from 3 months to 5 years

- Early withdrawal penalties

- Higher rates than regular savings

- Low risk investment

Savings Accounts

- Variable interest rates

- FDIC insured up to $250,000

- Unlimited access to funds

- No withdrawal penalties

- Lower interest rates than CDs

- Low risk investment

Money Market Accounts

- Variable interest rates

- FDIC insured up to $250,000

- Limited check writing privileges

- Some withdrawal restrictions

- Rates between savings and CDs

- Low risk investment

When to Choose a CD

CDs are ideal for investors who:

- Have a specific time horizon for their financial goals

- Want guaranteed returns with minimal risk

- Don’t need immediate access to their funds

- Want higher returns than traditional savings accounts

- Are looking to diversify their investment portfolio

Compare your potential returns

Use our calculator to see how a CD investment could grow compared to other options.

Strategies to Maximize Your CD Returns

While CDs are relatively straightforward investments, there are several strategies you can employ to optimize your returns.

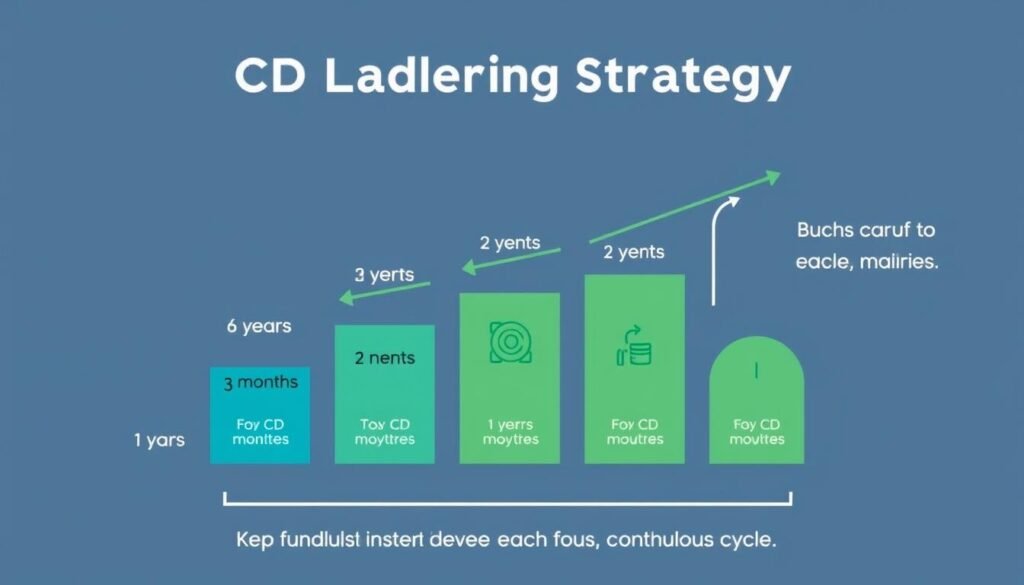

CD Laddering Strategy

CD laddering involves dividing your investment across multiple CDs with different maturity dates. This approach provides regular access to funds while still benefiting from higher interest rates of longer-term CDs.

CD laddering provides liquidity while maximizing interest rates

How to Build a CD Ladder

- Divide your investment amount into equal portions (e.g., five equal parts)

- Invest each portion in CDs with increasingly longer terms (e.g., 1, 2, 3, 4, and 5 years)

- When the shortest-term CD matures, reinvest those funds in a new 5-year CD

- Repeat this process as each CD matures

- Eventually, you’ll have all 5-year CDs (highest rates) with one maturing each year

Rate Shopping Tips

Finding the best CD rates can significantly impact your returns. Here are some tips for finding competitive rates:

- Compare rates from online banks, which often offer higher rates than brick-and-mortar institutions

- Check credit unions, which frequently provide better rates for members

- Look for promotional or special CD rates for new customers

- Consider bump-up CDs that allow you to increase your rate if interest rates rise

- Negotiate rates, especially if you’re depositing a large sum or are an existing customer

Important: Always verify that the financial institution is FDIC-insured before investing in a CD. This insurance protects your deposit up to $250,000 per depositor, per bank.

