Use our Student Loan Calculator to estimate monthly payments, total interest, and payoff time. Plan your repayment strategy and manage student debt wisely.

Planning for college expenses can be overwhelming, especially when it comes to understanding student loans. Our student loan calculator helps you estimate monthly payments, total interest costs, and repayment timelines for both federal and private student loans. Whether you’re a prospective student, current borrower, or looking to refinance, this tool provides the clarity you need to make informed financial decisions about your education.

Student Loan Calculator

Use our calculator below to estimate your monthly payments, total interest, and repayment timeline. Enter your loan details to get started.

Enter Your Loan Details

Your Results

Monthly Payment

$329.48

| Loan Summary | Amount |

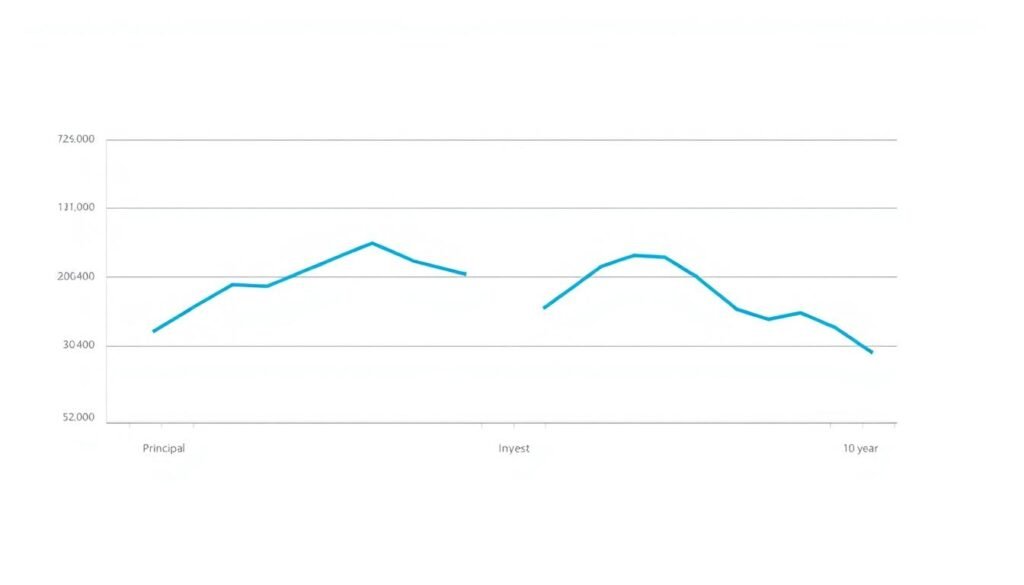

| Principal Amount | $30,000.00 |

| Total Interest | $9,537.62 |

| Total Repayment | $39,537.62 |

| Loan Payoff Date | May 2034 |

Example of loan balance reduction over a 10-year repayment period

Understanding Student Loan Types

Before calculating your student loan payments, it’s important to understand the different types of loans available. Federal and private student loans have different terms, interest rates, and repayment options that will affect your financial planning.

Federal Student Loans

Federal student loans are funded by the government and typically offer more favorable terms and flexible repayment options than private loans.

- Fixed interest rates set by Congress (currently 4.99%-7.54%)

- No credit check required (except for PLUS loans)

- Income-driven repayment plans available

- Potential loan forgiveness options

- 6-month grace period after graduation

Types of Federal Loans

- Direct Subsidized Loans: For undergraduate students with financial need; government pays interest during school

- Direct Unsubsidized Loans: For undergraduate and graduate students; interest accrues during school

- Direct PLUS Loans: For graduate students and parents; requires credit check

Private Student Loans

Private student loans are offered by banks, credit unions, and online lenders. They typically have less flexible terms than federal loans but may be necessary to fill funding gaps.

- Variable or fixed interest rates based on credit score

- Credit check required (cosigner often needed)

- Fewer repayment options and protections

- May require payments while in school

- No forgiveness programs available

When to Consider Private Loans

Private student loans should generally be considered only after exhausting federal loan options, scholarships, grants, and work-study opportunities.

Key differences between federal and private student loans

How to Use Our Student Loan Calculator

Our student loan calculator is designed to help you understand the financial impact of your education loans. Follow these steps to get the most accurate results for your situation.