Understanding Early Withdrawal Penalties

One of the key considerations when investing in a CD is understanding the penalties for early withdrawal. These penalties can significantly impact your returns if you need to access your funds before the maturity date.

Typical Early Withdrawal Penalties

| CD Term | Typical Penalty | Example ($10,000 at 4%) |

| Less than 3 months | 1 month of interest | $33 (assuming withdrawal after 2 months) |

| 3 months to 1 year | 3 months of interest | $100 (assuming withdrawal after 6 months) |

| 1 to 3 years | 6 months of interest | $200 (assuming withdrawal after 1 year) |

| 3 to 5 years | 12 months of interest | $400 (assuming withdrawal after 2 years) |

| 5+ years | 18 months of interest | $600 (assuming withdrawal after 3 years) |

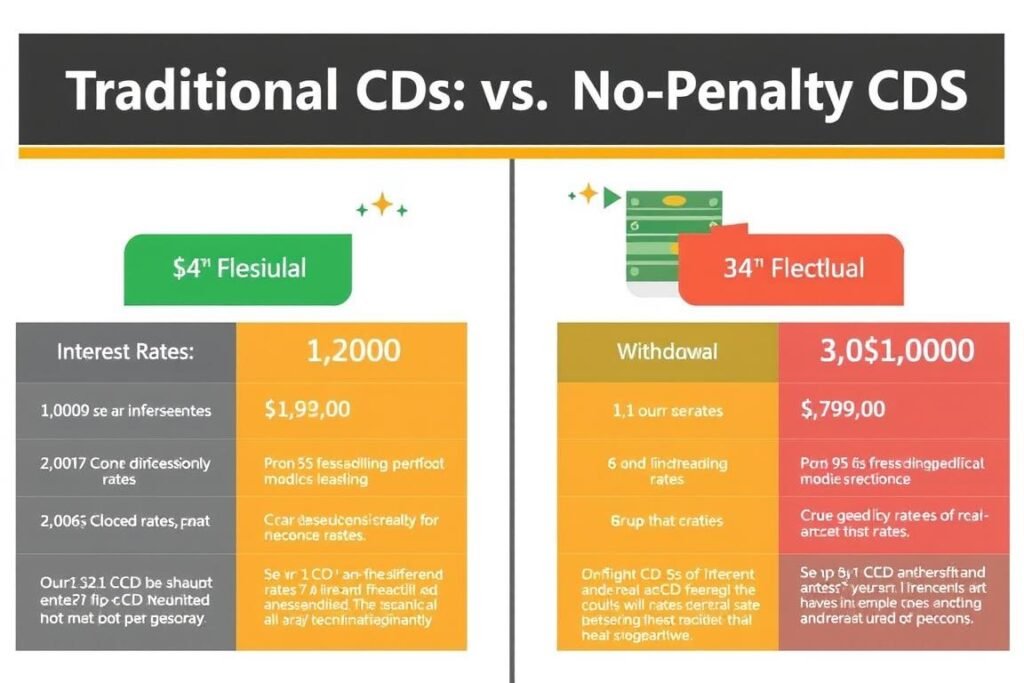

No-Penalty CDs

Some financial institutions offer no-penalty CDs, which allow you to withdraw your funds without a penalty after a short initial period (typically 7 days). These CDs typically offer lower interest rates than traditional CDs but provide more flexibility.

When considering early withdrawal, always calculate whether the penalty outweighs the benefit of accessing your funds early or investing them elsewhere at a potentially higher rate.

Calculate the impact of early withdrawal

Use our CD calculator to see how early withdrawal penalties affect your returns.