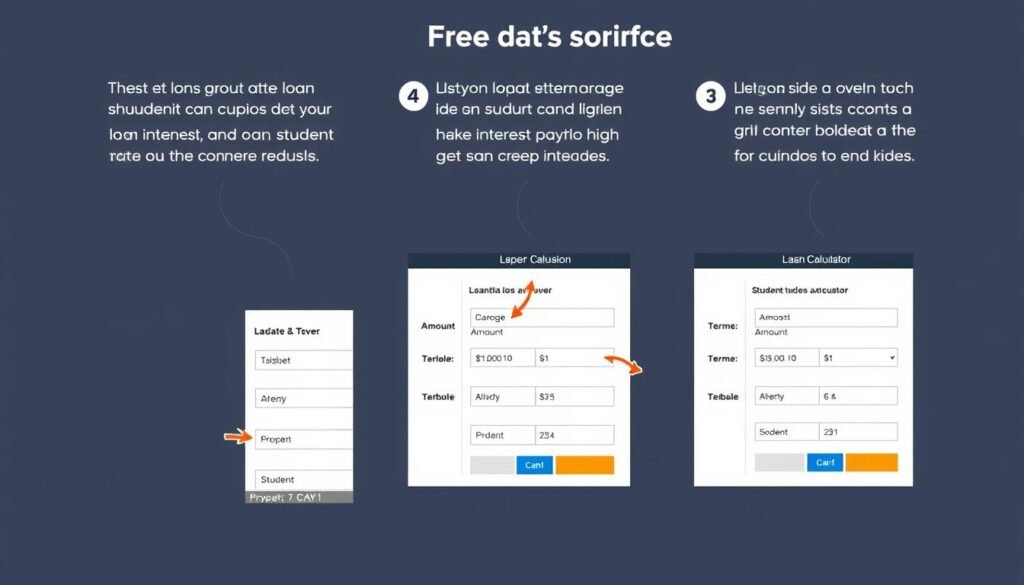

Enter Loan Details

Input your total loan amount, interest rate, and loan term (in years). For multiple loans, you can add them separately or use a weighted average interest rate.

Select Loan Type

Choose between federal subsidized, unsubsidized, or private loans. This affects how interest accrues during school and grace periods.

Review Results

Analyze your monthly payment, total interest paid, and complete repayment timeline. Adjust inputs to see how different scenarios affect your results.

Pro Tip: Understanding Your Results

Your monthly payment is calculated using the standard amortization formula, which ensures that you pay the same amount each month while gradually paying down the principal. Early in your repayment, a larger portion of each payment goes toward interest, while later payments primarily reduce the principal.

Visual guide to using our student loan calculator

Student Loan Calculation Examples

To help you understand how different loan scenarios affect your repayment, we’ve provided some common examples below. These examples illustrate how loan amount, interest rate, and term length impact your monthly payments and total cost.

| Scenario | Loan Amount | Interest Rate | Term (Years) | Monthly Payment | Total Interest | Total Repayment |

| Undergraduate Federal Loan | $30,000 | 4.99% | 10 | $318.09 | $8,170.80 | $38,170.80 |

| Graduate Federal Loan | $60,000 | 6.54% | 10 | $681.54 | $21,784.80 | $81,784.80 |

| Private Undergraduate Loan | $25,000 | 7.99% | 10 | $303.31 | $11,397.20 | $36,397.20 |

| Extended Repayment Plan | $40,000 | 5.8% | 25 | $253.95 | $36,185.00 | $76,185.00 |

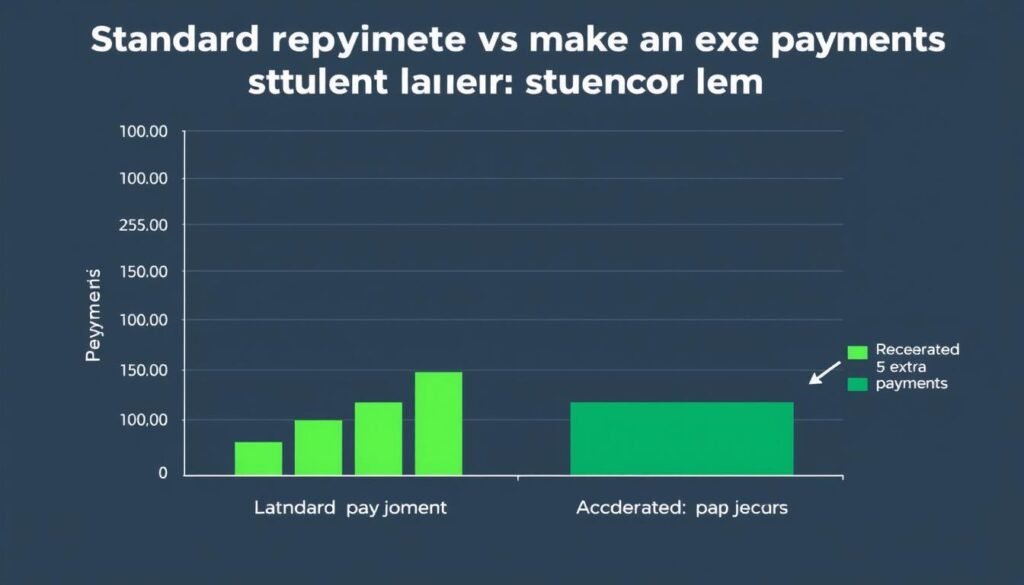

Impact of Extra Payments

Making extra payments can significantly reduce your total interest and shorten your repayment period. For example, paying an extra $100 per month on a $30,000 loan at 5% interest could save you $3,245 in interest and help you pay off your loan 2.5 years earlier.

Impact of extra payments on total loan cost and repayment time

Student Loan Repayment Options

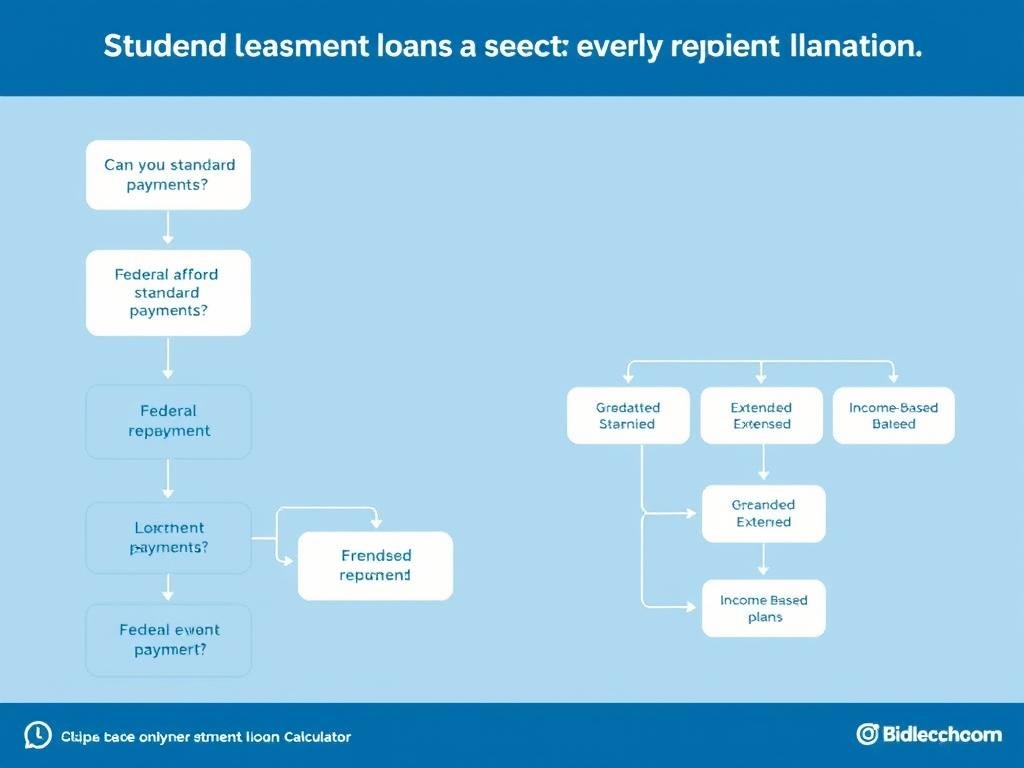

Understanding your repayment options is crucial for managing your student loans effectively. Federal loans offer several repayment plans to fit different financial situations, while private loans typically have fewer options.

Federal Loan Repayment Plans

| Repayment Plan | Description | Term Length | Best For |

| Standard Repayment | Fixed monthly payments to pay off loan within term | 10 years | Borrowers who can afford higher monthly payments |

| Graduated Repayment | Payments start low and increase every two years | 10 years | Borrowers expecting income to increase over time |

| Extended Repayment | Lower monthly payments extended over a longer period | 25 years | Borrowers with high loan balances needing lower payments |

| Income-Based Repayment (IBR) | Payments capped at 10-15% of discretionary income | 20-25 years | Low-income borrowers or those with high debt-to-income ratios |

| Pay As You Earn (PAYE) | Payments capped at 10% of discretionary income | 20 years | Recent borrowers with financial hardship |

Decision guide for choosing the right repayment plan

Not Sure Which Repayment Plan Is Right For You?