Current CD Rate Trends

CD rates are influenced by various economic factors, including Federal Reserve policies, inflation, and overall economic conditions. Understanding current trends can help you make more informed investment decisions.

Recent CD Rate Trends (2023-2025)

CD rates have fluctuated in response to Federal Reserve policy changes

Factors Affecting CD Rates

- Federal Reserve Policy: When the Fed raises or lowers the federal funds rate, CD rates typically follow suit

- Inflation: Higher inflation often leads to higher CD rates as banks try to offer returns that beat inflation

- Economic Growth: Strong economic growth typically leads to higher CD rates

- Bank Competition: More competition among banks can drive CD rates higher as institutions compete for deposits

- Bank Liquidity Needs: Banks may offer higher rates when they need to increase their deposits

Current Outlook: As of 2025, CD rates have begun to stabilize after a period of fluctuation. The Federal Reserve’s monetary policy continues to be a key driver of CD rate changes. Stay informed about economic indicators to anticipate potential rate movements.

Frequently Asked Questions About CDs

What happens when my CD matures?

When your CD reaches its maturity date, you typically have several options:

- Withdraw the full amount (principal plus interest)

- Renew the CD for the same term at the current interest rate

- Roll over the funds into a different CD with a different term

- Add more funds to your existing CD and renew it

Most banks offer a grace period (typically 7-10 days) after maturity during which you can make these decisions without penalty. If you don’t take action during this period, many banks will automatically renew your CD at the current rate for the same term.

Are CDs a good investment in a low-interest environment?

CDs can still be valuable in a low-interest environment, especially for funds you want to protect from market volatility. While returns may be modest, CDs offer guaranteed growth and FDIC insurance. They’re particularly useful for:

- Emergency funds that you don’t need immediate access to

- Saving for short to medium-term goals (1-5 years)

- Diversifying a broader investment portfolio

- Conservative investors who prioritize capital preservation

Consider CD laddering to maximize returns while maintaining some liquidity.

How are CD interest earnings taxed?

CD interest is generally taxable as ordinary income in the year it’s paid or available for withdrawal, even if you don’t withdraw it. Key tax considerations include:

- Interest is taxed at your marginal income tax rate

- You’ll receive a 1099-INT form from your bank reporting the interest earned

- For CDs with terms longer than one year, you must report interest annually as it accrues

- Early withdrawal penalties can be deducted from your taxable income

Consider holding CDs in tax-advantaged accounts like IRAs if you want to defer or potentially avoid taxes on the interest earnings.

What’s the difference between APY and interest rate?

While both terms relate to your earnings, they represent different measurements:

- Interest Rate: The simple annual interest paid on your investment without accounting for compounding

- Annual Percentage Yield (APY): The effective annual rate of return that accounts for compounding interest

APY is always equal to or higher than the interest rate. The more frequently interest compounds, the greater the difference between the interest rate and APY. When comparing CDs, always look at the APY for an accurate comparison of potential returns.

Can I add money to a CD after opening it?

Traditional CDs don’t allow additional deposits after the initial investment. However, there are some alternatives:

- Add-on CDs: Specially designed CDs that allow additional deposits throughout the term

- CD Ladders: Creating a strategy where you invest in multiple CDs with staggered maturity dates

- CD Clusters: Opening multiple CDs at the same time with the same maturity date

If you expect to have additional funds to invest, consider these options or look specifically for banks that offer add-on CDs.

Make Informed CD Investment Decisions

Certificates of Deposit offer a secure way to grow your savings with predictable returns. By using our CD Calculator, you can make informed decisions about your investments and determine whether a CD aligns with your financial goals.

Remember to compare rates from different financial institutions, consider your time horizon, and explore strategies like CD laddering to maximize your returns. Whether you’re saving for a short-term goal or looking to diversify your investment portfolio, CDs can be a valuable component of your financial plan.

Start calculating your potential CD returns today

Use our free CD Calculator to plan your investment strategy and secure your financial future.