Use our calculator to compare different repayment options and see which one fits your financial situation best.

Student Loan Refinancing Options

Refinancing your student loans can potentially lower your interest rate, reduce your monthly payment, or change your repayment term. However, refinancing federal loans with a private lender means losing federal benefits and protections.

Benefits of Refinancing

- Potentially lower interest rate

- Combine multiple loans into one payment

- Choose a new loan term

- Remove a cosigner from original loans

- Switch from variable to fixed interest rate

Drawbacks of Refinancing

- Loss of federal loan benefits and protections

- No access to income-driven repayment plans

- No eligibility for federal loan forgiveness programs

- Requires good credit score (typically 650+)

- May need a cosigner if income or credit is insufficient

Example of potential savings through student loan refinancing

Is Refinancing Right For You?

Consider refinancing if you:

- Have a stable income and good credit score (650+)

- Are paying high interest rates on your current loans

- Don’t plan to use federal loan benefits like income-driven repayment

- Want to simplify multiple loan payments

Refinancing might not be right if you:

- Work in public service and are pursuing loan forgiveness

- Have an unstable income or employment situation

- Benefit from income-driven repayment plans

- Have a poor credit score or limited credit history

Tips for Managing Student Loan Debt

Effectively managing your student loans can help you pay them off faster and reduce the total amount you pay over time. Here are some strategies to consider:

Make Extra Payments

Even small additional payments can significantly reduce your total interest and shorten your repayment period. Be sure to specify that extra payments should be applied to the principal.

Set Up Autopay

Many lenders offer a 0.25% interest rate reduction for enrolling in automatic payments. This not only saves money but also ensures you never miss a payment.

Prioritize High-Interest Loans

If you have multiple loans, focus on paying off the ones with the highest interest rates first while making minimum payments on others.

Strategies to pay off your student loans faster

Avoid Common Student Loan Mistakes

- Missing payments or paying late (damages credit score)

- Ignoring loan statements and communications

- Not updating contact information with loan servicers

- Borrowing more than necessary for education expenses

- Not exploring all repayment options when struggling financially

Take Control of Your Student Loans Today

Use our calculator to understand your current situation and explore strategies to optimize your repayment plan.

Frequently Asked Questions About Student Loans

How are student loan interest rates determined?

Federal student loan interest rates are set by Congress and are fixed for the life of the loan. They are based on the 10-year Treasury note plus a fixed margin. Private student loan interest rates are determined by the lender based on your credit score, income, and other financial factors. They can be fixed or variable.

What is the difference between subsidized and unsubsidized federal loans?

With subsidized federal loans, the government pays the interest while you’re in school, during the grace period, and during deferment periods. These loans are available to undergraduate students with financial need. With unsubsidized loans, interest accrues from the time the loan is disbursed, even while you’re in school. Unsubsidized loans are available to undergraduate and graduate students regardless of financial need.

Can I refinance my federal student loans?

Yes, you can refinance federal student loans with a private lender, but you’ll lose federal benefits and protections such as income-driven repayment plans, loan forgiveness options, and deferment/forbearance options. If you have federal loans, you can also consolidate them through a federal Direct Consolidation Loan, which maintains your federal benefits but doesn’t lower your interest rate.

How does the grace period work for student loans?

Most federal student loans offer a six-month grace period after you graduate, leave school, or drop below half-time enrollment before you must begin making payments. For subsidized loans, interest doesn’t accrue during this period. For unsubsidized loans, interest continues to accrue during the grace period. Private loans may or may not offer grace periods, depending on the lender’s terms.

What happens if I can’t make my student loan payments?

If you have federal loans and can’t make your payments, you have several options: apply for an income-driven repayment plan, request deferment or forbearance, or consolidate your loans. For private loans, contact your lender immediately to discuss hardship options, which may include temporary forbearance or modified payment plans. Avoiding or missing payments can damage your credit score and lead to default.

Student loan terminology quick reference guide

Make Informed Student Loan Decisions

Understanding your student loan options and how they will affect your financial future is crucial for making sound borrowing decisions. Our student loan calculator provides the tools you need to estimate payments, compare scenarios, and develop a repayment strategy that works for your situation.

Remember that student loans are a significant financial commitment, and it’s important to borrow only what you need. By using our calculator and educational resources, you can approach your education financing with confidence and clarity.

Ready to Take Control of Your Student Loans?

Use our calculator to understand your options and create a plan for managing your education debt.